Project 2 - Final Deck

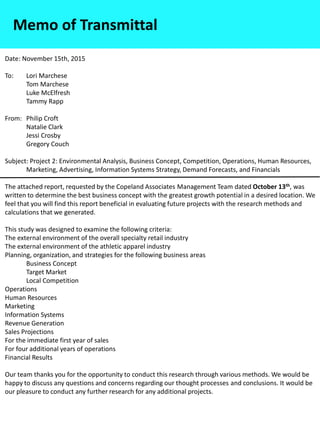

- 1. Date: November 15th, 2015 To: Lori Marchese Tom Marchese Luke McElfresh Tammy Rapp From: Philip Croft Natalie Clark Jessi Crosby Gregory Couch Subject: Project 2: Environmental Analysis, Business Concept, Competition, Operations, Human Resources, Marketing, Advertising, Information Systems Strategy, Demand Forecasts, and Financials The attached report, requested by the Copeland Associates Management Team dated October 13th, was written to determine the best business concept with the greatest growth potential in a desired location. We feel that you will find this report beneficial in evaluating future projects with the research methods and calculations that we generated. This study was designed to examine the following criteria: The external environment of the overall specialty retail industry The external environment of the athletic apparel industry Planning, organization, and strategies for the following business areas Business Concept Target Market Local Competition Operations Human Resources Marketing Information Systems Revenue Generation Sales Projections For the immediate first year of sales For four additional years of operations Financial Results Our team thanks you for the opportunity to conduct this research through various methods. We would be happy to discuss any questions and concerns regarding our thought processes and conclusions. It would be our pleasure to conduct any further research for any additional projects. Memo of Transmittal

- 2. Prepared for: Senior Partners Copeland & Associates College of Business Prepared by: Team 2 – Philip Croft, Natalie Clark, Jessi Crosby, and Gregory Couch Mid Cohort 107 College of Business Ohio University

- 3. The city of Chapel Hill would greatly benefit from the development of a new athletic apparel store, especially for the busy lifestyle that many working women face. Altai is a retail store that provides a large amount of reliable products that are fashionable and functional for everyday tasks, including yoga in the morning, grocery shopping in the afternoon, and cocktails in the evening. Copeland Associates utilized various research methods for analyzing the current state of the macro- environment of the specialty retail industry. Through this, the growth potential for athletic apparel stores was very prevalent, resulting in the further research of the micro-environment of the athletic apparel industry. This research gave Copeland Associates the inspiration to create a business plan for Altai, which is located in Chapel Hill, North Carolina. The creation would create several benefits for the Chapel Hill area, and this company would result in the satisfaction of many potential customers within the area. Altai is the premier destination for athletic apparel for women and their busy schedules, which is why the store is equipped with some of the best equipment to maximize efficiency while minimizing shopping stress with long lines. Altai’s business plan includes the following: • A clear and direct business mission and objective as well as a very strong target market • A location with a large amount of foot traffic and college-student populations • A small amount of similar stores in the area, but not direct competitors • A highly organized business operations plan as well as a very simplistic shopping/returns process • A small, but dedicated group of employees, who can monitor their progress with advanced technology systems • A strong product mix of reliable products • A strategic and diversified marketing plan, including the following platforms • Free classes taught by local instructors to attract customers into the store • Social Media Platforms specified to customers in the target market • Special events at the neighboring college campuses • A highly sophisticated and efficient shopping experience through RFID technology that is compatible with all of Altai’s shopping technology • Accurate sales projections using primary and secondary data based on forecasted demand • Strong financials that will result in: • A start-up capital requirement of $210,000 • A positive Net Present Value and strong Internal Rate of Return • Growing financial ratios after Year 2 Based on these findings, Altai would be a very successful business in the foreseeable future and would be very beneficial for the Chapel Hill community overall. This business would revolutionize the way that customers shop, almost completely eliminating lines. This process will also innovate the way that companies utilize inventory control, making employees happier and more capable of focusing on the customer experience instead of tracking items. Executive Summary

- 4. Table of Contents Introduction 1 Specialty Retail Apparel Industry: 2 Industry Overview and Drivers 2 Millennial Consumers Will Drive the Industry 2 Passage of the Trans-Atlantic Partnership Will Lower Clothes Prices 2 Athletic Apparel Segment: 3 Imported Products are a Threat to Domestic Manufacturers 3 Buyer Power Outweighs Supplier Power 3 Competitive Landscape 3 Business Concept: 4 Who Altai Is 4 Name and Logo 4 Value 4 Altai’s Market: 5 Target Market 5 Chapel Hill Demographics 5 Location 5 Local Competition: 6 Operations: 7 Inventory Control and Supply Chain 7 Human Resources 7 Marketing: 8 Marketing to Millennials 8 What Altai Means to Customers 8 Customer Reviews as a Form of Marketing 8 Inventory Bought and Pricing 9 Products and Services 9 Place 10 Promotion 10 Marketing in the ‘Research Triangle’ 10

- 5. Table of Contents Advertising: 11 Billboard 11 Facebook 11 Twitter 11 Instagram 11 Loyalty Program 11 Information Systems Strategy: 12 Using Information Systems to Add Customer Value 12 Inventory Management with RFID Technology 12 Managing the Stock Room with RFID Technology 13 POS Transaction Processing 13 Reaching Customers Cross-Platform 14 Disaster Recovery and Security 14 Demand Forecast #1: 15 Potential Sales Based on Number of Customers per Day and Average Ticket Price 15 Step 1: Expected Potential Customers per Day 15 Step 2: Average Ticket Price 15 Demand Forecast #2: 16 Potential Sales Based on Market Size 16 Step 1: Forecasting Obtainable Millennials 16 Step 2: Average Ticket Price 16 Financials: 17 Weighting of Demand Forecasts 17 Fiscally-Impacting Risks 17 Revenue Generation Plan 17 Pro Forma Statement Overview 18 Sales Growth, Profit Margin, ROE, and ROA 18 Free Cash Flows 18 Details on Key Ratios 18 Conclusion 19

- 6. Table of Contents References 20 Appendices: 27 Appendix A: Financials 27 Appendix B: Depreciation Schedule 33 Appendix C: Amortization Schedule 40 Appendix D: Cash Flow for Year 1 41 Appendix E: Inventory Mix and Average Ticket Price 43 Appendix F: Technology Equipment 44 Appendix G: PESTLE Analysis 46 Appendix H: Porter’s Five Forces 48 Appendix I: Facebook Page 50 Appendix J: Twitter Page 51 Appendix K: Instagram Page 52 Appendix L: Billboard, T-Shirt, and Flyer 53 Appendix M: Desktop Website Mockup 54 Appendix N: Perceptual Map 55 Appendix O: Positioning Pyramid 56 Appendix P: Aaker Model 57 Appendix Q: Customer Order and Inventory Processing 58 Appendix R: Processing New Inventory and Returns 59 Appendix S: System Security and Inventory Management 60 Appendix T: Dashboards 62 Appendix U: Interviews 64 Appendix V: Financial Calculations 70 Appendix W: Store Front 71

- 7. List of Figures Figure 1: Demand Forecast 1 Figure 2: Financial Predictions 1 Figure 3: U.S. Population Growth by Age 2 Figure 4: Industry Drivers 2 Figure 5: Supplier/Buyer Weighing 3 Figure 6: Favorite Brands for Women’s Sportswear 3 Figure 7: Nile Running Look 4 Figure 8: Store Blueprints 5 Figure 9: Local Competition Chart 6 Figure 10: Manager and Employee Qualities 7 Figure 11: Employee Logistics 7 Figure 12: Brand Mix 8 Figure 13: Products Mix 9 Figure 14: Map of ‘Research Triangle’ 10 Figure 15: Females in ‘Research Triangle’ 10 Figure 16: Membership Card 11 Figure 17: On-Shelf Availability 12 Figure 18: RFID vs Barcode 12 Figure 19: RFID Tag 13 Figure 20: Inventory Tagging & Management 13 Figure 21: POS Software Comparison 13 Figure 22: Cost of Web Development 14 Figure 23: Causes of Data Loss 14 Figure 24: Customer Expectancy 15 Figure 25: Customer per Day Forecast 15 Figure 26: Sales Forecast 15 Figure 27: Percent of Market Size in Locations 16 Figure 28: Breakdown of Potential First Year Sales 16 Figure 29: Weighing of Demand Forecast 17

- 8. List of Figures Figure 30: Sales Growth 18 Figure 31: Profit Margin 18 Figure 32: ROE & ROA 18 Figure 33: Free Cash Flows 18 Figure 34: Projected Net Income 19

- 9. Introduction 1 In this business plan, we explore the different aspects that would follow the creation of the specialty apparel store, Altai, that specializes in athleisure clothing. The first topic that is focused on is the specialty retail apparel industry as a whole, then the sports apparel industry and local competitors within Altai’s market to illustrate the current and future growth. The business itself has a target market of millennial females in and around Chapel Hill, North Carolina. Compared to other businesses within the area, Altai would be one of few with this specific target market. The surrounding area proves valuable as well, due to that fact that Duke University and North Carolina State University are both within 25 miles of the University of North Carolina, which is located in Chapel Hill. The largest segment of the target market will come from these college students. In order to reach these students and other female millennials within the community, our marketing efforts will primarily revolve around being visible on each campus and in the town. Advertising will consist of a billboard located between Chapel Hill and Durham, 300 flyers spread throughout each campus, 600 free t-shirts, a Facebook ad, and Twitter sponsored tweets. Altai differentiates itself from its competitors through its superior customer experience that deviates from its advanced technology, and in-store yoga and Pilates sessions . The store will implement RFID tags for each product, so that customers can just walk through a terminal and the prices automatically be added up for them instead of having to wait in long lines. Touch screen displays above each unit provide the customers with information on how much is in stock, and if it has a specific size in the back. Once an item is sold, an extra replica from the back will be brought up so customers shouldn’t have to spend time trying to find a particular size. In terms of the yoga and Pilates sessions, there will be various ones throughout the day during the slow hours of the store. This will create a sense of serenity within the store, and incentivize more customers to enter. Since customers are the top priority, an option to provide feedback and customer reviews for others to see are located almost anywhere in correlation to the store. Based on the facts further provided within this business plan and projected net present value, internal rate of return, and payback period, Altai would be a positive venture to pursue and capitalize on. Net Present Value Internal Rate of Return Payback Period $25,622 26.62% (WACC = 25.73%) 4.22 Figure 1: Demand Forecast Demand Forecast #1 Demand Forecast #2 Forecast: $930,355.52 $722,848.45 Weighing: 10% 90% Estimated Total Cost of Start-Up: $210,000 Figure 2: Financial Predictions

- 10. Analysis of Specialty Retail Apparel Industry 2 Industry Overview and Drivers The specialty retail apparel industry is composed of the manufacturing, or distribution, of clothing, accessories, and footwear for consumers that focuses on a specific range or type of product. This excludes department stores that sell non-apparel items as well (i.e. Target, Walmart, etc.). Passage of the Trans-Atlantic Partnership Will Lower Clothing Prices The Trans-Pacific Partnership is a negotiation between the United States and 11 other countries which will create a free trade zone to nearly 40% of all the world's gross domestic products (Ellis, 2015). With tariffs on clothing reaching up to 32%, the U.S. Government collected $13.5 billion in tariffs on imported clothing and shoes in 2014 (Lamar, 2015). These tariffs must be compensated when pricing clothing, raising the retail value. With 97% of all US clothing imported (Michael, 2015), the passage of the Trans-Pacific Partnership will help make clothing more affordable to individuals with lower disposable income without affecting the manufacturer’s income. Millennial Consumers Will Drive the Industry Millennials are defined as, “those born in 1982 and approximately the 20 years after” (Bump, 2014). This age group’s purchasing power is estimated to be nearly $170 billion per year and growing (Honigman, 2013). However, millennials are cautious with their spending, often turning to others’ reviews and advice for further information before purchasing a product. For example, more than 50% use a smart phone to research products while shopping (Honigman, 2013). Also, 51% claim customer reviews have a greater impact on their purchase decision than direct recommendations from family and friends. In order to attract this powerful segment, it is important for companies to have easily accessible product information that reflects positively on the company. -10% -5% 0% 5% 10% 15% 20% <25 25-34 35-44 45-54 55-64 65+ U.S Population Growth by Age 2015 - 2020 2020 - 2025 Consumer Confidence 0.9% forecasted compound growth (IBISWorld, 2015) Per Capita Disposable Income 2.5% forecasted compound growth (IBISWorld, 2015) Average Household Income 2.6% of income is spent on apparel (Bureau of Labor Statistics, 2015) Industry Drivers Figure 3: U.S. Population Growth by Age Figure 4: Industry Drivers

- 11. Analysis of the Athletic Apparel Segment 3 Buyer Power Outweighs Supplier Power What gives purchaser’s power strength is the high level of choices they have; with a plethora of styles, brands and even colors buyer’s can freely chose between them with little consequence (Mintel, 2015). Furthermore, due to relaters’ position at the end of the supply chain, companies are forced to follow customer demand. Buyer strength is further purchased due to shortfalls in supplier power. Due to the relative fragmentation of retailers, supplier power is weakened due to the retailer’s ability to buy inventory from multiple sources. Intense competition from low-wage, foreign manufacturers create large incentives for retailers to import clothing, further weakening a supplier’s power. Imported Products Are A Threat to Domestic Manufacturers Competitive Landscape The athletic apparel segment is highly competitive, both internationally and locally. Nike is currently the largest athletic retailer in the US with a 21% market share, followed by VF Corp with 6% and Adidas America with 5% (Passport, 2015). These large companies compete amongst themselves and with large department stores who have begun to diversify their product mix into athletic apparel. Threat of New Entry is high due to the relatively low capital investment required to make market entry. However, imported apparel prove the highest threat; foreign child labor and low working conditions allow for cheaper products. With the passage of the Trans-Atlantic Partnership, these products will continue to lower in price. While this seems cost effective, a company’s reputation for using such manufacturing practices can greatly impact its sales, causing companies to avoid this method. 0% 10% 20% 30% 40% 50% 60% Favorite Brands for Women’s Sportswear Statista, 2015 Figure 6: Favorite Brands for Women’s Sportswear Small, independent operators compete on the local level, usually targeting niche markets to obtain a market share (IBISWorld 2015). Due to improving economic conditions, the number of these retailers is expected to increase, further creating competition. In order to compete, the ability to create a strong brand awareness is crucial to separating a retailer from its competitors, causing many companies to invest heavily in marketing and public relations. Supplier Buyer Figure 5: Supplier/Buyer Weighing

- 12. Business Concept 4 “Altai’s vision is to be the premier destination for women who want a balance between fitness and fashion.” - Company Vision Statement Value Altai’s products are for more than just exercise. Using simple, practical patterns and designs, its clothing easily match with almost any outfit, allowing for complete seasonality and long-term use. The company believes that customer experience is the key to a successful retailer, which is why it incorporates radio-frequency identification technology (RFID) to solve common customer complaints such as lack of product information and long check out lines. This in turn leads to a more positive shopping experience, increasing the likelihood for repeat shopping. However, the benefits of RFID aren’t limited to the customers. Using modern inventory practices, RFID allows for detailed inventory tracking and data collection. Not only does this allow for more accurate inventory replacement, but it provides critical information on popular product lines, sizes, and seasons. This simplifies company planning and procedures, freeing management and employees to handle other tasks. Figure 7: Nike Running Look Who Altai Is Altai sells fashionable, practical athleisure wear to progressive women who want the convenience of a whole day's wear from a single outfit. The company values simplicity, functionality and personality, which is reflected through its extensive selection of clothing and superior customer experience. To foster its family of customers, the company offers in-store programs such as yoga and Pilates in order to make each individual feel like part of the Altai community. Name and Logo Altai’s name stems from the mountain range in Central Asia. The point where Russia, China, Mongolia, and Kazakhstan come together, the company wanted a name that aligned with its vision as the intersection of fitness and fashion. The colors of Altai’s logo reflect a sense of peace and balance. The stretching woman in its design creates an image of activity but tranquility. The combination of color and design express the balance and functionality of its products.

- 13. Altai’s Market 5 Altai’s store is located on 109 East Franklin Street in the heart of downtown Chapel Hill, North Carolina. Just a few minutes walk from the University of North Carolina's campus, it rents an ADA compliant, 2,380 sq. ft. retail space with a glass storefront and exposed brick walls. Refer to Appendix W for a picture of the store. Location Chapel Hill Demographics Chapel Hill has a total population of 60,138, including the 29,153 students at the University of North Carolina. Of this population, 53.4% are female and 24% are females between the ages of 18-34. Furthermore, with an average household income of $106,337 (SimplyMap, 2015) Chapel Hill is about 26% higher than the U.S average. Retail sales from women’s clothing stores in Chapel Hill totaled $4,425,050 in 2014. Sportswear accounted for $728,200 of this, or roughly 16% of total sales. This is more than 2.5 times higher than the portion sportswear accounted for in the US total (IBISWorld, 2015). With a larger demographic within the target market that has a high spending on sportswear, Chapel Hill is the perfect location for Altai. Target Market Altai's primary customers are women between the ages of 18-34. Women's apparel is the largest segment in global apparel with 49.4% market share or a $121 billion value (MarketLine). This is expected to increase 14% to $139 billion by 2019 (Mintel, 2015). Within this segment, 20-30 year olds represent a key demographic (IBISWorld, 2015). The millennial age group is projected to reach 75.3 million in number by the end of 2015 (Fry, 2015), with 50% of millennial females shopping more than twice a month compared to 36% of older females (Honigman, 2013). With the female population between the ages of 25-34 expected to increase, targeting this growing and spending segment will prove a successful market. Figure 8: Store Blueprints

- 14. Local Competition 6 Local Competition Company Miles from Altai Target Market Strengths Weaknesses Dragonwing GirlGear: - - - Young females High quality, affordable products at a niche, targeted market. Young market leaves out large potential from older customers. Chapel Hill Sportswear: 0.5 University of North Carolina students and fans Large selection of UNC apparel. Only UNC apparel targets very small market. Great Outdoor Provision: 2.5 Casual outdoorsman High quality, name brand products lines. Focuses on functionality rather than fashion. Fleet Feet Sports: 0.9 Runners Well respected, recognizable name in running market with high quality products and services. Niche targeting creates niche brand association with runners. Durham/Raleigh stores: 11-28 Women Established brands with large customer bases. Distance from Chapel Hill customers. Chapel Hill has four major competitors: Dragonwing Girlgear, Chapel Hill Sportswear, Great Outdoor Provision, and Fleet Feet Sports. While all of these companies provide competition to Altai, Altai has a major advantage over these companies: Altai is the only women’s sportswear store to target millennial women in the Chapel Hill area. While there are multiple vendors of women’s sportswear, none of these companies market themselves as women’s clothing wear. For example, while Fleet Feet Sports carries many similar products to Altai, it has a strong brand association with runners rather than the broader female market. By actively marketing as a women’s sportswear, Altai will be the only store in Chapel Hill associated with women’s sportswear. The most immediate competition within Altai’s target market is from the nearby cities of Raleigh and Durham. Large, well established companies such as Dick’s Sporting Goods, Omega Sports, Athleta, and Lululemon draw customers out of Chapel Hill to these stores mainly due to their strong brand recognition. However, Altai has a large factor in its favor over these competitors: location. Altai is a more convenient location for Chapel Hill residents, translating to a large portion of them coming to Altai rather than traveling to a neighboring city. Furthermore, these large retailers are about equal distance from Durham as Chapel Hill is. By actively marketing in Durham, women will be more likely to visit Altai before these other competitors. Figure 9: Local Competition Chart

- 15. Operations 7 Inventory Control and Supply Chain In order to guarantee acquisition of top trending products, Atlai places its orders 6 months in advance of season (fall wear ordered in February- March, spring wear in September-October, etc). Altai will hold 2-3 months worth of inventory and re-purchase as necessary. The company offers to purchase inventory from distributors at a 55% discount with payment due 90 days from purchase. As products arrive to the store, they are moved into the stock room for processing. Using Seagull RFID tagging software, tags for individual items in the shipment are printed in-house. The apparel is then unpacked and tagged before being placed onto pre-determined racks and shelves. As inventory is purchased from the floor, the Point of Sales (POS) System sends a notification to the stock room. A message showing the item to be restocked and its locations in the stock room is displayed on a monitor located near the shelving units. The stock room attendant then locates the item and brings it to the floor. An antenna above the door between the floor and stock room senses the article of clothing leaving the stock room, notifying the system that the item has been restocked and clears it from the stock room display. Customers place their items in a shopping bag as they go through the store. When a customer has finished their shopping, they move to the back of the store where two RFID equipped POS terminal are located. The items are read within seconds and totaled. A store clerk will be waiting on the other side of the scanner in order to collect payment. Once payment is complete, the POS system updates the central database that inventory has been sold and numbers are reduced. If the database detects low inventory for an item, an alert is sent to the store manager with the option to automatically reorder. Management will make the final decision to place the order. Human Resources Altai believes that having a positive customer experience is not only composed of its advanced technological equipment, but also with the employees that are on the floor and in the stockroom. The store has one manager during each shift and three part-time employees. These employees are held to the standard of being the most customer- centric in the industry. This includes product knowledge and customer interaction. Altai’s highly efficient inventory control system through RFID allows employees to avoid the monotonous scanning of products, freeing the sales associates to improve customer experiences. Using the business dashboards in Appendix T, employees will be able to track their own progress. Position: # of Employees: Salary: Total Expense: Manager 2 $42,000 $92,000 Sales associate: 11 $11/hour $110,352 Instructor: New one each week $100 per session $5,200 Managers Hiring, firing, and leading of sales associates Purchasing and tracking of inventory Collection and counting of end-day cash Employees Customer greeting Organizing and arranging of store Product information and suggestions Completing retail transactions Figure 10: Manager and Employee Qualities Figure 11: Employee Logistics

- 16. Marketing 8 Marketing to Millennials Marketing to millennials is different from traditional strategies. This is mainly due to their daily use of technology and its integration within their lifestyles. For example, because of their close online interactions, millennials want to be the first to receive updates and coupons (Newman, 2015). 85% of ages 15 to 35 own a smartphone, making optimization for mobile marketing and usage a must. (Kaplan, 2015). Finally, millennials expect to be rewarded for their loyalty and want to be included in a brand’s communication efforts (Newman, 2015). In order to reach the entire target market of millennial women, the store must connect with the consumers primarily through social media, loyalty programs, an effective website, and promotional materials. Customer Reviews as a Form of Marketing 64% of millennials feel that companies should offer more ways to share their opinions online (Honigman, 2013). In order to maximize customer’s ability to share product information, Altai incorporates the ability to share and read product reviews both online and in-store. Online review platforms include the company website and app. These reviews collect both customer input as well as social media posts regarding the products. For example, Instagram pictures where products are used can be viewed so customers can see real applications of products. For customers who do not want to use their smartphone to access reviews, in-store kiosks can be used; scanning the barcode of the product, product reviews and information will immediately be displayed. Not only will this help keep the consumer more involved and interactive, but it will also provide valuable insight to those looking to purchase a product. This is important because 51% of millennials say consumer opinions found on a company’s website have a greater impact on purchase decisions than recommendations from acquaintances (Honigman, 2013). What Altai Means to Customers When customers think of Altai, it should be associated with its superior customer experience and quality line of products . These products that are fashionable, functional, practical, comfortable, and most importantly, versatile. These come from trusted, quality brands, making Altai’s product mix very reliable. Selection of brands was based on favorite clothing brands for women’s sportswear (Figure 6, page 3). For more information on the brand mix, refer to Figure 10 below. Through the classes that Altai provides to its customers, it is also recognized as a community-involving through athletics and healthier lifestyles. Brand % of Inventory Mix Nike 30% Adidas 20% Under Armour 20% Reebok 15% North Face 15% Figure 12: Brand Mix

- 17. Marketing 9 Products Clothing Type Spring/Summer Fall/Winter T-Shirts 15% 15% Tank 20% 5% Sports Bra 15% 5% Hoodie 5% 20% Shorts 20% 5% Leggings 15% 20% Sweat Pants 5% 10% Jacket 5% 20% Altai’s product mix represents what percent of the inventory is a certain type of clothing, such as t- shirts, leggings, and jackets. Figure 13 is a table showing a breakdown of the product mix. These products will come from specific brands, such as Nike, Adidas, Under Armour, Reebok, and North Face. These brands make up the inventory at 30%, 20%, 20%, 15%, and 15% respectively. Inventory Bought and Pricing Figure 13: Product Mix In order to compete with the increasing competition of online sales, Altai provides in-store fitness sessions. Offered once a week, these sessions bring customers in to the store for half-hour long group classes. These will be primarily scheduled around the slow times of the store in order to maximize store efficiency. For those who have signed up to be Altai members, they can find short clips of the daily sessions online. These videos allow new customers to see a session before deciding if they want to participate and for novice’s to practice in case they would feel uncomfortable coming to a class without having done the activity before. In order to incentivize customers to attend sessions, frequent attendance rewards are distributed; if a customer comes to ten sessions, they will receive 10% off their next purchase. These sessions not only provide Altai with more customers, but also offer two major benefits. First, research has found that sitting down in a store can cause a customer to spend about 40% more (Byron, 2015). These in-store sessions surround participants with products in a casual environment, increasing their likelihood to make a purchase without feeling pressured or overwhelmed. Second, these sessions build a sense of belonging. Altai creates a peaceful, supportive environment for its customers to participate in, creating a sense of community rather than an feeling like an individual. This feeling of place is key to maintaining loyal customers and separating ourselves from competitors . Altai will purchase inventory from a wholesale distributor at a 55% discount with three months payable. Inventory will then be marked up by 45%. After year 3, inventory will be purchased at a 50% discount with immediate payment. It will then be marked up 50%, increasing gross margin. Product prices range from $25 to $100 due to the variety of brands and styles. For more information on pricing, please refer to Appendix E. Services

- 18. Marketing 10 Marketing in the ‘Research Triangle’ Promotion Place Altai is located within the ‘Research Triangle’, or the region within North Carolina between the three major colleges: University of North Carolina (UNC) in Chapel Hill, Duke University in Durham, and North Carolina State (NC State) in Raleigh. Colleges. With UNC only a five minute walk, Duke 15 miles away, and NC State only 20 miles away, many of the potential female consumers will come from these schools . Businesses in the area who sell athleisure clothing only target one of these schools, usually through selling affiliated apparel. By marketing to all three, Altai has a competitive advantage over these companies . Promotional items will include free t-shirts and flyers at each of the three colleges to help incentivize consumers to stop in. There will also be advertising on the social media sites, which include Facebook, Twitter, and Instagram, and a digital billboard between Chapel Hill and Durham will be used as well. More information on advertising will be discussed on page 11. The first method of campus advertisement is through on-campus flyers. 300 informational flyers will be distributed and posted in and around major campus locations, such as sororities and libraries. To highlight this potential, this method reaches 1,809 potential customers from sororities at UNC alone. Before its grand-opening, Altai will also set up a tent on the campus in order to help promote the store. This includes the distribution of 200 t-shirts with Altai’s logo and holding a free outdoor yoga sessions to raise brand awareness. At the tent students can see samples of products offered and learn more about session offerings. This method will also be implemented at Duke and North Carolina State University. Figure 13 below represents the total undergraduate female population at all three colleges, as well as the number of sororities and approximate number of females within them. This represents the fewest number of potential views from the flyers being posted amongst the sororities. This number also does not include graduate females, so that is something to take into consideration as well. UNC Duke NC State Female Population 10,643 3,313 10,768 Females in Sororities 1,809 1,325 1,077 Number of Sororities 23 18 15 Figure 15: Females in ‘Research Triangle’ Google Maps, 2015Figure 14: Map of ‘Research Triangle’

- 19. Advertising 11 Billboard Instagram Twitter Facebook Located between Chapel Hill and Durham off US – 15 and 501, an ad for Altai will be on a 10” by 40” billboard that is facing the Chapel Hill area. This will reach approximately 138,700 potential consumers within a four week span, and will remain up for the next five years. This will be beneficial to the business because most people travel the same road on a daily basis and will easily memorize what the ad is about (Wombrose,2015). Altai’s Facebook page will primarily focus on informing the consumers of when sales will begin and end, as well as the Pilates and yoga schedule. There will also be pictures of items posted with a direct link to the item on the website. According to Teen Vogue's "Seeing Social" survey, which consisted of 1,074 millennial women, 85% purchased a product after viewing it on a social media network (Cohen, 2014). Altai will also budget for the use of Facebook ads to help draw in customers in the area. The purpose of Altai’s Instagram will be to post pictures of actual consumers wearing the clothes bought at Altai. The account will be linked with Facebook, so the pictures will be posted on both sites. Many consumers are now heavily impacted by customer reviews, so the option to post a comment with the submitted picture will be provided as well. By physically seeing how the product fits on “real” people and creating additional outfit options, Altai hopes to connect with the visual consumers. With the 140-character limit, there isn’t much that can be said on Twitter. However, it provides an excellence source of direct communication. Altai’s Twitter account would be primarily used for giving “shout- outs” to consumers. If a customer would direct message the account, or simply type ‘Altai’ in her tweet, Altai would be able to see it and comment back. This would be a positive interaction with the consumers, and help create a positive brand image for the store. The use of sponsored tweets will also be implemented in the hopes of consumers retweeting it to further spread the message of the store. Figure 16: Membership Card Loyalty Program Name Membership Card 3765 5342 8268 7253 In order to help the customers feel more connected with Altai, there will be a membership card (see Figure 14, below) available. When signing up, the customer will receive 15% off her next purchase, and will accumulate points per how much is spent. Another included feature will be that members can use their card number on the website to access yoga videos in case they aren’t able to make it to the instore session. The purpose of the card is to incentivize customers to buy more in order to receive discounts and extra exclusives.

- 20. Information Systems Strategy 12 Using Information Systems to Add Customer Value Information systems provide insight into some of the most important aspects of the business process through in-depth analytics of data collected from everyday business activities. By implementing strong inventory management, Customer Relationship Management (CRM), a powerful website, and innovative technology in store, Altai aims to provide a customer experience like no other. Online sales and a modern website with up to date product information enhances customer interaction with Altai. Through a comprehensive information systems strategy, Altai seeks to keep its costs low, its consumers informed, and provide a level of service greater than any other stores in the area. Inventory Management with RFID Technology Mismanagement of inventory is one of the leading causes of failure in a retail business (Roggio, 2014). In order to accurately track in store inventory, Altai uses the industry changing technology of Radio Frequency Identification (RFID) tracking to manage its stock. RFID technology allows unparalelled accuracy when inventorying store merchandise, and its ease of use enables frequent inventory counting. Unlike barcodes, RFID tags can never be scanned twice by accident while counting inventory. Rather than counting inventory twice a year with barcodes and limited accuracy, RFID technology allows large retailers like Macy’s to inventory its shelves up to 24 times a year (O’Connor, 2014). IMPINJ, 2012Figure 17: On-Shelf Availability Figure 18: RFID vs Barcode Radio Frequency Identification (RFID) Barcode Inventory Accuracy 95%+ 65% Price Per Tag 20¢ 3¢ Throughput > 100 Tags Can Be Read at Once User Dependent Line of Sight None Needed Direct (Optical) Read Distance Up to 35 Feet Inches Source: Jovix 2015, inLogic 2014, IMPINJ 2012 Another benefit of RFID technology is that no direct line of sight is needed to read RFID tags. An employee equipped with a hand-held RFID gun can scan an entire rack of clothes in seconds without having to physically locate each item’s price tag. Since a direct line of sight is not needed, a customer does not need to remove their items from their shopping bag when checking out. A single stationary reader can register the contents of the shopping bag in seconds and allow the cashier to complete the transaction quickly. The cost per RFID tag is slightly higher than a barcode system, but provides more benefits which justify this cost. Speed in all aspects of the inventory handling process is increased with the use of RFID technology, which benefits both Altai and its customers.

- 21. Criteria WASP QuickStore Microsoft RMS QuickBooks POS v12 Automatic Product Reorders No No Yes Employee Timekeeping Yes Requires Microsoft Dynamics Yes Gift Card Processing Yes Yes Yes Rewards Program Tracking Yes No Yes Electronic & Online Payment Processing Yes Requires Third Party Software Yes Automatic Inventory Tracking No Yes Yes Price $2,065.50 $2,070.00 $1,999.95 Information Systems Strategy 13 Managing The Stock Room With RFID Technology Inventory is Delivered RFID Tags Printed Tagged Inventory is Shelved Customer Purchases Item System Alerts Stock Room for Replacement Inventory accuracy and management is one of the main factors that will drive Altai’s success. Customers can be assured that items shown on the website can be found that same day in store and in the size they need. As new inventory is delivered, it is moved to the back of the store for processing. Seagull BT-3 software prints labels similar to that of Figure 19 for all items in the shipment, which are then affixed to the clothing. Figure 19: RFID Tag Figure 20: Inventory Tagging & Management Figure 21: POS Software Comparison Completing The Transaction: Point of Sale (POS) Transaction Processing Altai employs Point of Sale (POS) Software in store to provide inventory tracking, sales management, and transaction processing. Various POS software solutions were vetted to find the best balance of features and functionality. All of the solutions shown in Figure 21 provide for integration with QuickBooks accounting software, which Altai uses to process transactions and generate financial reports . iPad based solutions were not considered due to their inability to interface with the store’s RFID antennas. QuickBooks POS Software is the best fit for Altai, as it meets all the critical criteria outlined in Figure 21. Its ability to seamlessly integrate with QuickBooks for Business and process online transactions placed it above and beyond the competition. QuickBooks Accounting software generates accounting and inventory reports in conjunction with QuickBooks POS Software. A detailed breakdown of the customer checkout process with QuickBooks POS can be found in Appendix Q, while total system costs are outlined in Appendix F. Once it is shelved in the stock room, it remains there until a customer purchases the same item from the store floor. An employee is alerted by the POS system to replace the item on the floor. Immediate replacement ensures the customer can always find the exact item, in the size they need, at all times on the store floor. A detailed breakdown of this process can be found in Appendix R.

- 22. Information Systems Strategy 14 Disaster Recovery and Security Altai relies heavily on data produced by its POS terminals and its inventory management system in its day-to-day business. As such, precautions have been taken to minimize the risk to consumer data and the systems they are stored on. According to Figure 23, hardware failure accounts for 40% of all business data loss. To minimize this risk, Altai’s server is cloned twice daily to protect against hardware failure in a disaster proof hard drive enclosure. APC battery backup protects the entire store’s IT system, providing 30 min of uptime in the event of power loss. More information on Altai’s data security can be found in Appendix S. Hardware Failure 40% Human Error 29% Software Corruption 13% Computer Viruses 6% Theft 9% Hardware Distruction 3% Causes of Data Loss Figure 23: Causes of Data Loss Source: Smith 2003 Reaching Customers Cross-Platform A modern website and mobile browser design add to the premium look and feel that Altai strives to achieve. Online, customers can browse everything Altai has to offer in store. Thanks to the RFID tagging of inventory, customers can know exactly what sizes and items are in stock. They have the option to order online, reserve to try on in store, or order for in store pickup. Though Altai does not plan to allow online orders upon opening, the functionality of an online storefront it calculated into the development costs below in Figure 22. Visitors of Altai’s site can preview upcoming classes held on a weekly basis and connect with the company via social media integration. $- $20,000 $40,000 $60,000 Desktop Site Mobile Site iOS App Android App Cost of Web Development A fully functional mobile site compliments the desktop site, with added functionality for in store use. Customers can use this mobile site to scan QR codes on items in store, which directs them to product information such as sizes in stock, price, and photos of the item. Developing a mobile site over a fully functional app will save Altai money in its infancy. Fully developing a mobile app for Android and iOS alongside a mobile site and desktop site would cost nearly double that of just developing the two browser- based sites. The estimated cost of development was $89,100 (Otreva, 2015). As the business grows, Altai plans to develop its own apps to further enhance the customer experience. Website mockups can be found in Appendix M. Figure 22: Cost of Web Development

- 23. Demand Forecast #1 15 Potential Sales Based on Number of Customers Per Day and Average Ticket Price The potential sales per year will be calculated by finding the expected number of customers per day and multiplying that by the average ticket price for purchases from Altai. This number will then be multiplied by the number of days the store is open to find the yearly sales potential. Step 1: Expected Potential Customers Per Day Store Name: Location: Number of Visitors Per Day: Purchasing Customers: Great Outdoor Provision Chapel Hill 160 80 Omega Sports Durham, NC 75 55 Athleta Durham, NC 120 65 Average Total: = 118 per day = 67 Customers In order to determine the number of customers to expect per day, primary research was gathered from sportswear and sporting goods stores in Chapel Hill and nearby cities. Averaging the number of customers from similar stores, the expected number of customers per day is roughly 67. Figure 24: Customer Expectancy Figure 26: Sales Forecast 46 customers per day $66.53 ticket price $3,060.38 sales per day Open 304 days a year $930,355.52 first year sales The average price for apparel from Altai was calculated by finding the average price per type of apparel (t-shirts, shorts, jackets, etc.) for each brand Altai carries. The average price for each type of apparel per brand was then totaled and averaged to find the average price per type of apparel. All types of apparel were then averaged to find the average item price for Altai. For a breakdown of average pricing, refer to Appendix E. Step 2: Average Ticket Price However, this is an expected potential after multiple years of establishment. Assuming an average yearly growth rate of 15%, or the rate at which a company would need to grow to double its size within 5 years (Nagel, 2013), this 67 customers can be scaled back to approximately 45 customers for the first year. Year 1 Year 2 Year 3 Year 4 Year 5 46 51 56 61 67 Figure 25: Customers Per Day Forecast

- 24. Demand Forecast #2 16 Potential Sales Based on the Market Size Step 1: Forecasting Obtainable Millennials The potential sales per year will be calculated by finding the potential number of female customers within Chapel Hill and multiplying it by the average price per item for Altai. In order to determine the portion of the company’s target market who will purchase clothing from Altai, the national percent for women within this age range who purchased women’s sports clothing within the past 12 months is taken, or 19.5% (MRI+). Next, this percentage is multiplied by the female population in Chapel Hill, Durham, Clay and Raleigh (the areas of advertisement and nearby cities) to determine the number of potential customers from each location. Adjustments were estimated based external factors such as number of competitors in the area and distance from Altai. For example, Durham has a similar women’s athletic apparel market to Chapel Hill, but due to the fact that it’s almost 30 miles away, this number was adjusted to fit the number that the company believes would shop at Altai compared to other competitors. Location: Target Market Size: % Adjustment: Total Market Potential: Chapel Hill: 2,818 95% 2,677 Durham: 8,325 80% 6,660 Clay 3,011 30% 903 Raleigh: 12,501 5% 625 Total: 10,865 Step 2: Average Ticket Price The average price for apparel from Altai was calculated by finding the average price per type of apparel (t-shirts, shorts, jackets, etc.) for each brand Altai carries. The average price for each type of apparel per brand was then totaled and averaged to find the average price per type of apparel. All types of apparel were then averaged to find the average item price for Altai. For a breakdown of average pricing, refer to Appendix E. 10,865 potential customers per year $66.53 average item price $722,848.45 potential first year sales Figure 27: Percent of Market Size in Locations Figure 28: Breakdown of Potential First Year Sales

- 25. 17 Weighing of Demand Forecasts Based on the demand forecasts, Altai has decided to use an initial customer base of 36 customers per day, or 12,464 customers per year. This weighing was made based on Chapel Hill’s demographics: high average income and above average spending on sportswear. However, Altai believes first year sales of over $900,000 are unrealistic. Using financial formulas, one of the lowest numbers of customers per day while still growing at 15% per year rate and maintaining a positive net present value was 36. This yields first year sales of $727,995, which aligns closer with Demand Forecast #2. However, Altai believes Demand Forecast #1 depicts future sales potential, granting it a 10% weighing. Fiscally-Impacting Risks A Highly Competitive Industry This risk could affect the company and its sales based on a possibly lower penetration rate than projected. However, with the location that the store is in, it is predicted to attract a heavy amount of foot traffic and campus students. The free fitness classes will also heavily involve the community and give a personalized shopping environment. A Highly Cyclical Industry This risk can definitely impact sales and the major parts of business operations. Entering the market during a time of expected growth in the economy will allow the company to establish personal connections with customers. Dependence on Quality of Wholesaler’s Products Based on other companies’ issues with manufacturing errors, the company is very vulnerable to these problems as well. To combat this possibility for error, the company chooses very reputable brands that create high-quality, pairing with customer experience. Heavy Technology Involvement High involvement in technology poses for large investments and can have large amounts of difficulties. Personal dedication to technology has been tested by various major companies and has shown large amounts of return on investment. Revenue Generation Plan Altai’s majority of revenue will come from the selling of various athletic apparel through the brick-and-mortar store in Chapel Hill, North Carolina. Coupons and free fitness classes for customers are offer to come try new items in the store . Altai offers an excellent customer shopping experience, which increases customer retention rates. Altai estimates that for the first year, it will average 36 customers per day with a $66.53 average ticket price. By year 5, it is estimated that Altai will have 63 customers per day, which is similar to the pre-calculated average for established companies. Financials Figure 27: Projected Customers Per Day Demand Forecast #1 Demand Forecast #2 Estimated Total Start-Up Cost: 10% 90% $210,000 Figure 29: Demand Forecast Weighing

- 26. 18 Pro Forma Statement Overview Altai’s business operations and various projections give it a good position fiscally. Altai plans to take a start-up loan for $63,000, with a financing plan of 8% interest for 7 years and issuing $147,000 worth of common stock . Altai projects that even with its initial investment in technology, that it will be compensated for these costs by the fourth year, provided that the revenue growth model is followed or exceeded. To begin this business venture, Altai’s Net Present Value (NPV) is a positive $25,622 and its Internal Rate of Return is 26.62%, 1.53% greater than the Weighted Average Cost of Capital. With its financial standings and various investment decisions, Altai will be able to finance its debt and keep investors happy, creating an overall healthy business. Sales Growth Details on Key Ratios Using Altai’s estimated expenses and sales forecasts, various quantitative ratios support the initiation of the project. WACC was generated through the terms of the loan and the cost of equity. The equity’s cost of capital for was calculated through the Capital Assets Pricing Model (CAPM). Using Economist Peter Bernstein’s analysis that the stock market provides a 10% annual return for the Market return (Investing Answers) and 2.14% for the risk-free rate (Bloomberg, L.P.), the risk premium for this investment is 7.86%. A beta of 4 was used due to Altai’s very cyclical industry and startup risks. Figure 31 illustrates the free cash flows and the horizon value of $1,022,970 was omitted. For additional information, please see Appendix A. Additional calculation details can be found in Appendix V. Investors can predict to see a return on investments within Year 2, where sales growth, profit margin, return on equity (ROE), and return on assets (ROA) are positive. Financials Profit Margin ROE & ROA Free Cash Flows 14% 17% 13% 15% 10% 12% 14% 16% 18% 20% Year 1 Year 2 Year 3 Year 4 5% 39% 35% 34% -12% 1% 12% 16% 25% -50% -35% -20% -5% 10% 25% 40% Year 1 Year 2 Year 3 Year 4 Year 5 ROE ROA -0.07 0.01 0.07 0.08 0.1 -0.1 -0.05 0 0.05 0.1 0.15 Year 1 Year 2 Year 3 Year 4 Year 5 Figure 30: Sales Growth Figure 31: Profit Margin Figure 32: ROE & ROA Figure 33: Free Cash Flows $(600,000.00) $(400,000.00) $(200,000.00) $- $200,000.00 Year0 Year1 Year2 Year3 Year4 Year5

- 27. Conclusion 19 By following this business plan, Altai will reach its financial goals and become a successful specialty retail business. Analyzing industry drivers, Chapel Hill, North Carolina has above average statistics, making it the perfect location to open our store . With the inclusion of the ‘Research Triangle’, Altai will have a large pool of potential customers who will help the company grow an average of 15% per year, doubling our size within 5 years. Through consistent, targeted marketing to millennial females across a range of social media and physical channels, these potential customers are expected to translate to 63 customers per day by year five. Our superior customer experience, implementation of cutting-edge technology, and addition of yoga and Pilates sessions offer more to the customer than the average retailer. Through these incentives we believe the company will develop a strong, loyal customer base. Based upon the data produced from demand forecasts and financial projectionssuch as a positive NPV , a 1.53% larger Internal Rate of Return than the Weighted Average Cost of Capital, and a manageable payback period, Copeland Associates would accept this project and would recommend to move forward with the creation of this business. The company is in a very favorable position and with its commitment to incorporating technology into its customers’ shopping experience, it will be able to counteract the various risks that companies in this industry face with the changing economy. As seen in Figure 32, Altai is poised to succeed in the specialty apparel industry . $(100,000) $(50,000) $- $50,000 $100,000 $150,000 Year 1 Year 2 Year 3 Year 4 Year 5 Projected Net Income Figure 34: Projected Net Income

- 28. 20 Adamczyk, A. (2015, 26 Feb). Athleisure trend drives fashion sales growth in 2014. Retrieved from http://www.forbes.com/sites/aliciaadamczyk/2015/02/26/athleisure-trend-drives-fashion-sales- growth-in-2014/. ApparelStats 2014 and ShoeStats 2014 Reports. (2015, 9 Jan). American Apparel and Footwear Association. Retrieved from https://www.wewear.org/apparelstats-2014-and-shoestats-2014- reports/. Arnstein, J. (2012). Fast Track to Profits: Using Simulation to Improve Store Operations. Retrieved from http://sps.impinj.com/Case_Study.php. Athleta. (2015, Oct). Telephone Interview. Baum-Snow, Nathaniel, Hartley, Daniel. (2015, July). Demographic changes in and near US downtowns. Economic Trends (07482922), 1-11. Retrieved from http://web.b.ebscohost.com.proxy.library.ohiou.edu/ehost/pdfviewer/pdfviewer?sid=8e7f7911- 9eb0-41e0-9da0-e55c78384315%40sessionmgr111&vid=1&hid=110. Bevello. (2015, Oct). Telephone Interview. Bluetique Cheap Chic. (2015, Oct). Telephone Interview. Bjork, C. (2014, 16 Sept). Zara Builds Its Business Around RFID. Retrieved from http://www.wsj.com/articles/at-zara-fast-fashion-meets-smarter-inventory-1410884519. Bump, P. (2015, 25 March). Here is When Each Generation Begins and Ends, According to Facts. Retrieved from The Atlantic. Carter, Britanny. (2015, Aug). Men’s clothing stores in the US. Retrieved from http://clients1.ibisworld.com.proxy.library.ohiou.edu/reports/us/industry/default.aspx?entid=10 66 Castillo, M. (2015, 18 Aug). ‘Athleisure’ forces brands to think function and form. Retrieved from http://www.cnbc.com/2015/08/18/nd-form.html. Chapel Hill Sportswear. (2015, Oct). Telephone Interview. Clemente, D. (2015, 5 Aug). Why and when did Americans begin to dress so casually? Time Magazine. Retrieved from http://time.com/3984690/american-casual-dressing/. Cohen, H. (2014, 4 April). Social media millennial shopping trends. Retrieved from http://heidicohen.com/social-media-millennial-shopping-trends-research/. References

- 29. References 21 CRMTrends. (n.a). Evolving Consumer Demographics. Retrieved November 3, 2015 from http://www.crmtrends.com/ConsumerDemographics.html D’Adamo, A. (2015, 12 May). Athleisure is winning the lifestyle marketing game. Retrieved from http://www.womensmarketing.com/blog/2015/05/athleisure-is-winning-the-lifestyle-marketing- game/. Deeb, G. (2014, 27 Feb). Looking for investors? Here’s how to value your startup. Retrieved from http://thenextweb.com/entrepreneur/2014/02/27/looking-investors-heres-value-startup/. DiBlassio, N. (2014, Dec). Retailers rush to tap millennial 'athleisure' market. USA Today. Retrieved from: http://www.usatoday.com/story/money/2014/12/23/athleisure-activewear-shopping- holiday/19616825/. Dick’s Sporting Goods. (2015, Oct). Telephone Interview. Dimensional Research. (2013, April). Customer service and business results: a survey of customer service from mid-size companies. Retrieved from https://www.zendesk.com/resources/customer- service-and-lifetime-customer-value/. Dua, T. (2014, 2 Oct). Marketing to millennials, the advertising week way. Retrieved from http://digiday.com/brands/celtraes-marketing-millennials-advertising-week-taught-us/. Ellis, K. (2015, July). Doubling Down On TPP. Retrieved from Business Source Complete database. eMarketer. (2014, 11 Sept).How to reach US female millennials. Retrieved from http://www.emarketer.com/Article/How-Reach-US-Female-MillennialsIts-Not-Easy/1011182. Euromoniter. (2015, 15 May). Apparel and footwear in the US. Retrieved from http://www.portal.euromoniter.com. Euromoniter. (2015, 19 May). Apparel and footwear in 2015: Trends, developments, and prospects. Retrieved from http://www.portal.euromoniter.com. Euromonitor. (2011). Female breadwinners: 2011 how the rise in working women is influencing spending patterns– Executive Briefing. Retrieved from http://www.portal.euromonitor.com/. Euromonitor. (2015). Function, fashion and the environment dominate outdoor sportswear Innovation. Retrieved from http://www.portal.euromonitor.com/. Euromonitor. (2015). Going local: Why proximity prevails over size for shoppers in the Americas. Retrieved from http://www.portal.euromonitor.com/.

- 30. 22 Euromonitor. (2011). Make way for generation z: Marketing to today’s tweens and teens – Executive Briefing. Retrieved from http://www.portal.euromonitor.com/. Euromonitor. (2015, 1 Sept). TOP 10 APPAREL AND FOOTWEAR MARKETS: GROWTH STRATEGIES WHEN THE GOOD TIMES STALL. Retrieved from http://www.portal.euromonitor.com.proxy.library.ohiou.edu/portal/analysis/tab. Exploring E-Commerce. (2015) Retrieved from http://www.entrepreneur.com/article/159680. Fashion Law – Guide to Fashion Law. (2015). HG.org Legal Resources. Retrieved from http://www.hg.org/fashion-law.html. First Research. (2015). Retail sector industry report. Retrieved from http://mergent.firstresearch- learn.com/industry.aspx?chapter=0&pid=360. Fleet Feet. (2015, Oct). Telephone Interview. Forte, G. & Gatschke, J. (2014, July). Sporting goods in the U.S. – Statista Dossier. Retrieved from http://www.statista.com/study/10925/sporting-goods-in-the-us-statista-dossier/. Fraternity and Sorority Life. (2015). Duke University: Student Affairs. Retrieved from https://studentaffairs.duke.edu/greek/frequently-asked-questions/faqs-students. Fry, Richard (2015, 16 January) This year, Millennials will overtake Baby Boomers. Retrieved from PewResearchCenter. Ginnebaugh, L. (2012, 1 March). Retail Roundtable. Retrieved from Business Source Complete database. Google Maps. (2015). Retrieved from www.googlemaps.com. Great Outdoor Provisions. (2015, Oct). Telephone Interview. Haider, Zeeshan. (2015, May). Men’s and boys’ apparel manufacturing in the US. Retrieved from http://clients1.ibisworld.com.proxy.library.ohiou.edu/reports/us/industry/default.aspx?entid=34 2. Haug, A., Münster, & Borch, M. (N.D.). Design Constraints in Fashion Store Design Processes. Retrieved from http://delivery.acm.org/10.1145/2470000/2466662/p316- haug.pdf?ip=64.247.113.238&id=2466662&acc=ACTIVE%20SERVICE&key=1D8E1CA5B8D7D8DD %2ED5A6ADDF5D6D6A95%2E4D4702B0C3E38B35%2E4D4702B0C3E38B35&CFID=721902566& CFTOKEN=72559546&__acm__=1444945333_48962301b9e37c278c1b0a1a4b9acbd7. References

- 31. 23 Hellwig, Basia. (2015). A natural extension. Dance Retailer News, 14(10), 24-25. Retrieved from http://web.a.ebscohost.com/ehost/pdfviewer/pdfviewer?sid=b03147dc-73bb-4845-9150- fe41964998b1%40sessionmgr4003&vid=1&hid=4212. Hoffman, G. (2013, 18 Nov). Where fashion-focused millennials find inspiration. Retrieved from http://www.cmo.com/articles/2013/11/17/where_fashion_focuse.html. Holmes, Elizabeth. (2015, May). Are you going to the gym, or do you just dress that way? The Wall Street Journal. Retrieved from http://www.wsj.com/articles/are-you-going-to-the-gym-or-do-you-just- dress- that-way-1430847310?alg=y. Honigman, B. (2013, 5 Aug). How millennials shop: 20 interesting statistics & figures. Retrieved from http://www.brianhonigman.com/millennials-shopping-habits-2013/. Hoover's. (2015). Internet & mail order retail industry report. Retrieved from http://subscriber.hoovers.com/H/industry360/overview.html?industryId=1547. Imbruglia, M. (2015, Oct). Women’s Clothing Stores in the US. Retrieved from http://www.ibisworld.com/. Johnny T-Shirt. (2015, Oct). Telephone Interview. Johnson, Robert. (2015, Aug). Top five ways customer service affects bottom line results. Retrieved from http://customerthink.com/top-five-ways-customer-service-affects-bottom-line-results/. Jones, K. (2015, 19 May). RFID: New Tag Technology Will Elevate Target’s Guest Experience. Retrieved from https://corporate.target.com/article/2015/05/keri-jones-perspectives-RFID. Joseph, C. (n.d.). What are the benefits of delivering excellent customer service? Retrieved from http://smallbusiness.chron.com/benefits-delivering-excellent-customer-service-2086.html#. Kaplan, J. (2015, 16 July). 5 effective ways to market to millennials. Retrieved from http://mashable.com/2015/07/16/5-ways-market-to-millennials/#GmtFydBCGaqK. Kieler, A. (2015, 3 June). Nearly 70% of consumers rely on online reviews before making a purchase. Retrieved from http://consumerist.com/2015/06/03/nearly-70-of-consumers-rely-on-online- reviews-before-making-a-purchase/. Kell, J. (2014, 26 Dec). Athletic apparel: Outperforming the competition in 2014. Retrieved from http://web.a.ebscohost.com.proxy.library.ohiou.edu/ehost/detail/detail?sid=b4829edb-b8c4- 4095-b958- 04823343c251%40sessionmgr4004&vid=8&hid=4112&bdata=JnNpdGU9ZWhvc3QtbGl2ZSZzY29 wZT1zaXRl#AN=100151457&db=bth. References

- 32. 24 Lamar, S. (2015, 10 June). How the congressional trade agenda helps Americans save money. American Apparel and Footwear Association. Retrieved from https://www.wewear.org/politicaltrends/. Lipson, A. (2014, May). Men’s Clothes Shopping. Retrieved from http://academic.mintel.com/. Lululemon. (2015, Oct). Telephone Interview. MarketLine. (2015, May). Global apparel retail industry profile. Apparel Retail Industry Profile: Global, 1- 34. Retrieved from http://web.a.ebscohost.com/ehost/pdfviewer/pdfviewer?sid=9c69e7d1- 5346-446f-9c74-ab823301a18a%40sessionmgr4002&vid=4&hid=4212. McKitterick, W. (2015, April). Online Designer Clothing Sales in the US. Retrieved from http://www.ibisworld.com/. Mintel. (2015, Feb). Black Millennials – US. Retrieved from http://academic.mintel.com/. Mintel. (2015, Oct). Children’s Clothing – US. Retrieved from http://academic.mintel.com/. Mintel. (2014, Oct). Fitness Clothing – US. Retrieved from http://academic.mintel.com/. Mintel. (2010, Nov). Footwear – US. Retrieved from http://academic.mintel.com/. Mintel. (2015, 29 July). Levi’s aggressively targets women with new denim collection. Retrieved from http://academic.mintel.com/. Mintel. (2015, Sept). Marketing to Hispanic Moms – US. Retrieved from http://academic.mintel.com/. Mintel. (2015, June). Online Shopping – US. Retrieved from http://academic.mintel.com/. Mintel. (2015, June). Plus Size and Big & Tall Clothing. Retrieved from http://academic.mintel.com/. Mintel. (2015, May). Women’s clothing – US. Retrieved from http://academic.mintel.com/. Nagel, J. (2013). Five rates to guide your business growth. Retrieved from Synnovatia. Neville, A. (2015, Sept). Clothing boutiques in the US. Retrieved from http://clients1.ibisworld.com.proxy.library.ohiou.edu/reports/us/industry/default.aspx?entid=56 16. New, C. (2012, 7 June). Cash dying as credit card payments predicted to grow in volume. Retrieved from http://www.huffingtonpost.com/2012/06/07/credit-card-payments-growth_n_1575417.html. Newman, D. (2015, 28 April). Research shows millennials don’t respond to ads. Retrieved from http://www.forbes.com/sites/danielnewman/2015/04/28/research-shows-millennials-dont- respond-to-ads/2/. Niche. (n.d.). University of North Carolina in Chapel Hill - Greek Life. Retrieved from https://colleges.niche.com/university-of-north-carolina-at-chapel-hill/greek-life/. References

- 33. 25 Nike [Untitled Image of Nike Running Look]. Retrieved November 4, 2015 from http://store.nike.com/us/en_us/outfit/41122 North Carolina State University - Greek Life. (2014). Retrieved from https://colleges.niche.com/north- carolina-state-university/greek-life/. O’Connor, M. (2014, 6 April). Can RFID save brick-and-mortar retailers after all? Retrieved from http://fortune.com/2014/04/16/can-rfid-save-brick-and-mortar-retailers-after-all/. O'Donnell, F. (2015, 1 April). American Lifestyles 2015: The Connected Consumer - Seeking Validation from the Online Collective - US. Retrieved from http://academic.mintel.com.proxy.library.ohiou.edu/display/735268/?highlight. Omega Sports. (2015, Oct). Telephone Interview. Otreva Estimates. (2015). Retrieved from www.otreva.com/calculator/?saveId=EJQLJaTw- aS5KRpu0HAiIhlXu56fLSNG_y-Ut6jzN1. Petro, G. (2015, 16 Sept). Lululemon, Nike and the rise of ‘athleisure’. Retrieved from http://www.forbes.com/sites/gregpetro/2015/09/16/lululemon-nike-and-the-rise-of-athleisure/. Purt, J. (2011, 28 Sept). Discussion round-up: sustainability in the fashion business. Guardian Professional Network. Retrieved from http://www.theguardian.com/sustainable-business/sustainable-ethical- fashion-business. REI. (2015, Oct). Telephone Interview. Richtman, M. (2015, 27 Aug). Athleisure wear is not a trend, and there’s plenty of statistics to prove it. Retrieved from http://www.bustle.com/articles/106820-athleisure-wear-is-not-a-trend-and- theres-plenty-of-statistics-to-prove-it. Roggio, A. (2014, 7 Nov). 8 Reasons Why Ecommerce Businesses Fail. Retrieved from http://www.practicalecommerce.com/articles/75484-8-Reasons-Why-Ecommerce-Businesses- Fail. Rumors. (2015, Oct). Telephone Interview. Ryan, T. (2010, 6 Jan). The toll of casualization. Retrieved from http://apparel.edgl.com/news/The-Toll- of-Casualization63979. Salfino, C. (2015, 12 Feb).Athleisure runs up the score with even more designers and collaborations. Retrieved from https://sourcingjournalonline.com/athleisure-runs-score-even- designers-collaborations-cs/. References

- 34. 26 Schlossberg, M. (2015, 15 Oct ). Clothing Brands that will dominate the industry. Retrieved from First Research at https://uk.finance.yahoo.com/news/clothing-brands-dominate-industry- 155119686.html. Sender, T. (2015, 26 Aug ). Combining fashion retailing and foodservice. Retrieved from http://academic.mintel.com.proxy.library.ohiou.edu/display/746867/?highlight. Shieber, J. (2015, 14 Oct). Tackling the multi-billion-dollar “athleisure” wear market, Outdoor Voices raises $7 million. Retrieved from http://techcrunch.com/2015/10/14/tackling-the-multi-billion- dollar-athleisure-wear-market-outdoor-voices-raises-7-million/. Shrunken Head Boutique. (2015, Oct). Telephone Interview. Siwicki, Bill. (2014, Aug). How often do shoppers use retail apps? Retrieved from: https://www.internetretailer.com/2014/08/21/how-often-do-shoppers-use-retail-apps. Spears, B. (2014, 21 July). Top 6 tech trends in the fashion industry. Retrieved from http://apparel.edgl.com/news/Top-6-Tech-Trends-in-the-Fashion-Industry94135. Springmeyer, B. (n.d.). Million dollar idea? Business valuation for startups. Retrieved from http://www.calstartuplawfirm.com/business-lawyer-blog/business-valuation-angel- investment.php. Statista. (2014, May) Leadng selling apparel categories for shops in the United States in 2013, based on generated revenue. Retrieved from Statista. Statista. ( 2015). Sales of women's clothing stores (NAICS 44812) in the United States from 2008 to 2020 (in million U.S. dollars). In Statista - The Statistics Portal. Retrieved from http://www.statista.com/forecasts/409654/united-states-womens-clothing-stores-sales- forecast-naics-44812. University of North Carolina - Chapel Hill. (2015). Retrieved from http://colleges.usnews.rankingsandreviews.com/best-colleges/unc-2974. Womenswear Industry Profile: United States. (2015). Womenswear Industry Profile: United States, 1- 35. Retrieved from http://web.a.ebscohost.com.proxy.library.ohiou.edu/ehost/pdfviewer/pdfviewer?sid=0df81a7ff aea4d8497a63afb0bad51f7%40sessionmgr4005&vid=4&hid=4207. World March of Women 2000. (n.d.). Retrieved from http://www.worldmarch.org/clothing- industry.html. References

- 35. 27 Appendix A: Financials Altai Pro Forma Statements of Financial Position Start-Up Year 1 Year 2 Year 3 Year 4 Year 5 Cash $210,000 $137,189 $200,191 $213,308 $217,204 $180,816 Accounts Receivables Inventory $300,000 300,000 350,000 350,000 350,000 360,000 RFID Labels $445 Thermal Print Paper $75 Total current assets $510,519 437,189 550,191 563,308 567,204 540,816 Property and equipment, net (a) $145,645 (8,791) (14,065) (8,439) (5,063) (5,063) Intangible assets, net $- - - - - - Total assets $656,165 $428,398 $536,126 $554,869 $562,141 $535,753 Accounts payable Accrued expenses $446,165 268,671 377,569 339,800 265,898 115,284 Current portion of long-term debt $7,008 $7,586 $8,211 $8,888 $9,621 Total current liabilities $446,165 275,679 385,155 348,011 274,786 124,905 Long-term debt $63,000 55,992 48,984 40,772 31,884 22,264 Total liabilities $509,165 331,671 434,139 388,784 306,670 147,168 Paid-in equity capital $147,000 147,000 147,000 147,000 147,000 147,000 Retained earnings (b) (50,273) (45,012) 19,085 108,470 241,584 Total equity $147,000 96,727 101,988 166,085 255,470 388,584 Total liabilities and equity $656,165 $428,398 $536,126 $554,869 $562,141 $535,753

- 36. Appendix A: Financials 28 Altai Pro Forma Statements of Financial Position (a) Property and equipment, net: Leasehold improvements Fixtures and equipment 13,000 Computer hardware and software RFID Hardware 4 Port Fixed RFID Terminal $2,929.80 RFID Antenna $524.40 Large RFID Antenna $2,315.20 RFID Gun $2,846.00 RFID Capable Printer $4,613.00 Total RFID Hardware $13,228.40 Networking APC UPS Battery Backup $239.99 Cisco 8 Port Gigabit Network Switch $59.96 Cisco Modem $70.00 Cisco Small Business Router $65.28 Total Networking Equipment $435.23 Intercom System PylePro 8 Ohm 300 Watt Amplifier $170.00 3.5 mm to RCA Cable $10.00 Wired through speaker selector $2,120.00 Coper L/R Channel Speaker Wire CL 3 14 Guage $179.99 Stereo 4 Channel Splitter $232.00 Total Intercom System $2,711.99 IT Equipment Seagull ET-Pro Label Printing Software $495.00 Panasonic Link2Cell KX-TG9581B Cordless Phone $149.95 Screens for Back Office $389.30 Inventory & POS LED Backlit LCD $185.15 VERSA Mount $13.50 Verifone M132-409-01-R Payment Terminal $1,158.20 Quickbooks Pro V12 POS Software $2,000.00 ThinkCentre M73 Small Form Factor Desktop $1,197.60 POS Keyboard $239.60 Quickbooks Accounting $199.95 ThinkServer Server with Windows Server 2012 $2,827.80 ioSafe 1515+ Waterproof & Fireproof NAS Storage $1,899.99 WD Enterprise 6TB 7200 RPM Drives $1,744.00 Software Development Fee $89,100.00 Thermal Reciept Printer $509.98 Total IT Equipment $102,110.02 Cabling CAT 6e Patch Cable $486.54 CAT 6e Crimp Connectors $78.90 CAT Crimpers $10.72 Total Cabling $576.16 Total Computer Hardware and Software $119,061.80 Furniture Back Room Shelves (48 x 18 x 72) $2,239.65 Back Room Table $406.00 Clothing Bins $400.00 Office Desk $439.00 Custom Checkout Counter $450.00 Alta Large Display Table $1,625.00 Alta Medium Display Table $555.00 Alta Small Display Table $185.00 Alta Island $2,634.00 Alta Wall Module $1,890.00 Alta 4 Way Tree $1,710.00 Custom Wall Mount Racks $400.00 Window & In-Store Displays $500.00 Desk Chair $149.99 Total Furniture $13,583.64 Less: Accumulated depr and amort 8,791 14,065 8,439 5,063 5,063 Property and equipment, net $145,645.44 $(8,791) $(14,065) $(8,439) $(5,063) $(5,063) (b) Retained earnings: Balance, beginning of year $- $- $(50,273) $(45,012) $19,085 $108,470 Net income - (50,273) 5,260 64,098 89,385 133,114 Balance, end of year $- $(50,273) $(45,012) $19,085 $108,470 $241,584

- 37. Appendix A: Financials 29 Altai Pro Forma Statements of Operations Income Tax Expense for Year 7% 22% 46% 46% 46% Year 1 Year 2 Year 3 Year 4 Year 5 Sales (a) $727,995 $829,105 $970,660 $1,112,214 $1,273,991 Cost of goods sold and occupany costs (b) 476,175 531,785 561,107 631,885 712,773 Gross profit 251,820 297,320 409,552 480,330 561,218 Direct store expenses (c) 209,291 190,252 190,252 218,539 218,539 General and administrative expenses* 92,000 92,000 92,000 92,000 92,000 Pre-opening expenses Operating income (49,471) 15,068 127,301 169,791 250,679 Interest expense $4,833.22 4,256 3,630 2,953 2,221 Income before income taxes (54,304) 6,781 119,639 166,837 248,458 Provision for income taxes (4,032) 1,521 55,541.11 77,453 115,344 Net income $(50,273) $5,260 $64,098 $89,385 $133,114 (a) Sales: Number of customers per day 36 41 48.00 55 63.00 x Average transaction value 66.52 66.52 66.52 66.52 66.52 Sales per day 2,395 2,727 3,193 3,659 4,191 x Number of days open per year 304 304 304 304 304 Sales $727,995 $829,105 $970,660 $1,112,214 $1,273,991 (b) Cost of goods sold and occupancy costs: Cost of goods sold $400,397 $456,008 $485,330 $556,107 $636,996 Rent 72,000 72,000 72,000 72,000 72,000 Utilities 3,777 3,777 3,777 3,777 3,777 Cost of goods sold and occupancy costs $476,175 $531,785 $561,107 $631,885 $712,773 (c) Direct store expenses: Store payroll, payroll taxes, and benefits Store Payroll $101,006 $101,006 $101,006 $135,616 $135,616 Payroll Taxes $11,580 $11,580 $11,580 $13,657 $13,657 Store supplies TWC Internet $1,188.00 1,188 1,188 1,188 1,188 TWC Phone $300.00 300 300 300 300 Quickbooks Payroll $301.00 301 301 301 301 RFID Labels $444.80 Printer Paper $75 Shopping Software $229.00 229 229 229 229 Adobe Creative Suite for Business $11,088.00 11,088 11,088 11,088 11,088 Webhosting $1,440.00 1,440 1,440 1,440 1,440 Advertising $81,640.00 63,120 63,120 54,720 54,720 Direct store expenses $209,291 $190,252 $190,252 $218,539 $218,539 *General and Administrative Expenses include Manager Salaries

- 38. Appendix A: Financials 30 Altai Pro Forma Statements of Operations Income Tax Expense for Quarter 7% Q1 Q2 Q3 Q4 Sales (a) $196,899 $179,604 $184,393 $181,999 Cost of goods sold and occupany costs (b) 127,239 117,727 120,361 119,044 Gross profit 69,660 61,877 64,033 62,955 Direct store expenses (c) 55,995 51,915 55,475 51,915 General and administrative expenses 23,000 23,000 23,000 23,000 Pre-opening expenses - Operating income (9,334) (13,038) (14,442) (11,960) Interest expense $1,260.00 1,226 1,191 1,156 Income before income taxes (10,594) (14,264) (15,634) (13,116) Provision for income taxes (787) (1,059) (1,161) (974) Net income $(9,808) $(13,205) $(14,473) $(12,142) (a) Sales: Number of customers per day 37 36 36 38 x Average transaction value 66.52 66.52 66.52 66.52 Sales per day 2,461 2,395 2,395 2,528 x Number of days open per year 80 75 77 72 Sales $196,899 $179,604 $184,393 $181,999 (b) Cost of goods sold and occupancy costs: Cost of goods sold 108,294.6 98,782.2 101,416.4 100,099.3 Rent 18,000.0 18,000.0 18,000.0 18,000.0 Utilities 944 944 944 944 Cost of goods sold and occupancy costs $127,239 $117,727 $120,361 $119,044 (c) Direct store expenses: Store payroll, payroll taxes, and benefits Store Payroll $25,251.40 $25,251.40 $25,251.40 $25,251.40 Payroll Taxes $2,895.08 $2,895.08 $2,895.08 $2,895.08 Store supplies TWC Internet $297.00 $297.00 $297.00 $297.00 TWC Phone $75.00 $75.00 $75.00 $75.00 Quickbooks Payroll $75.25 $75.25 $75.25 $75.25 RFID Labels $444.80 Printer Paper $74.69 Shopping Software $57.25 $57.25 $57.25 $57.25 Adobe Creative Suite for Business $2,772.00 $2,772.00 $2,772.00 $2,772.00 Webhosting $360.00 $360.00 $360.00 $360.00 Depreciation and amortization $1,502.23 $1,502.00 $1,502.00 $1,502.00 Advertising* $22,190.00 $18,630.00 $22,190.00 $18,630.00 Direct store expenses $55,995 $51,915 $55,475 $51,915 *Advertising Expense Includes: • Billboard • Facebook • Twitter • T-Shirts (Year 1) • Flyers (Year 1)

- 39. Appendix A: Financials 31 Altai Capital Budgeting Analysis Project Cash Flows 0 1 2 3 4 5 EBIT $ (49,471) $ 15,068 $ 127,301 $ 169,791 $ 250,679 x (1 - tax rate) 93% 78% 54% 54% 54% Operating profit after tax (45,798) 11,689 68,203 90,967 134,304 + Depreciation and amortization 8,791 14,065 8,439 5,063 5,063 Operating cash flow $ - $ (37,008) $ 25,754 $ 76,641 $ 96,030 $ 139,367 - Change in net working capital 300,000 - Capital spending 119,062 Free cash flow $ (419,062) $ (37,008) $ 25,754 $ 76,641 $ 96,030 $ 139,367 + Horizon value (end of year 5) 1,022,970 Project cash flow $ (419,062) $ (37,008) $ 25,754 $ 76,641 $ 96,030 $ 1,162,337 EBITDA (year 5) $ 255,742 x Market multiple 4.0 Horizon value (end of year 5) $ 1,022,970 Required Rate of Return Weighted average cost of capital (WACC): Capital x Cost of x After-Tax = WACC Structure Capital Adjustment Debt 30% x 8% x 66% = 1.59% Equity 70% x 33.58% = 23.51% + 25.09% CAPM Ra= Rf + Beta(Rm-Rf) Rf Beta Rm-Rf Ra 2.14% 4 7.86% 0.3358 Decision-Making Criteria Net present value = 25,622 Internal rate of return = 26.62% Payback period = 4.22 Project Cash Flows: Year 0 $(419,062) Year 1 $(37,008) Year 2 $25,754 Year 3 $76,641 Year 4 $96,030 Year 5 $1,162,337

- 40. Appendix A: Financials 32 Year One Cash Flows Q1 Q2 Q3 Q4 Tax Rate: 0.07 EBIT (10,033) (13,736) (15,141) (12,659) x (1 - tax rate) 93% 93% 93% 93% Operating profit after tax (9,331) (12,775) (14,081) (11,773) + Depreciation and amortization 2,201 2,201 2,201 2,201 Operating cash flow $ (7,130) $ (10,574) $ (11,880) $ (9,572) - Change in Net Working Capital - Capital Spending Free cash flow $ (7,130) $ (10,574) $ (11,880) $ (9,572)