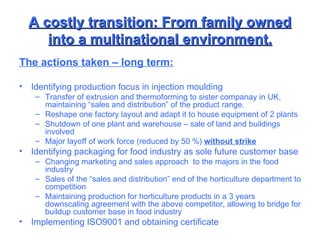

A Belgian plastics company that was family owned struggled financially after being acquired by a multinational corporation. The company faced issues including a mismatch of culture between the family-owned and multinational environments, over diversification, and lack of cost control. Consulting firm BIZSON was hired to evaluate the company and develop a turnaround plan. Their plan involved focusing production, reducing costs, improving cash flow, and restructuring management. After two years of implementing the plan, the changes stabilized the company's finances and positioned it for future growth under new ownership.