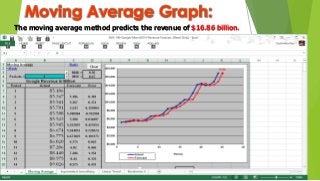

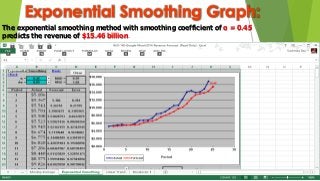

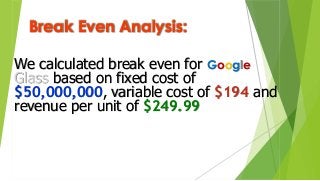

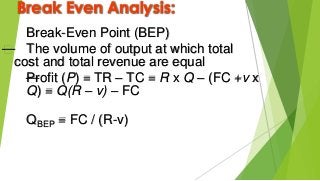

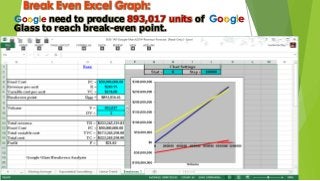

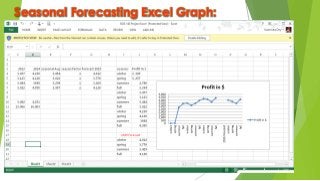

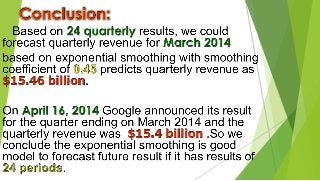

Google generates most of its revenue from online advertising on its properties and other websites. Time series forecasting of Google's quarterly revenues from 2008-2014 was performed using moving average and exponential smoothing methods, predicting revenues of $16.86 billion and $15.46 billion respectively for Q1 2014. Break even analysis for Google Glass found the break even point would be production of 893,017 units based on fixed and variable costs. Seasonal forecasting of Google profits from 2012-2015 can help with market planning, budgeting, and cash flow.