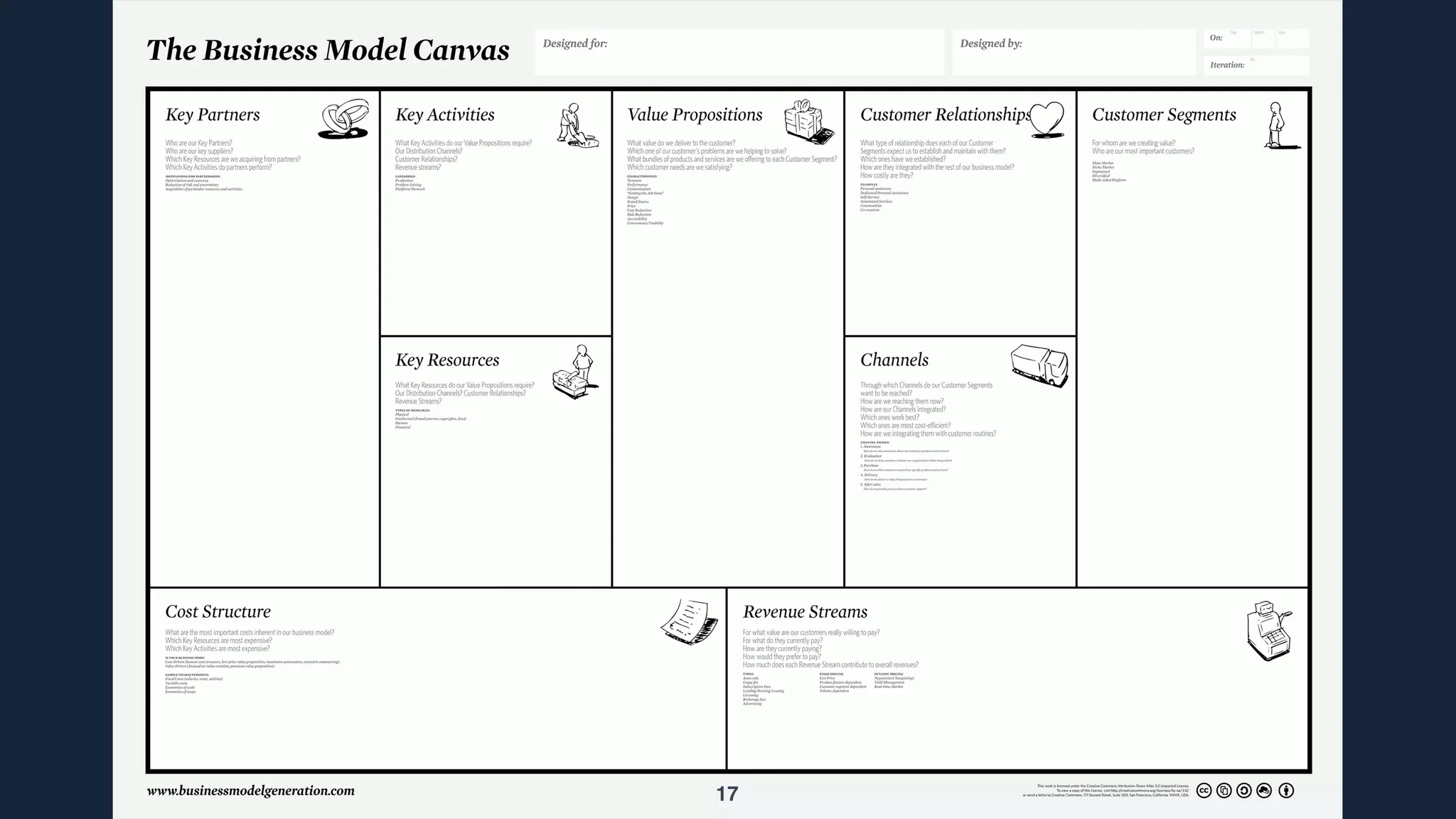

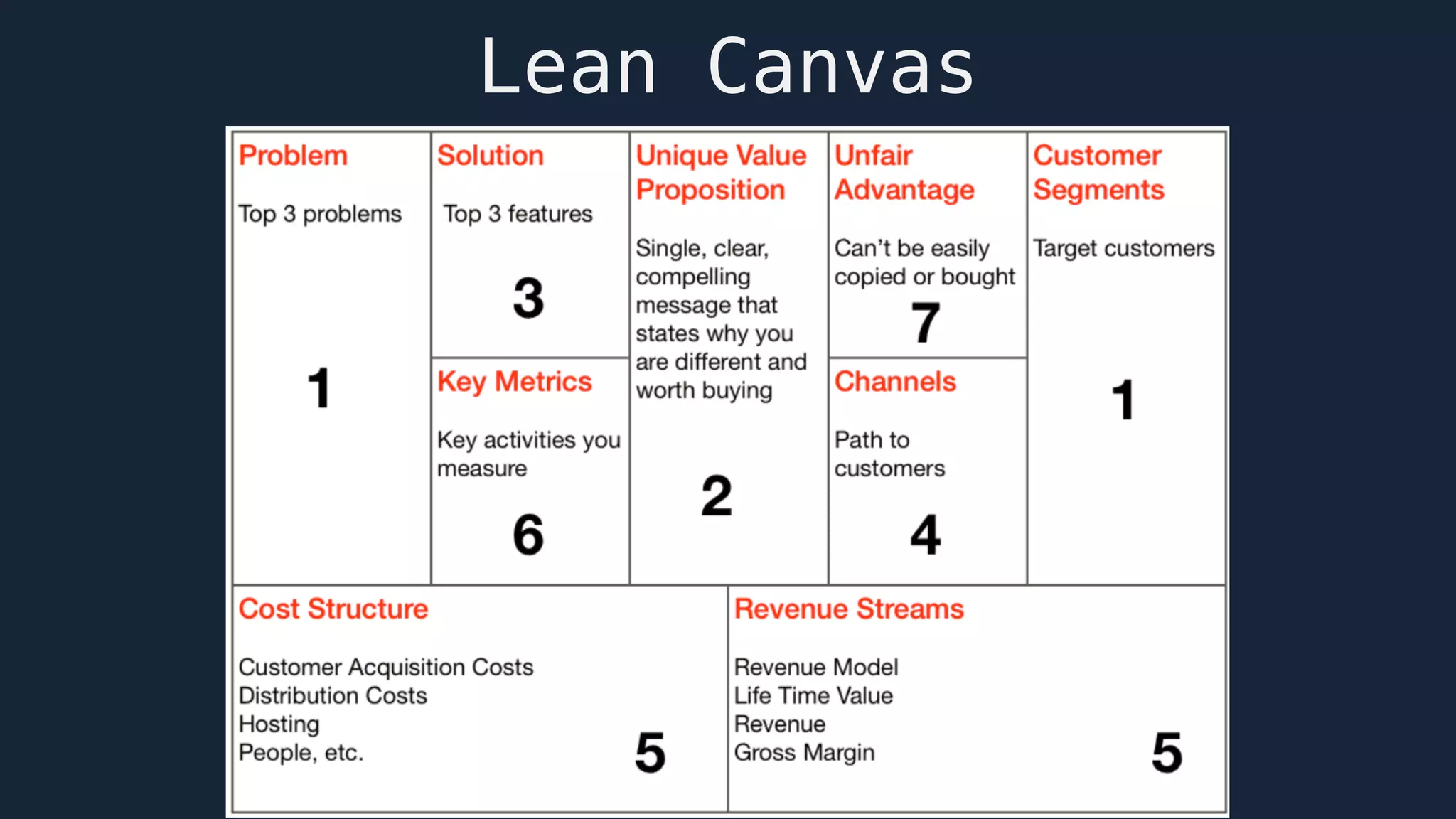

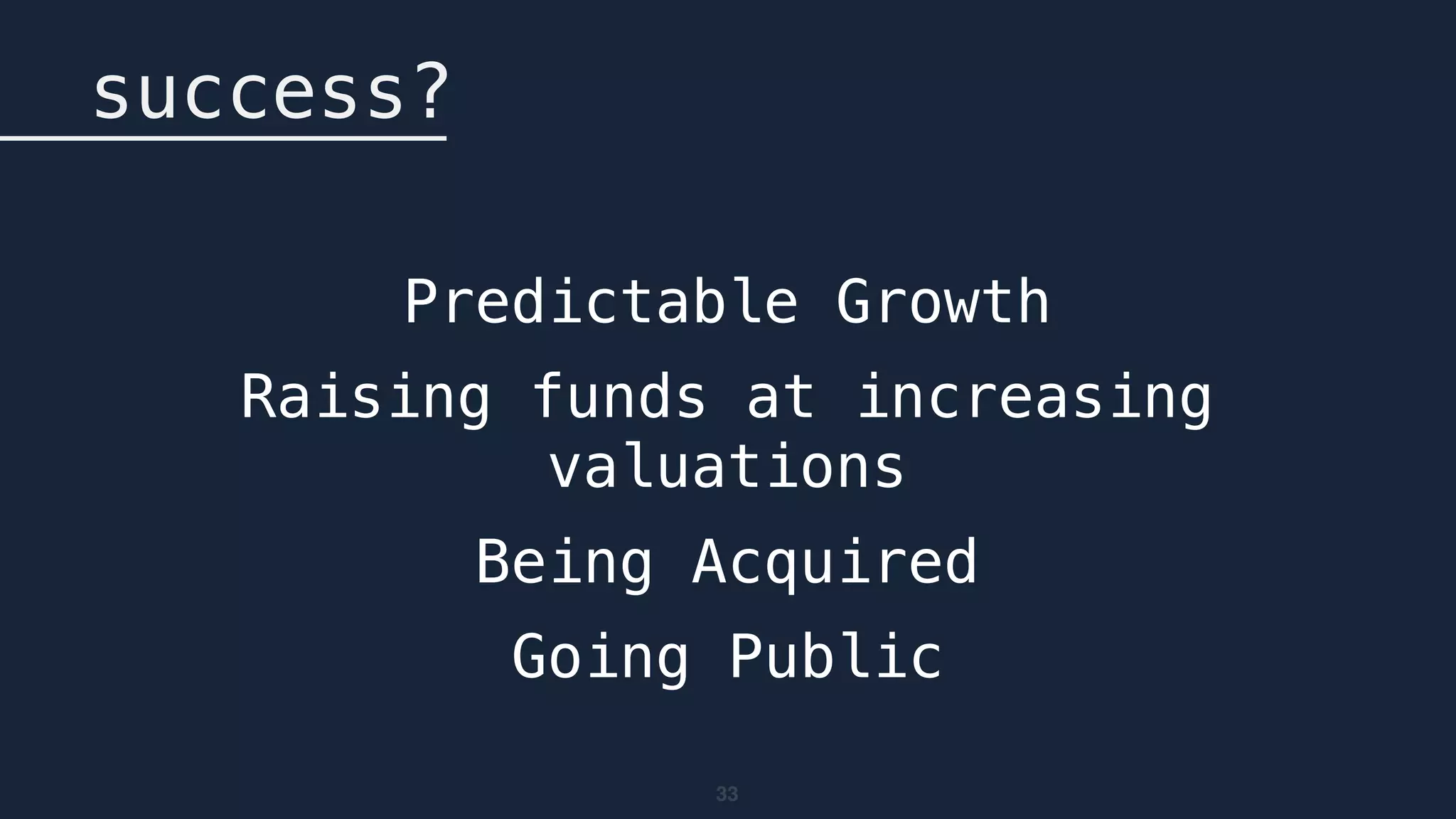

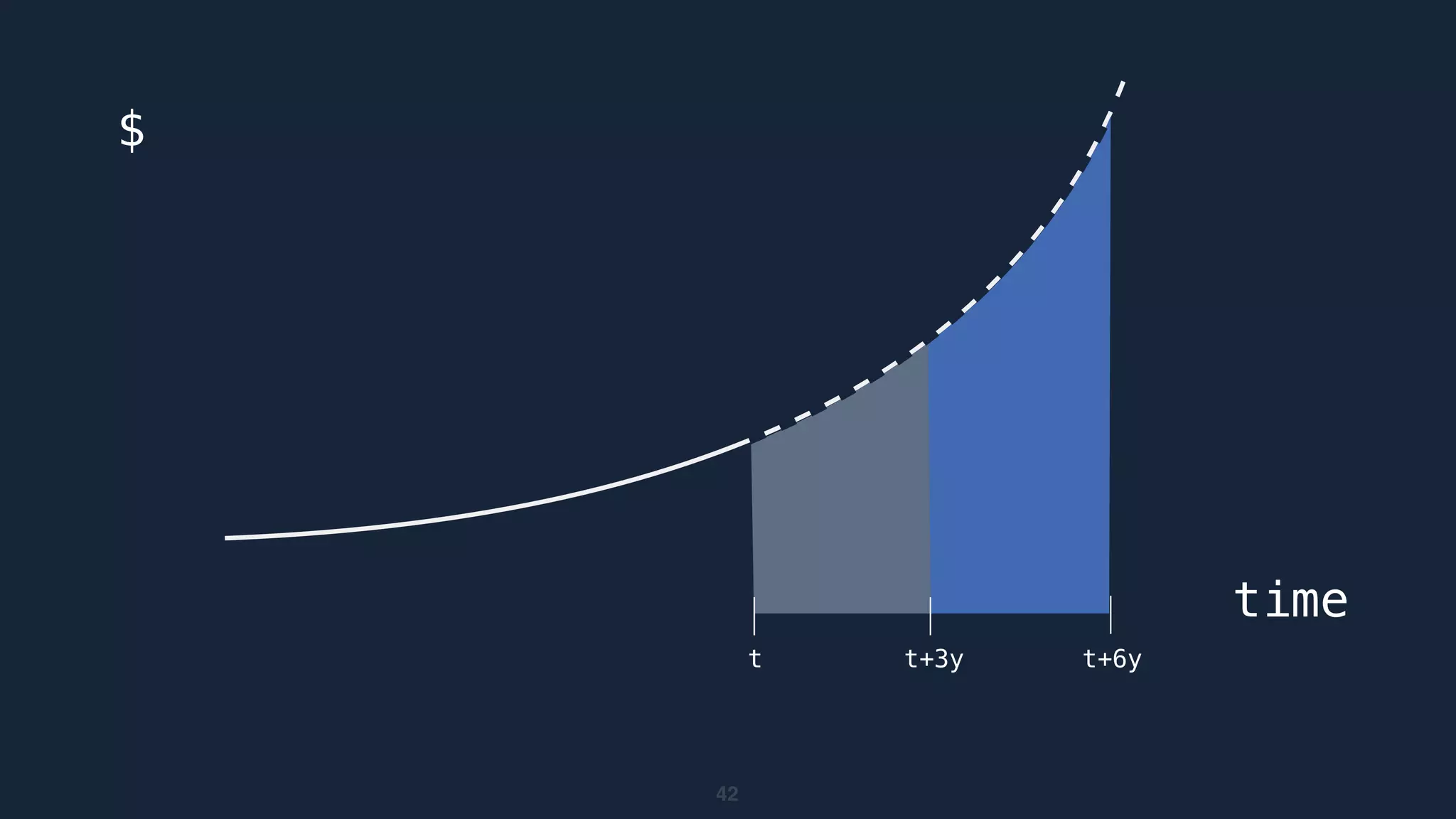

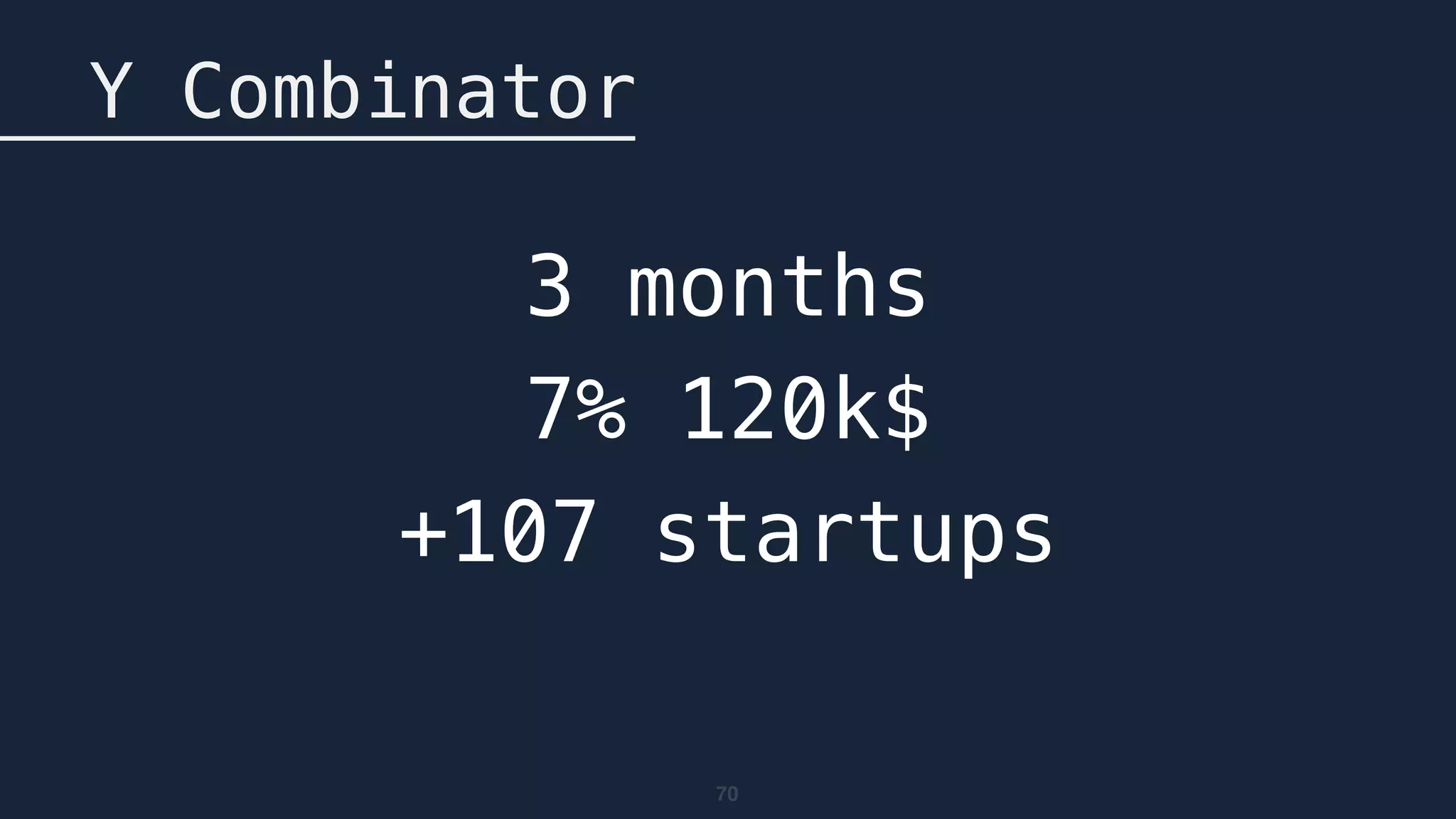

The document outlines key concepts and insights on the startup ecosystem, highlighting the importance of technology and innovation in shaping new business models. It discusses definitions of startups, funding options such as venture capital and crowdfunding, and the role of incubators and accelerators in supporting entrepreneurs. Additionally, it emphasizes the challenges faced by startups and the criteria for success, including predictable growth and meeting market needs.