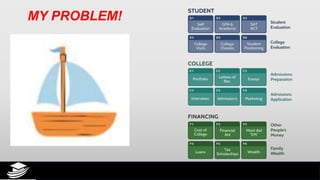

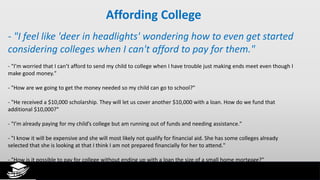

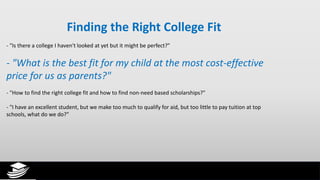

Peter Lampert is a seasoned expert in college, tax, and financial advisory services with over 22 years of experience. The document addresses common concerns parents have about affording college for their children, navigating the admissions process, and maximizing financial assistance without jeopardizing retirement plans. It emphasizes the importance of finding the right college fit and understanding various payment options available.