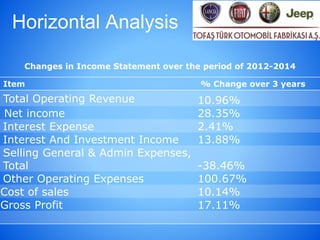

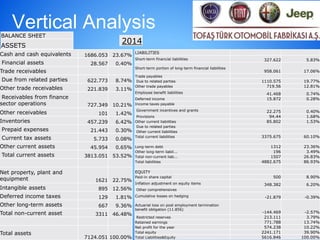

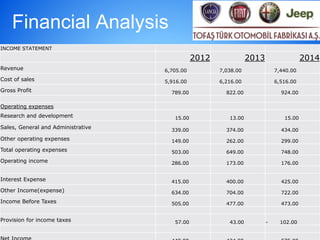

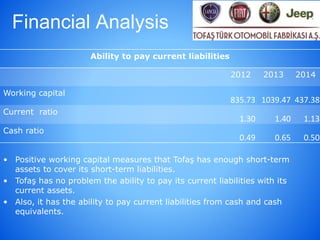

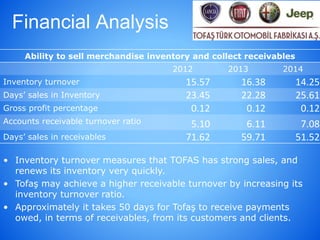

Tofaş is a Turkish automaker founded in 1968. It produces Fiat, Alfa Romeo, Lancia, Maserati, Ferrari, and Jeep vehicles. The document analyzes Tofaş' financial statements from 2012-2014 through horizontal analysis, vertical analysis, and key financial ratios to evaluate the company's performance and investment potential. The analysis found that Tofaş demonstrates financial stability, low investment risk, and ability to meet obligations, leading to a recommendation to invest in the company.