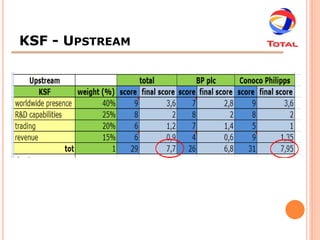

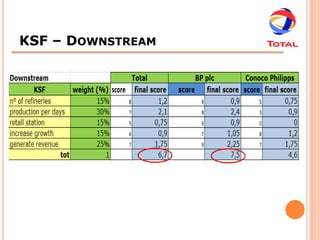

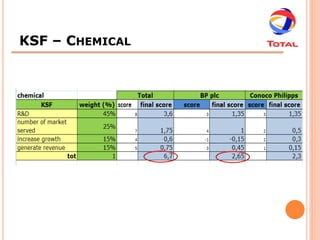

The document provides an agenda and overview of Total S.A., a leading integrated oil and gas company. The summary includes:

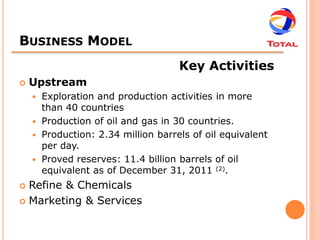

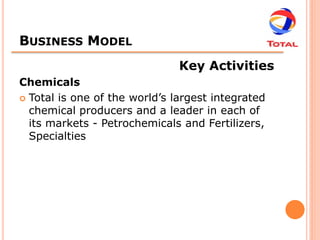

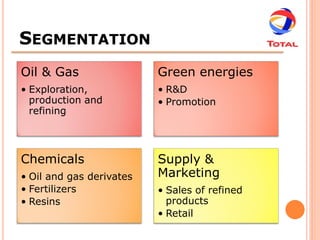

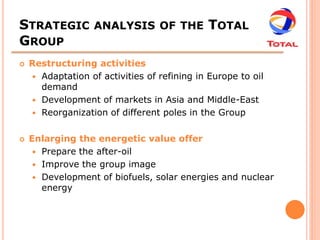

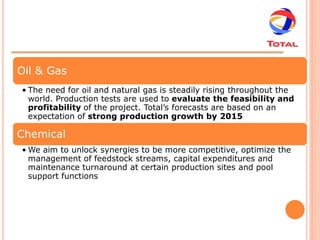

- Total is engaged in all aspects of the petroleum industry, including exploration, production, refining, chemicals, and marketing operations in over 130 countries.

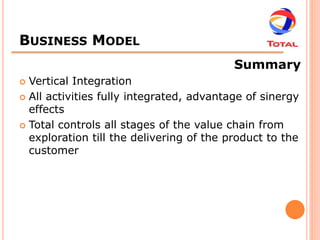

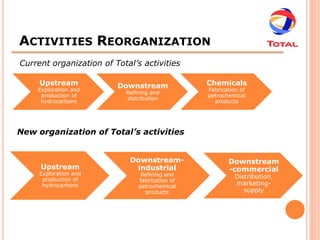

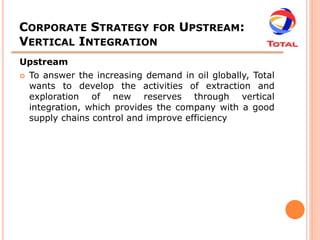

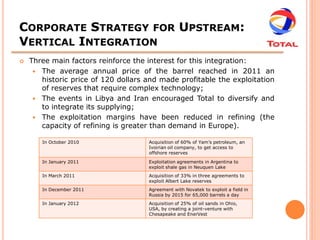

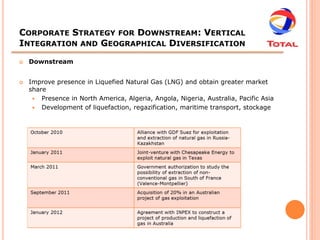

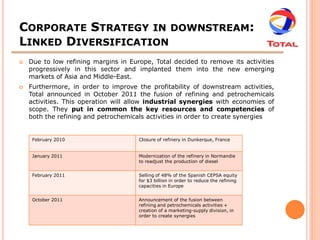

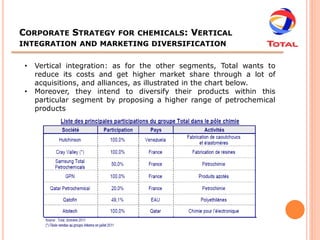

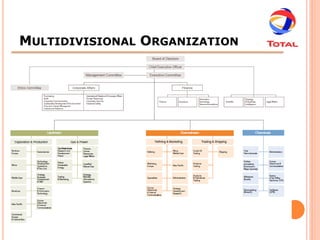

- The document outlines Total's business model, which involves vertical integration across the value chain from upstream exploration to downstream delivery to customers.

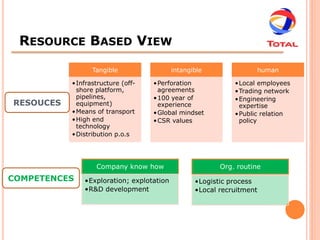

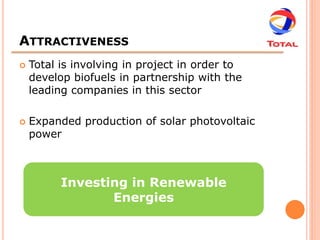

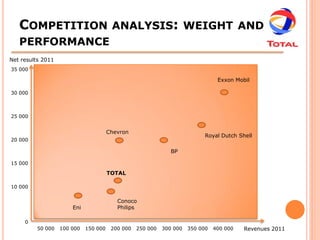

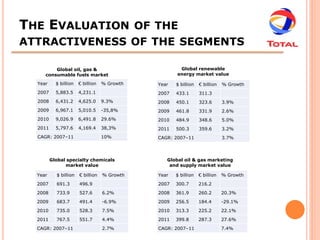

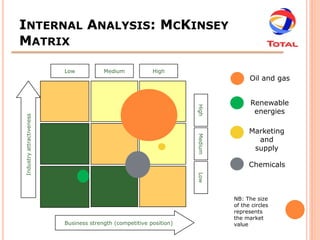

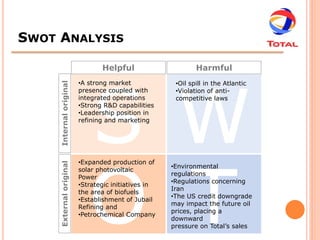

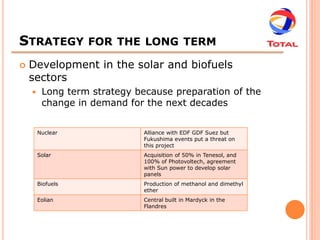

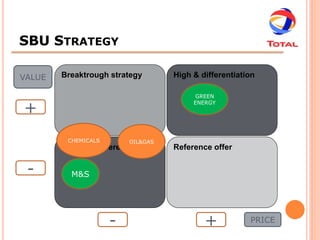

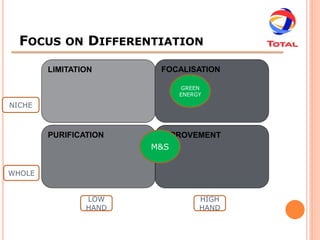

- An analysis of Total's resources, competencies, and the attractiveness and competitiveness of different industry segments like oil/gas, renewables, and chemicals is also provided.