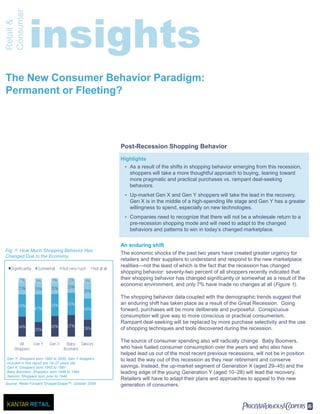

The document discusses how consumer shopping behavior has permanently changed as a result of the recession. It notes that 72% of shoppers have changed their behavior, focusing more on practical purchases rather than deals. Younger generations like Gen X and Gen Y will drive spending recovery. Retailers need to adapt to this "new normal" by appealing to these generations and recognizing shopping is now more deliberate and purposeful with an emphasis on value. The recession has increased consumers' focus on savings techniques and maximizing deals, so retailers need to make promotions easily accessible across all channels to engage these thoughtful shoppers.