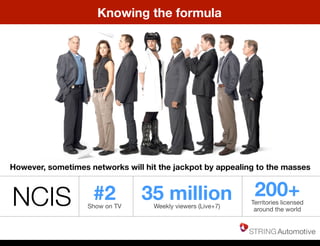

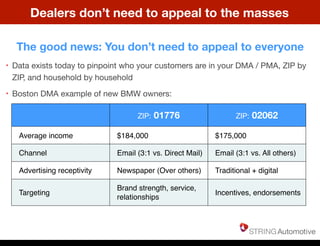

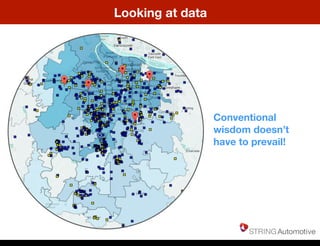

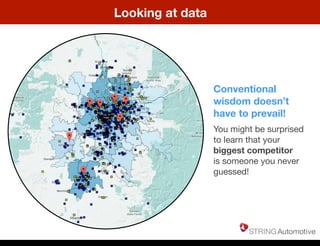

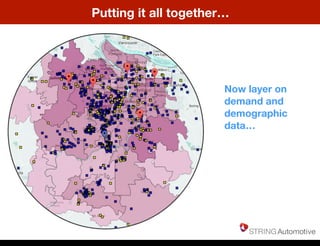

The document discusses how networks have traditionally used Nielsen ratings to measure audience size and evaluate programming success. However, the ways audiences consume media are changing as people now watch TV, use DVRs, and access content online. Similarly, auto dealers need better data tools to understand their target customers across different channels like traditional media, digital advertising, and social media. Just as networks target specific demographics, dealers can use local data to pinpoint customer attributes and tailor their messaging. Rather than solely relying on generic metrics, dealers should analyze key performance indicators and consider unexpected competitors to improve their business.