Embed presentation

Downloaded 49 times

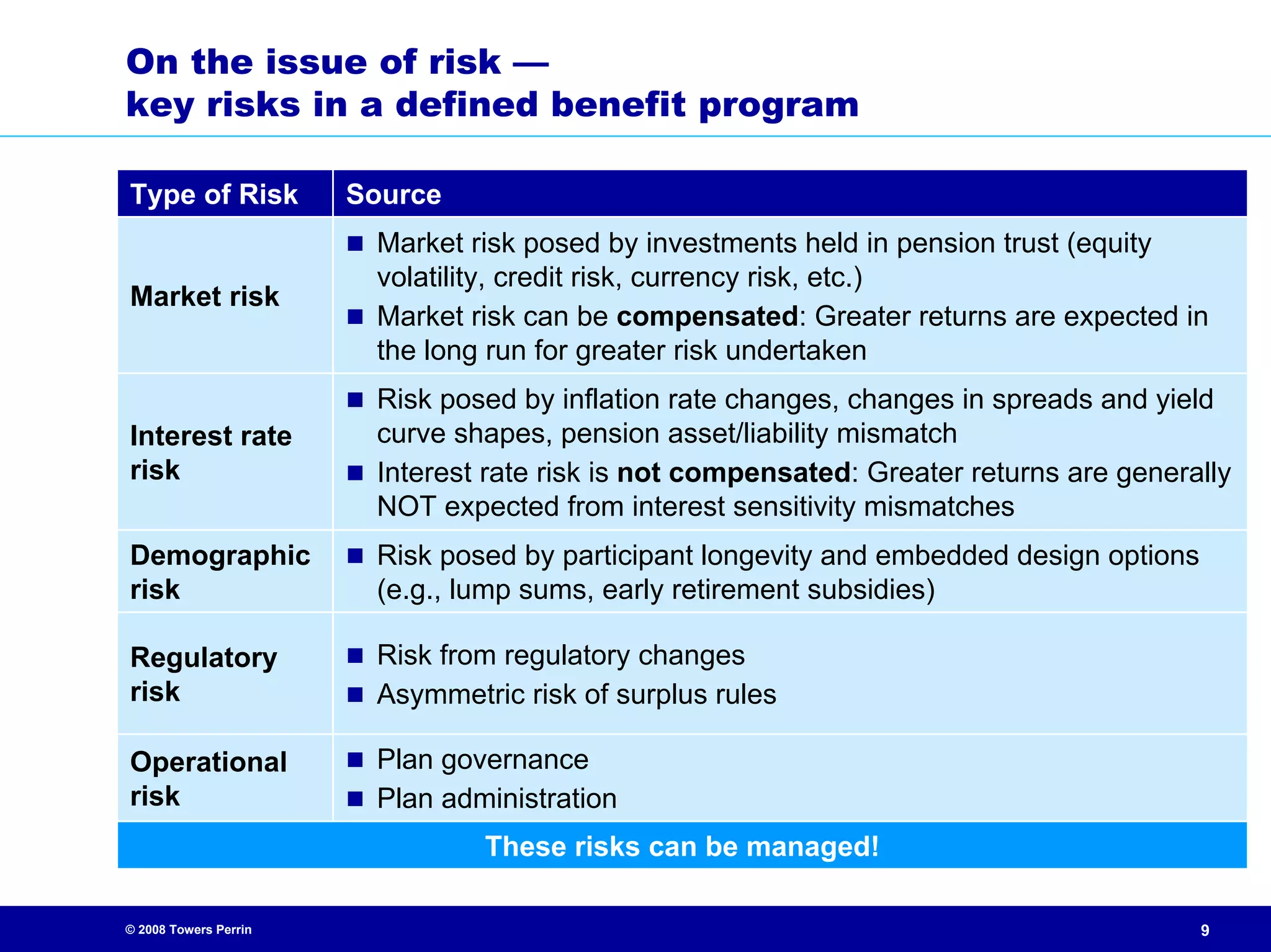

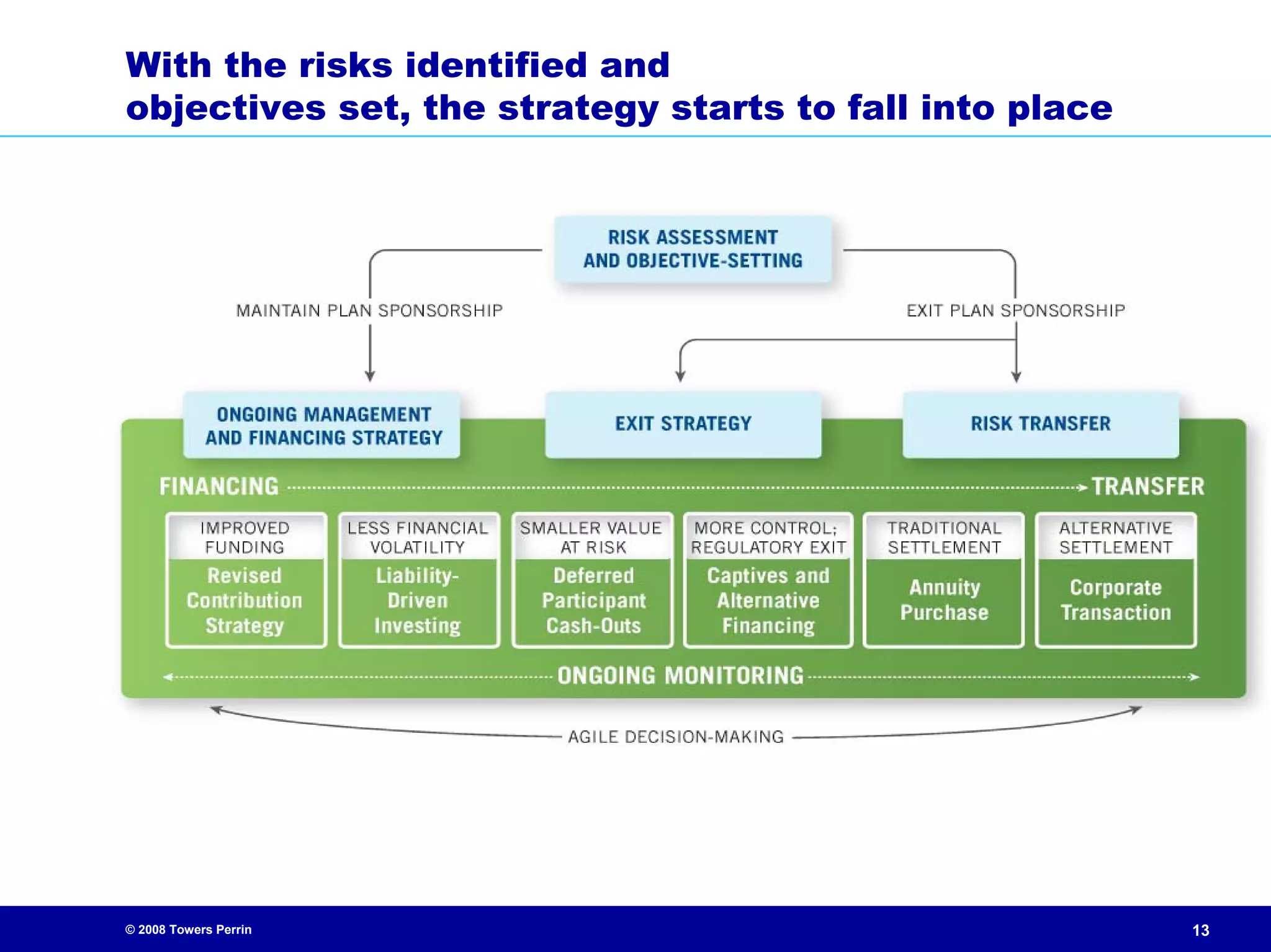

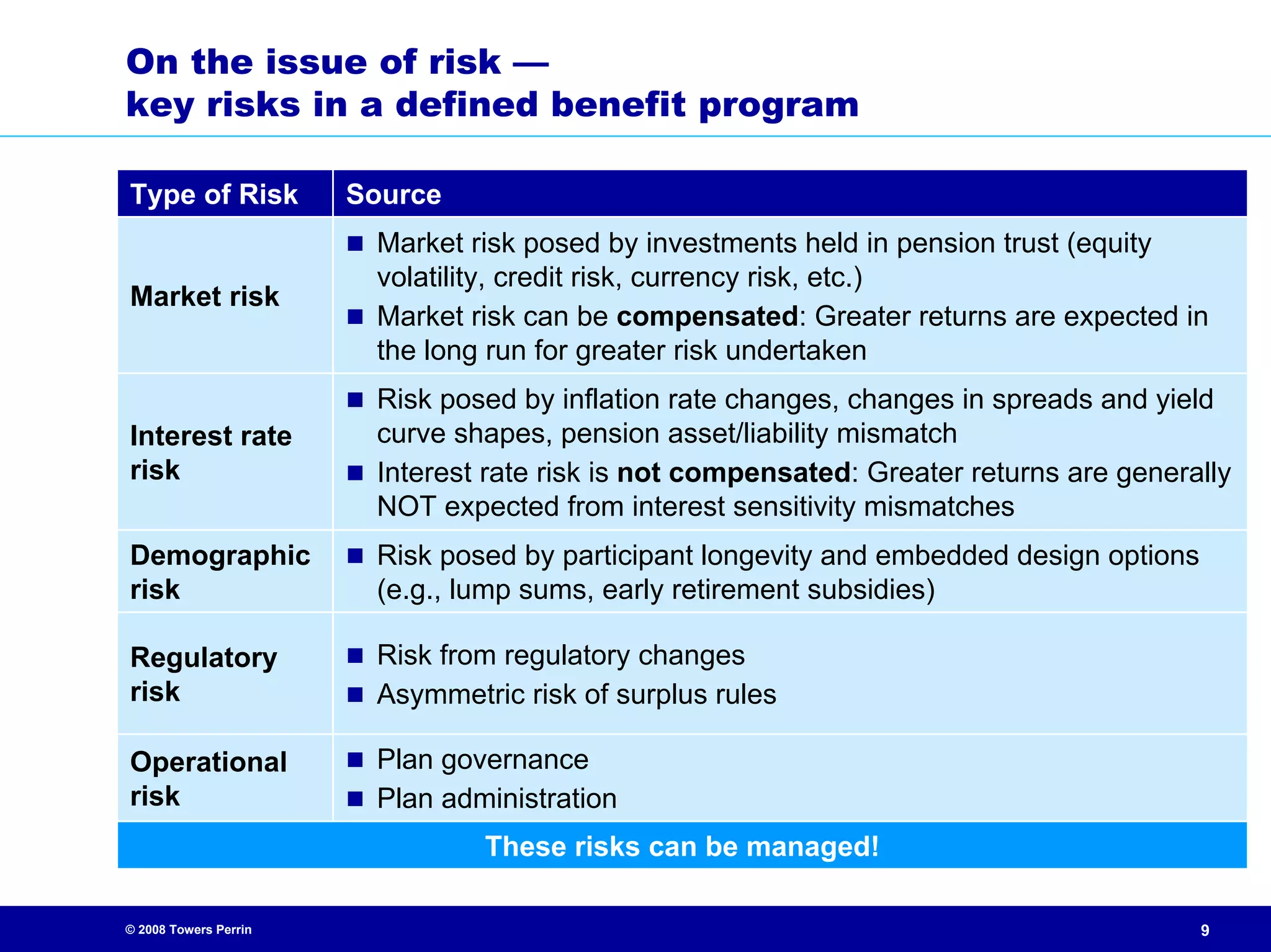

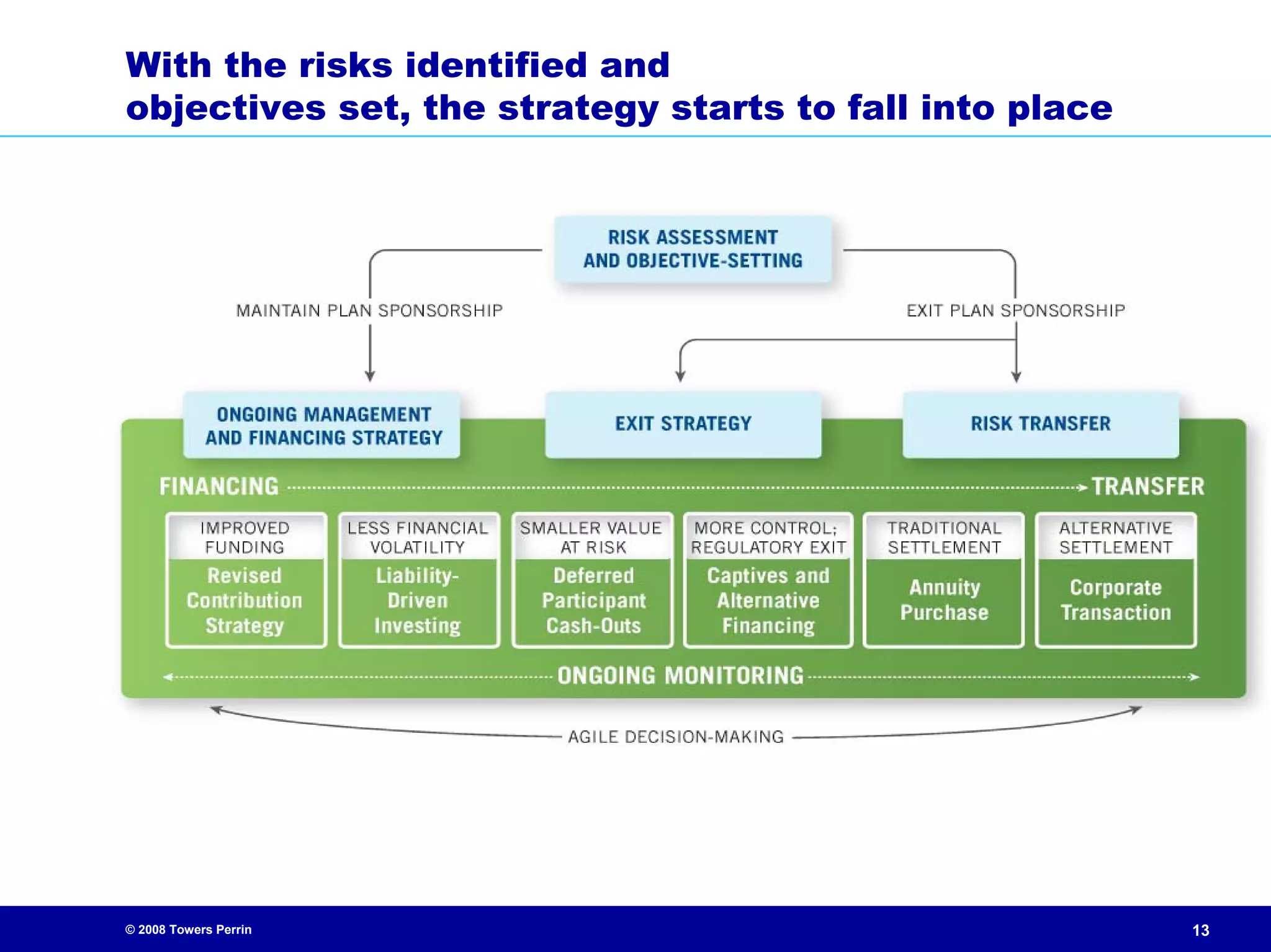

The report discusses findings from the 2nd annual Towers Perrin pension plan study, highlighting a shift among companies towards risk reduction in defined benefit (DB) plans amidst market volatility. Key concerns for companies include cash flow and regulatory compliance, with many opting to focus more on managing pension risk rather than seeking higher returns. The study reveals an incremental approach to pension plan design changes, with a reluctance to fully terminate plans despite a trend towards freezing or closing existing DB plans.