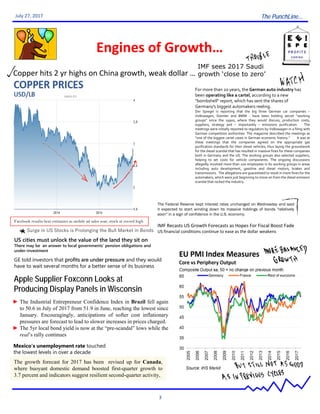

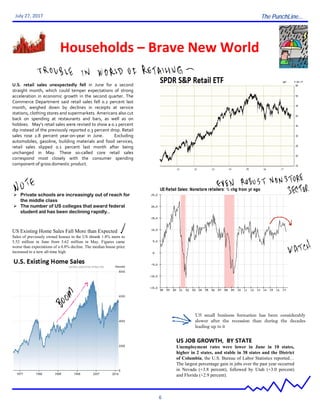

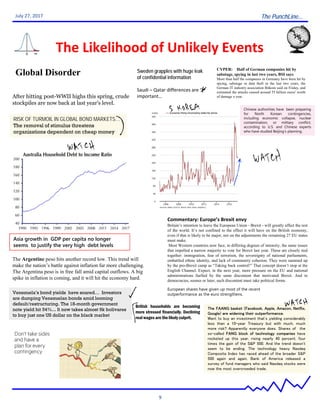

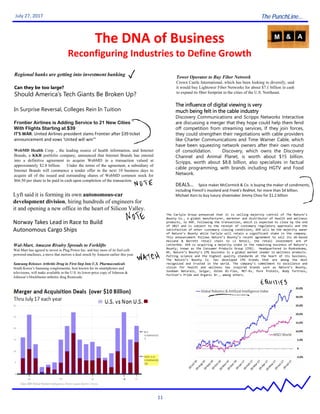

The document provides an overview of recent global economic developments and risks. It discusses the surprising pickup in global growth despite headwinds, with growth momentum becoming more evident in the EU. However, the US growth outlook has been reduced due to concerns about losing momentum from fiscal policy changes. Commodity exporters continue to struggle with lower revenues and diversifying growth. Financial stability risks need monitoring in emerging markets. Strong credit growth in China supports growth but debt levels raise risks. Markets have performed well with low volatility, but this raises concerns about a potential market flare up given rich valuations and policy uncertainties.