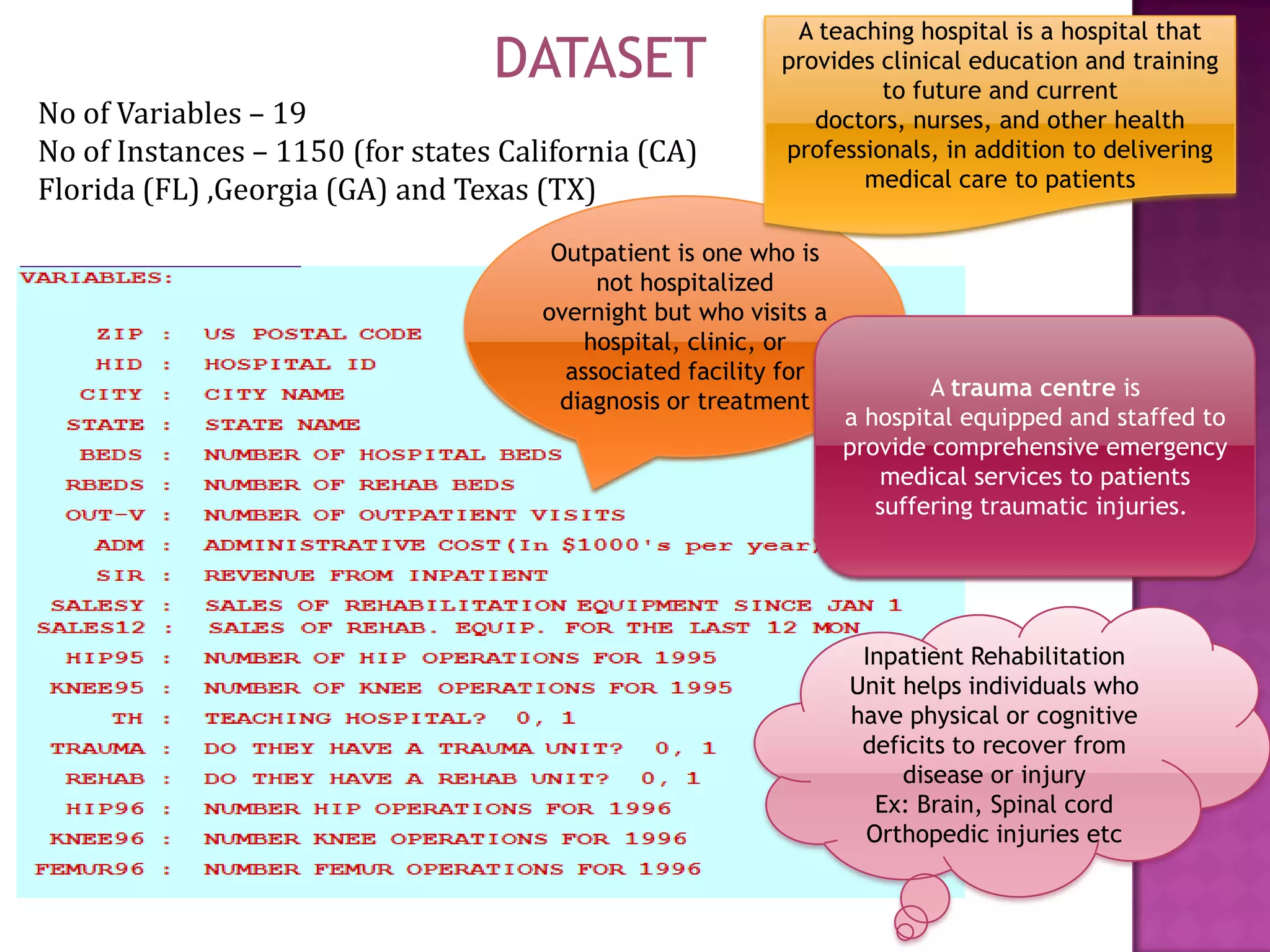

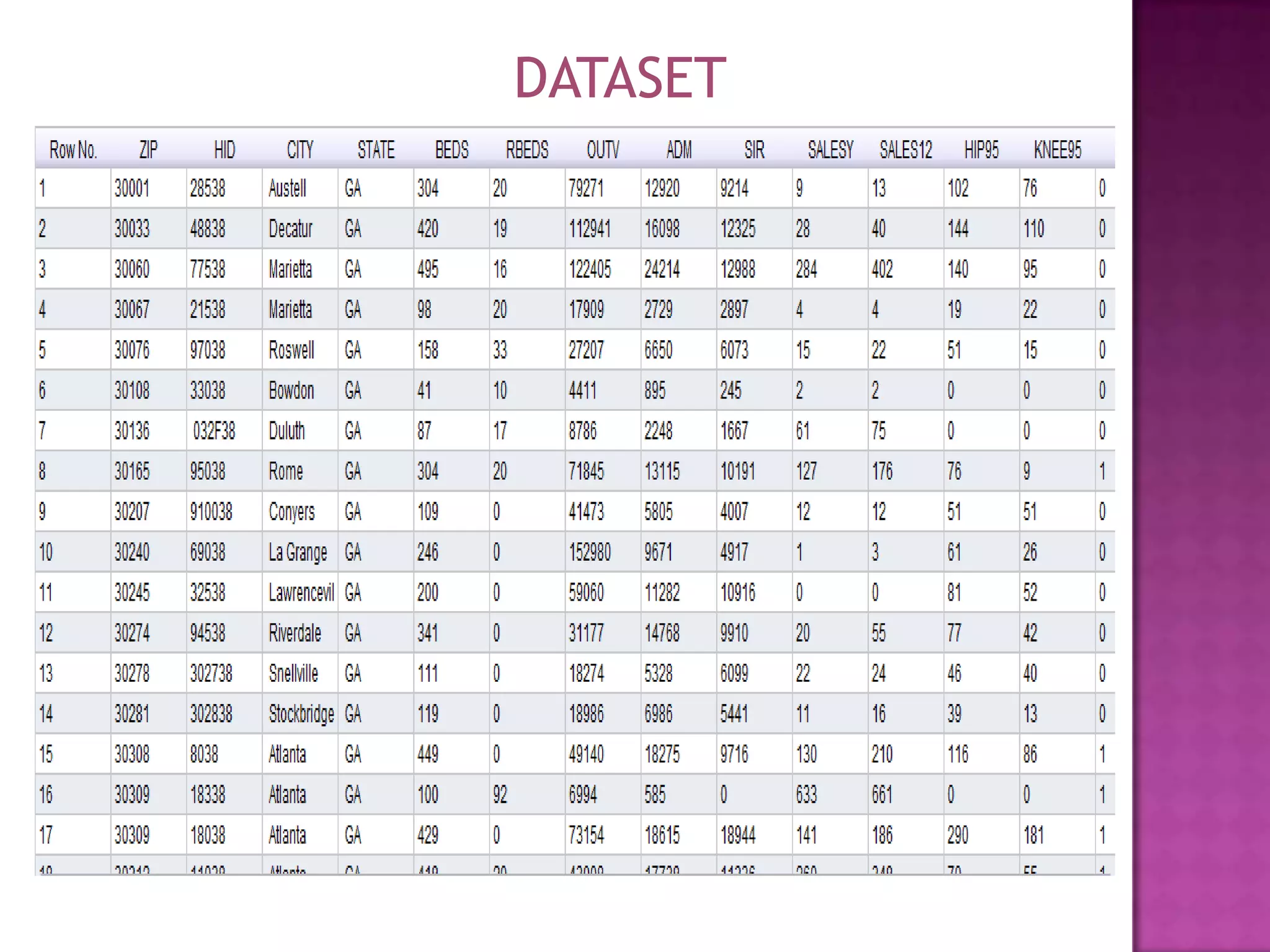

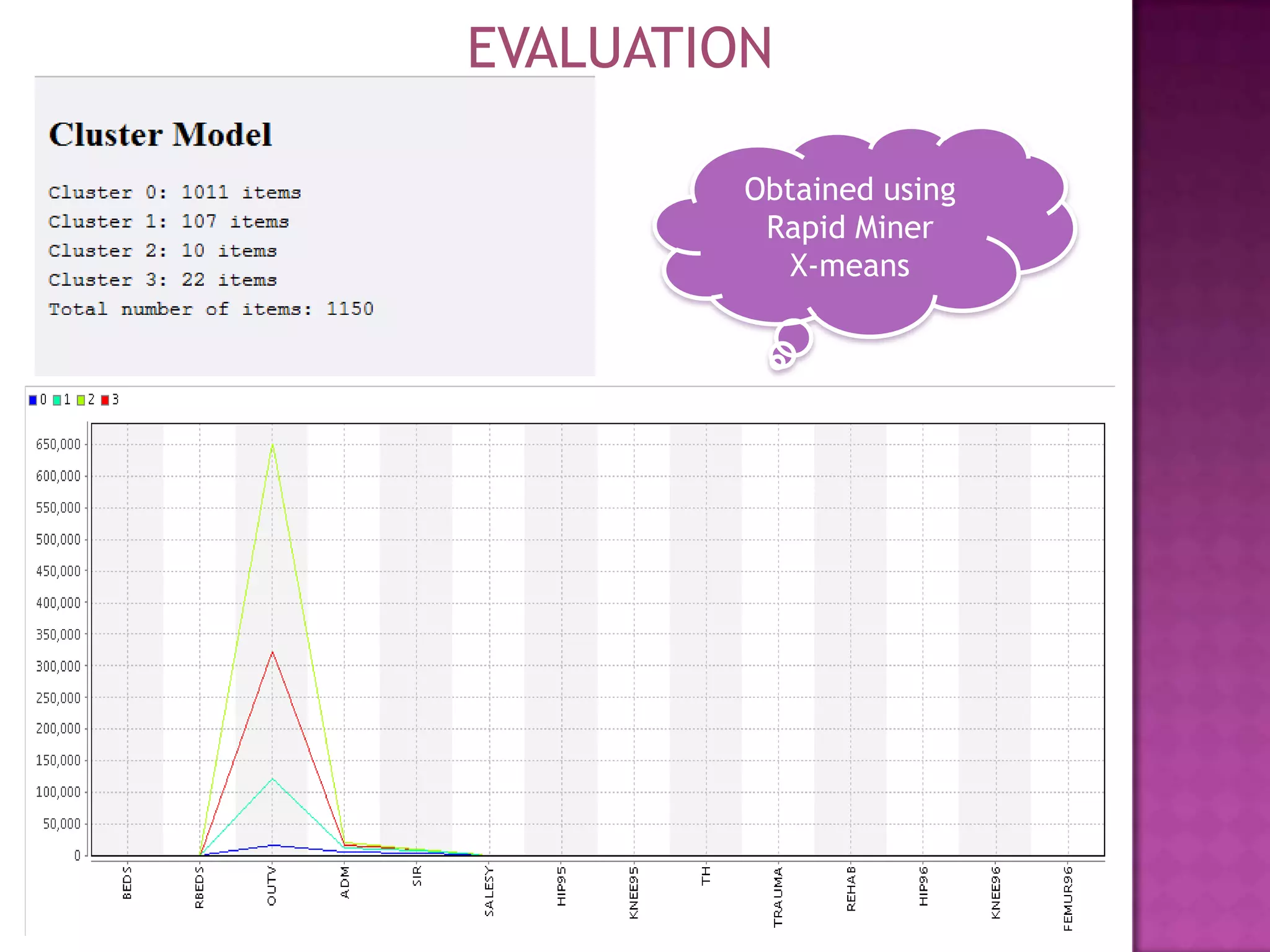

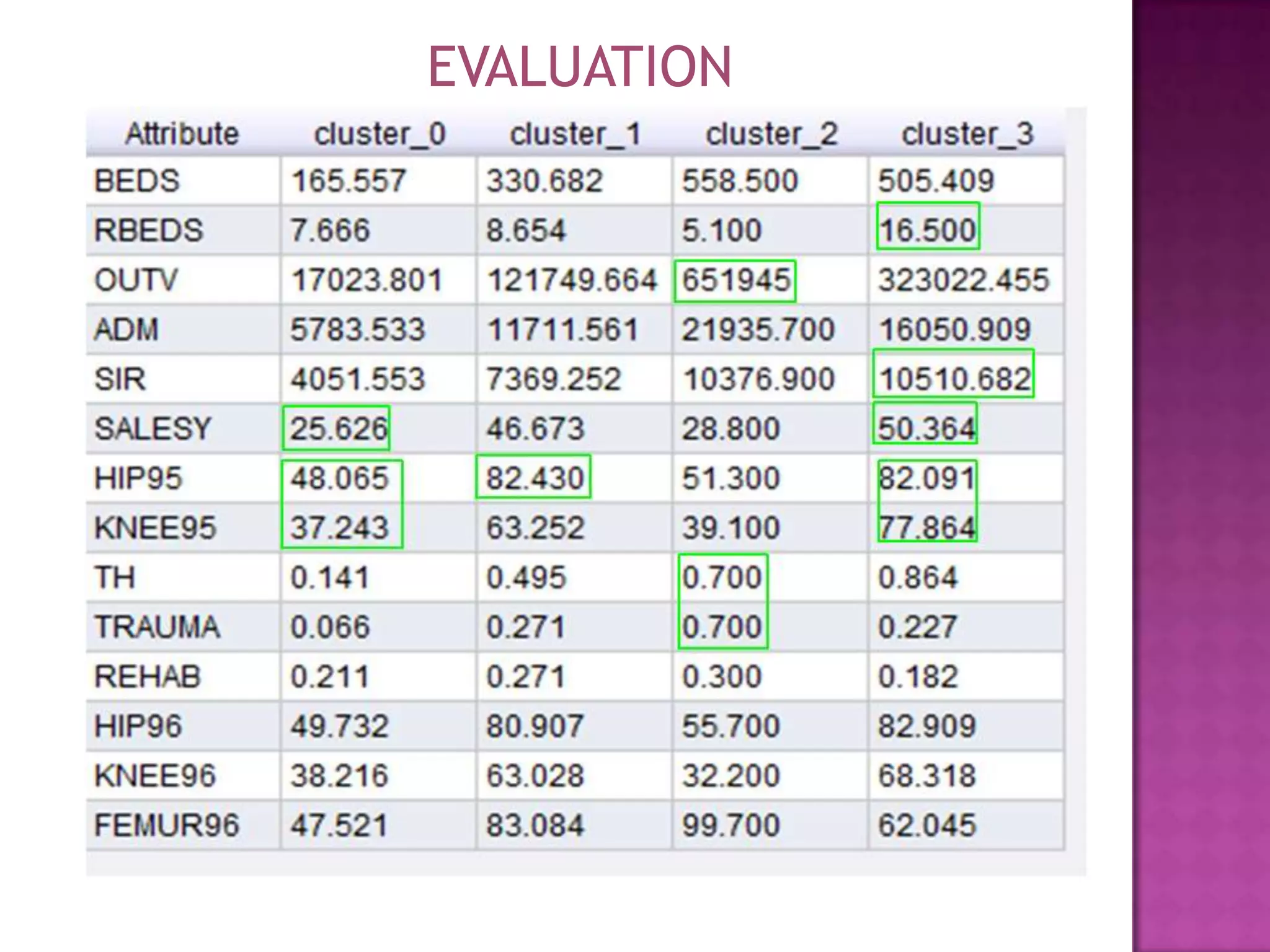

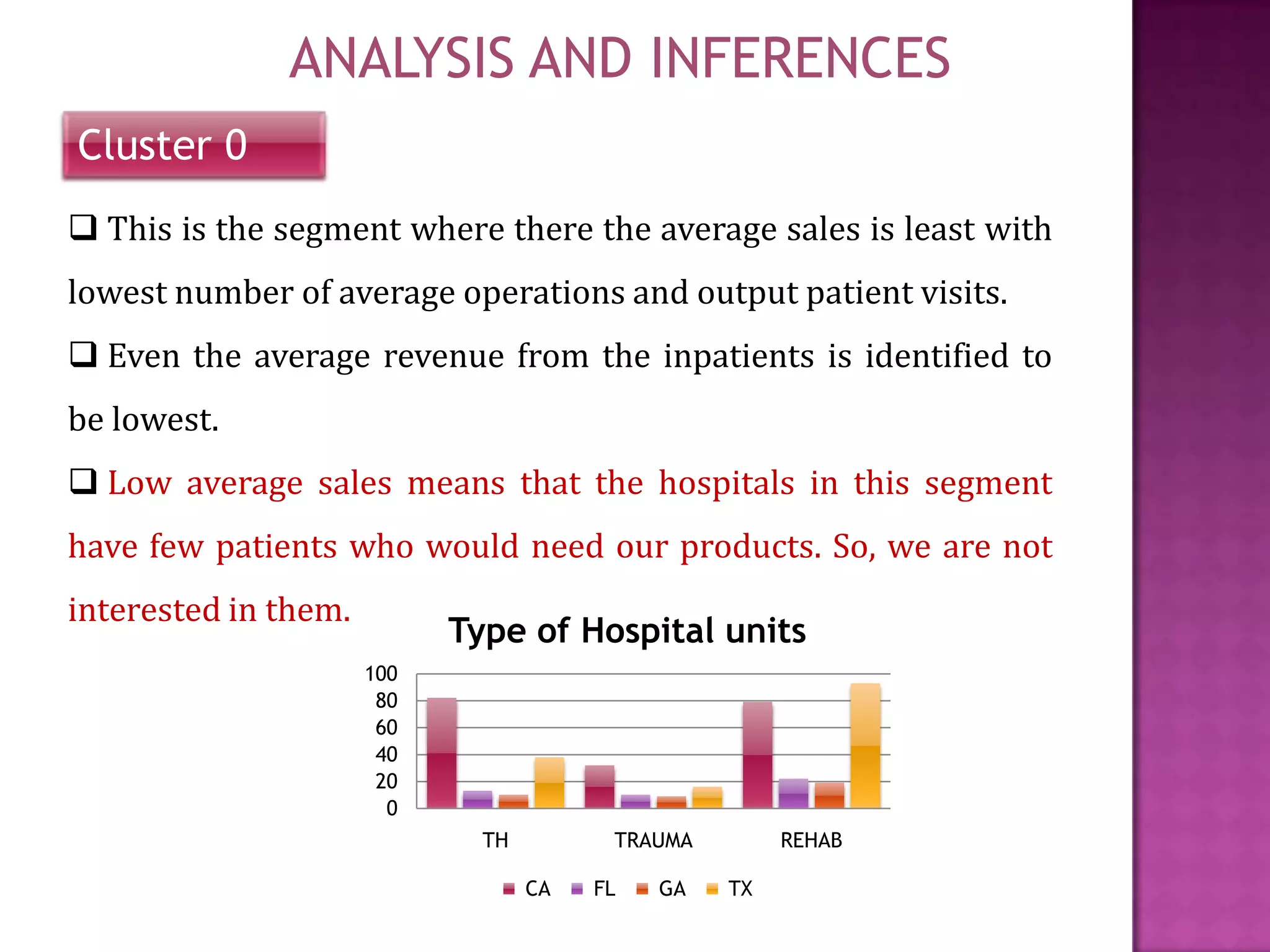

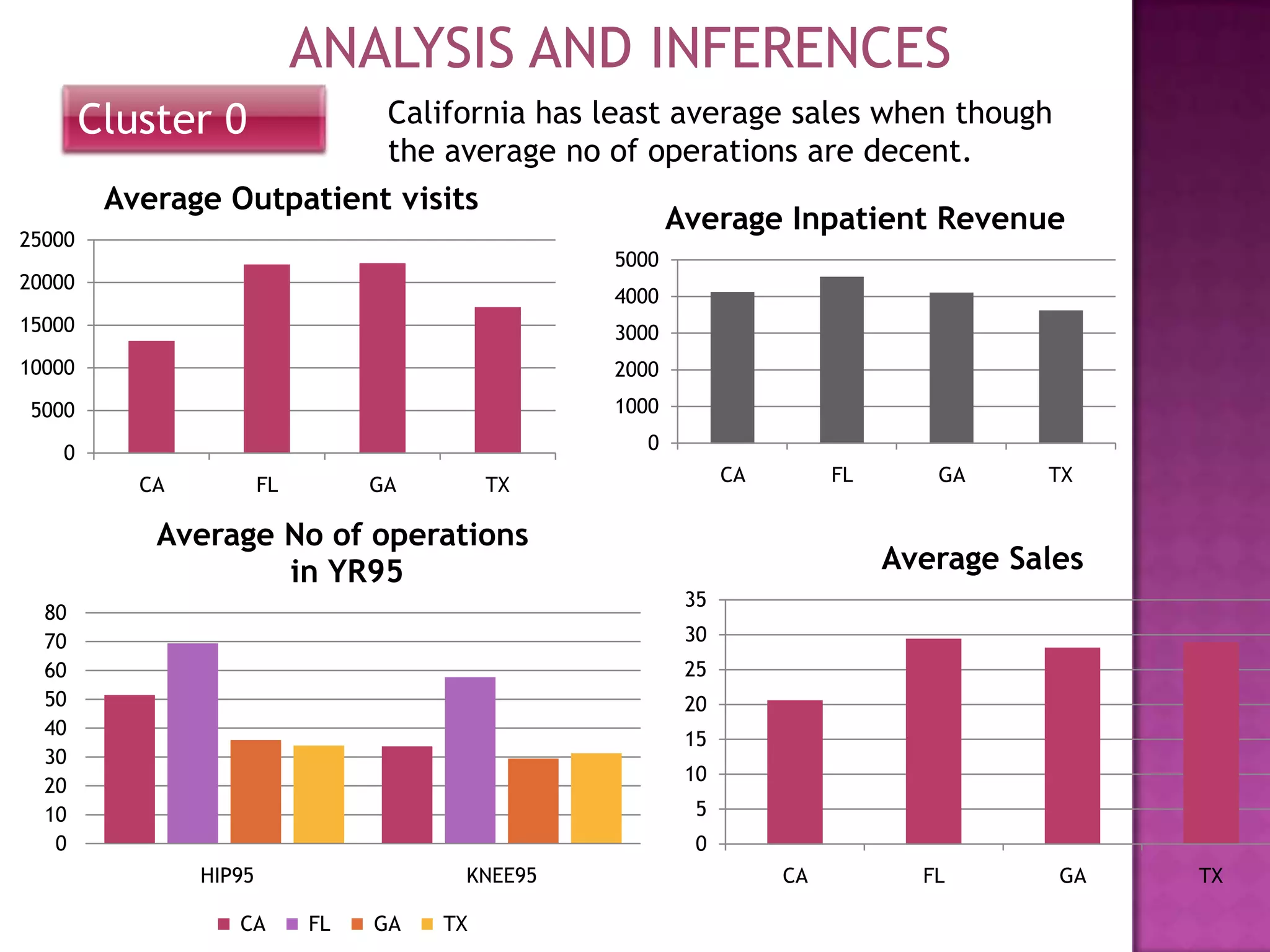

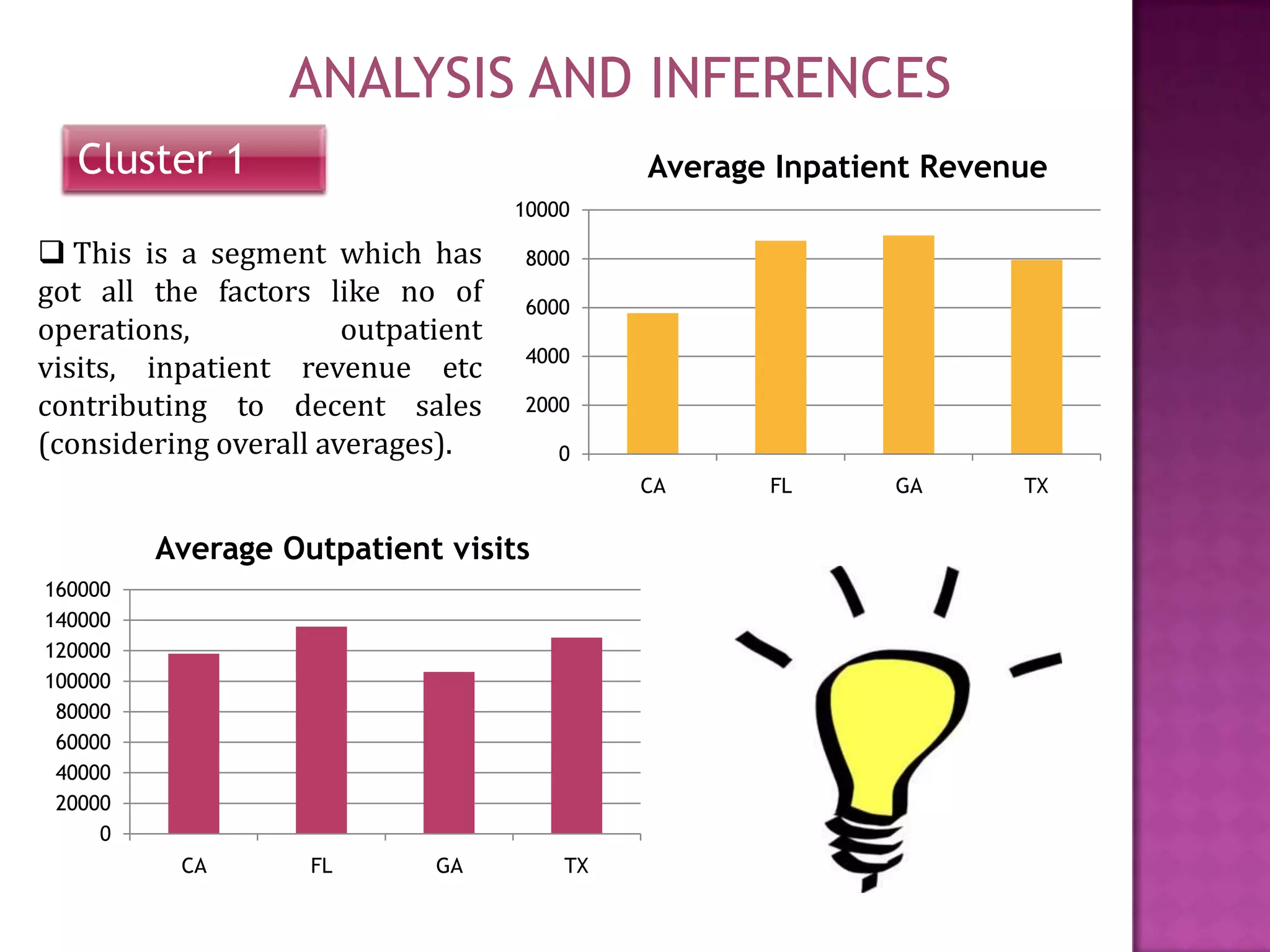

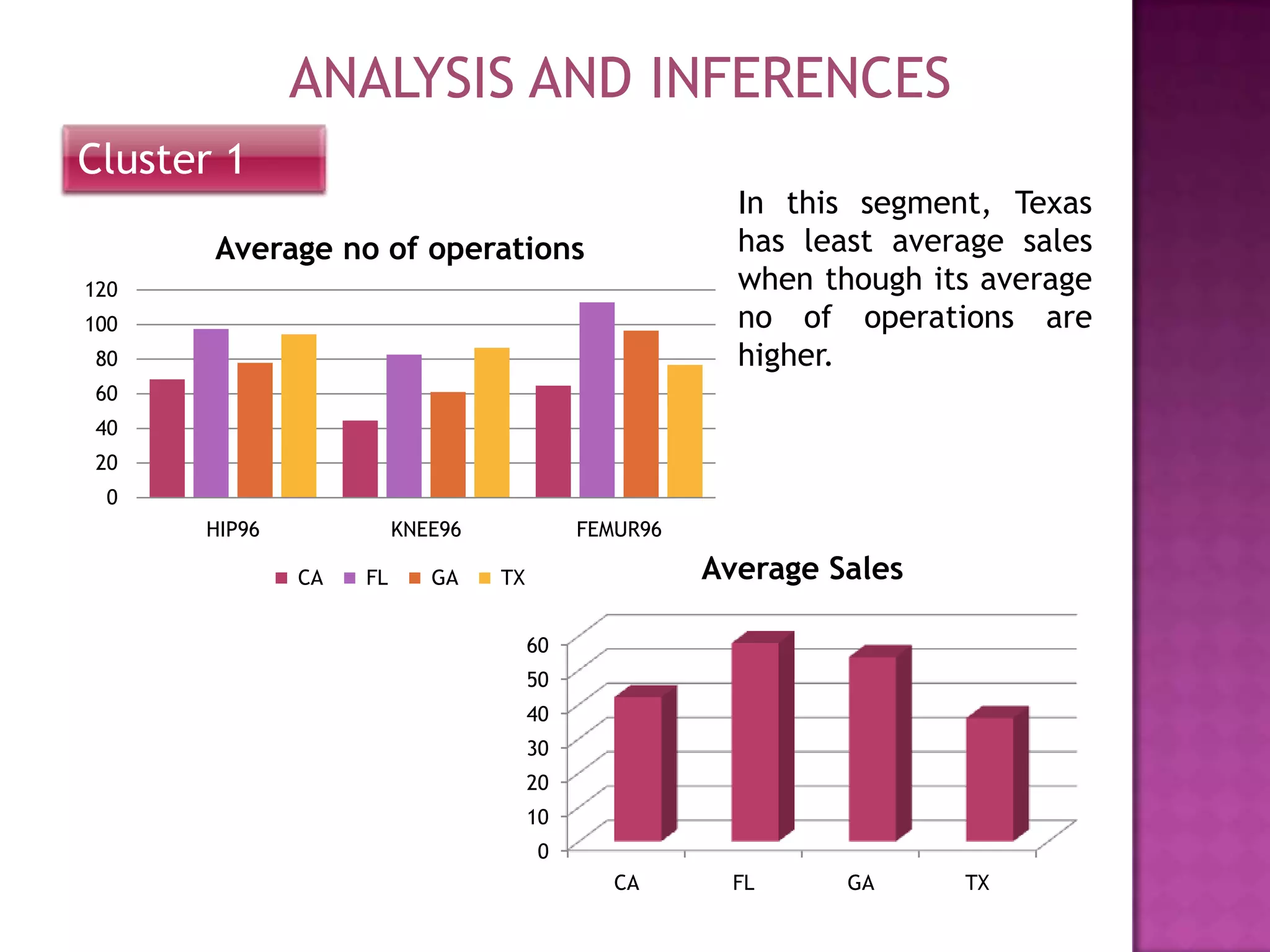

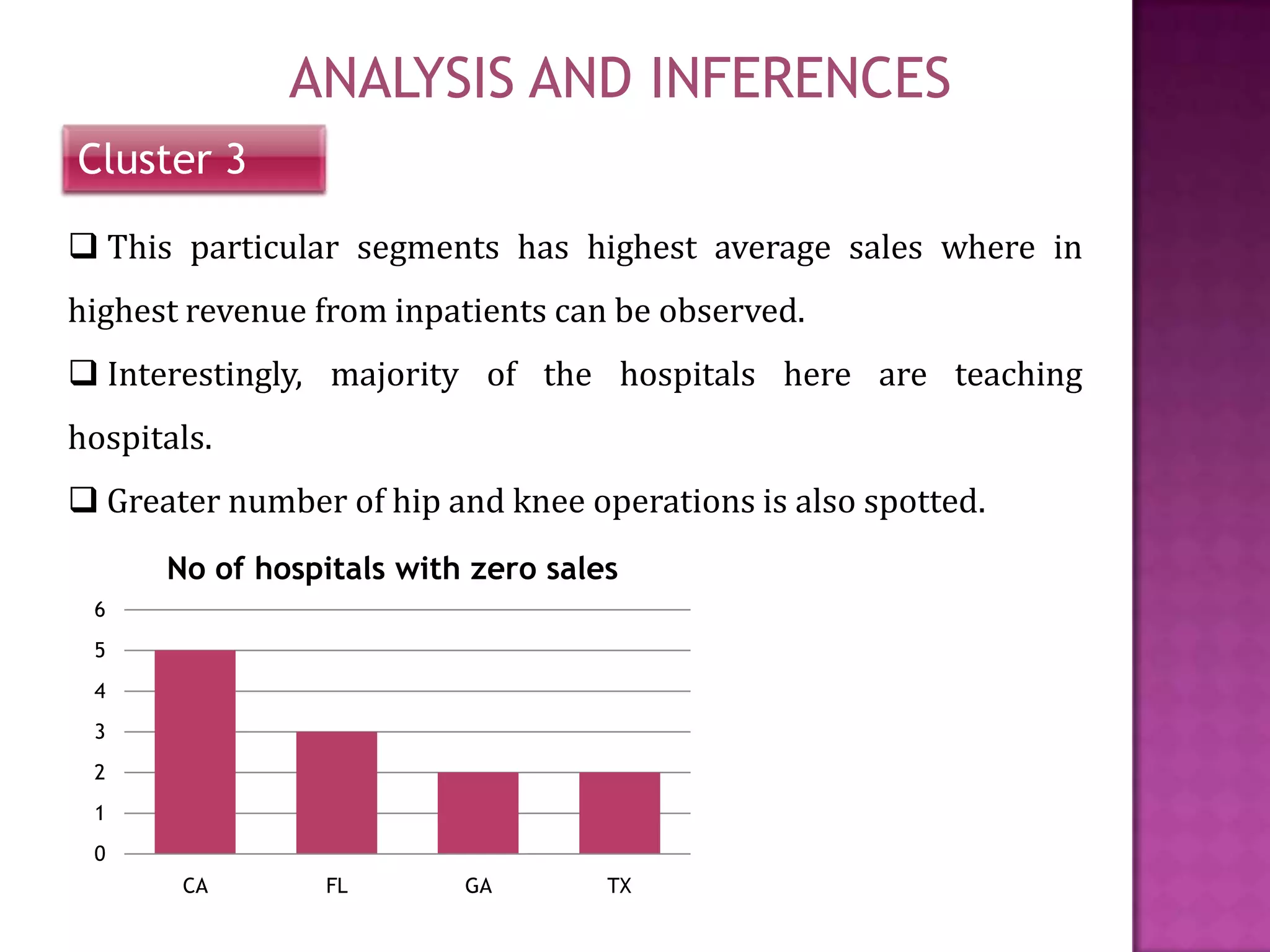

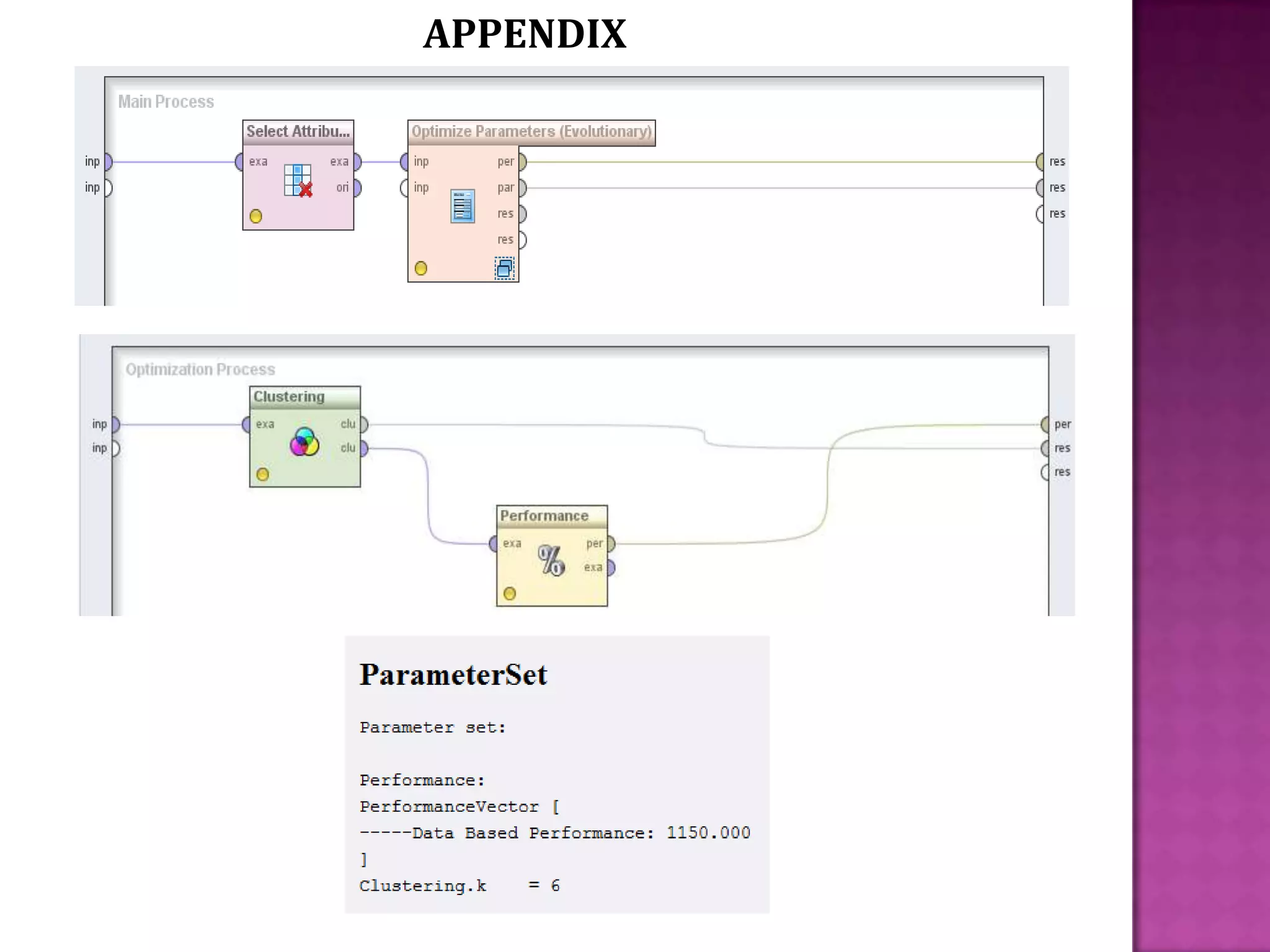

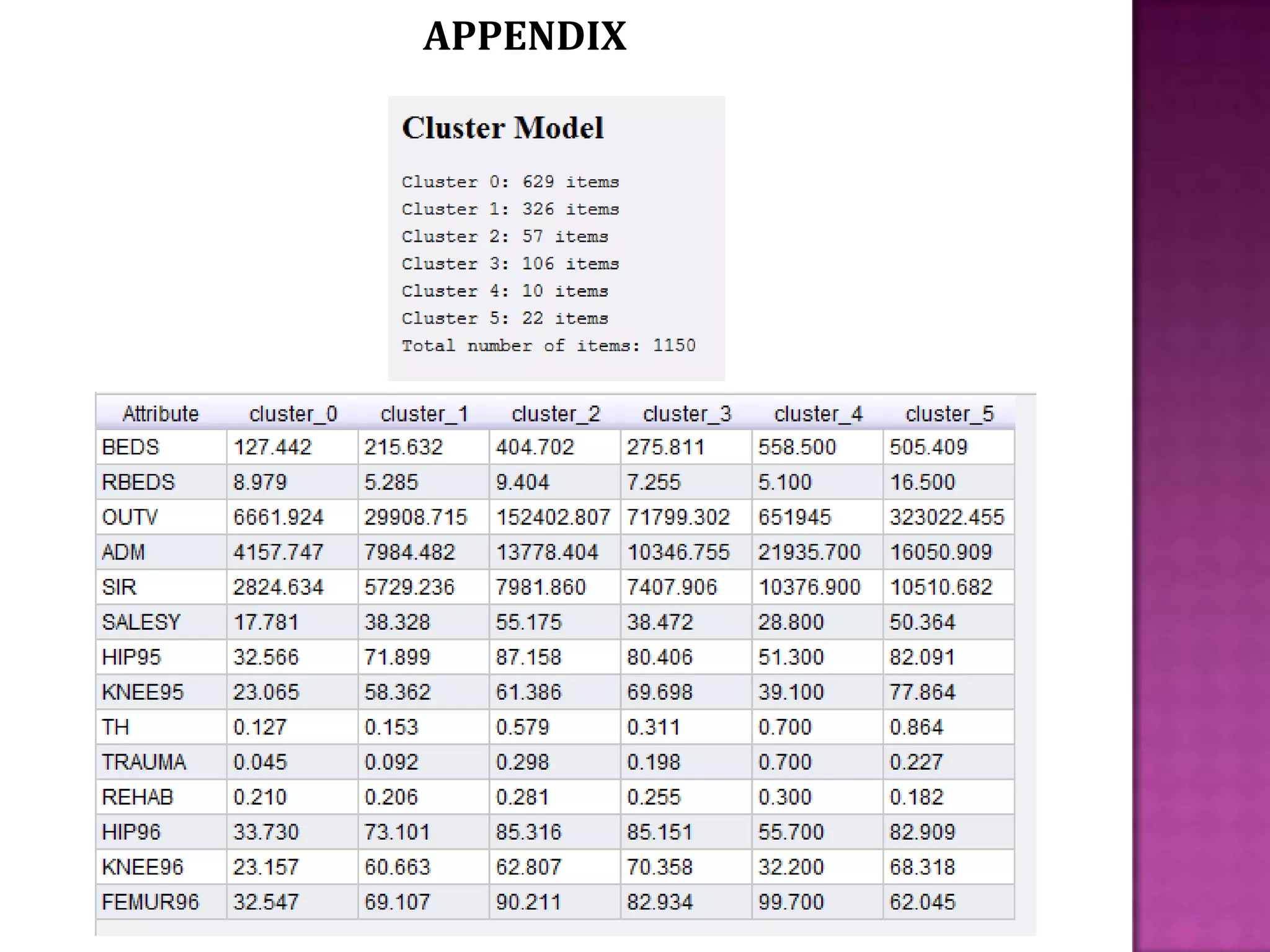

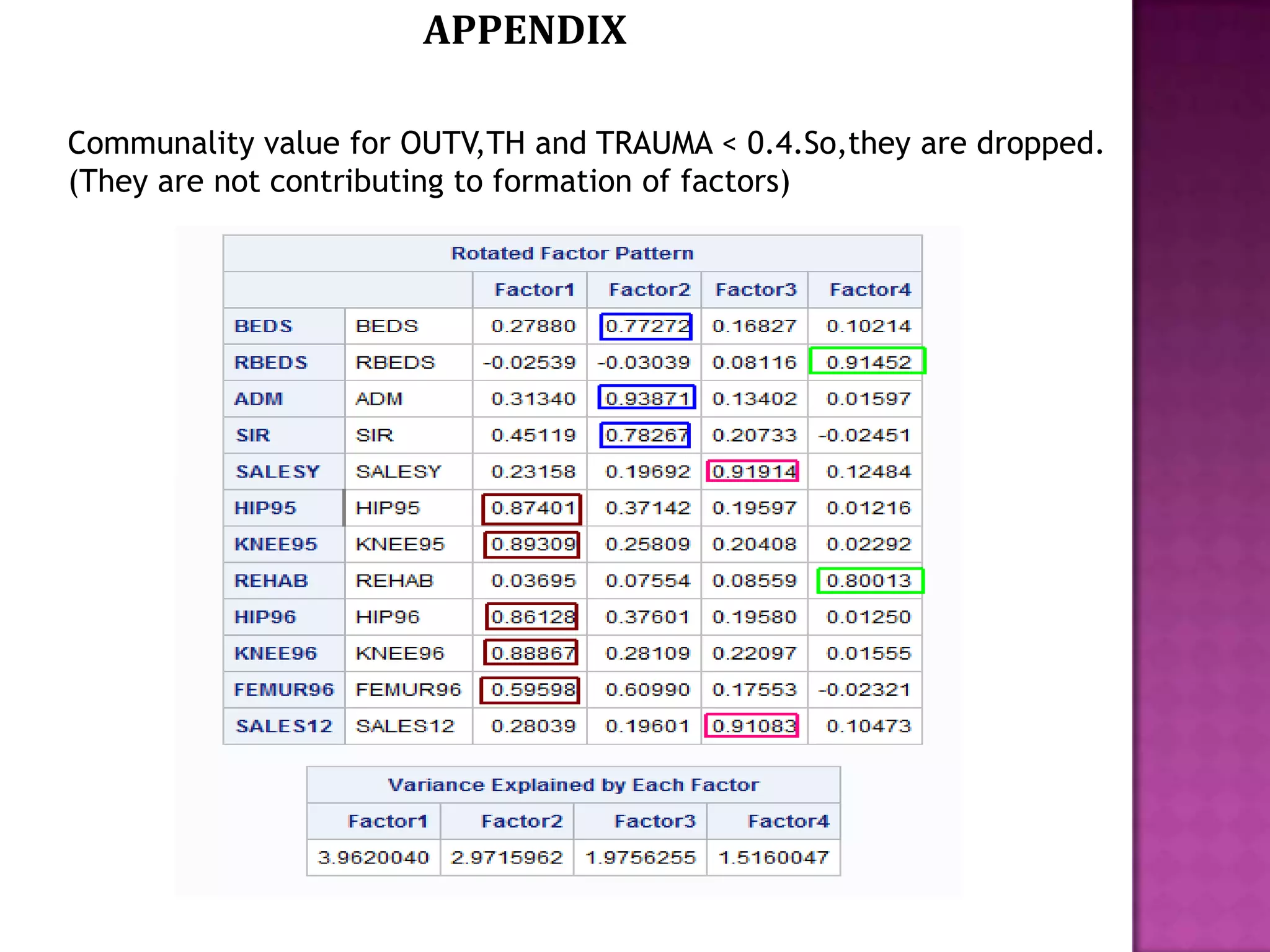

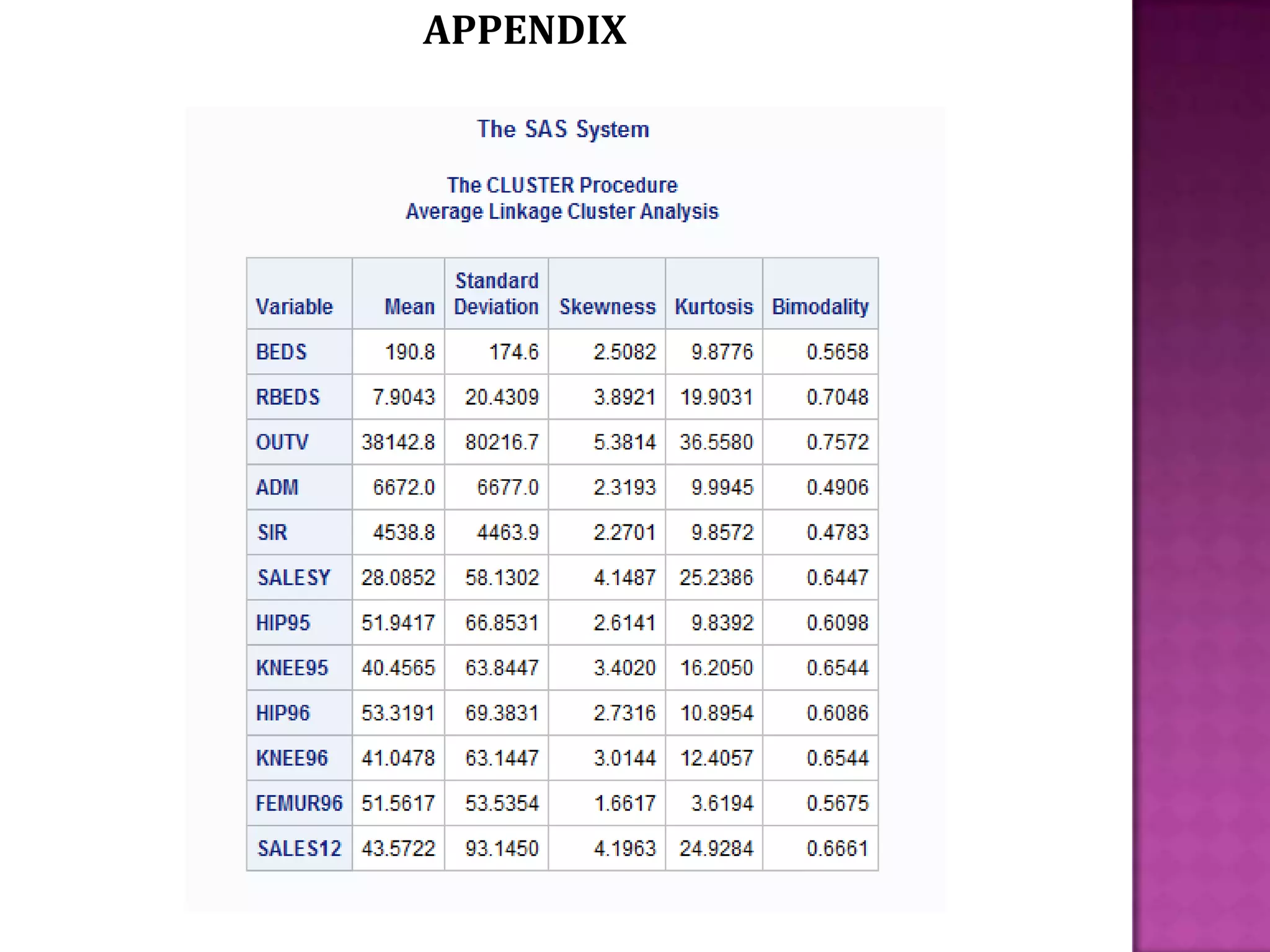

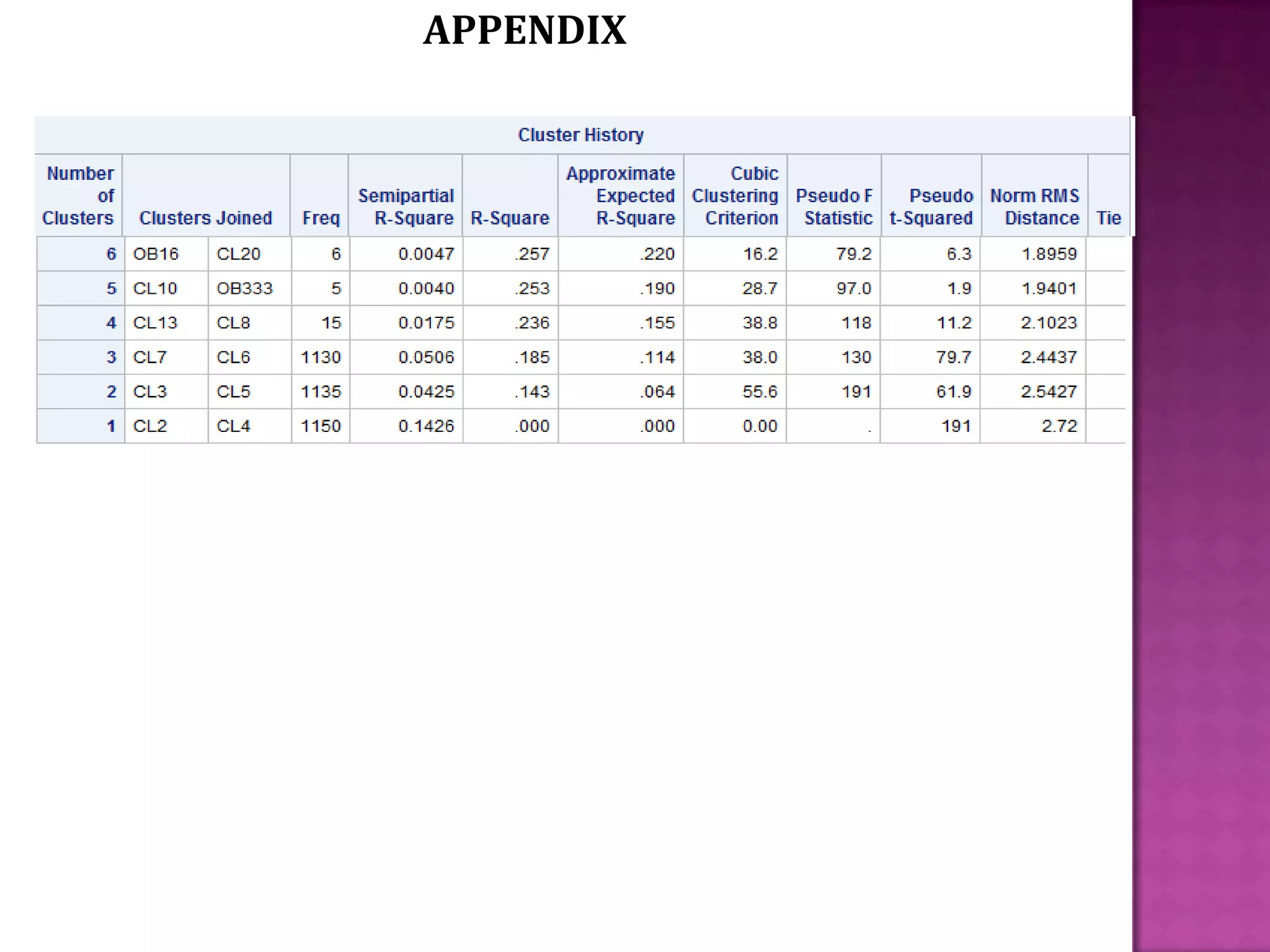

The document presents a market segmentation analysis conducted by ABC Surgical to increase sales of orthopedic surgical equipment in US hospitals, focusing on California, Florida, Georgia, and Texas. It identifies four hospital segments through cluster analysis, ultimately recommending targeting Cluster 1 due to consistent demand for orthopedic surgeries influenced by demographics and injury rates. Future directions include refining analytical techniques and determining sales drivers to enhance market opportunities.