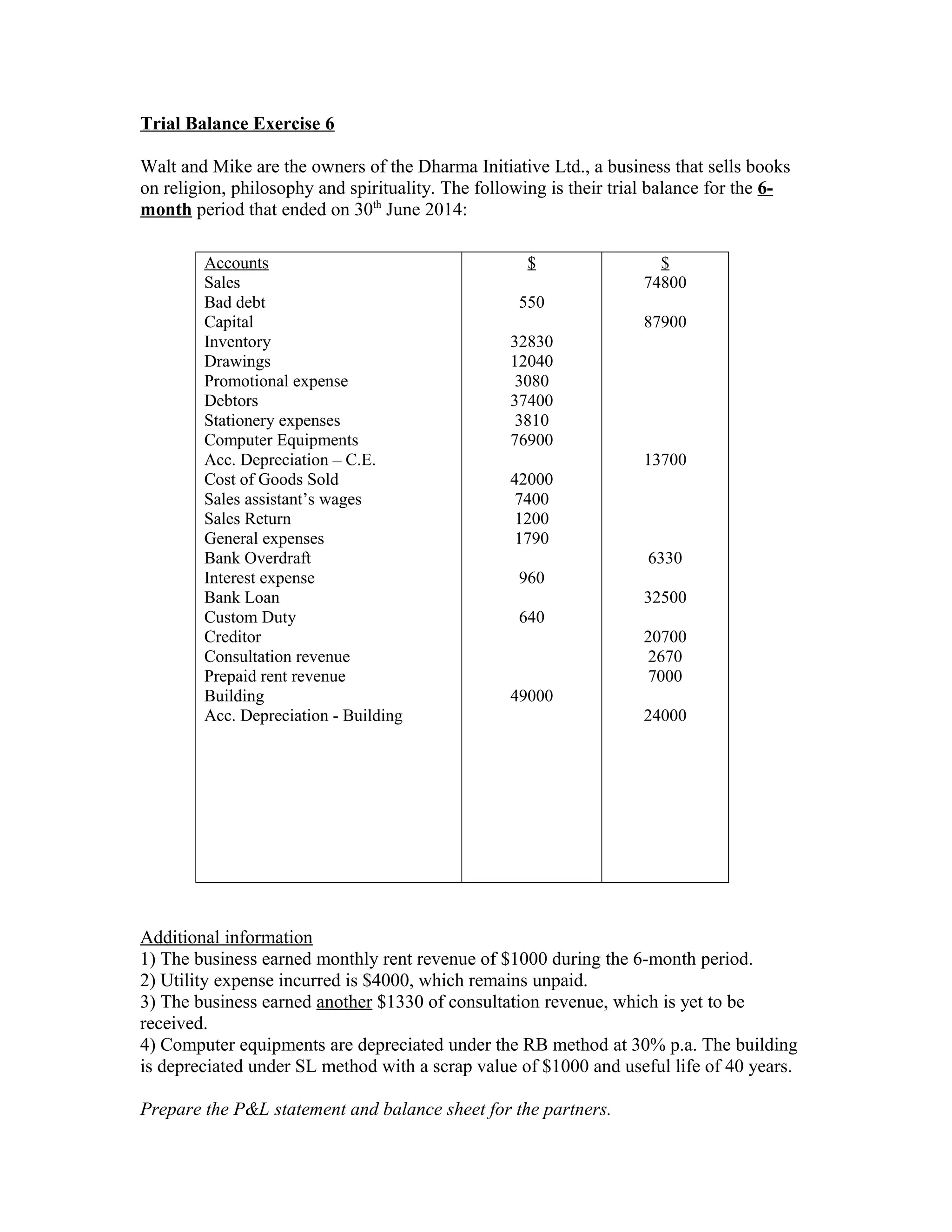

The Dharma Initiative Ltd. sells books on religion and spirituality. Their trial balance for the 6-month period ending June 30, 2014 shows revenues of $32830 from sales and $32500 from consultation revenue. Expenses include $76900 for promotional expenses, $42000 for salaries, $49000 for general expenses, and depreciation of $2400 for computer equipment and building. The balance sheet will show $74800 in bank loans and $6330 in creditors, with $87900 in capital and $13700 in bank overdraft.