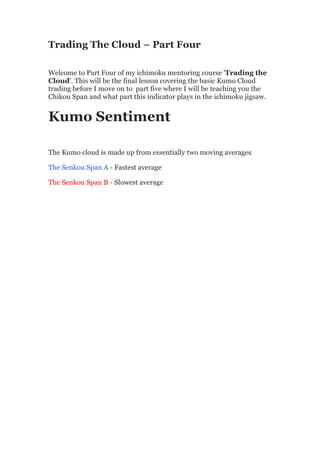

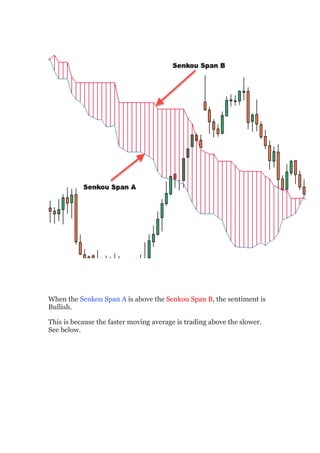

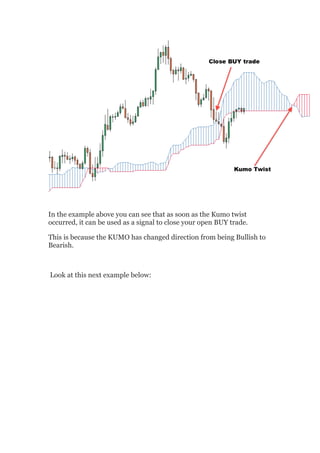

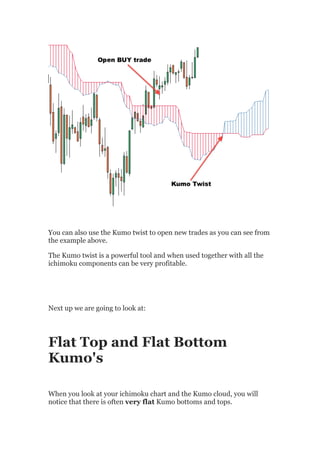

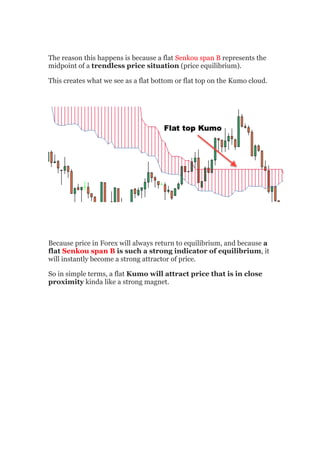

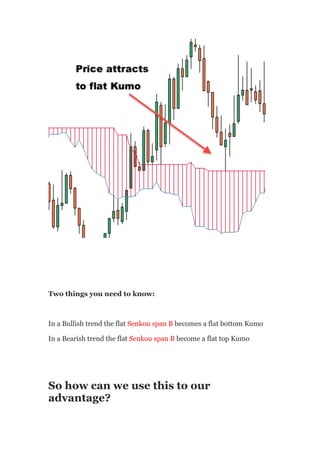

This document is the final lesson in a mentoring course on Ichimoku trading, focusing on the kumo cloud and its significance in trading strategies. It explains how the positioning of the senkou spans can indicate market sentiment and the importance of the 'kumo twist' as a signal for trade entries and closings. Additionally, it covers the concept of flat kumo tops and bottoms, emphasizing their role in price equilibrium and trading decisions.