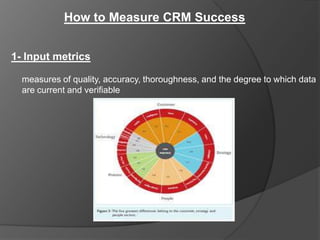

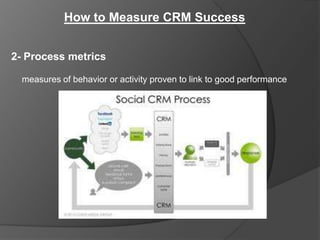

CRM can benefit banks by helping them understand customers better in order to personalize services. However, CRM systems often fail to live up to expectations due to faulty assumptions like the idea that relationships can be systematically managed or that salespeople will enjoy added data entry tasks. For CRM to succeed, banks must identify proper initiatives, implement technologies to support them, set targets, evaluate performance, and take corrective actions. A new CRM system implemented by one bank reduced data entry time and provided a single access point for customer data across the organization.