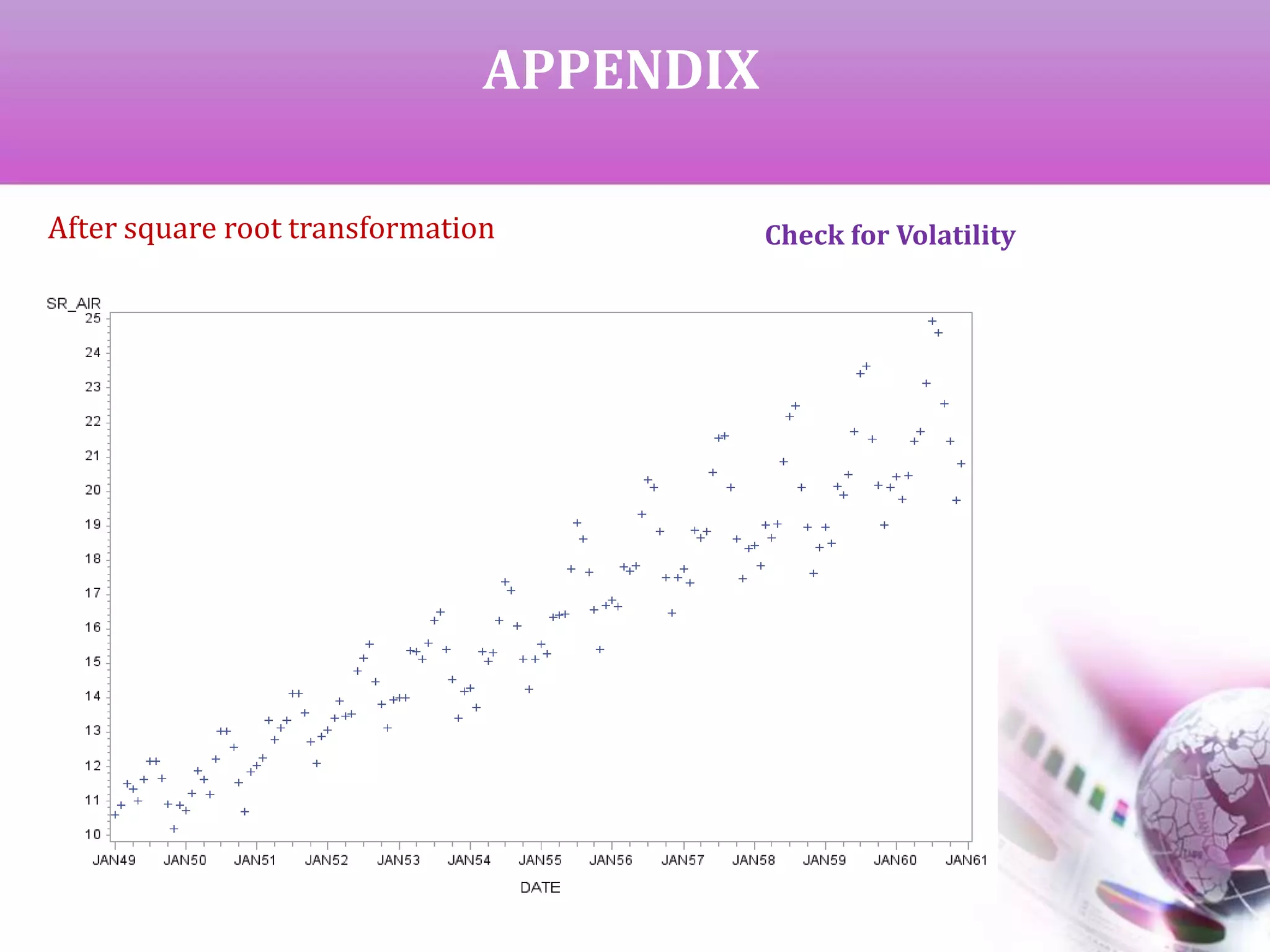

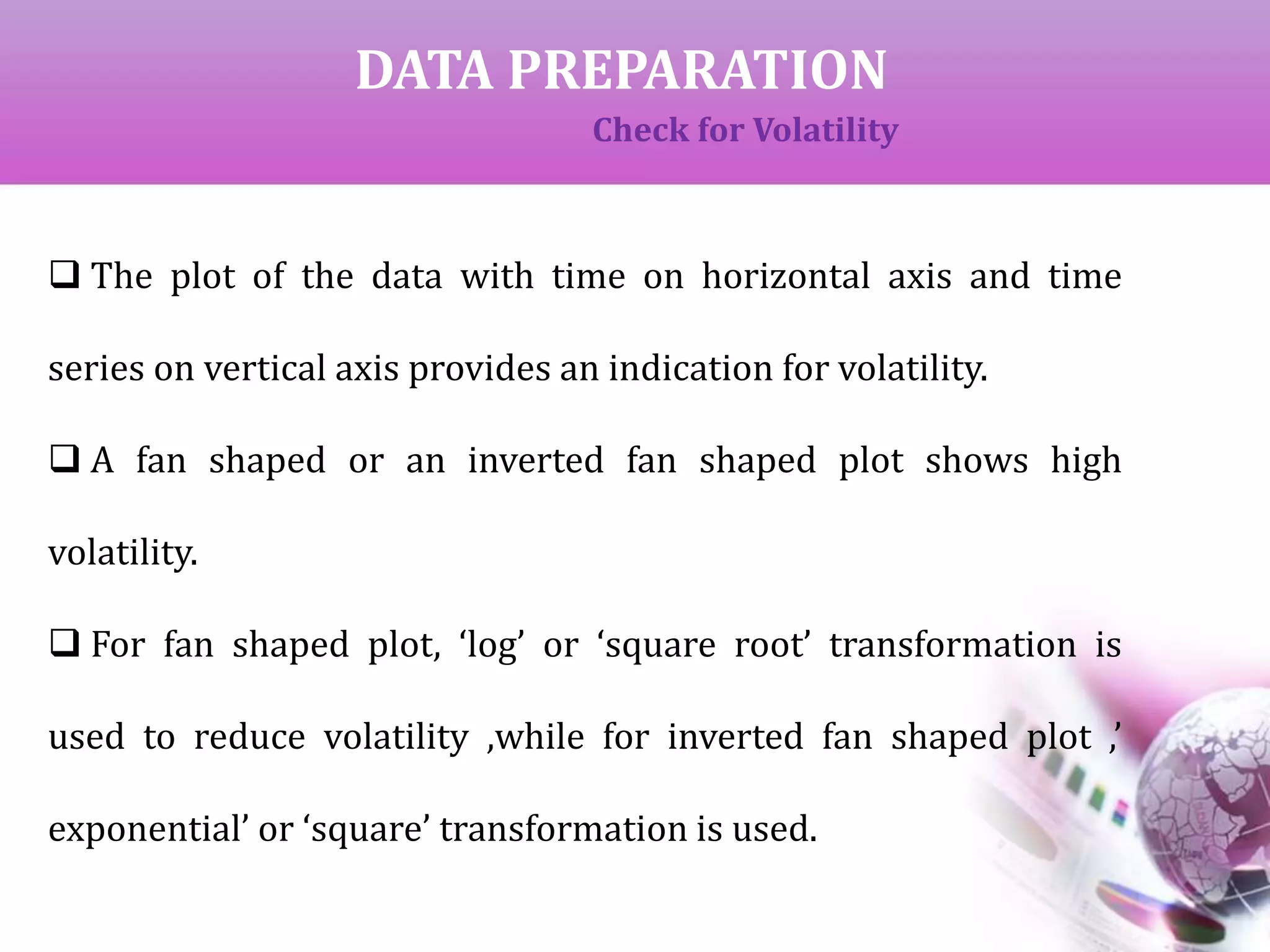

The document presents a study on time series analysis and forecasting of airline travel using the SAS dataset from January 1949 to December 1960. It details the methods for checking data volatility, non-stationarity, and seasonality, and describes the steps for model identification and estimation using the ARIMA framework. The final goal is to generate accurate forecasts for future airline travel based on the historical data analyzed.

![DATA PREPARATION

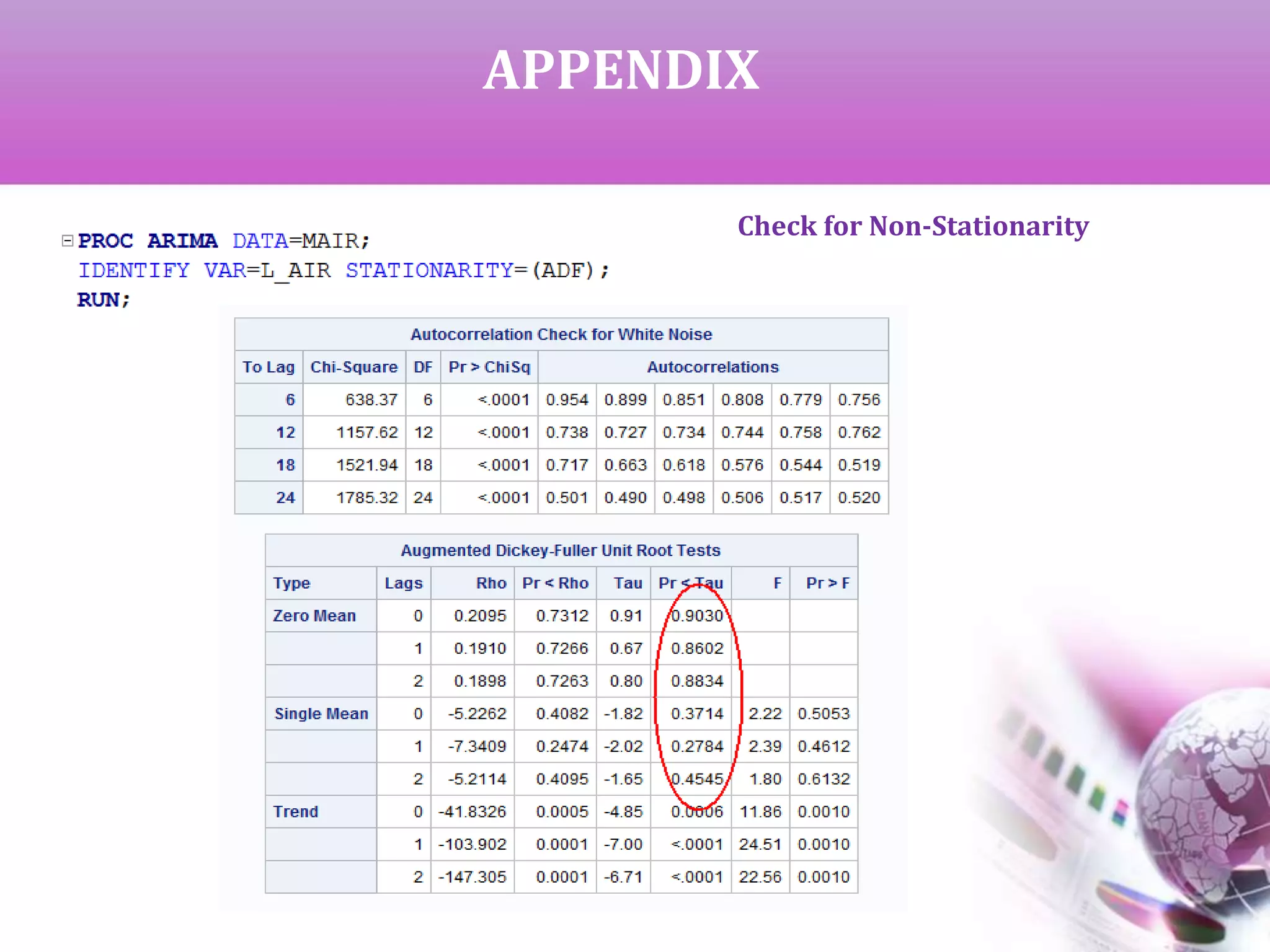

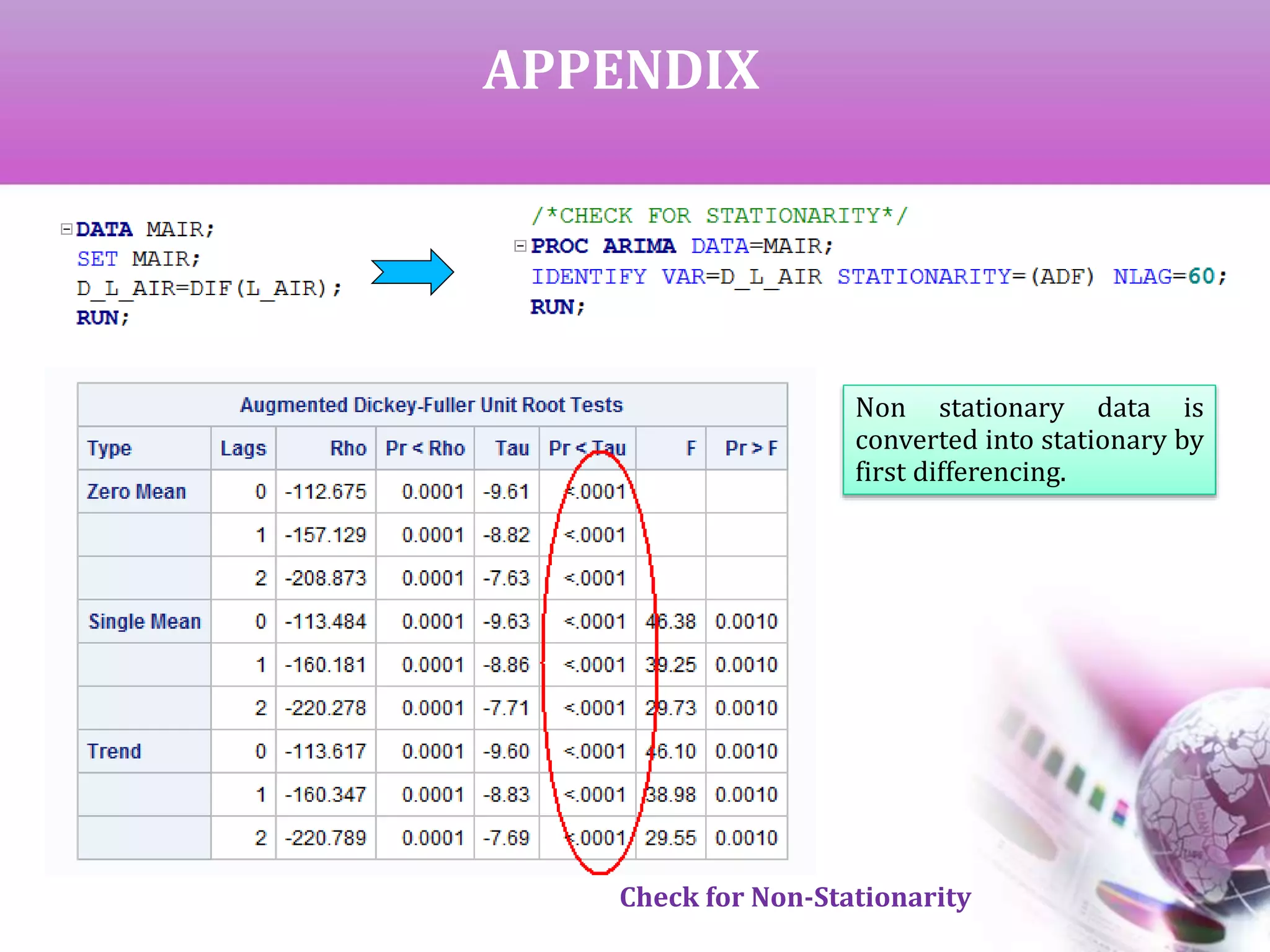

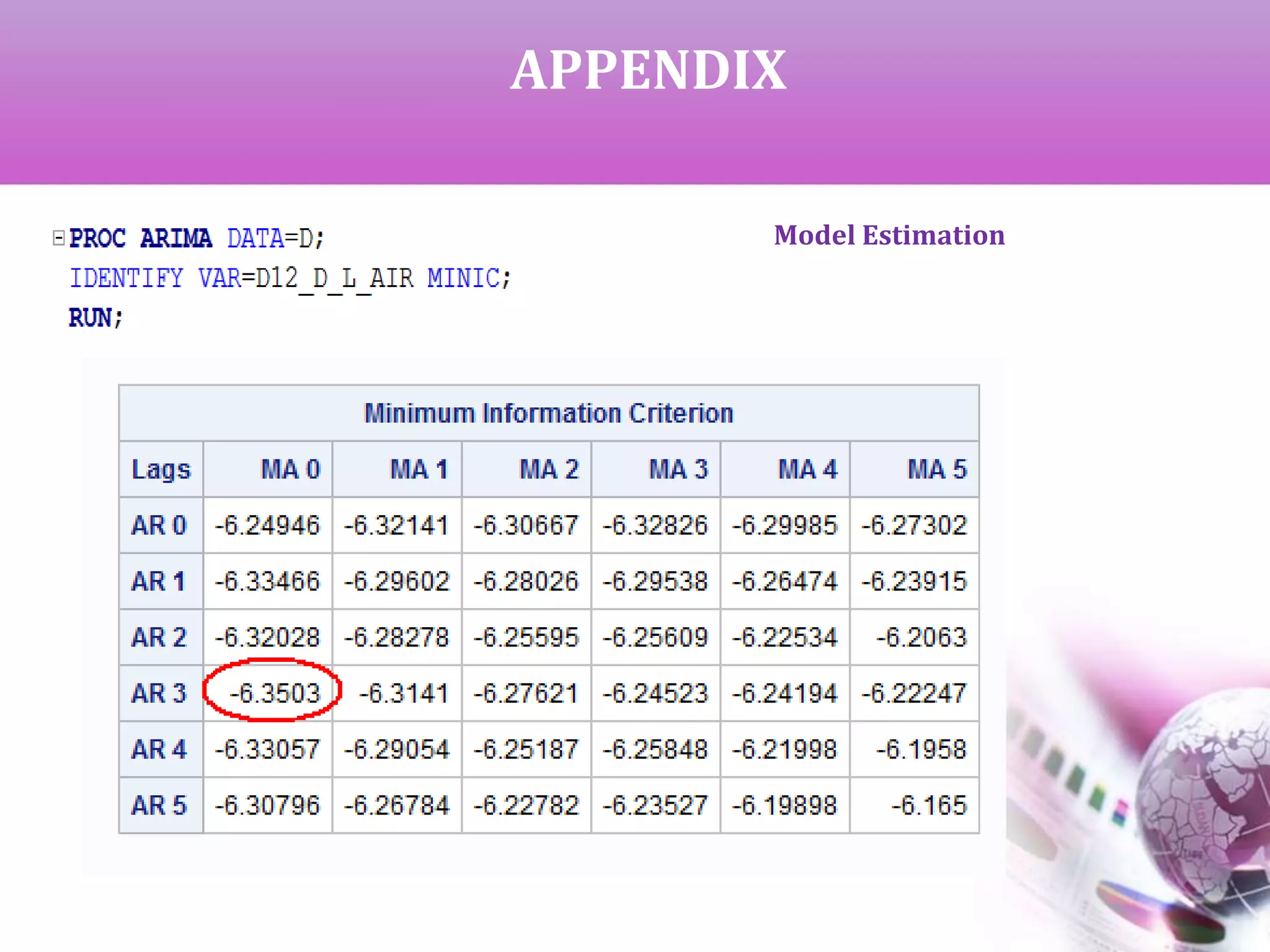

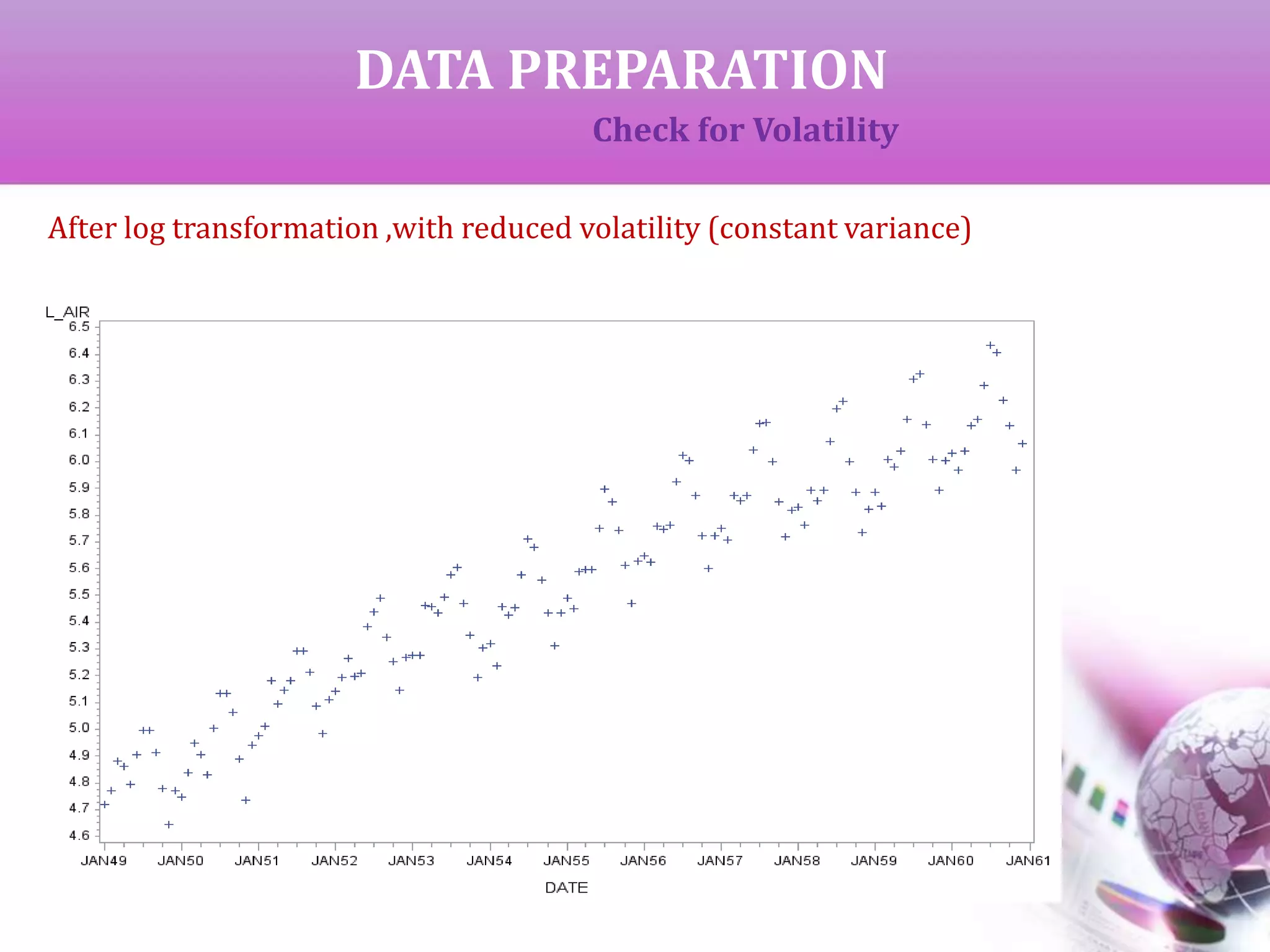

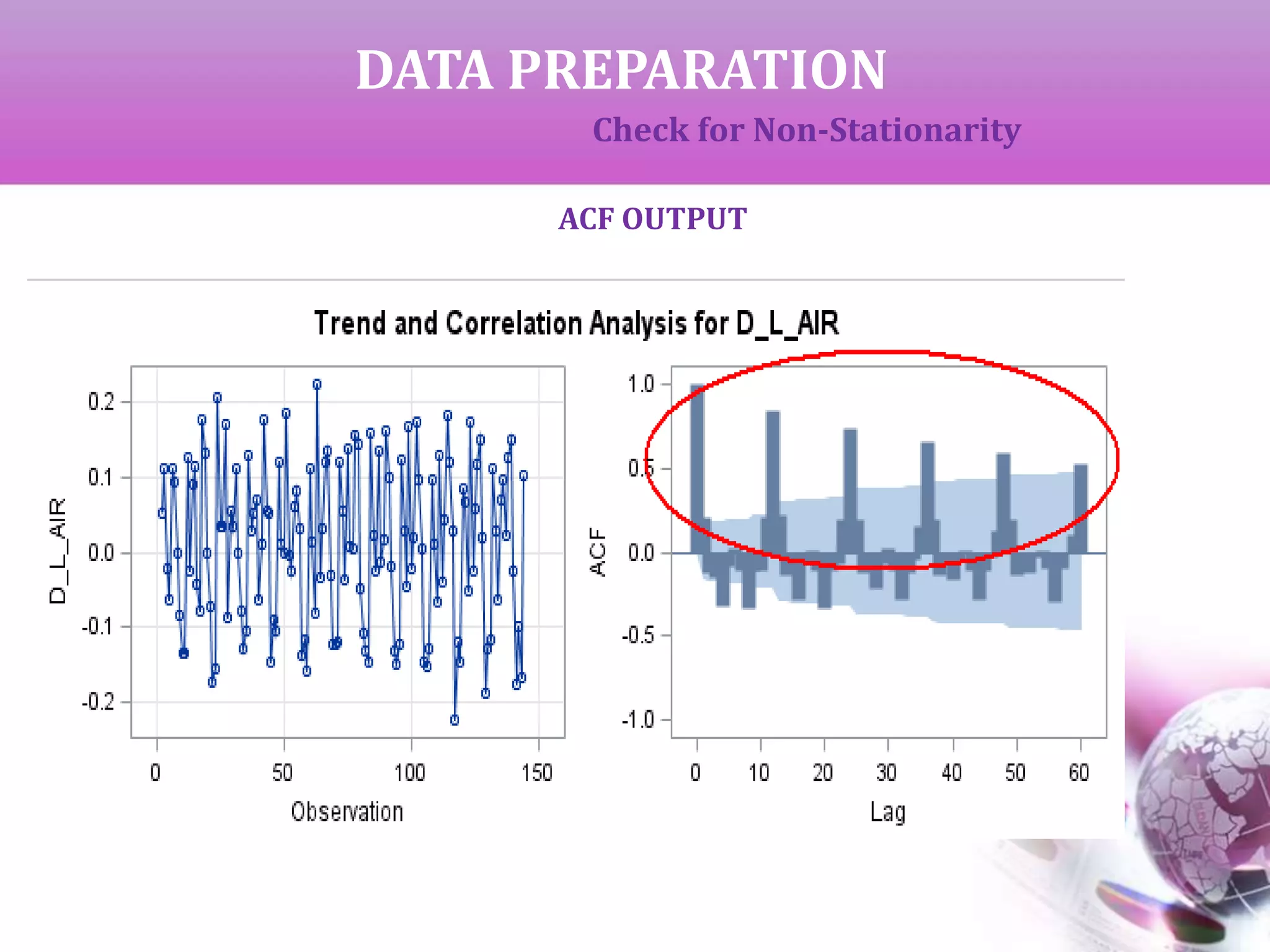

Check for Non-Stationarity

If the data is completely random with no fixed pattern, it is called non-

stationary data and cannot be used for future forecasting. This is checked

by ‘Augmented Dickey-Fuller Unit Root Test’ (ADF).Here,

H0 : Data is non-stationary

If p < alpha, we reject H0 to claim that the data is stationary and

hence

can be used for forecasting.

If p > alpha, we get non-stationary data which can be converted to

stationary by successive differencing.

We can start with first difference (y[t]-y[t-1]) which can obtained using

DIF(L_AIR) or L_AIR(1).Similarly, if we need second difference, it is

DIF2(L_AIR) .](https://image.slidesharecdn.com/timeseriesanalysis-140408021726-phpapp02/75/Time-Series-Analysis-Modeling-and-Forecasting-8-2048.jpg)

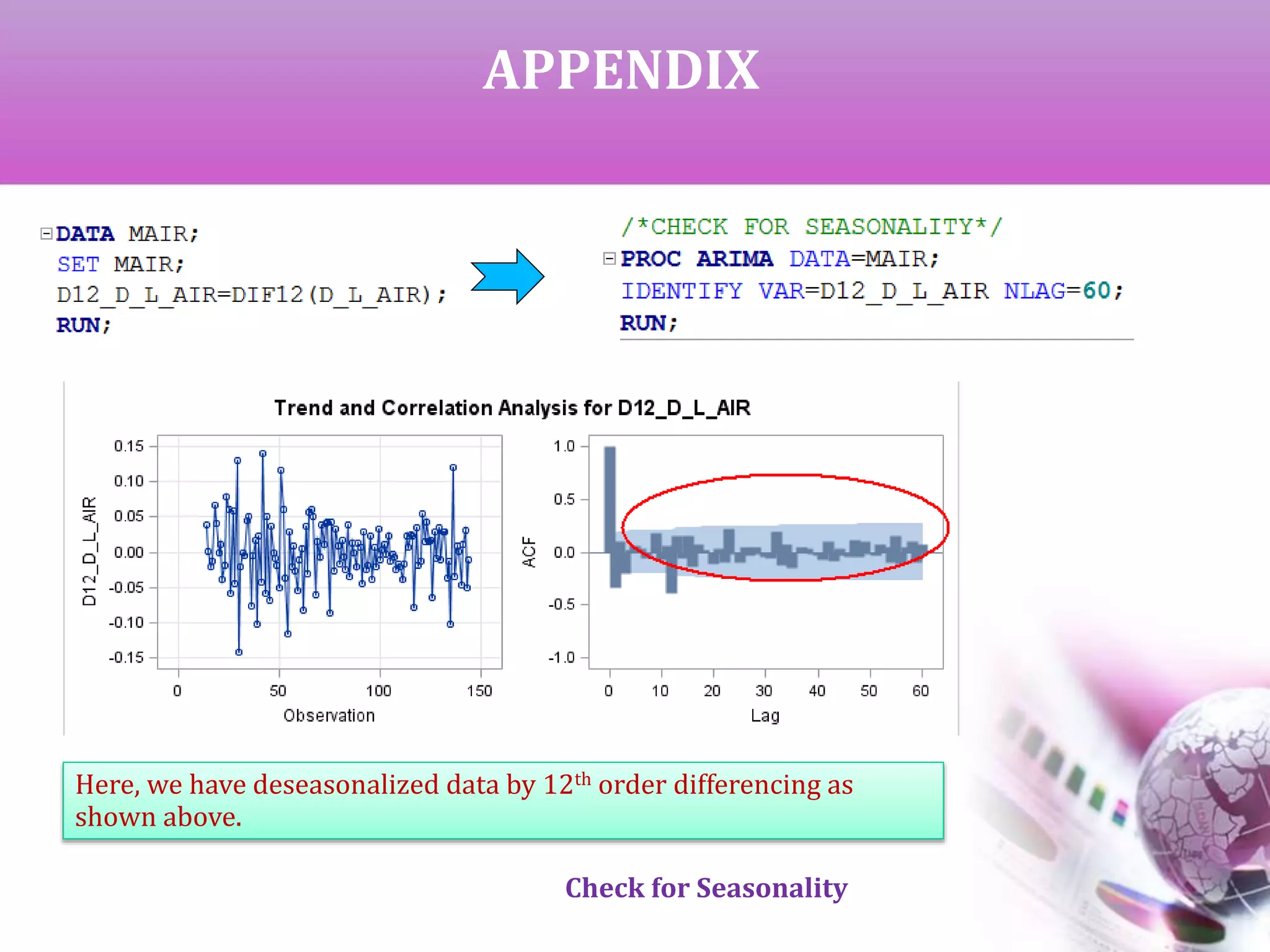

![DATA PREPARATION

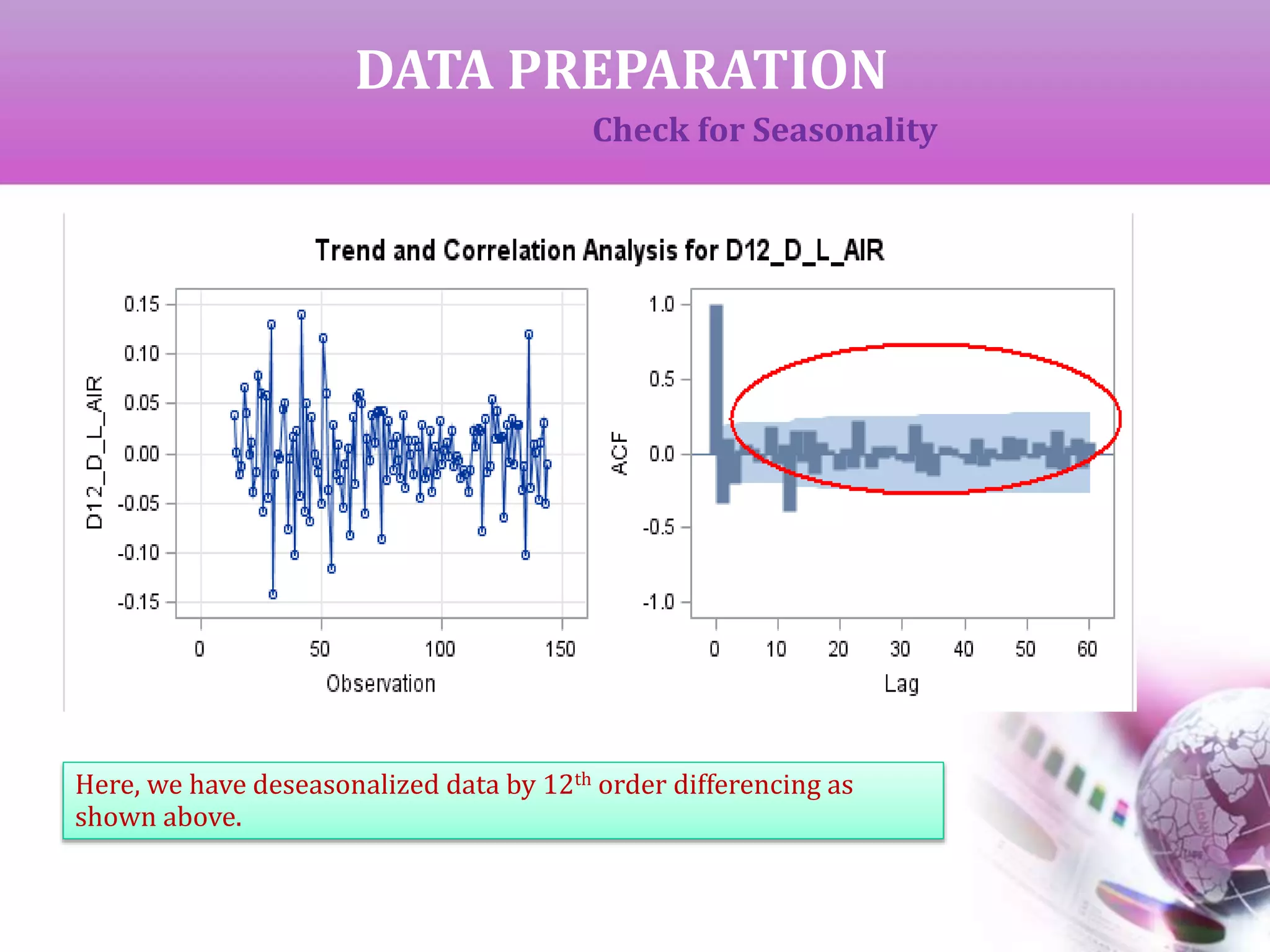

Check for Seasonality

The Auto Correlation function (ACF) gives the correlation between

y[t]-y[t-s] where ‘s’ is the period of lag.

If the ACF gives high values at fixed interval, that interval can be

considered as the period of seasonality. A differencing of same order

will deseasonalize the data.

From the output of ACF it can be observed that the period of

seasonality is 12 years.](https://image.slidesharecdn.com/timeseriesanalysis-140408021726-phpapp02/75/Time-Series-Analysis-Modeling-and-Forecasting-11-2048.jpg)

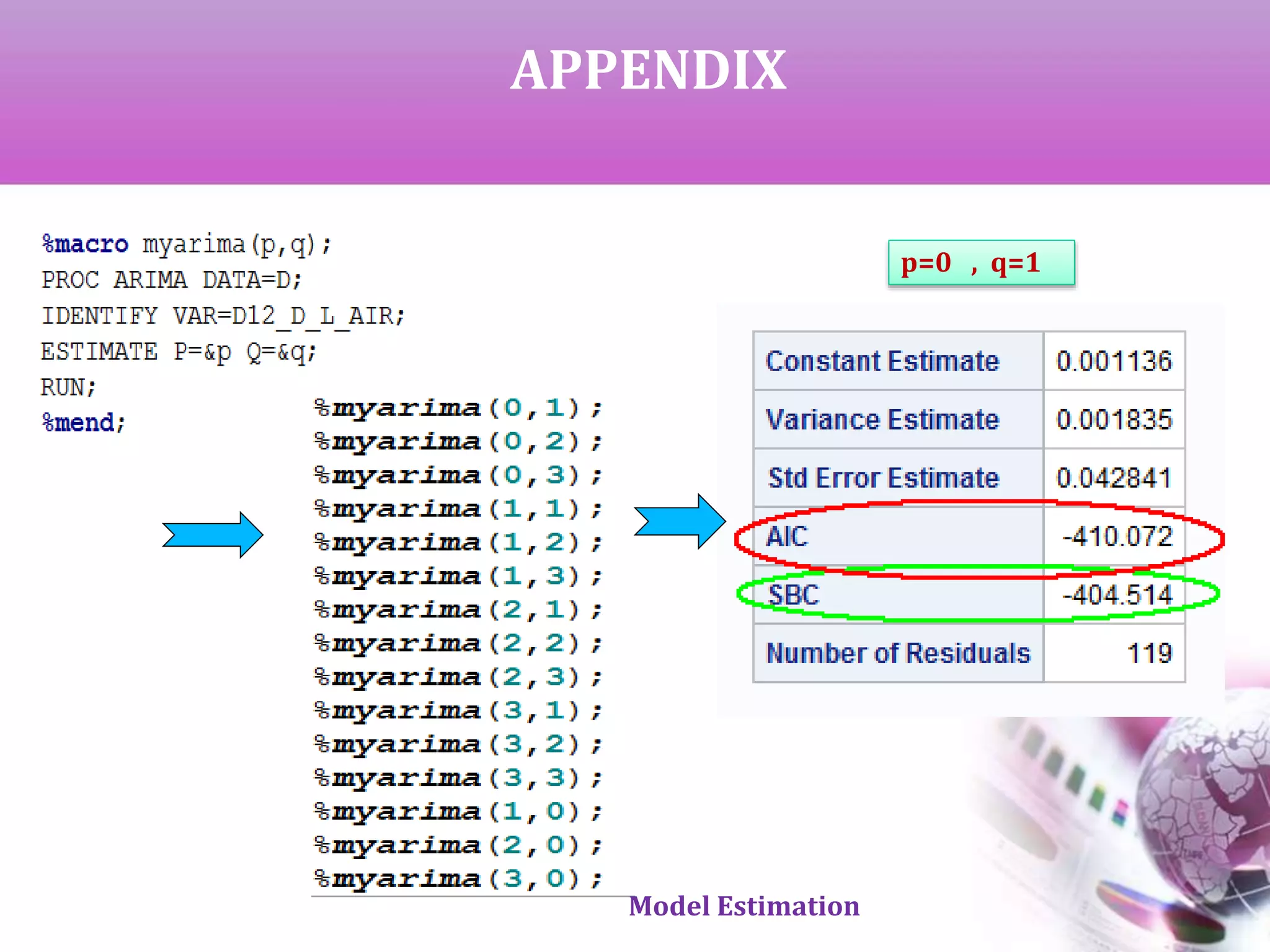

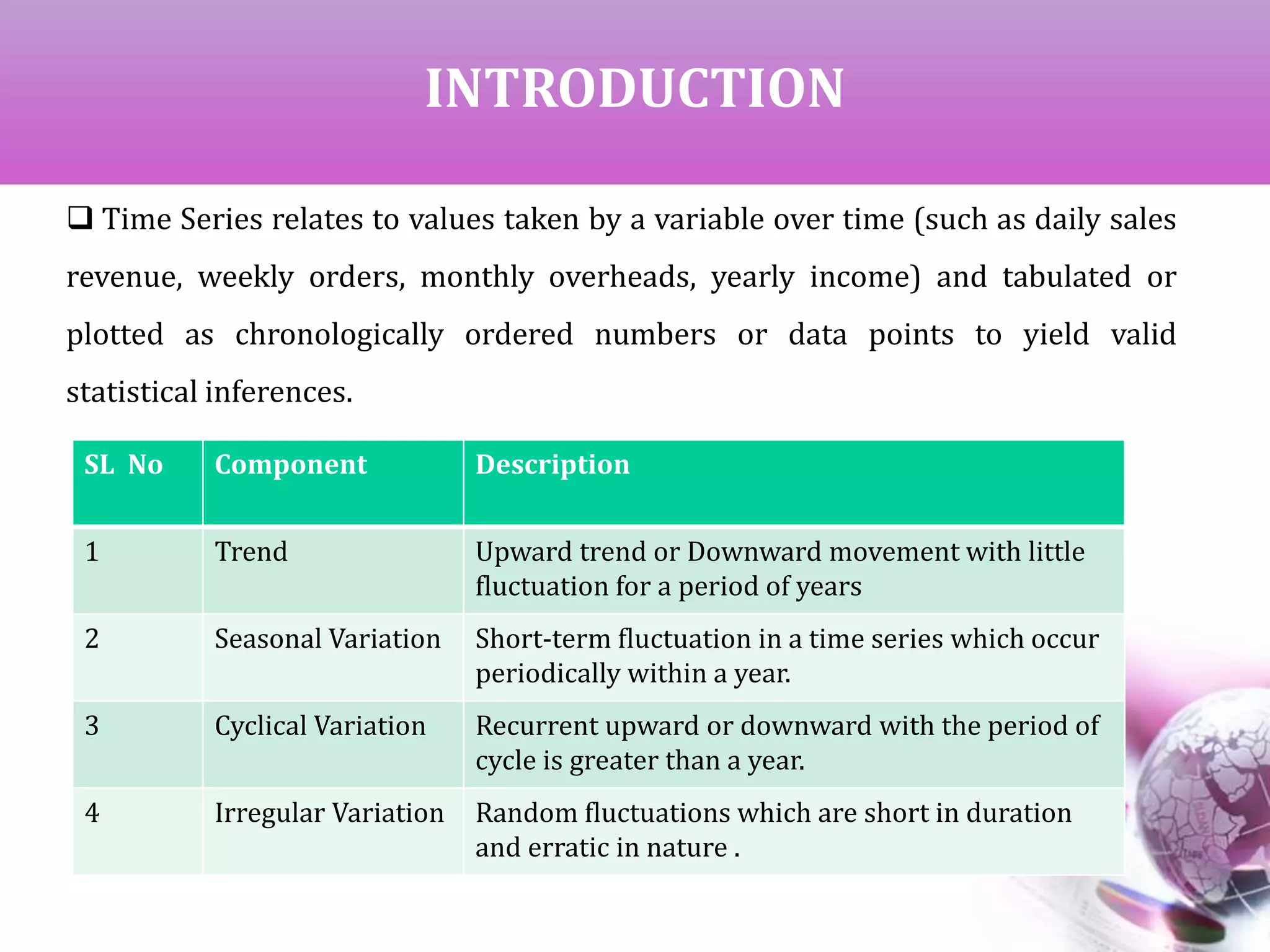

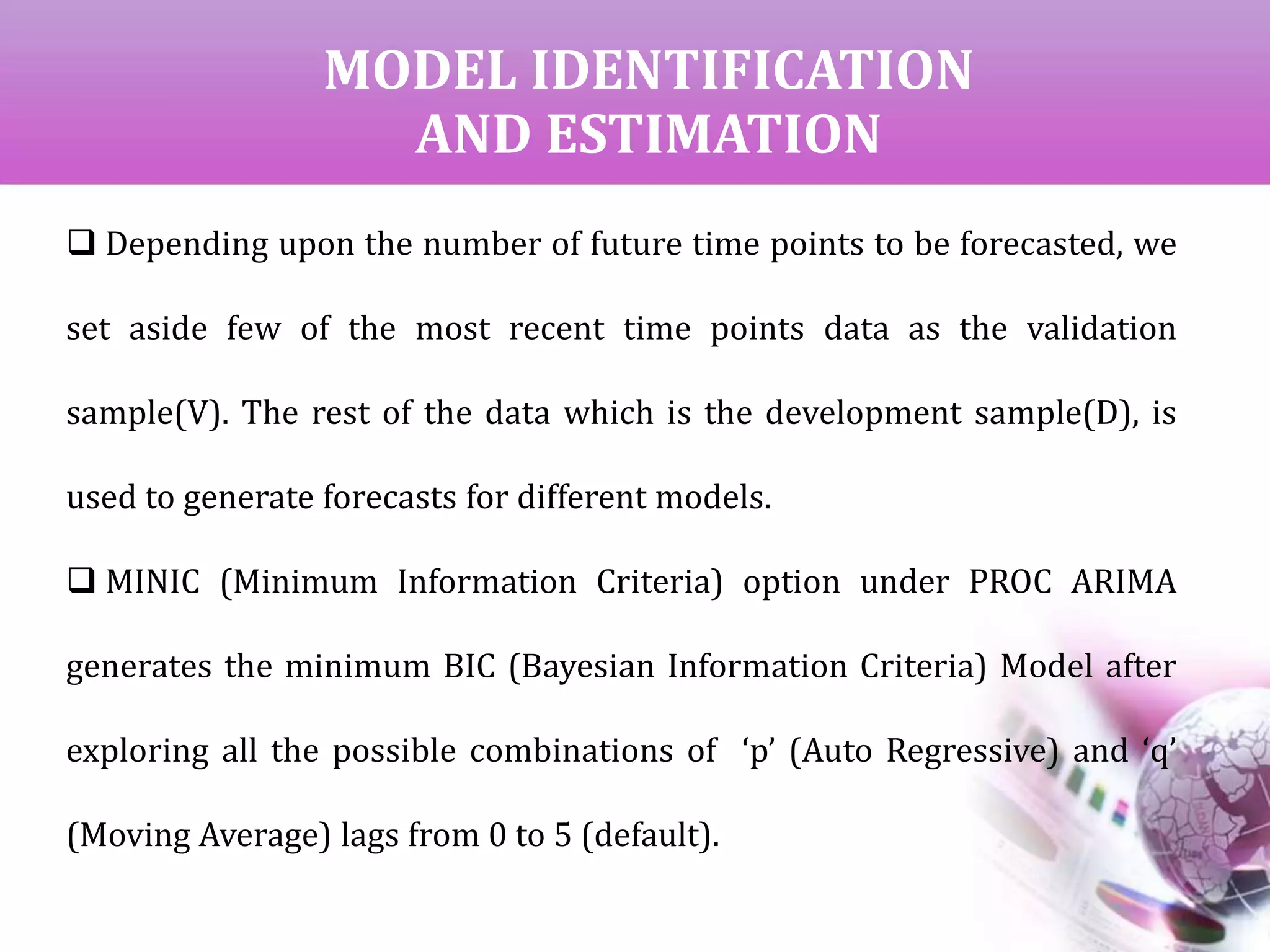

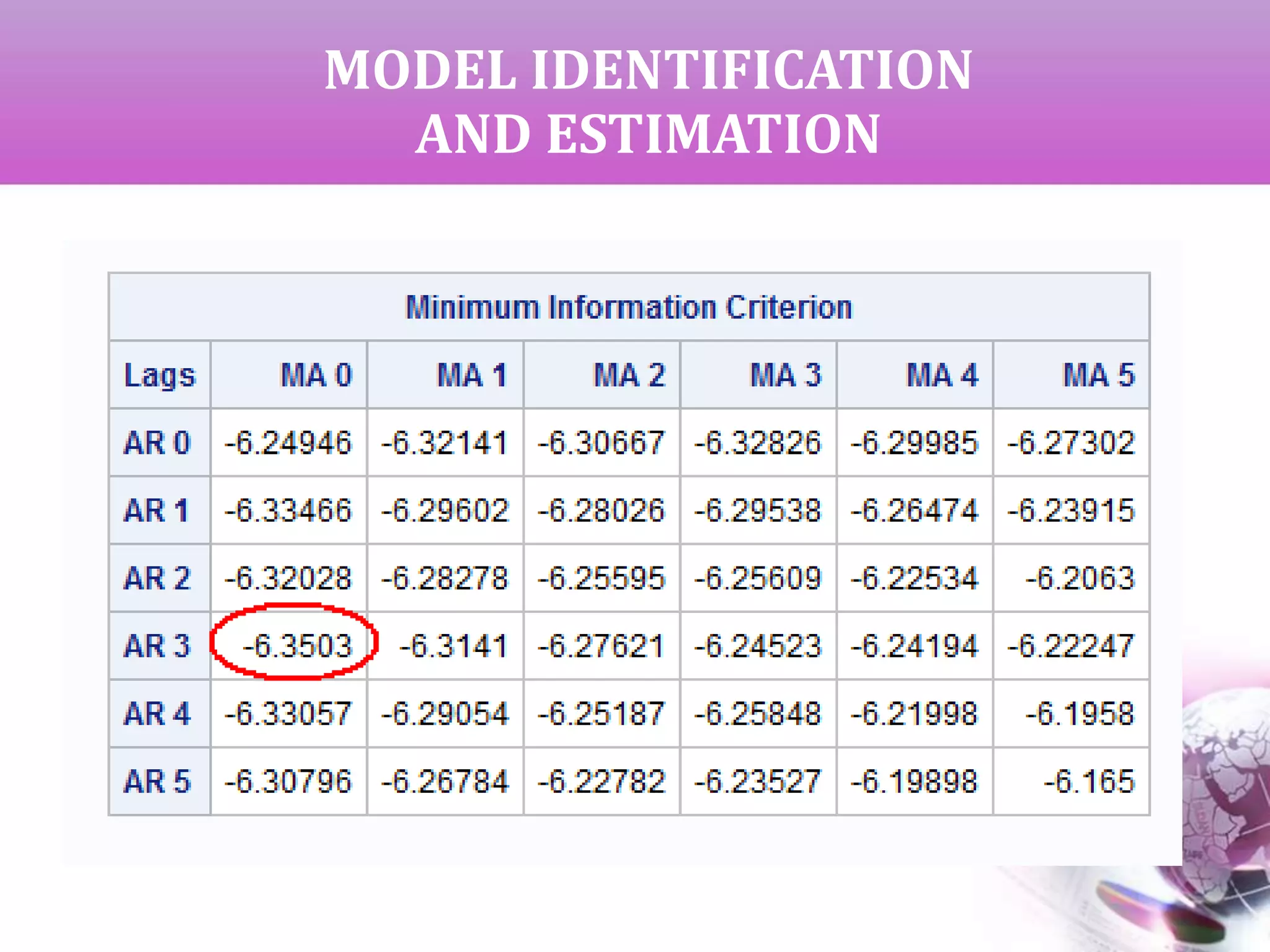

![MODEL IDENTIFICATION

AND ESTIMATION

AIC & SBC for all the neighborhood

models [ (0,1) to (3,3)]

Top 7 models based on lower

average value

Model Estimation](https://image.slidesharecdn.com/timeseriesanalysis-140408021726-phpapp02/75/Time-Series-Analysis-Modeling-and-Forecasting-16-2048.jpg)