Building Stronger Tax Systems - Third UN Conference on Financing for Development, Addis Ababa

•

1 like•331 views

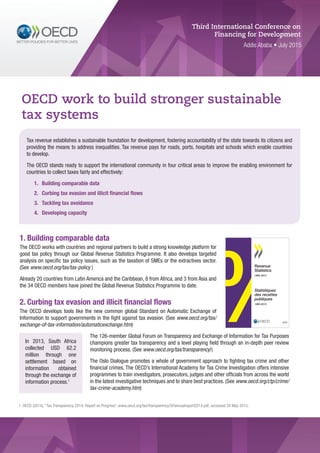

The OECD works to strengthen tax systems and revenue collection in four key areas: 1. Building comparable tax data across countries to facilitate analysis and policymaking. 2. Curbing tax evasion and illicit financial flows through tools like automatic exchange of information and monitoring tax transparency. 3. Tackling tax avoidance by working with countries on the Base Erosion and Profit Shifting (BEPS) project to reform international tax rules and address tax incentives that artificially shift profits.

Report

Share

Report

Share

Download to read offline

Recommended

BEPS - Third UN conference on financing for development Addis Ababa

Mobilising domestic resources through tackling base erosion and profit shifting (BEPS).

Tax Transparency in Latin America 2021: Punta del Este Declaration Progress R...

Presentation of the report's key findings by Zayda Manatta, Head of the Global Forum Secretariat

Revenue-statistics-africa-2020-launch-webinar

12 November 2020: the fifth edition of Revenue Statistics in Africa was released via webinar where high-level representatives from the African Tax Administration Forum (ATAF), the African Union Commission (AUC), the OECD Centre for Tax Policy and Administration, the OECD Development Centre, the European Commission, and the Ugandan Revenue Authority discussed public revenue trends in African countries and the future of domestic revenue mobilisation in Africa in the aftermath of the COVID-19 pandemic, including the impact of the African Continental Free Trade Area (AfCFTA).

The BEPS Project and Developing Countries - From Consultation to Participation

Taxation plays a central role in promoting sustainable development, and developing countries face significant challenges in developing their tax capacities and mobilising domestic resources. Engagement of developing countries in the international tax agenda, including on BEPS, is therefore important, in particular to ensure they receive appropriate support to address the specific challenges they face.

More information: www.oecd.org/tax/developing-countries-and-beps.htm

Tax Transparency - Third UN Conference on Financing for Development, Addis Ababa

A New Age of Tax Transparency: The Global Forum’s work to strengthen international tax co-operation

Regional Challenges: A view from Asia (Part 1) - OECD Global Parliamentary Ne...

Regional Challenges: A view from Asia (Part 1) - OECD Global Parliamentary Ne...OECD - Organisation for Economic Co-operation and Development

Session (Part 1) by Randall Jones, Head of Japan/Korea Desk, OECD Economics Department.

The growth of global value chains (GVCs) has increased the interconnectedness of economies. We understand that emerging economies in Southeast Asia play a pivotal role in the global economy. This session will provide you with the latest OECD analysis on the regional economy and on the key challenges it faces in light of regional integration.

International trade, which used to be a leading driver of economic growth, is now lagging behind, as world trade growth slowed down to around 2% in 2015. Two decades prior to the 2008 crisis, world trade growth annually registered at 7%. Many factors are at play – both cyclical and structural – but their effects are posing risks to the emerging and developing economies in Asia, where trade growth is currently relatively robust. Regional free trade agreements, notably the Trans-Pacific Partnership and the Regional Comprehensive Economic Partnership, will also influence trade in Asia, and will certainly have implications for the global value chains of specific industries, including in those countries not belonging to the new regional agreements. Strengthening regional ties by 2025 is one of Asia’s most important agendas. This can be made more effective by building on important and positive achievements through ASEAN, ASEAN+3 and ASEAN+6 and making greater efforts to improve co-ordination between regional and sub-regional initiatives and national agendas, reduce disparities in the region, move towards a “Global ASEAN” and strengthen monitoring capacity. Additionally, addressing issues of green growth, renewable energy and private sector development will be particularly important to Asia’s success in regional integration. Revenue Statistics in Africa: First edition

Revenue Statistics in Africa: First edition. Official launch presentation given in Addis Ababa

Recommended

BEPS - Third UN conference on financing for development Addis Ababa

Mobilising domestic resources through tackling base erosion and profit shifting (BEPS).

Tax Transparency in Latin America 2021: Punta del Este Declaration Progress R...

Presentation of the report's key findings by Zayda Manatta, Head of the Global Forum Secretariat

Revenue-statistics-africa-2020-launch-webinar

12 November 2020: the fifth edition of Revenue Statistics in Africa was released via webinar where high-level representatives from the African Tax Administration Forum (ATAF), the African Union Commission (AUC), the OECD Centre for Tax Policy and Administration, the OECD Development Centre, the European Commission, and the Ugandan Revenue Authority discussed public revenue trends in African countries and the future of domestic revenue mobilisation in Africa in the aftermath of the COVID-19 pandemic, including the impact of the African Continental Free Trade Area (AfCFTA).

The BEPS Project and Developing Countries - From Consultation to Participation

Taxation plays a central role in promoting sustainable development, and developing countries face significant challenges in developing their tax capacities and mobilising domestic resources. Engagement of developing countries in the international tax agenda, including on BEPS, is therefore important, in particular to ensure they receive appropriate support to address the specific challenges they face.

More information: www.oecd.org/tax/developing-countries-and-beps.htm

Tax Transparency - Third UN Conference on Financing for Development, Addis Ababa

A New Age of Tax Transparency: The Global Forum’s work to strengthen international tax co-operation

Regional Challenges: A view from Asia (Part 1) - OECD Global Parliamentary Ne...

Regional Challenges: A view from Asia (Part 1) - OECD Global Parliamentary Ne...OECD - Organisation for Economic Co-operation and Development

Session (Part 1) by Randall Jones, Head of Japan/Korea Desk, OECD Economics Department.

The growth of global value chains (GVCs) has increased the interconnectedness of economies. We understand that emerging economies in Southeast Asia play a pivotal role in the global economy. This session will provide you with the latest OECD analysis on the regional economy and on the key challenges it faces in light of regional integration.

International trade, which used to be a leading driver of economic growth, is now lagging behind, as world trade growth slowed down to around 2% in 2015. Two decades prior to the 2008 crisis, world trade growth annually registered at 7%. Many factors are at play – both cyclical and structural – but their effects are posing risks to the emerging and developing economies in Asia, where trade growth is currently relatively robust. Regional free trade agreements, notably the Trans-Pacific Partnership and the Regional Comprehensive Economic Partnership, will also influence trade in Asia, and will certainly have implications for the global value chains of specific industries, including in those countries not belonging to the new regional agreements. Strengthening regional ties by 2025 is one of Asia’s most important agendas. This can be made more effective by building on important and positive achievements through ASEAN, ASEAN+3 and ASEAN+6 and making greater efforts to improve co-ordination between regional and sub-regional initiatives and national agendas, reduce disparities in the region, move towards a “Global ASEAN” and strengthen monitoring capacity. Additionally, addressing issues of green growth, renewable energy and private sector development will be particularly important to Asia’s success in regional integration. Revenue Statistics in Africa: First edition

Revenue Statistics in Africa: First edition. Official launch presentation given in Addis Ababa

Inter-American Centre for Tax Administration (CIAT)

The Swiss State Secretariat of Economic Affairs (SECO) and the Inter-American Centre for Tax Administration (CIAT) have created closer ties, mainly with the purpose of strengthening the effective management of tax administrations in Latin America and the Caribbean (LAC). The cooperation program has taken it upon itself to offer support to tax administrations in order to promote the mobilization of additional tax revenues, reduce dependency on official assistance for development (ODA) and allow for a sustainable financing with an aim to diminish the poverty levels.

Strategic tax policy design in the face of the changing business environment ...

Strategic tax policy design in the face of the changing business environment ...OECD - Organisation for Economic Co-operation and Development

Session by David Bradbury, Head, Tax Policy Statistics Division, OECD Centre for Tax Policy and Administration, Meeting of the OECD Parliamentary Group on Tax, 19 Oct 2015Mobilising domestic resources through tackling base erosion and profit shift...

5th Plenary Meeting of the Task Force on Tax and Development

Tax and digitalisation - OECD Policy note

Digitalisation has a wide range of implications for taxation, impacting tax policy and tax administration at both the domestic and international level. As a result, the tax policy implications of digitalisation have been at the centre of the recent global debate over whether or not international tax rules continue to be fit for purpose in an increasingly changing environment.

International Tax Reform, Digitalization and Developing Economies

Presentation given at World Bank/IMF event on Strengthening Tax Systems in a Digitalizing World event, 2019

Revenue Statistics in Asian and Pacific Countries: An overview

Revenue Statistics in Asian and Pacific Countries, an annual series since 2014, currently has the participation of Indonesia, Japan, Kazakhstan, Korea, Malaysia, the Philippines and Singapore and will include further Asian and Pacific countries in future editions.

Dr Dev Kambhampati | Doing Business in France - 2014 Country Commercial Guide...

Dr Dev Kambhampati | Doing Business in France - 2014 Country Commercial Guide for US Companies

Financial income and wealth taxation in Italy: efficiency and equity issues

Presentation by Alessandra Sanelli - Bank of Italy

OECD Conference on wealth inequalities: Measurement and policies

Paris, 26 April 2018.

Subnational and Supranational IFIs from AIReF's perspective - José Luis Escri...

This presentation was made by José Luis Escriva, Independent Authority for Fiscal Responsibility (AIReF), at the 8th meeting of Parliamentary Budget Officials and Independent Fiscal Institutions held in Paris on 11-12 April 2016.

Economic and government policies – United Kingdom – June 25, 2016

GDP Growth

Trade

Canada and UK Trade

GDP / Sector

Debt to GDP

Deficits/Surplus

Business Taxation

Payroll Taxes

Foreign Direct Investment

Banking/Financial Services Sector

Government

The ICTD Government Revenue Dataset

The ICTD Government Revenue Dataset

Presentation made at the ICTD Annual Centre Meeting

Arusha, 2014

��������������������������������������������������������������Uganda's Tax Tr...

��������������������������������������������������������������Uganda's Tax Tr...International Centre for Tax and Development - ICTD

Uganda's Tax Treaties: A Legal and Historical Analysis

Presentation made at the ICTD Annual Centre Meeting

Arusha, 2014Summary and Analysis of the OECD's Work Program for BEPSs-2.0

The OECD's new work program would fundamentally change the way multinationals are taxed in the digital age, raising numerous questions of economic effects, compliance costs, and coordination between countries.

The four elements necessary for the OECD to be successful:

1.Identification of the scope and magnitude of the issues being addressed and how they are left unresolved by previous BEPS efforts.

2.A clear set of recommendations on both taxing rights and anti-base erosion policies that do the least amount of harm to economic growth.

3.Economic assessment of the potential impact of the policies on cross-border investment, cost of capital, foreign direct investment, compliance and administration costs, and countries’ tax revenue.

4.Commitment from countries to remove policies that conflict with the recommendations

Over the years, tax competition has led some countries to adopt more neutral, pro-growth business tax policies. This project could directly undermine that progress.

OECD Investment Policy Review of Uruguay - Key findings

OECD Investment Policy Review of Uruguay - Key findingsOECD Directorate for Financial and Enterprise Affairs

In July 2020, the Investment Committee recommended to Council to invite Uruguay to become the 50th adherent to the OECD Declaration on International Investment and Multinational Enterprises. This OECD Investment Policy Review of Uruguay documents the progress made in recent years to align investment policies with the national development strategy in pursuit of the Sustainable Development Goals (SDGs). The Review also assesses remaining challenges in improving the business climate, in particular the actions needed to establish an enabling responsible business environment and ensure full application of the Declaration. Uruguay’s success in attracting more and better investment will make its economy more resilient and better prepared to accelerate the recovery after COVID-19.

Find out more at: https://www.oecd.org/investment/oecd-investment-policy-reviews-uruguay-1135f88e-en.htmOECD Tax Talks #18 (4 March 2021)

As the COVID-19 crisis continues to affect people's lives and force governments to take action, the international tax agenda remains highly relevant. Work has continued throughout the crisis on the pressing issue of reaching a multilateral, consensus-based solution to the tax challenges arising from the digitalisation of the economy, and in other areas of the OECD's tax agenda. With a number of recent and upcoming developments in the OECD's international tax agenda, experts from the OECD Centre for Tax Policy and Administration gave an update on our work.

Topics included:

- Update on G20

- Tax and digitalisation update on Pillar One and Pillar Two

- Tax policy

- COVID-19 response – tax treaties and transfer pricing

- BEPS implementation and tax transparency

- Tax and crime

Visit our website: http://oe.cd/taxtalks

Property tax collection in dar es salaam

This is a presentation shared at the ICTD's Annual Centre Meeting

The case:

• 2008: TRA directed by Gov. to collect Property Tax (PT) on behalf of Dar es Salaam municipalities

• 2014: Gov. announced that PT-collection should be returned to municipalities

Not the first attempt to address PT challenges:

• Outsourcing of collection to private agents Purpose of the study:

• Document and analyse the experiences with this ‘experiment’ in order to inform subsequent reform efforts

• Contribute to the knowledge base on intergovernmental cooperation

Ø Ø

Ø Ø Ø

Research questions

Why was this initiative launched?

Who was driving/resisting the process?

What has been achieved

Revenue enhancement?

Capacity development of LG tax adm? New payment methods

Taxpayer relations

Policy implementation without intergovernmental cooperation?

Future tax collaboration between TRA and LGAs?

A. Agostinelli, N. Di Veroli, Addressing Measurement Challenges related to Mu...

A. Agostinelli, N. Di Veroli, Addressing Measurement Challenges related to Mu...Istituto nazionale di statistica

13° Conferenza Nazionale di Statistica 4-5-6 luglio 2018

SESSIONI PARALLELE

#FUTURO

Centro Congressi Ergife Via Aurelia 619 RomaMore Related Content

What's hot

Inter-American Centre for Tax Administration (CIAT)

The Swiss State Secretariat of Economic Affairs (SECO) and the Inter-American Centre for Tax Administration (CIAT) have created closer ties, mainly with the purpose of strengthening the effective management of tax administrations in Latin America and the Caribbean (LAC). The cooperation program has taken it upon itself to offer support to tax administrations in order to promote the mobilization of additional tax revenues, reduce dependency on official assistance for development (ODA) and allow for a sustainable financing with an aim to diminish the poverty levels.

Strategic tax policy design in the face of the changing business environment ...

Strategic tax policy design in the face of the changing business environment ...OECD - Organisation for Economic Co-operation and Development

Session by David Bradbury, Head, Tax Policy Statistics Division, OECD Centre for Tax Policy and Administration, Meeting of the OECD Parliamentary Group on Tax, 19 Oct 2015Mobilising domestic resources through tackling base erosion and profit shift...

5th Plenary Meeting of the Task Force on Tax and Development

Tax and digitalisation - OECD Policy note

Digitalisation has a wide range of implications for taxation, impacting tax policy and tax administration at both the domestic and international level. As a result, the tax policy implications of digitalisation have been at the centre of the recent global debate over whether or not international tax rules continue to be fit for purpose in an increasingly changing environment.

International Tax Reform, Digitalization and Developing Economies

Presentation given at World Bank/IMF event on Strengthening Tax Systems in a Digitalizing World event, 2019

Revenue Statistics in Asian and Pacific Countries: An overview

Revenue Statistics in Asian and Pacific Countries, an annual series since 2014, currently has the participation of Indonesia, Japan, Kazakhstan, Korea, Malaysia, the Philippines and Singapore and will include further Asian and Pacific countries in future editions.

Dr Dev Kambhampati | Doing Business in France - 2014 Country Commercial Guide...

Dr Dev Kambhampati | Doing Business in France - 2014 Country Commercial Guide for US Companies

Financial income and wealth taxation in Italy: efficiency and equity issues

Presentation by Alessandra Sanelli - Bank of Italy

OECD Conference on wealth inequalities: Measurement and policies

Paris, 26 April 2018.

Subnational and Supranational IFIs from AIReF's perspective - José Luis Escri...

This presentation was made by José Luis Escriva, Independent Authority for Fiscal Responsibility (AIReF), at the 8th meeting of Parliamentary Budget Officials and Independent Fiscal Institutions held in Paris on 11-12 April 2016.

Economic and government policies – United Kingdom – June 25, 2016

GDP Growth

Trade

Canada and UK Trade

GDP / Sector

Debt to GDP

Deficits/Surplus

Business Taxation

Payroll Taxes

Foreign Direct Investment

Banking/Financial Services Sector

Government

The ICTD Government Revenue Dataset

The ICTD Government Revenue Dataset

Presentation made at the ICTD Annual Centre Meeting

Arusha, 2014

��������������������������������������������������������������Uganda's Tax Tr...

��������������������������������������������������������������Uganda's Tax Tr...International Centre for Tax and Development - ICTD

Uganda's Tax Treaties: A Legal and Historical Analysis

Presentation made at the ICTD Annual Centre Meeting

Arusha, 2014Summary and Analysis of the OECD's Work Program for BEPSs-2.0

The OECD's new work program would fundamentally change the way multinationals are taxed in the digital age, raising numerous questions of economic effects, compliance costs, and coordination between countries.

The four elements necessary for the OECD to be successful:

1.Identification of the scope and magnitude of the issues being addressed and how they are left unresolved by previous BEPS efforts.

2.A clear set of recommendations on both taxing rights and anti-base erosion policies that do the least amount of harm to economic growth.

3.Economic assessment of the potential impact of the policies on cross-border investment, cost of capital, foreign direct investment, compliance and administration costs, and countries’ tax revenue.

4.Commitment from countries to remove policies that conflict with the recommendations

Over the years, tax competition has led some countries to adopt more neutral, pro-growth business tax policies. This project could directly undermine that progress.

OECD Investment Policy Review of Uruguay - Key findings

OECD Investment Policy Review of Uruguay - Key findingsOECD Directorate for Financial and Enterprise Affairs

In July 2020, the Investment Committee recommended to Council to invite Uruguay to become the 50th adherent to the OECD Declaration on International Investment and Multinational Enterprises. This OECD Investment Policy Review of Uruguay documents the progress made in recent years to align investment policies with the national development strategy in pursuit of the Sustainable Development Goals (SDGs). The Review also assesses remaining challenges in improving the business climate, in particular the actions needed to establish an enabling responsible business environment and ensure full application of the Declaration. Uruguay’s success in attracting more and better investment will make its economy more resilient and better prepared to accelerate the recovery after COVID-19.

Find out more at: https://www.oecd.org/investment/oecd-investment-policy-reviews-uruguay-1135f88e-en.htmOECD Tax Talks #18 (4 March 2021)

As the COVID-19 crisis continues to affect people's lives and force governments to take action, the international tax agenda remains highly relevant. Work has continued throughout the crisis on the pressing issue of reaching a multilateral, consensus-based solution to the tax challenges arising from the digitalisation of the economy, and in other areas of the OECD's tax agenda. With a number of recent and upcoming developments in the OECD's international tax agenda, experts from the OECD Centre for Tax Policy and Administration gave an update on our work.

Topics included:

- Update on G20

- Tax and digitalisation update on Pillar One and Pillar Two

- Tax policy

- COVID-19 response – tax treaties and transfer pricing

- BEPS implementation and tax transparency

- Tax and crime

Visit our website: http://oe.cd/taxtalks

Property tax collection in dar es salaam

This is a presentation shared at the ICTD's Annual Centre Meeting

The case:

• 2008: TRA directed by Gov. to collect Property Tax (PT) on behalf of Dar es Salaam municipalities

• 2014: Gov. announced that PT-collection should be returned to municipalities

Not the first attempt to address PT challenges:

• Outsourcing of collection to private agents Purpose of the study:

• Document and analyse the experiences with this ‘experiment’ in order to inform subsequent reform efforts

• Contribute to the knowledge base on intergovernmental cooperation

Ø Ø

Ø Ø Ø

Research questions

Why was this initiative launched?

Who was driving/resisting the process?

What has been achieved

Revenue enhancement?

Capacity development of LG tax adm? New payment methods

Taxpayer relations

Policy implementation without intergovernmental cooperation?

Future tax collaboration between TRA and LGAs?

A. Agostinelli, N. Di Veroli, Addressing Measurement Challenges related to Mu...

A. Agostinelli, N. Di Veroli, Addressing Measurement Challenges related to Mu...Istituto nazionale di statistica

13° Conferenza Nazionale di Statistica 4-5-6 luglio 2018

SESSIONI PARALLELE

#FUTURO

Centro Congressi Ergife Via Aurelia 619 RomaWhat's hot (20)

Inter-American Centre for Tax Administration (CIAT)

Inter-American Centre for Tax Administration (CIAT)

Strategic tax policy design in the face of the changing business environment ...

Strategic tax policy design in the face of the changing business environment ...

Taxation and investment in Colombia_OECD Economics Department Working Paper_N...

Taxation and investment in Colombia_OECD Economics Department Working Paper_N...

Mobilising domestic resources through tackling base erosion and profit shift...

Mobilising domestic resources through tackling base erosion and profit shift...

International Tax Reform, Digitalization and Developing Economies

International Tax Reform, Digitalization and Developing Economies

Revenue Statistics in Asian and Pacific Countries: An overview

Revenue Statistics in Asian and Pacific Countries: An overview

Dr Dev Kambhampati | Doing Business in France - 2014 Country Commercial Guide...

Dr Dev Kambhampati | Doing Business in France - 2014 Country Commercial Guide...

Financial income and wealth taxation in Italy: efficiency and equity issues

Financial income and wealth taxation in Italy: efficiency and equity issues

Subnational and Supranational IFIs from AIReF's perspective - José Luis Escri...

Subnational and Supranational IFIs from AIReF's perspective - José Luis Escri...

Economic and government policies – United Kingdom – June 25, 2016

Economic and government policies – United Kingdom – June 25, 2016

��������������������������������������������������������������Uganda's Tax Tr...

��������������������������������������������������������������Uganda's Tax Tr...

Summary and Analysis of the OECD's Work Program for BEPSs-2.0

Summary and Analysis of the OECD's Work Program for BEPSs-2.0

OECD Investment Policy Review of Uruguay - Key findings

OECD Investment Policy Review of Uruguay - Key findings

A. Agostinelli, N. Di Veroli, Addressing Measurement Challenges related to Mu...

A. Agostinelli, N. Di Veroli, Addressing Measurement Challenges related to Mu...

Similar to Building Stronger Tax Systems - Third UN Conference on Financing for Development, Addis Ababa

Developing Capacity in Transfer Pricing

In partnership with the European Commission and World Bank Group, the Task Force on Tax and Development has developed a highly successful Transfer Pricing assistance programme in developing countries.

Tax Inspectors Without Borders - Third UN Conference on Financing for Fevelop...

Tax Inspectors Without Borders (TIWB) is an OECD-UNDP partnership to tackle domestic resource mobilisation with a practical hands-on approach

Base Erosion and Profit Shifting

On 19 July 2013, OECD presented a 15 point plan to the G20 on BEPS. This article summarizes its key messages.

Wealth inequalities: measurement and policies

Presentation by: David Bradbury (OECD, Head, Tax Policy and Statistics Division)

OECD Conference on wealth inequalities: Measurement and policies

Paris, 26 April 2018.

Corporate Tax Statistics, Fourth Edition

Corporate Tax Statistics is an OECD flagship publication on corporate income Tax, and includes information on corporate taxation, MNE activity, and base erosion and profit shifting (BEPS) practices.

Addressing international corporate tax evasion an analysis of the oecd acti...

This presentation aims to describe the issue around the international tax standards which are not adapted to the ongoing changes in the economy, creating loopholes and opportunities for base erosion and profit shifting. Such issue is currently being tackled and is taking place in a context where the OECD established the BEPS action plan.

This work is based around the following research question: Is the BEPS initiative an appropriate approach to harmonize the international tax system and consequently reduce base erosion and profit shifting?

Director: Professor Jean-Pierre De Laet

Assessor and jury president: Professor Pascal Minne

Etude PwC/Banque mondiale "Paying taxes 2014"

http://pwc.to/1fReiKb

Paying Taxes 2014 évalue les impôts et cotisations annuels obligatoires des petites et moyennes entreprises, sur la base d’une « société type » décrite page 140 de l’étude. Les impôts et cotisations évalués comprennent l’imposition des bénéfices, les cotisations et les charges sociales supportées par l'employeur, la taxe foncière, l'impôt sur la transmission du patrimoine, l'imposition des dividendes, l'impôt sur les plus-values, la taxe sur les transactions financières et les taxes sur la collecte des déchets, les taxes sur les véhicules et de circulation routière et d’autres droits et taxes accessoires.

Pour plus d'informations sur l'étude Paying Taxes rendez-vous sur : www.pwc.com/payingtaxes.

World Wide Tax News - Issue 37

The latest issue of newsletter BDO World Wide Tax News, which summarises recent tax developments of international

interest across the world.

OECD Tax Talks #12 - 11 June 2019

With a number of recent and upcoming developments in the OECD’s international tax work, we invite you to join a live webcast with experts from the Centre for Tax Policy and Administration for an update on the work relating to the tax challenges arising from the digitalisation of the economy.

Website: http://oe.cd/taxtalks

Tax Transparency in Latin America 2022

Presentation of the report's key findings by Zayda Manatta, Head of the Global Forum Secretariat

Getting to grips with the BEPS Action Plan

Tax management within multinational enterprises (MNEs) has never been more challenging. 'Getting to grips with the BEPS Action Plan' is the latest Grant Thornton report exploring the OECD’s planned overhaul of the international tax system, what it means for businesses and how they can prepare.

Similar to Building Stronger Tax Systems - Third UN Conference on Financing for Development, Addis Ababa (20)

Submission to the International Monetary Fund's Consultation on Economic "Spi...

Submission to the International Monetary Fund's Consultation on Economic "Spi...

Tax Inspectors Without Borders - Third UN Conference on Financing for Fevelop...

Tax Inspectors Without Borders - Third UN Conference on Financing for Fevelop...

Addressing international corporate tax evasion an analysis of the oecd acti...

Addressing international corporate tax evasion an analysis of the oecd acti...

Tax design for inclusive economic growth_OECD Taxation Working Papers No. 26

Tax design for inclusive economic growth_OECD Taxation Working Papers No. 26

Hidden Profits: The EU's role in supporting an unjust global tax system 2014

Hidden Profits: The EU's role in supporting an unjust global tax system 2014

More from OECDtax

Convention multilatérale pour la mise en œuvre des mesures relatives aux conv...

Cet instrument transposera les résultats du Projet sur l'érosion de la base d'imposition et le transfert de bénéfices (BEPS) dans plus de 2 000 conventions fiscales à l'échelle mondiale.

Multilateral instrument for BEPS tax treaty measures - Overview

The Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS will implement minimum standards to counter treaty abuse and to improve dispute resolution mechanisms while providing flexibility to accommodate specific tax treaty policies. It will also allow governments to strengthen their tax treaties with other tax treaty measures developed in the OECD/G20 BEPS Project.

Version January 2023.

Learn more about the BEPS MLI: https://oe.cd/mli

Presentation: Economic impact assessment of the Two-Pillar Solution (January ...

The OECD provided an update on its ongoing work to assess the economic impact of the Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy, including new estimates of the revenue impacts of implementing Pillar One and Pillar Two. These estimates are based on updated data and incorporate many recently agreed design features of Pillar One and Pillar Two, many of which have not been accounted for in other studies.

Transparencia Fiscal en América Latina 2022

Presentación de las principales conclusiones y puntos clave del informe, Zayda Manatta, Jefa de la Secretaría del Foro Global.

Fiscal sustainability and healthcare

Interim Meeting of the Network on Fiscal Relations Across Levels of Government November 2021

Will health spending and revenues be sustainable in the long-term?

Interim Meeting of the Network on Fiscal Relations Across Levels of Government November 2021

The Latest Progress of China’s Property Tax Reform

Interim Meeting of the Network on Fiscal Relations Across Levels of Government November 2021

Housing Policy and Fiscal Tools

Interim Meeting of the Network on Fiscal Relations Across Levels of Government November 2021

OECD Regional Recovery Platform

Interim Meeting of the Network on Fiscal Relations Across Levels of Government November 2021

How do you assess your country’s response during the crisis?

Interim Meeting of the Network on Fiscal Relations Across Levels of Government November 2021

Intergovernmental relations and the covid-19 crisis: early lessons

Interim Meeting of the Network on Fiscal Relations Across Levels of Government November 2021

Transparencia Fiscal en América Latina 2021: Informe de Progreso de la Declar...

Presentación de las principales conclusiones y puntos clave del informe, Zayda Manatta, Jefa de la Secretaría del Foro Global.

Transparence fiscale en Afrique 2021 : Rapport de progrès de l'Initiative Afr...

Présentation des principales conclusions par Zayda Manatta, Cheffe du Secrétariat du Forum mondial, 26 mai 2021

Tax Transparency in Africa 2021: Africa Initiative Progress Report

Presentation of the report's key findings by Zayda Manatta, Head of the Global Forum Secretariat, 26 May 2021

Independent oversight bodies lessons from fiscal productivity and regulatory ...

OECD Fiscal Network, annual meeting 2018

Item viiib-funding-devolved-government-in-the-uk-scotland-2020

OECD Network on Fiscal Relations across Levels of Government, 16th Annual Meeting, 3-4 December 2020 – Virtual Meeting

Item viiia-investments-in-local-and-regional-sector-in-finland-2020

OECD Network on Fiscal Relations across Levels of Government, 16th Annual Meeting, 3-4 December 2020 – Virtual Meeting

Item viib-global-ratings-view-on-global-lrg-indebtedness-2020

OECD Network on Fiscal Relations across Levels of Government, 16th Annual Meeting, 3-4 December 2020 – Virtual Meeting

Item viia-funding-and-financing-of-local-government-public-investment-2020

OECD Network on Fiscal Relations across Levels of Government, 16th Annual Meeting, 3-4 December 2020 – Virtual Meeting

Item vib-discussion-of-rising-subnational-debt-and-the-role-of-subnational-fi...

OECD Network on Fiscal Relations across Levels of Government, 16th Annual Meeting, 3-4 December 2020 – Virtual Meeting

More from OECDtax (20)

Convention multilatérale pour la mise en œuvre des mesures relatives aux conv...

Convention multilatérale pour la mise en œuvre des mesures relatives aux conv...

Multilateral instrument for BEPS tax treaty measures - Overview

Multilateral instrument for BEPS tax treaty measures - Overview

Presentation: Economic impact assessment of the Two-Pillar Solution (January ...

Presentation: Economic impact assessment of the Two-Pillar Solution (January ...

Will health spending and revenues be sustainable in the long-term?

Will health spending and revenues be sustainable in the long-term?

The Latest Progress of China’s Property Tax Reform

The Latest Progress of China’s Property Tax Reform

How do you assess your country’s response during the crisis?

How do you assess your country’s response during the crisis?

Intergovernmental relations and the covid-19 crisis: early lessons

Intergovernmental relations and the covid-19 crisis: early lessons

Transparencia Fiscal en América Latina 2021: Informe de Progreso de la Declar...

Transparencia Fiscal en América Latina 2021: Informe de Progreso de la Declar...

Transparence fiscale en Afrique 2021 : Rapport de progrès de l'Initiative Afr...

Transparence fiscale en Afrique 2021 : Rapport de progrès de l'Initiative Afr...

Tax Transparency in Africa 2021: Africa Initiative Progress Report

Tax Transparency in Africa 2021: Africa Initiative Progress Report

Independent oversight bodies lessons from fiscal productivity and regulatory ...

Independent oversight bodies lessons from fiscal productivity and regulatory ...

Item viiib-funding-devolved-government-in-the-uk-scotland-2020

Item viiib-funding-devolved-government-in-the-uk-scotland-2020

Item viiia-investments-in-local-and-regional-sector-in-finland-2020

Item viiia-investments-in-local-and-regional-sector-in-finland-2020

Item viib-global-ratings-view-on-global-lrg-indebtedness-2020

Item viib-global-ratings-view-on-global-lrg-indebtedness-2020

Item viia-funding-and-financing-of-local-government-public-investment-2020

Item viia-funding-and-financing-of-local-government-public-investment-2020

Item vib-discussion-of-rising-subnational-debt-and-the-role-of-subnational-fi...

Item vib-discussion-of-rising-subnational-debt-and-the-role-of-subnational-fi...

Recently uploaded

The Role of a Process Server in real estate

A process server is a authorized person for delivering legal documents, such as summons, complaints, subpoenas, and other court papers, to peoples involved in legal proceedings.

Understanding the Challenges of Street Children

By raising awareness, providing support, advocating for change, and offering assistance to children in need, individuals can play a crucial role in improving the lives of street children and helping them realize their full potential

Donate Us

https://serudsindia.org/how-individuals-can-support-street-children-in-india/

#donatefororphan, #donateforhomelesschildren, #childeducation, #ngochildeducation, #donateforeducation, #donationforchildeducation, #sponsorforpoorchild, #sponsororphanage #sponsororphanchild, #donation, #education, #charity, #educationforchild, #seruds, #kurnool, #joyhome

Effects of Extreme Temperatures From Climate Change on the Medicare Populatio...

Effects of Extreme Temperatures From Climate Change on the Medicare Populatio...Congressional Budget Office

Presentation by Jared Jageler, David Adler, Noelia Duchovny, and Evan Herrnstadt, analysts in CBO’s Microeconomic Studies and Health Analysis Divisions, at the Association of Environmental and Resource Economists Summer Conference.一比一原版(WSU毕业证)西悉尼大学毕业证成绩单

WSU毕业证【微信95270640】《西悉尼大学毕业证书》《QQ微信95270640》学位证书电子版:在线制作西悉尼大学毕业证成绩单GPA修改(制作WSU毕业证成绩单WSU文凭证书样本)、西悉尼大学毕业证书与成绩单样本图片、《WSU学历证书学位证书》、西悉尼大学毕业证案例毕业证书制作軟體、在线制作加拿大硕士学历证书真实可查.

[留学文凭学历认证(留信认证使馆认证)西悉尼大学毕业证成绩单毕业证证书大学Offer请假条成绩单语言证书国际回国人员证明高仿教育部认证申请学校等一切高仿或者真实可查认证服务。

多年留学服务公司,拥有海外样板无数能完美1:1还原海外各国大学degreeDiplomaTranscripts等毕业材料。海外大学毕业材料都有哪些工艺呢?工艺难度主要由:烫金.钢印.底纹.水印.防伪光标.热敏防伪等等组成。而且我们每天都在更新海外文凭的样板以求所有同学都能享受到完美的品质服务。

国外毕业证学位证成绩单办理方法:

1客户提供办理西悉尼大学西悉尼大学毕业证假文凭信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)

— — — — 我们是挂科和未毕业同学们的福音我们是实体公司精益求精的工艺! — — — -

一真实留信认证的作用(私企外企荣誉的见证):

1:该专业认证可证明留学生真实留学身份同时对留学生所学专业等级给予评定。

2:国家专业人才认证中心颁发入库证书这个入网证书并且可以归档到地方。

3:凡是获得留信网入网的信息将会逐步更新到个人身份内将在公安部网内查询个人身份证信息后同步读取人才网入库信息。

4:个人职称评审加20分个人信誉贷款加10分。

5:在国家人才网主办的全国网络招聘大会中纳入资料供国家500强等高端企业选择人才。碌爬起把牛驱到后龙山再从莲塘里采回一蛇皮袋湿漉漉的莲蓬也才点多点半早就吃过早餐玩耍去了山娃的家在闽西山区依山傍水山清水秀门前潺潺流淌的蜿蜒小溪一直都是山娃和小伙伴们盛夏的天然泳场水不深碎石底石缝里总有摸不尽的鱼虾活蹦乱跳的还有乌龟和王八贼头贼脑的倒也逗人喜爱日上三竿时山娃总爱窜进自家瓜棚里跟小伙伴们坐着聊天聊着聊着便忍不住往瓜田里逡巡一番抱起一只硕大的西瓜用石刀劈开抑或用拳头砸开每人抱起一大块就之

2024: The FAR - Federal Acquisition Regulations, Part 37

Jennifer Schaus and Associates hosts a complimentary webinar series on The FAR in 2024. Join the webinars on Wednesdays and Fridays at noon, eastern.

Recordings are on YouTube and the company website.

https://www.youtube.com/@jenniferschaus/videos

2024: The FAR - Federal Acquisition Regulations, Part 36

Jennifer Schaus and Associates hosts a complimentary webinar series on The FAR in 2024. Join the webinars on Wednesdays and Fridays at noon, eastern.

Recordings are on YouTube and the company website.

https://www.youtube.com/@jenniferschaus/videos

如何办理(uoit毕业证书)加拿大安大略理工大学毕业证文凭证书录取通知原版一模一样

原版纸张【微信:741003700 】【(uoit毕业证书)加拿大安大略理工大学毕业证】【微信:741003700 】学位证,留信认证(真实可查,永久存档)offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原海外各大学 Bachelor Diploma degree, Master Degree Diploma

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

快速制作(ocad毕业证书)加拿大安大略艺术设计学院毕业证本科学历雅思成绩单原版一模一样

原版纸张【微信:741003700 】【(ocad毕业证书)加拿大安大略艺术设计学院毕业证】【微信:741003700 】学位证,留信认证(真实可查,永久存档)offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原海外各大学 Bachelor Diploma degree, Master Degree Diploma

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Up the Ratios Bylaws - a Comprehensive Process of Our Organization

Up the Ratios is a non-profit organization dedicated to bridging the gap in STEM education for underprivileged students by providing free, high-quality learning opportunities in robotics and other STEM fields. Our mission is to empower the next generation of innovators, thinkers, and problem-solvers by offering a range of educational programs that foster curiosity, creativity, and critical thinking.

At Up the Ratios, we believe that every student, regardless of their socio-economic background, should have access to the tools and knowledge needed to succeed in today's technology-driven world. To achieve this, we host a variety of free classes, workshops, summer camps, and live lectures tailored to students from underserved communities. Our programs are designed to be engaging and hands-on, allowing students to explore the exciting world of robotics and STEM through practical, real-world applications.

Our free classes cover fundamental concepts in robotics, coding, and engineering, providing students with a strong foundation in these critical areas. Through our interactive workshops, students can dive deeper into specific topics, working on projects that challenge them to apply what they've learned and think creatively. Our summer camps offer an immersive experience where students can collaborate on larger projects, develop their teamwork skills, and gain confidence in their abilities.

In addition to our local programs, Up the Ratios is committed to making a global impact. We take donations of new and gently used robotics parts, which we then distribute to students and educational institutions in other countries. These donations help ensure that young learners worldwide have the resources they need to explore and excel in STEM fields. By supporting education in this way, we aim to nurture a global community of future leaders and innovators.

Our live lectures feature guest speakers from various STEM disciplines, including engineers, scientists, and industry professionals who share their knowledge and experiences with our students. These lectures provide valuable insights into potential career paths and inspire students to pursue their passions in STEM.

Up the Ratios relies on the generosity of donors and volunteers to continue our work. Contributions of time, expertise, and financial support are crucial to sustaining our programs and expanding our reach. Whether you're an individual passionate about education, a professional in the STEM field, or a company looking to give back to the community, there are many ways to get involved and make a difference.

We are proud of the positive impact we've had on the lives of countless students, many of whom have gone on to pursue higher education and careers in STEM. By providing these young minds with the tools and opportunities they need to succeed, we are not only changing their futures but also contributing to the advancement of technology and innovation on a broader scale.

Counting Class for Micro Observers 2024.pptx

Duties of Micro Observers during election counting to Parliament / Assembly Constituency

ZGB - The Role of Generative AI in Government transformation.pdf

This keynote was presented during the the 7th edition of the UAE Hackathon 2024. It highlights the role of AI and Generative AI in addressing government transformation to achieve zero government bureaucracy

一比一原版(UOW毕业证)伍伦贡大学毕业证成绩单

UOW毕业证【微信95270640】留学办理UOW文凭伍伦贡大学毕业证【Q微信95270640】办理全套留学文凭材料(伍伦贡大学毕业证/成绩单(GPA成绩修改)/UOW文凭学历证书);(真实可查)教育部学历认证、留信网认证、使馆认证留学人员回国证明、文凭认证、UOW diploma、UOW certificate、UOW Degree(实体公司,专业可靠)。

文凭办理流程:

1客户提供办理信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:微信95270640我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)。

7完成交易删除客户资料

高精端提供以下服务:

一:伍伦贡大学伍伦贡大学本科学位证成绩单全套材料从防伪到印刷水印底纹到钢印烫金

二:真实使馆认证(留学人员回国证明)使馆存档

三:真实教育部认证教育部存档教育部留服网站可查

四:留信认证留学生信息网站可查

五:与学校颁发的相关证件1:1纸质尺寸制定(定期向各大院校毕业生购买最新版本毕,业证成绩单保证您拿到的是鲁昂大学内部最新版本毕业证成绩单微信95270640)

A.为什么留学生需要操作留信认证?

留信认证全称全国留学生信息服务网认证,隶属于北京中科院。①留信认证门槛条件更低,费用更美丽,并且包过,完单周期短,效率高②留信认证虽然不能去国企,但是一般的公司都没有问题,因为国内很多公司连基本的留学生学历认证都不了解。这对于留学生来说,这就比自己光拿一个证书更有说服力,因为留学学历可以在留信网站上进行查询!

B.为什么我们提供的毕业证成绩单具有使用价值?

查询留服认证是国内鉴别留学生海外学历的唯一途径但认证只是个体行为不是所有留学生都操作所以没有办理认证的留学生的学历在国内也是查询不到的他们也仅仅只有一张文凭。所以这时候我们提供的和学校颁发的一模一样的毕业证成绩单就有了使用价值。着冒着层层蒸气的包子铺打转你争我抢的吵闹确是为这清淡的早晨增添了一副滑稽与乐趣伴着淡淡的心情褪下往日的繁忙在这残酷的世界中寻一份恬静适淡得一份娴静祥和实乃众心所愿可虽是心有此愿可奈何人生由不得远离尘世喧嚣盛夏初放安然树林乡间多为古代文人雅士吟诗作词之处茂盛的树林遮挡住清晨后炎炎烈日的光芒幽静曲折的小道在山间盘旋几缕从盘杂枝叶间透进的光柱照射在地上茂密的绿油清草上散发着一抹抹的光晕而这每处自然形成头

一比一原版(Adelaide毕业证)阿德莱德大学毕业证成绩单

Adelaide毕业证【微信95270640】国外文凭购买阿德莱德大学留信认证毕业证书印刷品《Q微信95270640》学历认证怎么做:原版仿制阿德莱德大学电子版成绩单毕业证认证《阿德莱德大学毕业证成绩单》、阿德莱德大学文凭证书成绩单复刻offer录取通知书、购买Adelaide圣力嘉学院本科毕业证、《阿德莱德大学毕业证办理Adelaide毕业证书哪里买》、阿德莱德大学 Offer在线办理Adelaide Offer阿德莱德大学Bachloer Degree。

【实体公司】办阿德莱德大学阿德莱德大学硕士学位证成绩单学历认证学位证文凭认证办留信网认证办留服认证办教育部认证(网上可查实体公司专业可靠)

— — — 留学归国服务中心 — — -

【主营项目】

一.阿德莱德大学毕业证成绩单使馆认证教育部认证成绩单等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

国外毕业证学位证成绩单办理流程:

1客户提供阿德莱德大学阿德莱德大学硕士学位证成绩单办理信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)。

专业服务请勿犹豫联系我!本公司是留学创业和海归创业者们的桥梁。一次办理终生受用一步到位高效服务。详情请在线咨询办理,欢迎有诚意办理的客户咨询!洽谈。

招聘代理:本公司诚聘英国加拿大澳洲新西兰美国法国德国新加坡各地代理人员如果你有业余时间有兴趣就请联系我们咨询顾问:+微信:95270640光总是太短太匆忙记得今年正月就在父亲扛起蛇皮袋将要跨出门槛的一刹那山娃突然抱紧父亲的大腿嚎啕大哭父亲吃力地掰开山娃的手哽咽道山娃好好听话好好念书到了暑假爸也接你进城爸的城好远好大好美山娃于是天天扳着手指算计着读书也格外刻苦无奈时间总过得太慢太慢每次父亲往家打电话山娃总抢着接听一个劲地提醒父亲别忘了正月说的话电话那头总会传来父亲嘿嘿的笑连连说记得记得但别忘了拿奖状进城啊考试一结束山娃就迫不及待地给间

Recently uploaded (20)

PD-1602-as-amended-by-RA-9287-Anti-Illegal-Gambling-Law.pptx

PD-1602-as-amended-by-RA-9287-Anti-Illegal-Gambling-Law.pptx

Effects of Extreme Temperatures From Climate Change on the Medicare Populatio...

Effects of Extreme Temperatures From Climate Change on the Medicare Populatio...

2024: The FAR - Federal Acquisition Regulations, Part 37

2024: The FAR - Federal Acquisition Regulations, Part 37

2024: The FAR - Federal Acquisition Regulations, Part 36

2024: The FAR - Federal Acquisition Regulations, Part 36

Up the Ratios Bylaws - a Comprehensive Process of Our Organization

Up the Ratios Bylaws - a Comprehensive Process of Our Organization

ZGB - The Role of Generative AI in Government transformation.pdf

ZGB - The Role of Generative AI in Government transformation.pdf

MHM Roundtable Slide Deck WHA Side-event May 28 2024.pptx

MHM Roundtable Slide Deck WHA Side-event May 28 2024.pptx

Building Stronger Tax Systems - Third UN Conference on Financing for Development, Addis Ababa

- 1. 1. Building comparable data The OECD works with countries and regional partners to build a strong knowledge platform for good tax policy through our Global Revenue Statistics Programme. It also develops targeted analysis on specific tax policy issues, such as the taxation of SMEs or the extractives sector. (See www.oecd.org/tax/tax-policy ) Already 20 countries from Latin America and the Caribbean, 8 from Africa, and 3 from Asia and the 34 OECD members have joined the Global Revenue Statistics Programme to date. 2. Curbing tax evasion and illicit financial flows The OECD develops tools like the new common global Standard on Automatic Exchange of Information to support governments in the fight against tax evasion. (See www.oecd.org/tax/ exchange-of-tax-information/automaticexchange.htm) The 126-member Global Forum on Transparency and Exchange of Information for Tax Purposes champions greater tax transparency and a level playing field through an in-depth peer review monitoring process. (See www.oecd.org/tax/transparency/) The Oslo Dialogue promotes a whole of government approach to fighting tax crime and other financial crimes. The OECD’s International Academy for Tax Crime Investigation offers intensive programmes to train investigators, prosecutors, judges and other officials from across the world in the latest investigative techniques and to share best practices. (See www.oecd.org/ctp/crime/ tax-crime-academy.htm) Third International Conference on Financing for Development Addis Ababa • July 2015 OECD work to build stronger sustainable tax systems Tax revenue establishes a sustainable foundation for development, fostering accountability of the state towards its citizens and providing the means to address inequalities. Tax revenue pays for roads, ports, hospitals and schools which enable countries to develop. The OECD stands ready to support the international community in four critical areas to improve the enabling environment for countries to collect taxes fairly and effectively: 1. Building comparable data 2. Curbing tax evasion and illicit financial flows 3. Tackling tax avoidance 4. Developing capacity In 2013, South Africa collected USD 62.2 million through one settlement based on information obtained through the exchange of information process.1 AvAilAble on line/disponible en ligne RevenueStatistics1965-2013 Statistiquesdesrecettespubliques1965-2013 2014 Revenue Statistics SPECIAL FEATURE: TREndS In TAx REvEnUES FoLLowIng ThE CRISIS 1965-2013 data on government sector receipts, and on taxes in particular, are basic inputs to most structural economic descriptions and economic analyses and are increasingly used in international comparisons. This annual publication presents a unique set of detailed and internationally comparable tax data in a common format for all oeCd countries from 1965 onwards. it also gives a conceptual framework to define which government receipts should be regarded as taxes and to classify different types of taxes. ALSo AvAILAbLE on Cd-Rom And on LInE The data in this publication are also available on line via www.oecd-ilibrary.org under the title OECD Tax Statistics (http://dx.doi.org/10.1787/tax-data-en). An offline edition of the database, providing data in Csv format is available on Cd-RoM under the title OECD Tax Statistics 2014, Volume I, Revenue Statistics. Statistiques des recettes publiques ÉTUDE SPÉCIALE : TENDANCES DE L’ÉVOLUTION DES RECETTES FISCALES APRÈS LA CRISE 1965-2013 Les données sur les recettes des administrations publiques, et sur le produit de la fiscalité en particulier, constituent la base de la plupart des travaux de description des structures économiques et d’analyse économique, et sont de plus en plus utilisées pour les comparaisons internationales. Cette publication annuelle présente un ensemble unique de statistiques fiscales détaillées et comparables au niveau international, utilisant une présentation identique pour tous les pays de l’OCDE depuis 1965. Elle constitue également un cadre conceptuel dont le but est de définir les recettes publiques devant être assimilées à des impôts et de classifier les différentes catégories d’impôts. ÉgALEmEnT dISPonIbLE En LIgnE ET SUR Cd-Rom Cette publication est également disponible sous forme de base de données en ligne via www.oecd-ilibrary.org sous le titre statistiques fiscales de l’oCde (http://dx.doi.org/10.1787/tax-data-fr). La base de données existe aussi en version CD-ROM sous le titre statistiques fiscales de l’oCde 2014, volume i, statistiques des recettes publiques. Les données sont fournies en format CSV. 2014 Revenue Statistics 1965-2013 Statistiques des recettes publiques 1965-2013 2014 ISSn 1560-3660 ISbn 978-92-64-22088-1 23 2014 34 3 P 9HSTCQE*ccaiib+ Consult this publication on line at http://dx.doi.org/10.1787/rev_stats-2014-en-fr: This work is published on the oeCd ilibrary, which gathers all oeCd books, periodicals and statistical databases.visit www.oecd-ilibrary.org for more information. veuillez consulter cet ouvrage en ligne : http://dx.doi.org/10.1787/rev_stats-2014-en-fr: Cet ouvrage est publié sur oeCd ilibrary, la bibliothèque en ligne de l’oCde, qui regroupe tous les livres, périodiques et bases de données statistiques de l’organisation. Rendez-vous sur le site www.oecd-ilibrary.org pour plus d’informations. 1. OECD (2014), “Tax Transparency 2014: Report on Progress”,www.oecd.org/tax/transparency/GFannualreport2014.pdf, accessed 20 May 2015.

- 2. For more information please contact: TaxandDevelopment@oecd.org 3. Tackling tax avoidance The OECD works with G20 and developing countries to reform the international tax rules through the Base Erosion and Profit Shifting (BEPS) Project, and works to identify and address the most pressing BEPS-related issues for low-income countries, such as tax incentives. BEPS refers to tax planning strategies that exploit gaps and mismatches in tax rules to artificially shift profits to locations where there is little or no economic activity or value creation. BEPS is of major significance for developing countries due to their heavy reliance on corporate income tax revenues. Fourteen developing countries participate directly in the decision-making and technical bodies of the BEPS Project, and more than 80 additional developing countries are engaged in 5 regional networks to develop tools to counter BEPS. (See www.oecd.org/tax/beps.htm) 4. Developing capacity The OECD gathers evidence and offers guidance for development co-operation agencies on how to provide more and better support to country-led domestic resource mobilisation efforts, like tax administration and policy reforms, taxpayer education and tax morale. (See www.oecd.org/tax/tax- global/taxanddevelopment.htm) The OECD also undertakes bilateral and multilateral projects in partnership with other international and regional organisations and developing countries to address their highest priority tax issues by building capacity, with initiatives like Tax Inspectors Without Borders. (See www. oecd.org/tax/taxinspectors.htm) Zambia is losing USD 2 billion annually to tax avoidance, the country’s mining industry being the biggest culprit.2 In Burundi one company contributes nearly 20% of total tax collected.3 2. Matthew Hill (2012),” Zambia tax avoidance costs US$2 billion a year”, Bloomberg News. 3. The North-South Institute (2010), “Domestic Resource Mobilization in Africa: An Overview”.