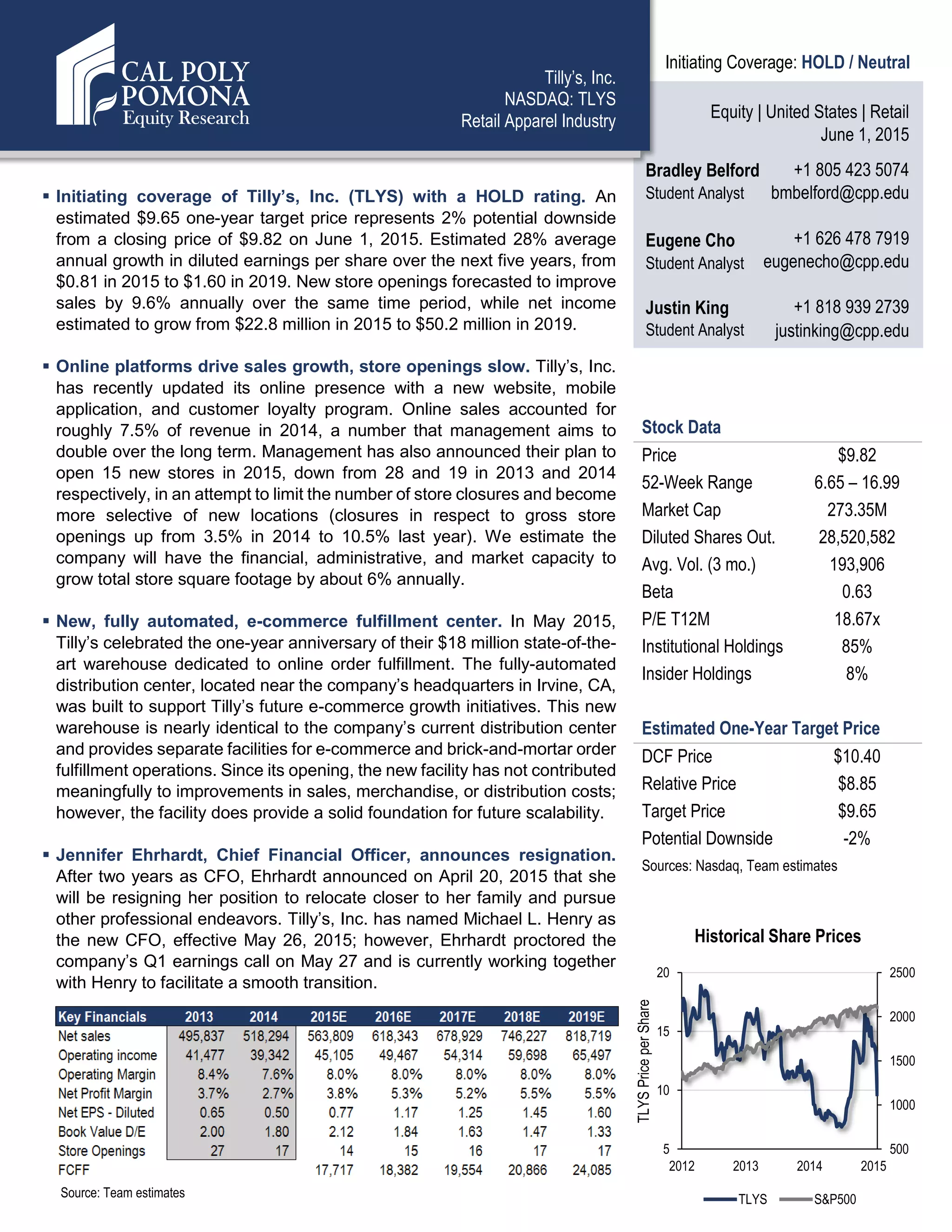

- The analyst initiates coverage of Tilly's, Inc. with a HOLD rating and a one-year target price of $9.65, representing 2% downside potential.

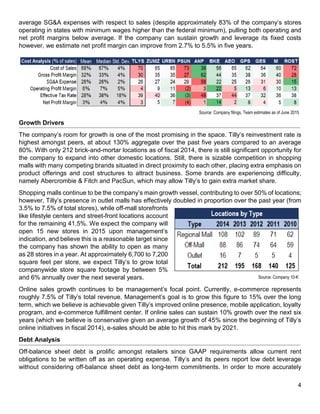

- Key growth drivers for Tilly's include expanding its online presence through improved websites and apps, as well as opening 15 new stores in 2015, though at a slower pace than previous years.

- While Tilly's has opportunities to grow through new store openings and increasing its online sales, its profitability lags peers due to its strategy of offering lower prices and deeper discounts than competitors.