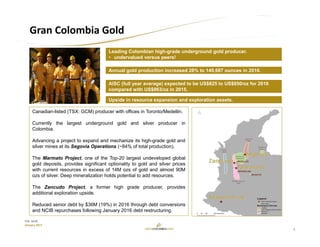

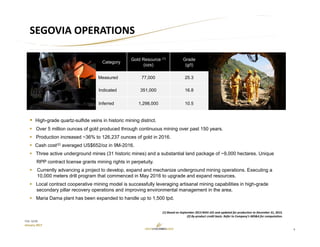

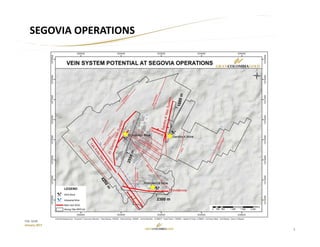

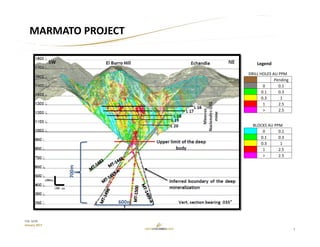

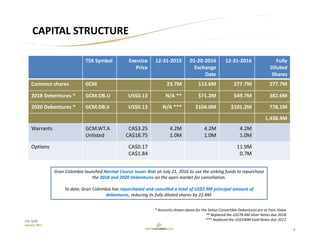

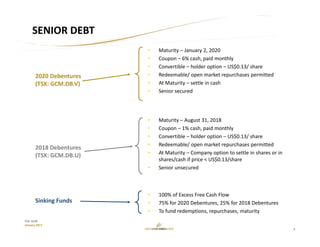

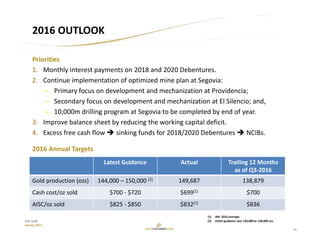

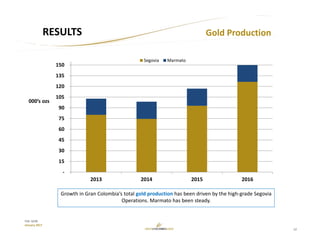

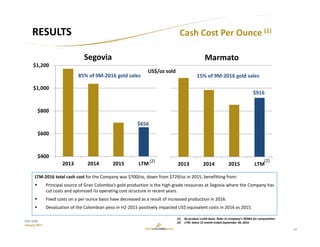

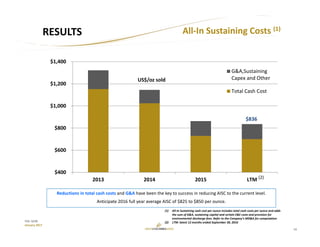

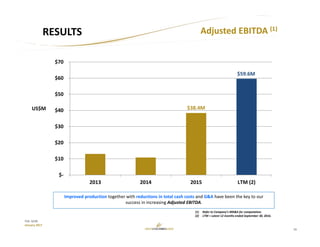

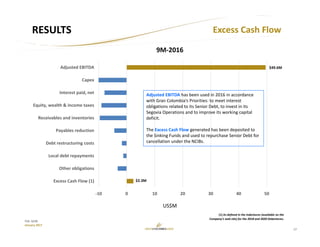

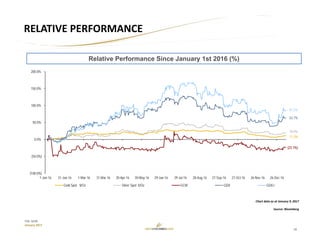

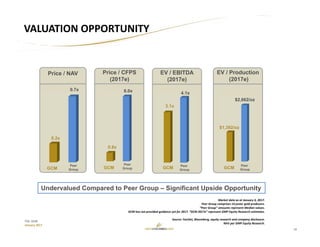

This corporate presentation from Gran Colombia Gold provides an overview of the company as the leading high-grade gold producer in Colombia. It summarizes Gran Colombia's key assets including its flagship Segovia Operations, the Marmato Project, and the Zancudo Project. It also provides details on recent financial and operating results such as increased annual gold production to 149,687 ounces in 2016 and reduced cash costs. The presentation aims to position Gran Colombia as an undervalued, leading Colombian gold producer with growth potential from resource expansion and exploration upside.