Top of FormBottom of FormBroadening Your Perspective.docx

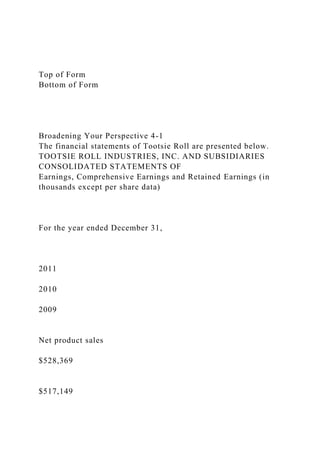

Top of Form Bottom of Form Broadening Your Perspective 4-1 The financial statements of Tootsie Roll are presented below. TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF Earnings, Comprehensive Earnings and Retained Earnings (in thousands except per share data) For the year ended December 31, 2011 2010 2009 Net product sales $528,369 $517,149 $495,592 Rental and royalty revenue 4,136 4,299 3,739 Total revenue 532,505 521,448 499,331 Product cost of goods sold 365,225 349,334 319,775 Rental and royalty cost 1,038 1,088 852 Total costs 366,263 350,422 320,627 Product gross margin 163,144 167,815 175,817 Rental and royalty gross margin 3,098 3,211 2,887 Total gross margin 166,242 171,026 178,704 Selling, marketing and administrative expenses 108,276 106,316 103,755 Impairment charges — — 14,000 Earnings from operations 57,966 64,710 60,949 Other income (expense), net 2,946 8,358 2,100 Earnings before income taxes 60,912 73,068 63,049 Provision for income taxes 16,974 20,005 9,892 Net earnings $43,938 $53,063 $53,157 Net earnings $43,938 $53,063 $53,157 Other comprehensive earnings (loss) (8,740 ) 1,183 2,845 Comprehensive earnings $35,198 $54,246 $56,002 Retained earnings at beginning of year $135,866 $147,687 $144,949 Net earnings 43,938 53,063 53,157 Cash dividends (18,360 ) (18,078 ) (17,790 ) Stock dividends (47,175 ) (46,806 ) (32,629 ) Retained earnings at end of year $114,269 $135,866 $147,687 Earnings per share $0.76 $0.90 $0.89 Average Common and Class B Common shares outstanding 57,892 58,685 59,425 (The accompanying notes are an integral part of these statements.) CONSOLIDATED STATEMENTS OF Financial Position TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES (in thousands except per share data) Assets December 31, 2011 2010 CURRENT ASSETS: Cash and cash equivalents $78,612 $115,976 Investments 10,895 7,996 Accounts receivable trade, less allowances of $1,731 and $1,531 41,895 37,394 Other receivables 3,391 9,961 Inventories: Finished goods and work-in-process 42,676 35,416 Raw materials and supplies 29,084 21,236 Prepaid expenses 5,070 6,499 Deferred income taxes 578 689 Total current assets 212,201 235,167 PROPERTY, PLANT AND EQUIPMENT, at cost: Land 21,939 21,696 Buildings 107,567 102,934 Machinery and equipment 322,993 307,178 Construction in progress 2,598 9,243 455,097 440,974 Less—Accumulated depreciation 242,935 225,482 Net property, plant and equipment 212,162 215,492 OTHER ASSETS: Goodwill 73,237 73,237 Trademarks 175,024 175,024 Investments 96,161 64,461 Split dollar o ...

Recommended

Recommended

More Related Content

Similar to Top of FormBottom of FormBroadening Your Perspective.docx

Similar to Top of FormBottom of FormBroadening Your Perspective.docx (20)

More from edwardmarivel

More from edwardmarivel (20)

Recently uploaded

Recently uploaded (20)

Top of FormBottom of FormBroadening Your Perspective.docx

- 1. Top of Form Bottom of Form Broadening Your Perspective 4-1 The financial statements of Tootsie Roll are presented below. TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF Earnings, Comprehensive Earnings and Retained Earnings (in thousands except per share data) For the year ended December 31, 2011 2010 2009 Net product sales $528,369 $517,149

- 2. $495,592 Rental and royalty revenue 4,136 4,299 3,739 Total revenue 532,505 521,448 499,331 Product cost of goods sold 365,225 349,334

- 3. 319,775 Rental and royalty cost 1,038 1,088 852 Total costs 366,263 350,422 320,627 Product gross margin 163,144 167,815

- 4. 175,817 Rental and royalty gross margin 3,098 3,211 2,887 Total gross margin 166,242 171,026 178,704 Selling, marketing and administrative expenses 108,276 106,316

- 5. 103,755 Impairment charges — — 14,000 Earnings from operations 57,966 64,710 60,949 Other income (expense), net 2,946 8,358

- 6. 2,100 Earnings before income taxes 60,912 73,068 63,049 Provision for income taxes 16,974 20,005 9,892 Net earnings $43,938 $53,063

- 7. $53,157 Net earnings $43,938 $53,063 $53,157 Other comprehensive earnings (loss) (8,740 ) 1,183

- 8. 2,845 Comprehensive earnings $35,198 $54,246 $56,002 Retained earnings at beginning of year $135,866 $147,687

- 9. $144,949 Net earnings 43,938 53,063 53,157 Cash dividends (18,360 ) (18,078 ) (17,790 ) Stock dividends (47,175 ) (46,806 )

- 10. (32,629 ) Retained earnings at end of year $114,269 $135,866 $147,687 Earnings per share $0.76 $0.90

- 11. $0.89 Average Common and Class B Common shares outstanding 57,892 58,685 59,425 (The accompanying notes are an integral part of these statements.) CONSOLIDATED STATEMENTS OF Financial Position TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES (in

- 12. thousands except per share data) Assets December 31, 2011 2010 CURRENT ASSETS: Cash and cash equivalents $78,612 $115,976 Investments

- 13. 10,895 7,996 Accounts receivable trade, less allowances of $1,731 and $1,531 41,895 37,394 Other receivables 3,391 9,961 Inventories:

- 14. Finished goods and work-in-process 42,676 35,416 Raw materials and supplies 29,084 21,236 Prepaid expenses 5,070 6,499 Deferred income taxes 578

- 15. 689 Total current assets 212,201 235,167 PROPERTY, PLANT AND EQUIPMENT, at cost: Land 21,939 21,696

- 16. Buildings 107,567 102,934 Machinery and equipment 322,993 307,178 Construction in progress 2,598 9,243 455,097 440,974

- 17. Less—Accumulated depreciation 242,935 225,482 Net property, plant and equipment 212,162 215,492 OTHER ASSETS: Goodwill 73,237

- 18. 73,237 Trademarks 175,024 175,024 Investments 96,161 64,461 Split dollar officer life insurance 74,209 74,441

- 19. Prepaid expenses 3,212 6,680 Equity method investment 3,935 4,254 Deferred income taxes 7,715 9,203 Total other assets 433,493

- 20. 407,300 Total assets $857,856 $857,959 Liabilities and Shareholders’ Equity December 31, 2011 2010 CURRENT LIABILITIES:

- 21. Accounts payable $10,683 $9,791 Dividends payable 4,603 4,529 Accrued liabilities 43,069 44,185 Total current liabilities 58,355

- 22. 58,505 NONCURRENT LIABILITES: Deferred income taxes 43,521 47,865 Postretirement health care and life insurance benefits 26,108 20,689 Industrial development bonds

- 23. 7,500 7,500 Liability for uncertain tax positions 8,345 9,835 Deferred compensation and other liabilities 48,092 46,157 Total noncurrent liabilities 133,566 132,046

- 24. SHAREHOLDERS’ EQUITY: Common stock, $.69-4/9 par value—120,000 shares authorized—36,479 and 36,057 respectively, issued 25,333 25,040 Class B common stock, $.69-4/9 par value—40,000 shares authorized—21,025 and 20,466 respectively, issued 14,601 14,212 Capital in excess of par value 533,677

- 25. 505,495 Retained earnings, per accompanying statement 114,269 135,866 Accumulated other comprehensive loss (19,953 ) (11,213 ) Treasury stock (at cost)—71 shares and 69 shares, respectively (1,992 ) (1,992 )

- 26. Total shareholders’ equity 665,935 667,408 Total liabilities and shareholders’ equity $857,856 $857,959 TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF Cash Flows (in thousands) For the year ended December 31,

- 27. 2011 2010 2009 CASH FLOWS FROM OPERATING ACTIVITIES: Net earnings $43,938 $53,063 $53,157

- 28. Adjustments to reconcile net earnings to net cash provided by operating activities: Depreciation 19,229 18,279 17,862 Impairment charges —

- 29. — 14,000 Impairment of equity method investment — — 4,400 Loss from equity method investment 194 342 233

- 30. Amortization of marketable security premiums 1,267 522 320 Changes in operating assets and liabilities: Accounts receivable

- 32. 455 Prepaid expenses and other assets 5,106 4,936 5,203 Accounts payable and accrued liabilities 84 2,180 (2,755 )

- 33. Income taxes payable and deferred (5,772 ) 2,322 (12,543 ) Postretirement health care and life insurance benefits 2,022 1,429 1,384 Deferred compensation and other liabilities 2,146

- 34. 2,525 2,960 Others (708 ) 310 305 Net cash provided by operating activities 50,390 82,805 76,994

- 35. CASH FLOWS FROM INVESTING ACTIVITIES: Capital expenditures (16,351 ) (12,813 ) (20,831 ) Net purchase of trading securities (3,234 )

- 36. (2,902 ) (1,713 ) Purchase of available for sale securities (39,252 ) (9,301 ) (11,331 ) Sale and maturity of available for sale securities 7,680 8,208 17,511

- 37. Net cash used in investing activities (51,157 ) (16,808 ) (16,364 ) CASH FLOWS FROM FINANCING ACTIVITIES: Shares repurchased and retired (18,190 )

- 38. (22,881 ) (20,723 ) Dividends paid in cash (18,407 ) (18,130 ) (17,825 ) Net cash used in financing activities (36,597 ) (41,011 ) (38,548 )

- 39. Increase (decrease) in cash and cash equivalents (37,364 ) 24,986 22,082 Cash and cash equivalents at beginning of year 115,976 90,990 68,908 Cash and cash equivalents at end of year $78,612 $115,976

- 40. $90,990 Supplemental cash flow information Income taxes paid $16,906 $20,586 $22,364

- 41. Interest paid $38 $49 $182 Stock dividend issued $47,053 $46,683 $32,538 (The accompanying notes are an integral part of these statements.) Warning Don't show me this message again for the assignment Ok Cancel

- 42. What was the amount of depreciation expense for 2011 and 2010? (You will need to examine the notes to the financial statements or the statement of cash flows.) (Enter amounts in thousands.) 2011 2010 Depreciation expenses $ Warning Don't show me this message again for the assignment Ok Cancel

- 43. What was the cash paid for income taxes during 2011, reported at the bottom of the consolidated statement of cash flows? What was income tax expense (provision for income taxes) for 2011? (Enter amounts in thousands.) Income tax paid during 2011 $ Provision for income tax made during 2011 $ Warning Don't show me this message again for the assignment Ok Cancel By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Question Attempts: 0 of 3 used Save for later Submit Answer

- 44. Copyright © 2000-2015 by John Wiley & Sons, Inc. or related companies. All rights reserved. Tooltip JS-control [id=_intjsTooltip_1_] take-question a quest2375799entra quest2375799 asnmt1478992 Top of Form Bottom of Form

- 45. IFRS Practice Question 1 GAAP: provides only general guidance on revenue recognition, compared to the detailed guidance provided by IFRS. provides very detailed, industry-specific guidance on revenue recognition, compared to the general guidance provided by IFRS. allows revenue to be recognized when a customer makes an order. requires that revenue not be recognized until cash is received. Warning Don't show me this message again for the assignment Ok Cancel Link to Text

- 46. Top of Form Bottom of Form IFRS Practice Question 2 Which of the following statements is false? IFRS requires that revenues and costs must be capable of being measured reliably. IFRS uses the cash basis of accounting. IFRS employs the periodicity assumption. IFRS employs accrual accounting. Warning Don't show me this message again for the assignment Ok Cancel

- 47. Link to Text By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Question Attempts: 0 of 3 used Save for later Submit Answer . Top of Form Bottom of Form

- 48. IFRS Practice Question 3 As a result of the revenue recognition project being undertaken by the FASB and IASB: revenue recognition will place more emphasis on when revenue is realized. revenue recognition will place more emphasis on when changes occur in assets and liabilities. revenue will no longer be recorded unless cash has been received. revenue recognition will place more emphasis on when revenue is earned. Warning Don't show me this message again for the assignment Ok Cancel Link to Text

- 49. By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Question Attempts: 0 of 3 used Save for later Submit Answer Top of Form Bottom of Form IFRS Practice Question 4 Which of the following is false? Under IFRS, firms do not engage in the closing process.

- 50. Under IFRS, the term expenses includes losses. IFRS has fewer standards than GAAP that address revenue recognition. Under IFRS, the term income describes both revenues and gains. Warning Don't show me this message again for the assignment Ok Cancel Link to Text By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Question Attempts: 0 of 3 used Save for later Submit Answer

- 51. Top of Form Bottom of Form Brief Exercise 4-1 Transactions that affect earnings do not necessarily affect cash. Identify the effect, if any, that each of the following transactions would have upon cash and net income. The first transaction has been completed as an example. (If an amount reduces the account balance then enter with negative sign preceding the number e.g. -15,000 or parentheses e.g. (15,000).) Cash Net Income (a) Purchased $108 of supplies for cash. $–108 $0 (b) Recorded an adjusting entry to record use of $28 of the above supplies.

- 52. (c) Made sales of $1,428, all on account. (d) Received $885 from customers in payment of their accounts. (e) Purchased equipment for cash, $2,790. (f) Recorded depreciation of building for period used, $747. Warning Don't show me this message again for the assignment Ok Cancel Link to Text Link to Text

- 53. By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Question Attempts: 0 of 3 used Save for later Submit Answer Copyright © 2000-2015 by John Wiley & Sons, Inc. or related companies. All rights reserved. quest2263802entra quest2263802 asnmt1478992

- 55. quest2263929 asnmt1478992 take-question a asnmt1478992 Top of Form Bottom of Form Problem 4-3A The Solo Hotel opened for business on May 1, 2014. Here is its trial balance before adjustment on May 31. SOLO HOTEL Trial Balance May 31, 2014 Debit Credit Cash $ 2,936 Supplies 2,600

- 56. Prepaid Insurance 1,800 Land 15,436 Buildings 73,600 Equipment 16,800 Accounts Payable $ 5,136 Unearned Rent Revenue 3,300 Mortgage Payable

- 57. 39,600 Common Stock 60,436 Rent Revenue 9,000 Salaries and Wages Expense 3,000 Utilities Expense 800 Advertising Expense 500 $117,472 $117,472 Other data: 1. Insurance expires at the rate of $450 per month.

- 58. 2. A count of supplies shows $1,062 of unused supplies on May 31. 3. (a) Annual depreciation is $4,200 on the building. (b) Annual depreciation is $4,080 on equipment. 4. The mortgage interest rate is 5%. (The mortgage was taken out on May 1.) 5. Unearned rent of $2,575 has been earned. 6. Salaries of $767 are accrued and unpaid at May 31. Warning Don't show me this message again for the assignment Ok Cancel Journalize the adjusting entries on May 31. (Credit account

- 59. titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit 1. 2. 3 (a). 3 (b).

- 60. 4. 5. 6. Warning Don't show me this message again for the assignment Ok Cancel Show List of Accounts Link to Text

- 61. Prepare a ledger using T-accounts. Enter the trial balance amounts and post the adjusting entries. (Post entries in the order of journal entries presented in the previous question.) Cash Prepaid Insurance Supplies

- 62. Land Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable

- 63. Unearned Rent Revenue Salaries and Wages Payable Interest Payable Mortgage Payable

- 64. Common Stock Rent Revenue Salaries and Wages Expense Utilities Expense

- 65. Advertising Expense Interest Expense Insurance Expense Supplies Expense Depreciation Expense

- 66. Warning Don't show me this message again for the assignment Ok Cancel Show List of Accounts Link to Text Prepare an adjusted trial balance on May 31. SOLO HOTEL Adjusted Trial Balance May 31, 2014

- 67. Debit Credit $ $

- 68. $ $ Warning

- 69. Don't show me this message again for the assignment Ok Cancel Show List of Accounts Link to Text Prepare an income statement for the month of May. SOLO HOTEL Income Statement For the Month Ended May 31, 2014 $ $

- 70. $ Warning Don't show me this message again for the assignment Ok Cancel Show List of Accounts Link to Text

- 71. Prepare a retained earnings statement for the month of May. SOLO HOTEL Retained Earnings Statement For the Month Ended May 31, 2014 $ : $ Warning Don't show me this message again for the assignment Ok Cancel Show List of Accounts Link to Text

- 72. Prepare a classified balance sheet at May 31. (List current assets in order of liquidity. List Property, Plant and Equipment in order of Land, Buildings and Equipment .) SOLO HOTEL Balance Sheet May 31, 2014 Assets $

- 73. $ $ :

- 74. : $ Liabilities and Stockholders' Equity

- 75. $ $

- 77. $ Warning Don't show me this message again for the assignment Ok Cancel Show List of Accounts Link to Text

- 78. By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Question Attempts: 0 of 3 used Save for later Submit Answer Copyright © 2000-2015 by John Wiley & Sons, Inc. or related companies. All rights reserved. viewthroughconversion/944609404/?value=0&guid=ON&a mp;script=0"/>< /div> take-question a quest2375793entra

- 79. quest2375793 asnmt1478992 Problem 4-2A Ken Lumas started his own consulting firm, Lumas Consulting, on June 1, 2014. The trial balance at June 30 is as follows. LUMAS CONSULTING Trial Balance June 30, 2014 Debit Credit Cash $ 6,850 Accounts Receivable 7,000 Supplies 2,041 Prepaid Insurance

- 80. 3,720 Equipment 15,000 Accounts Payable $ 4,300 Unearned Service Revenue 5,200 Common Stock 22,131 Service Revenue 8,000 Salaries and Wages Expense 4,000 Rent Expense

- 81. 1,020 $39,631 $39,631 In addition to those accounts listed on the trial balance, the chart of accounts for Lumas also contains the following accounts: Accumulated Depreciation—Equipment, Salaries and Wages Payable, Depreciation Expense, Insurance Expense, Utilities Expense, and Supplies Expense. Other data: 1. Supplies on hand at June 30 total $720. 2. A utility bill for $250 has not been recorded and will not be paid until next month. 3. The insurance policy is for a year. 4. Services were performed for $4,349 of unearned service revenue by the end of the month. 5. Salaries of $1,334 are accrued at June 30. 6. The equipment has a 5-year life with no salvage value and is

- 82. being depreciated at $250 per month for 60 months. 7. Invoices representing $4,281 of services performed during the month have not been recorded as of June 30. Warning Don't show me this message again for the assignment Ok Cancel Prepare the adjusting entries for the month of June. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit 1. 2.

- 83. 3. 4. 5. 6.

- 84. 7. Warning Don't show me this message again for the assignment Ok Cancel Show List of Accounts Link to Text Post the adjusting entries to the ledger accounts. Enter the totals from the trial balance as beginning account balances. (Use T- Accounts.) (Post entries in the order of journal entries presented

- 85. in the previous question.) Cash Accounts Receivable Equipment Accumulated Depreciation-Equipment Accounts Payable

- 86. Salaries and Wages Payable Unearned Service Revenue Common Stock Service Revenue

- 87. Prepaid Insurance Supplies Salaries and Wages Expense

- 88. Rent Expense Depreciation Expense Insurance Expense Utilities Expense

- 89. Supplies Expense Warning Don't show me this message again for the assignment Ok Cancel Show List of Accounts Link to Text

- 90. Prepare an adjusted trial balance at June 30, 2014. LUMAS CONSULTING Adjusted Trial Balance June 30, 2014 Debit Credit $ $

- 91. $ $