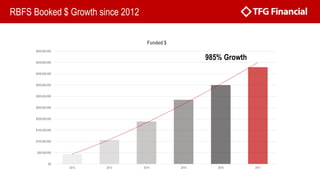

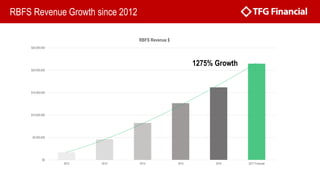

TFG Financial Group is a finance company that has been in operation since 1984. It provides equipment financing, automotive financing, and portfolio servicing across multiple geographies including the US, Europe, and Australia. TFG offers a multi-tiered financing solution that matches borrowers across the credit spectrum with various lenders, from banks and captives to sub-prime and near-prime brokers. This solution has helped clients like RBFS grow their auction proceeds by over 985% and revenue by over 1275% since 2012 by increasing the number of qualified bidders with financing. TFG provides a dedicated concierge service to support this financing program.