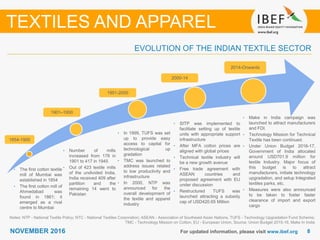

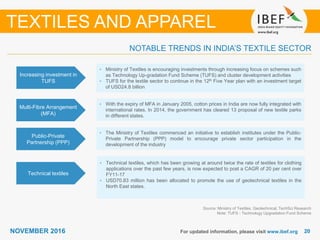

The document provides information on India's textiles and apparel sector. Some key points:

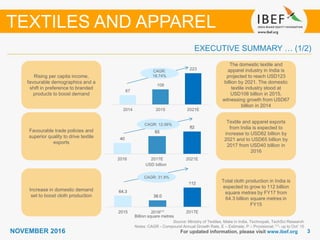

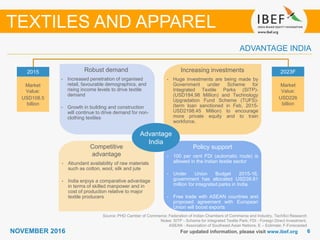

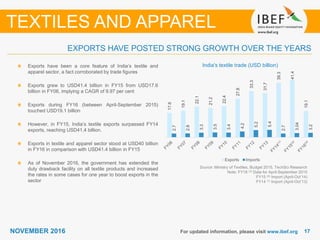

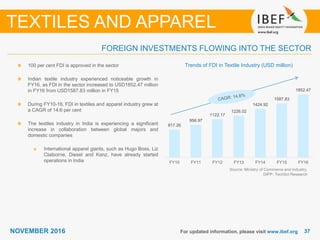

- The domestic textile industry in India is projected to reach USD123 billion by 2021, up from USD108 billion in 2015. Textile and apparel exports are expected to increase to USD82 billion by 2021, up from USD40 billion in 2016.

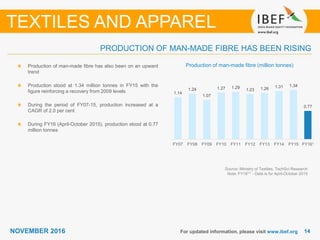

- Cotton production has been volatile in recent years, reaching 38 million bales in FY15, while man-made fiber production has been rising steadily.

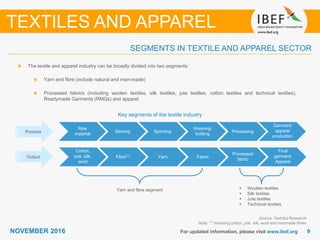

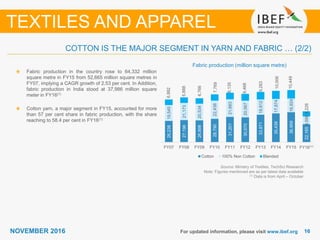

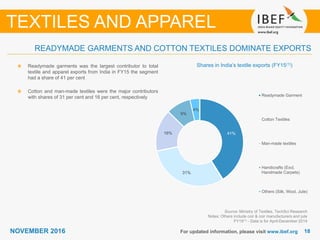

- The two main segments of the sector are yarn and fiber, and processed fabrics and apparel. Cotton is the major material in yarn and fabric production.

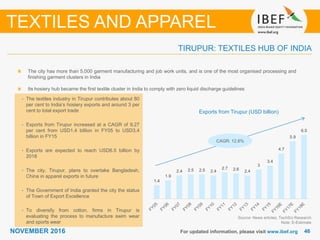

- Exports have grown significantly