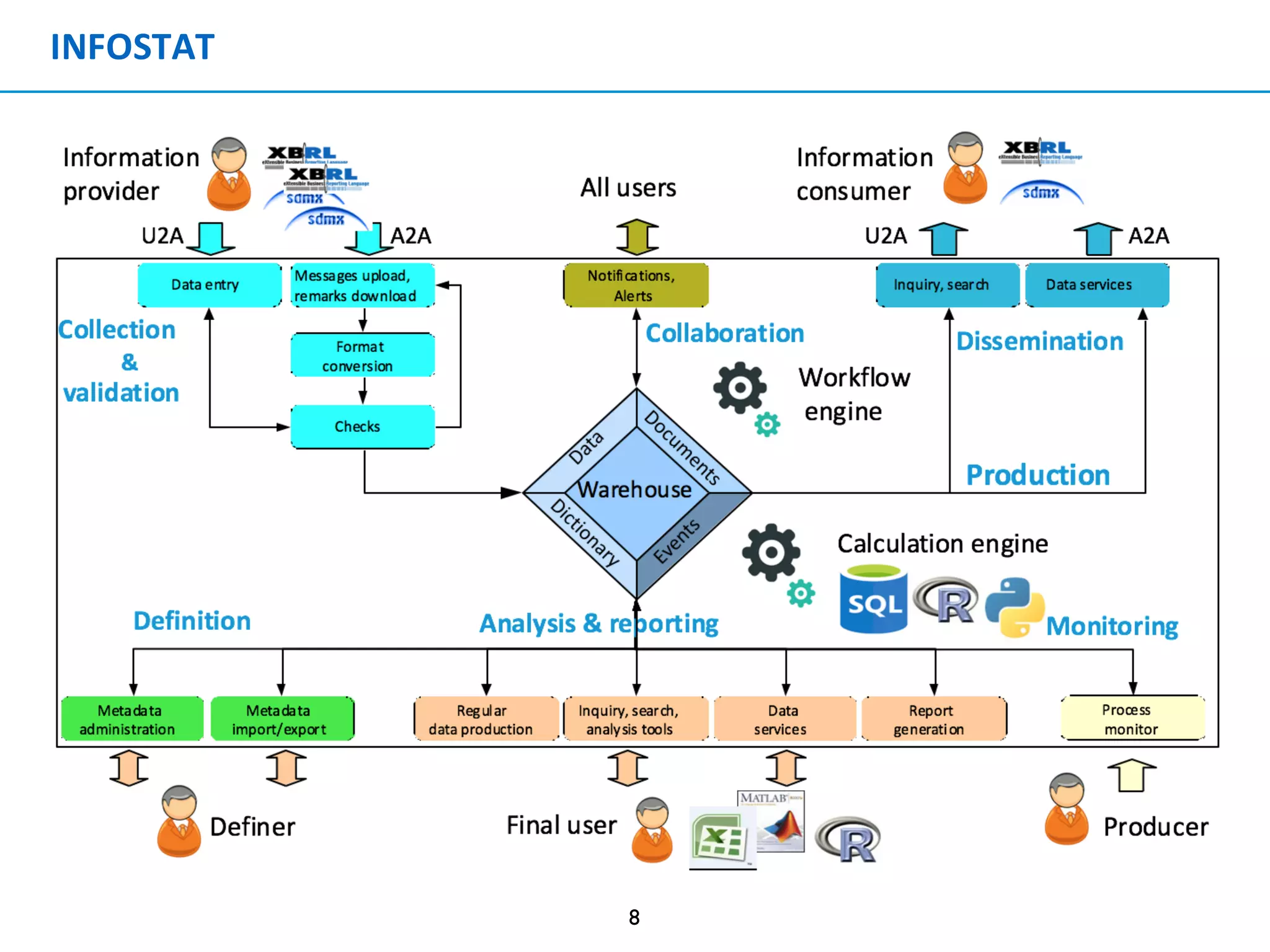

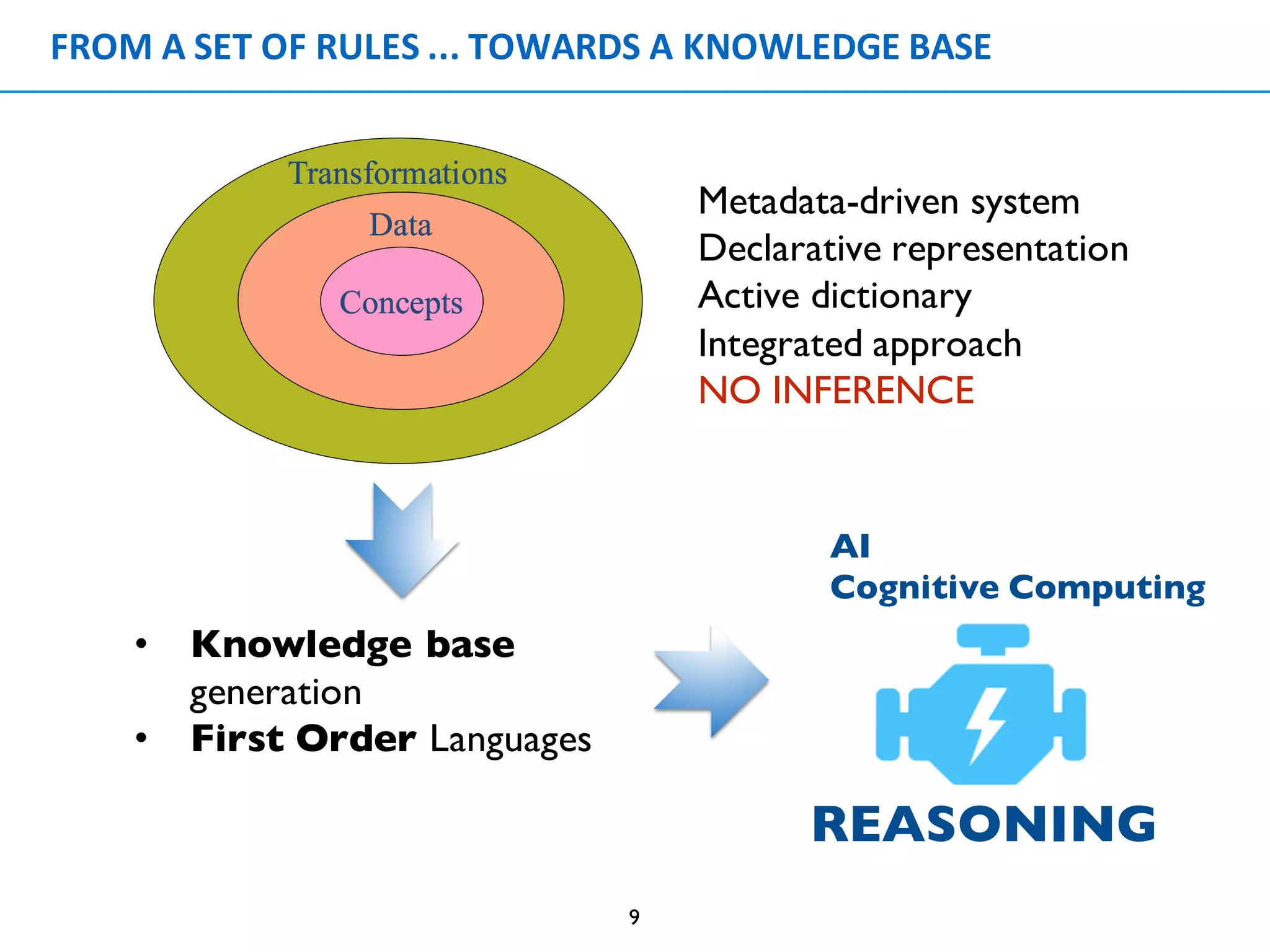

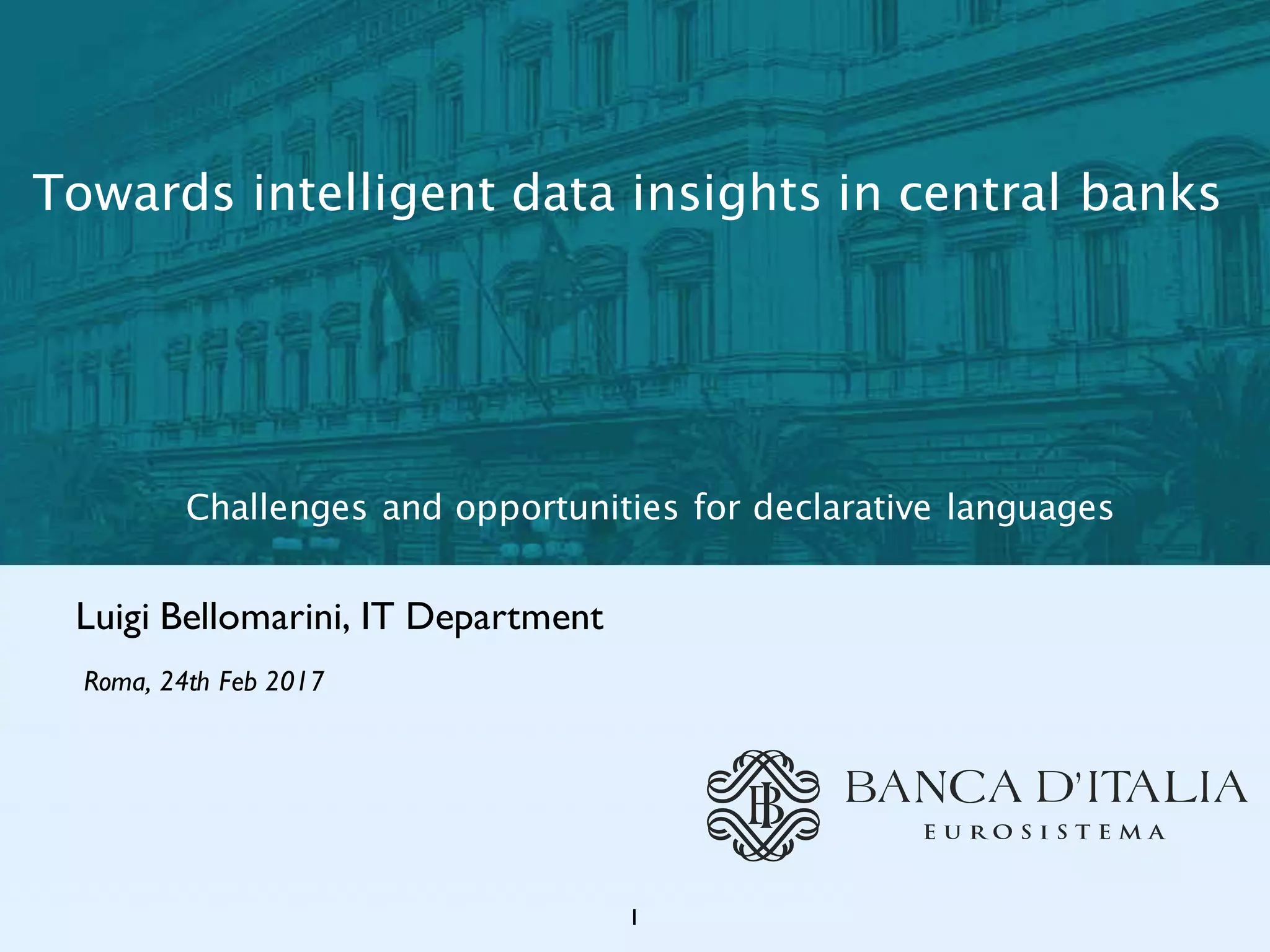

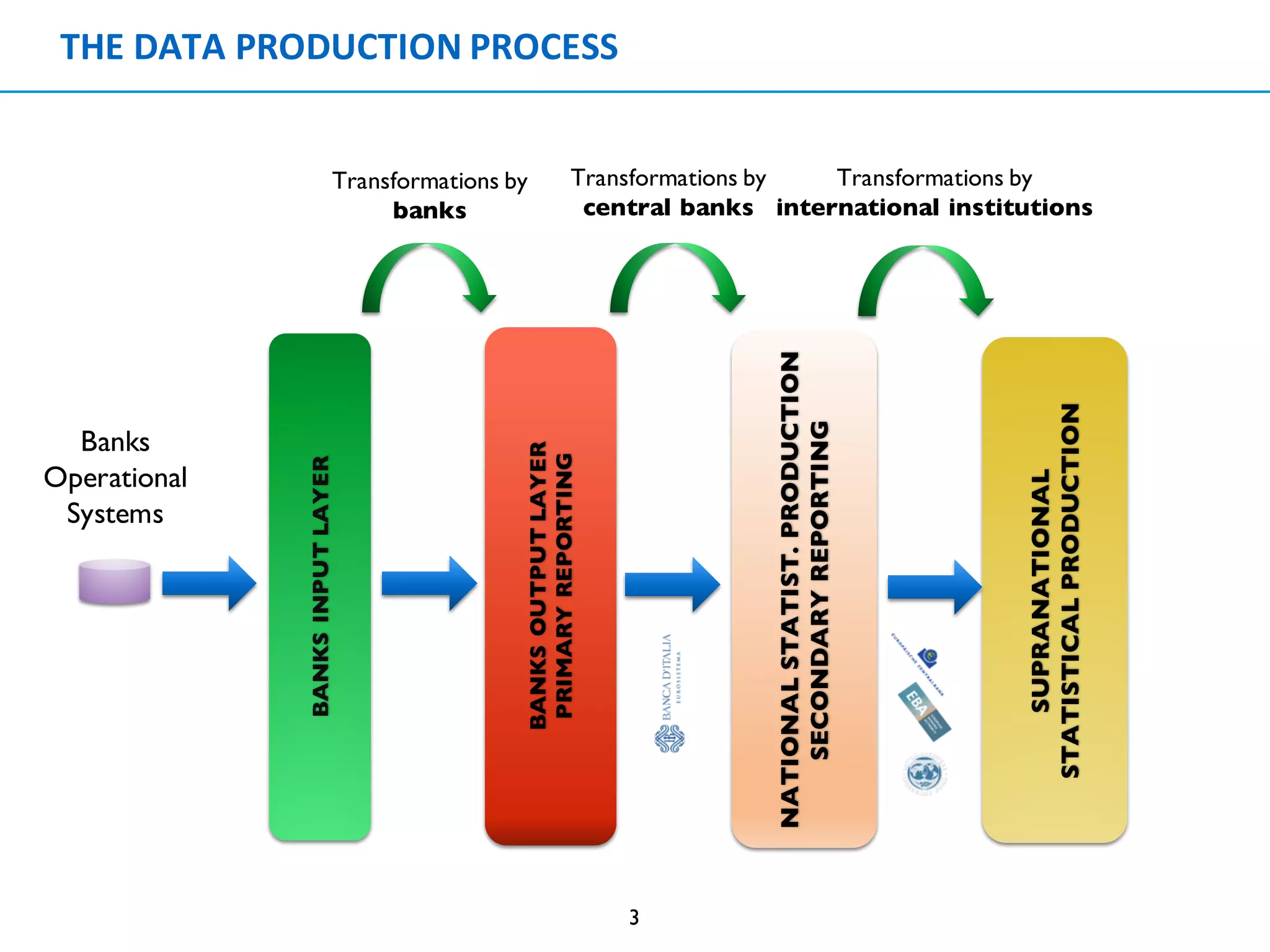

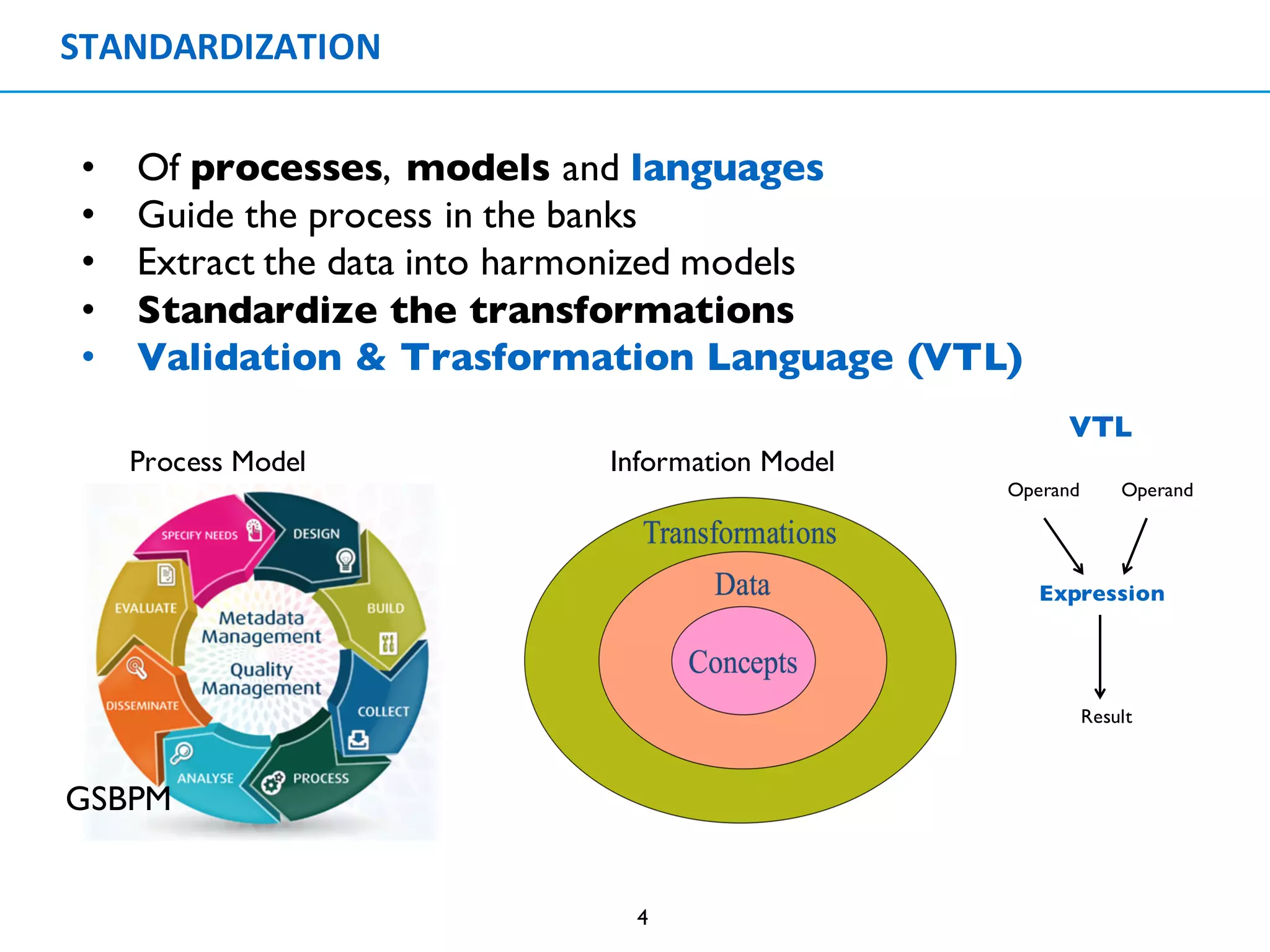

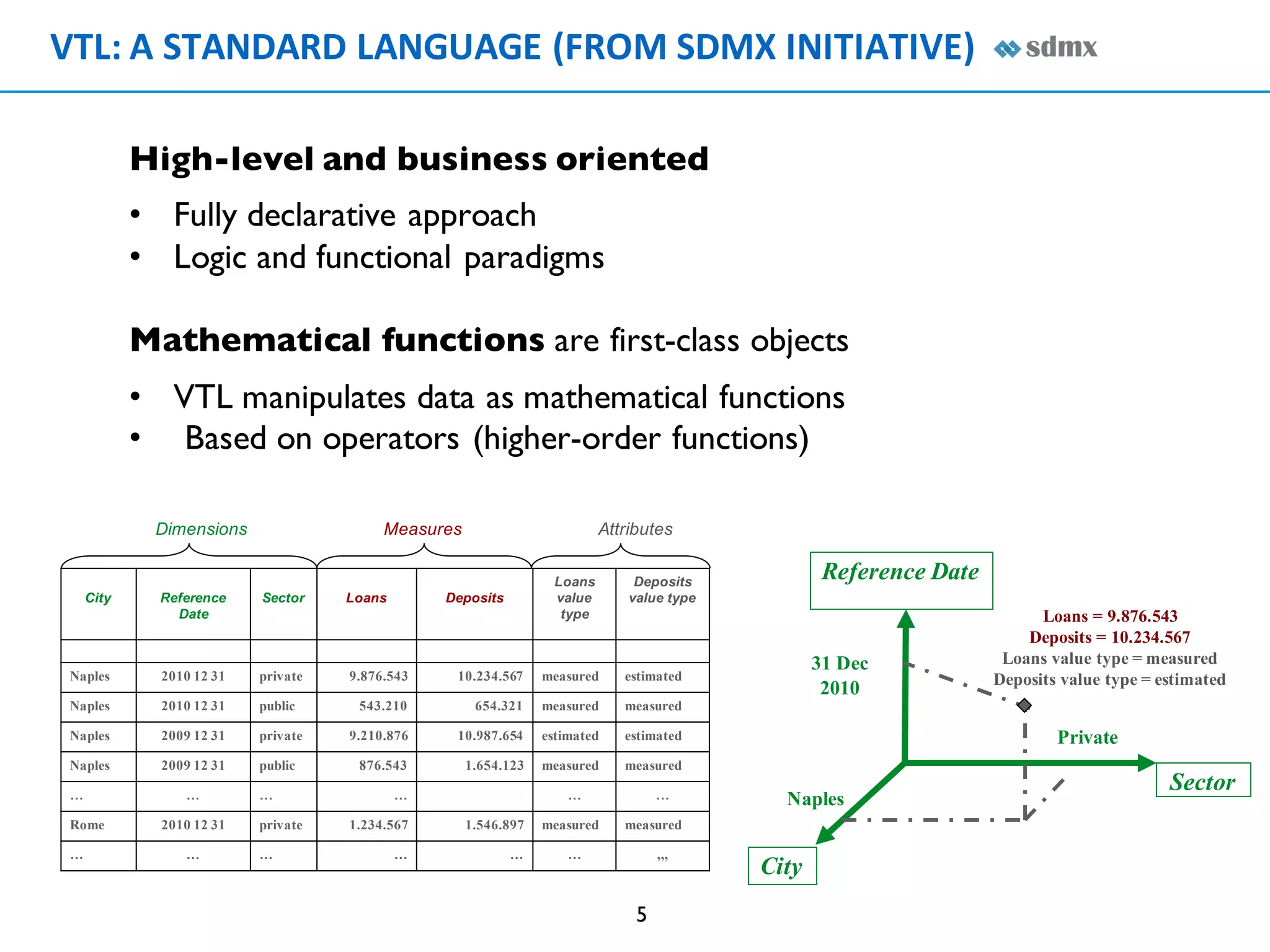

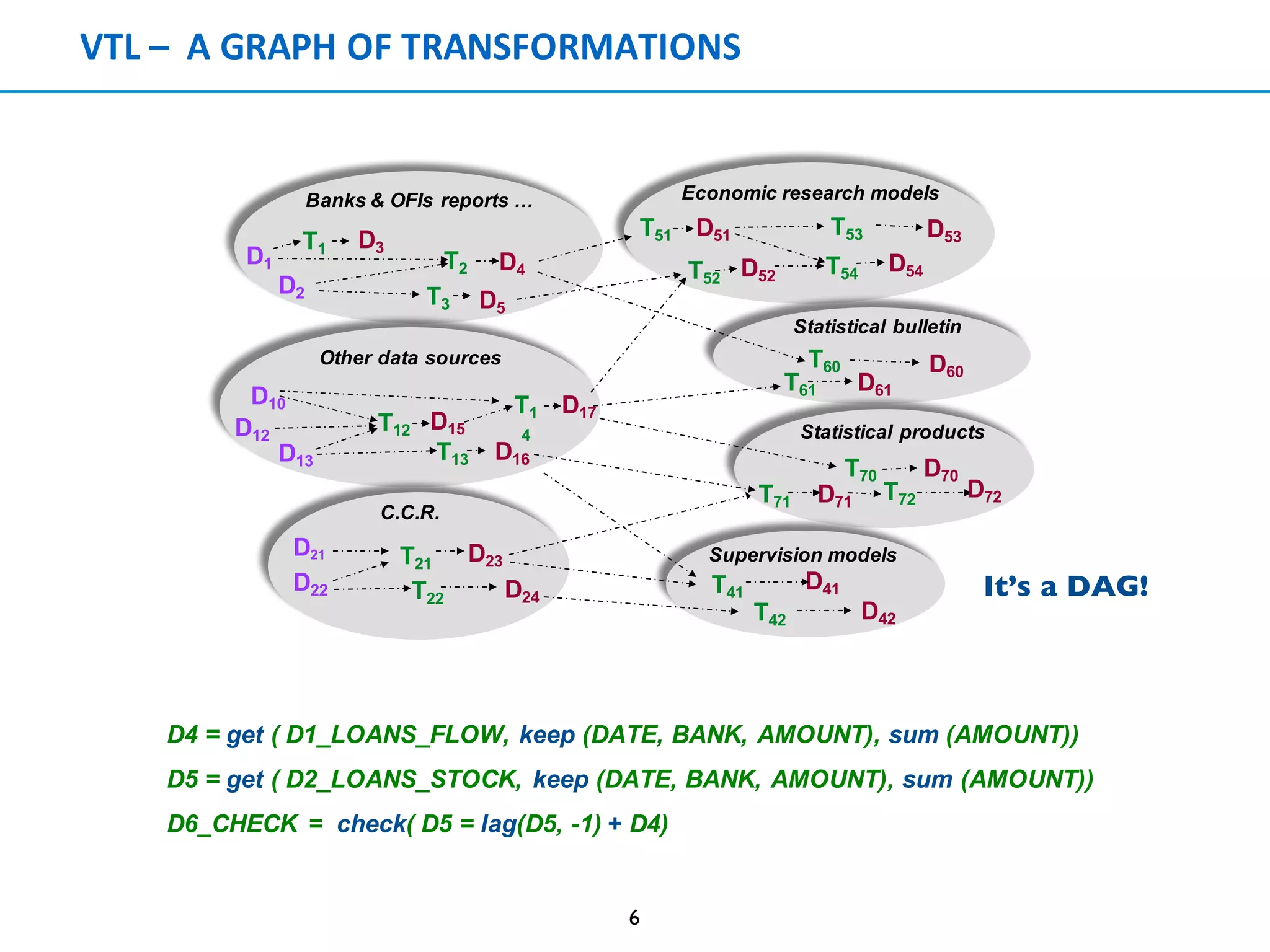

This document discusses intelligent data insights in central banks. It summarizes the data and statistical production processes used by central banks, including credit risk data, securities holdings, and monetary financial institution statistics. It also describes standardization efforts including validation and transformation languages to guide data extraction and processing. Finally, it provides examples of execution platforms used by the Bank of Italy to implement logical representations and transformations on statistical data.

![EXECUTION PLATFORMS - @Bank of Italy

7

VTL

RGDP := PQR * RGDPPC

tmp <- merge(PQR,RGDPPC,by=c("q","r")) tmp$i <-

tmp["p"] * tmp["g"]

TGDP <- tmp[-c("p","g")]

Rgdp = get_tab(pqr * rgdppc)

INSERT INTO RGDP(Q,R,P)

SELECT C2.Q AS Q, C2.R AS R, C1.P*C2.G AS P

FROM PQR C1 , RGDPPC C2

WHERE C1.Q = C2.Q AND C1.R = C2.R

PQR(q,r,p), RGDPPC(q,r,g) à ∃𝑧 RGDP(q,r, z)

User specification

Logical representation

IT implementation](https://image.slidesharecdn.com/vtlbellomarini-170308170051/75/Towards-intelligent-data-insights-in-central-banks-challenges-and-opportunities-for-declarative-languages-Luigi-Bellomarini-7-2048.jpg)