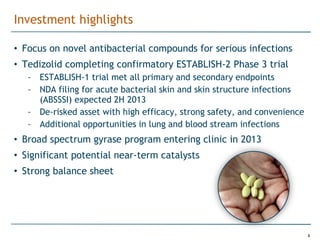

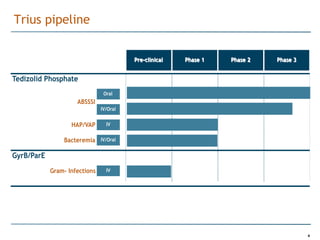

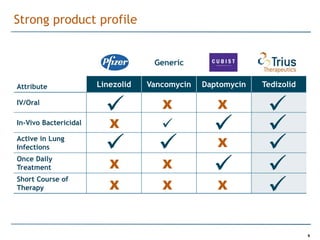

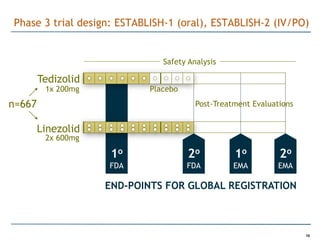

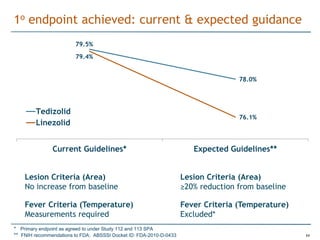

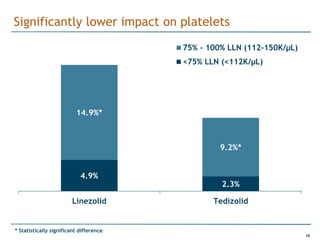

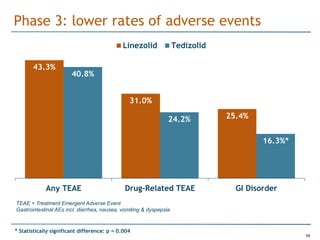

Trius Therapeutics is developing novel anti-infective compounds to treat serious bacterial infections. Their lead product candidate, tedizolid phosphate, is completing Phase 3 clinical trials for the treatment of acute bacterial skin and skin structure infections. Tedizolid has shown high efficacy comparable to generic antibiotics with a better safety profile in Phase 3 trials, including significantly lower impacts on platelets and rates of adverse gastrointestinal events. If approved, tedizolid would provide an important new treatment option with IV or oral dosing for patients with these infections. Trius is also advancing a new class of antibiotics targeting bacterial gyrase through their preclinical pipeline.