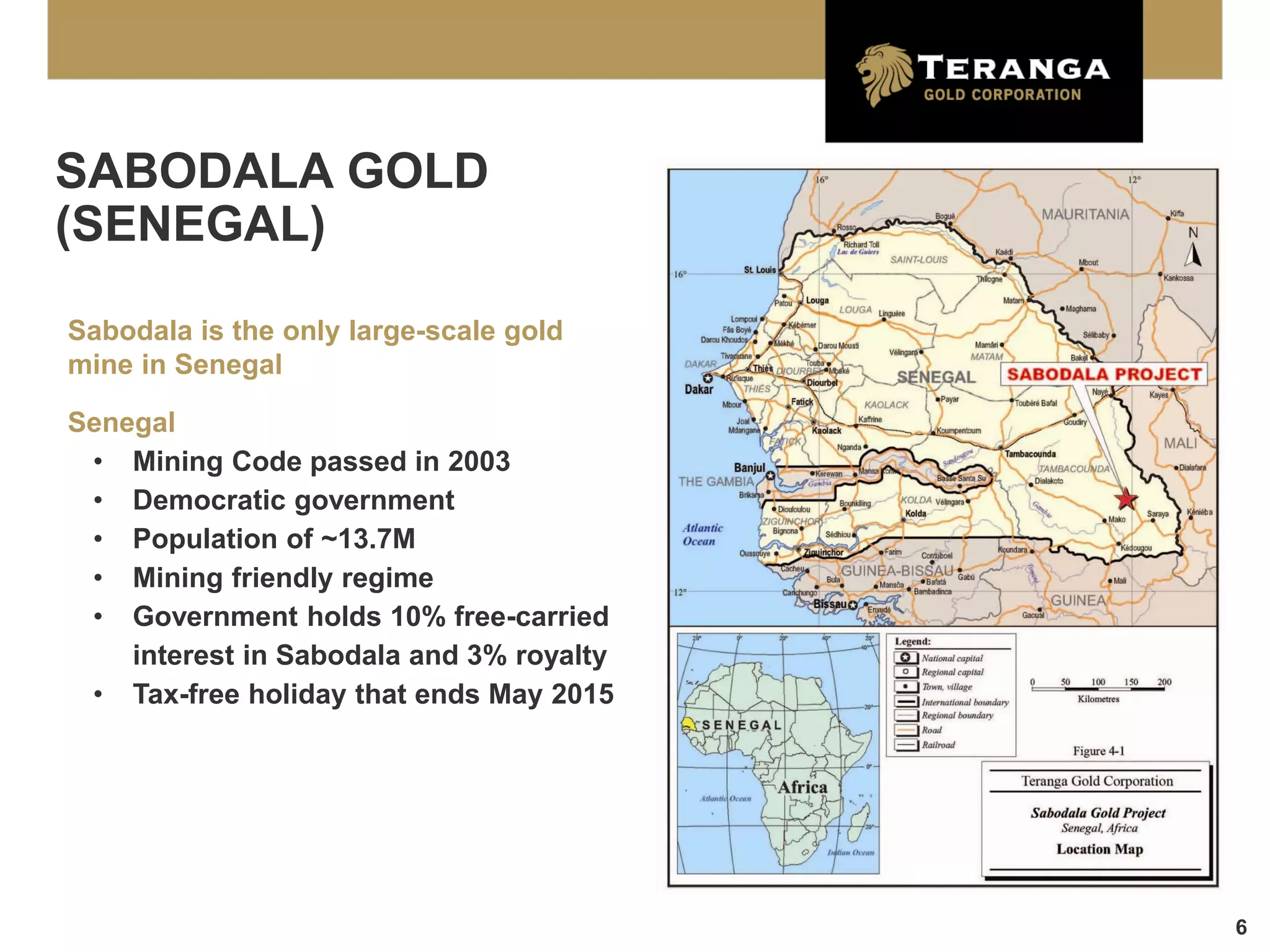

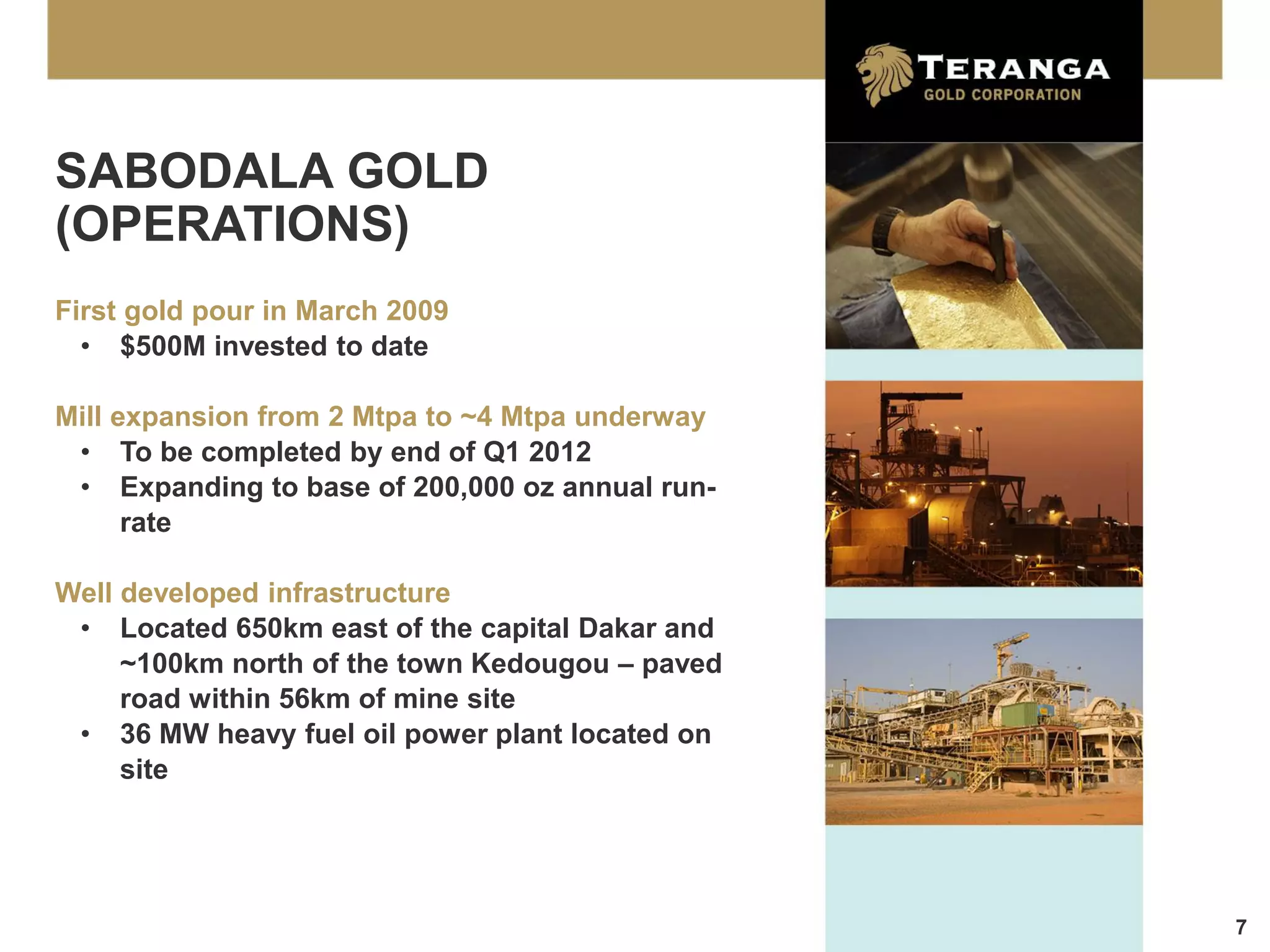

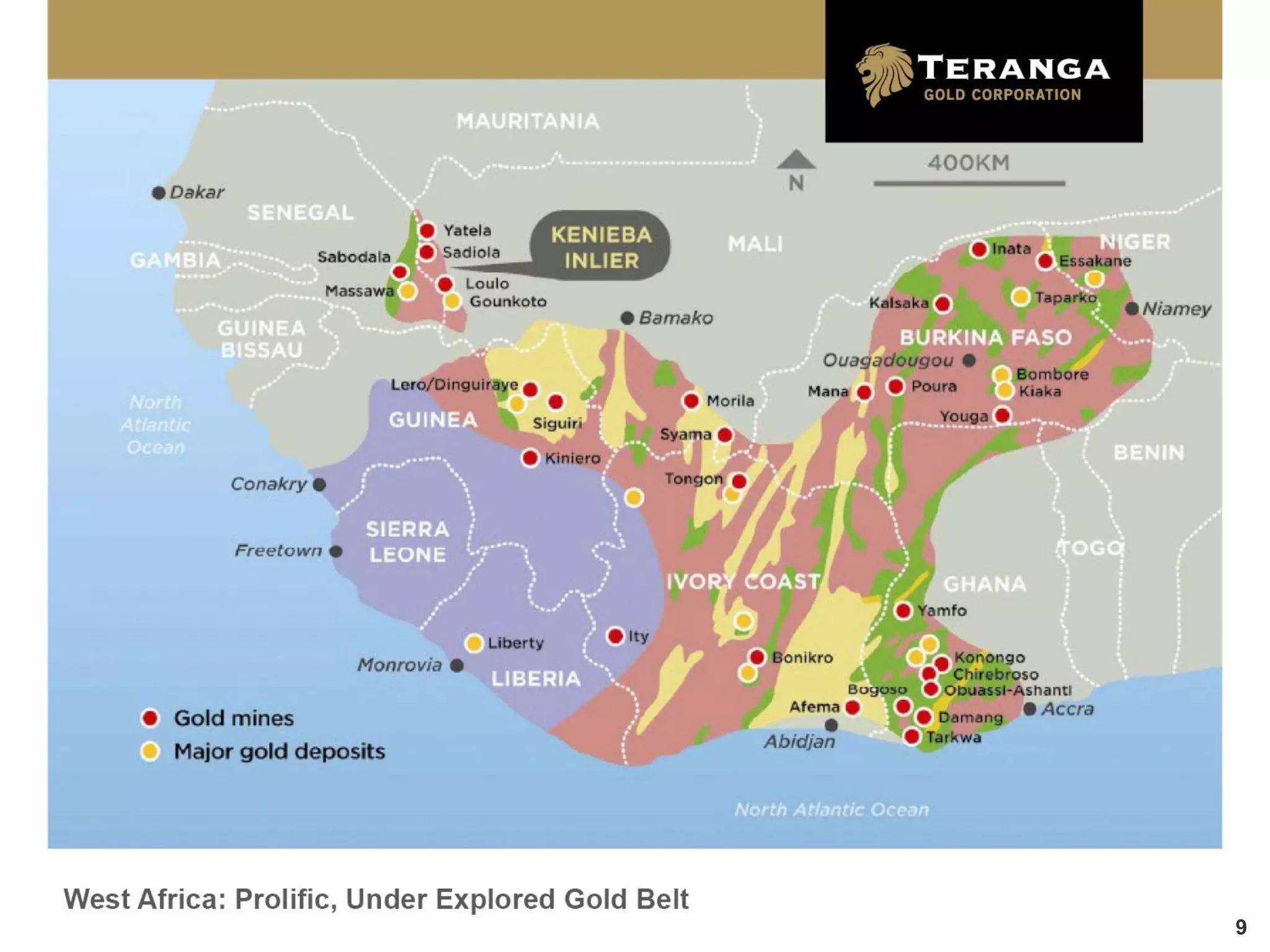

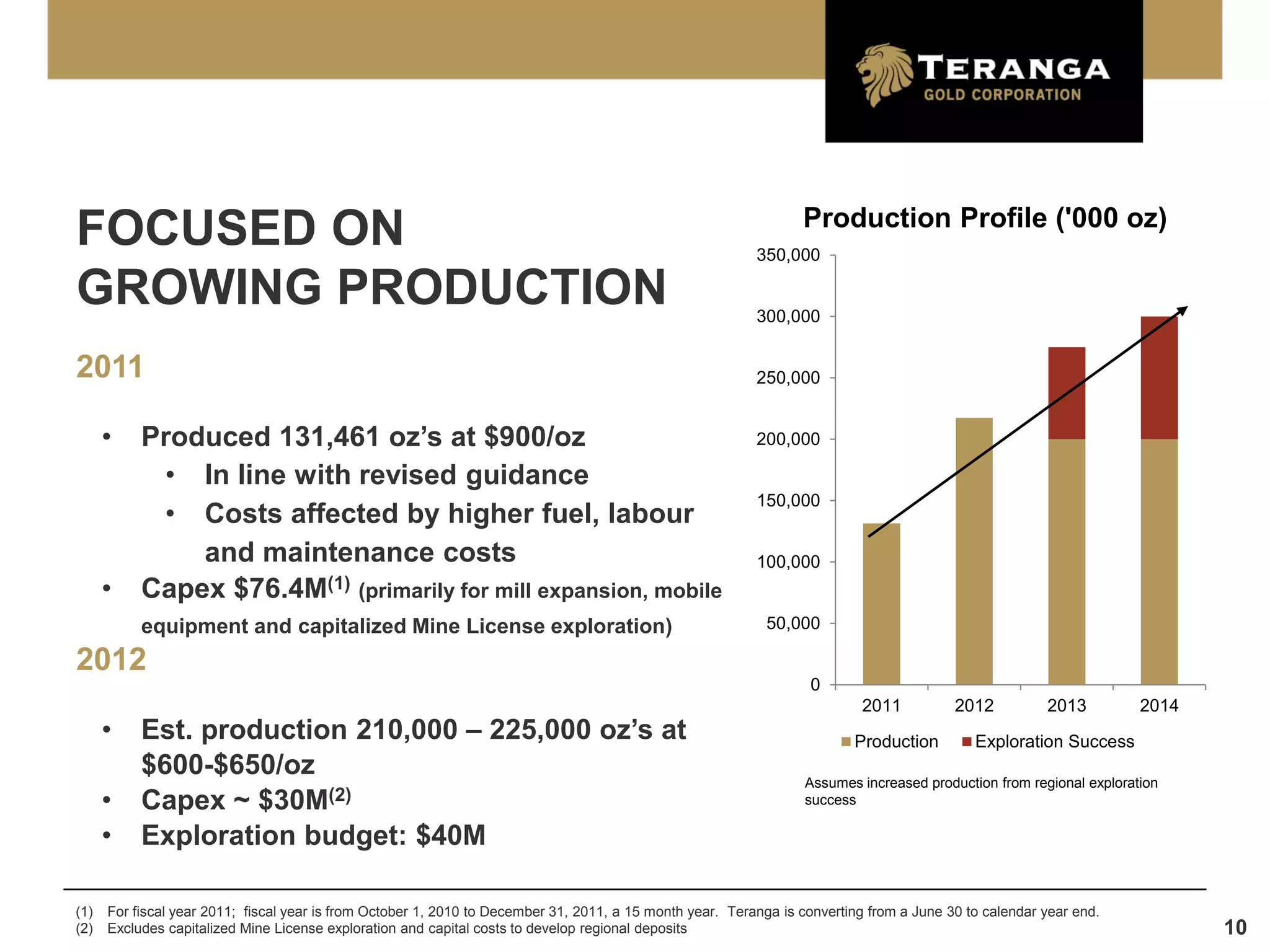

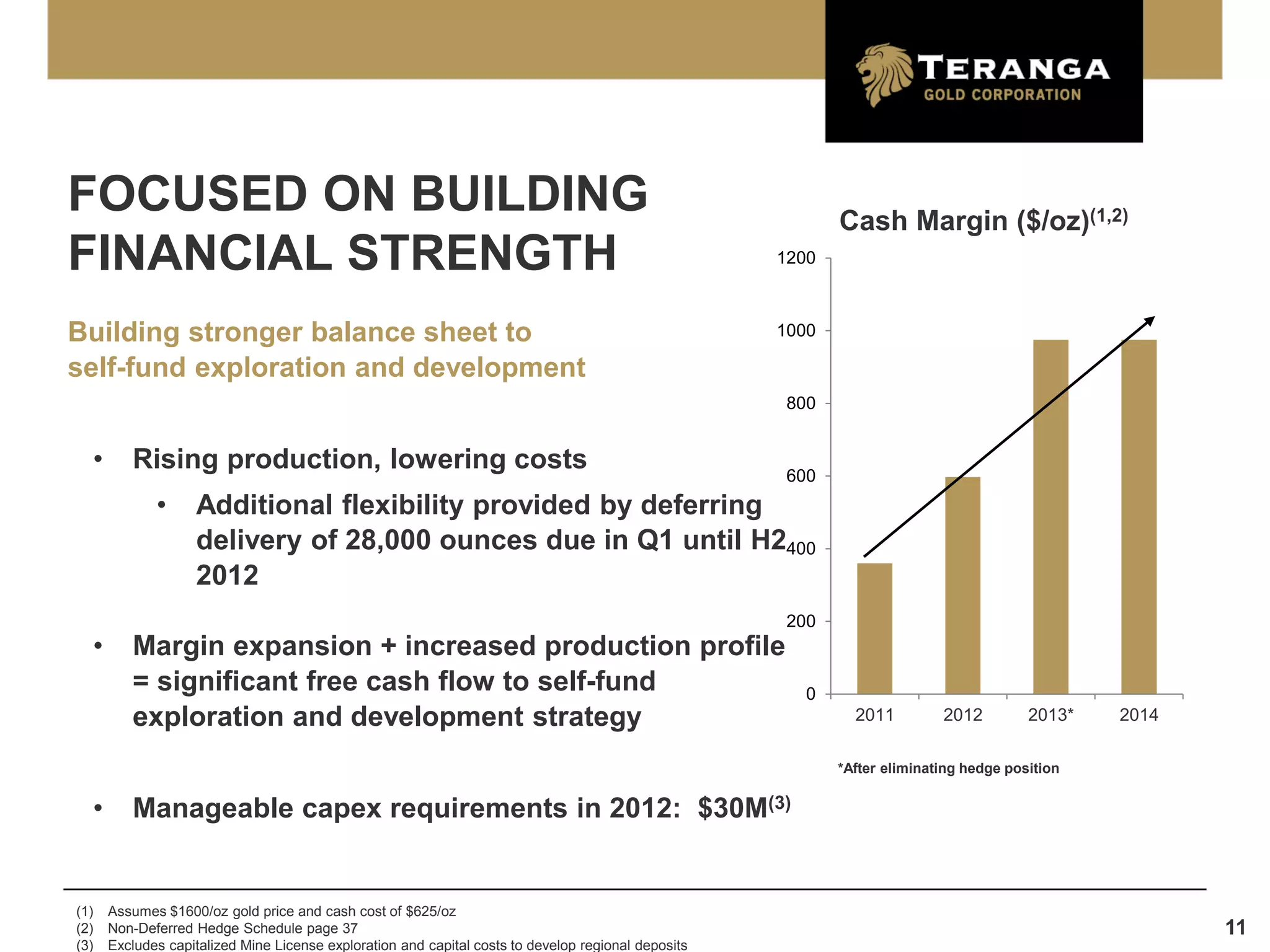

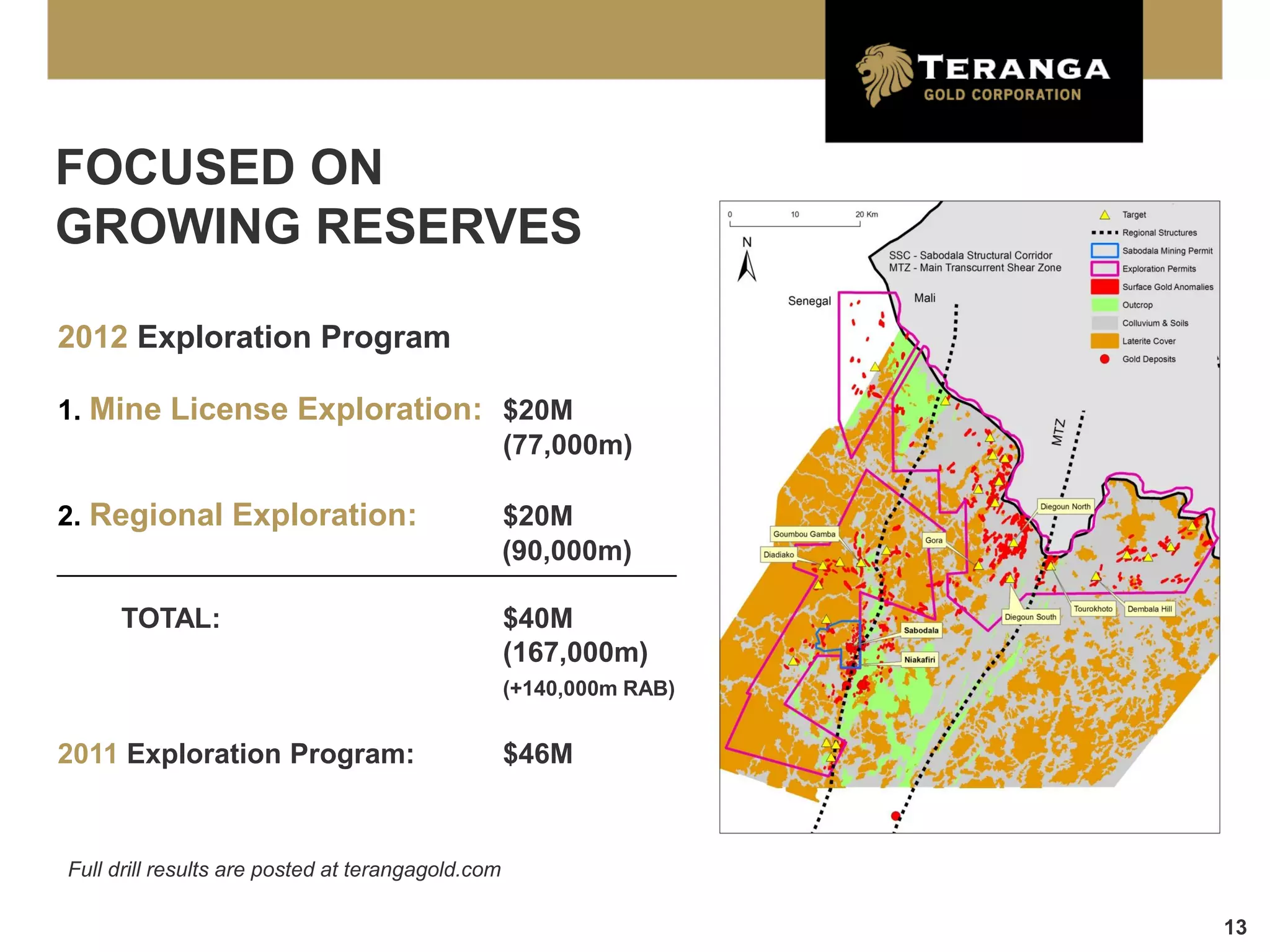

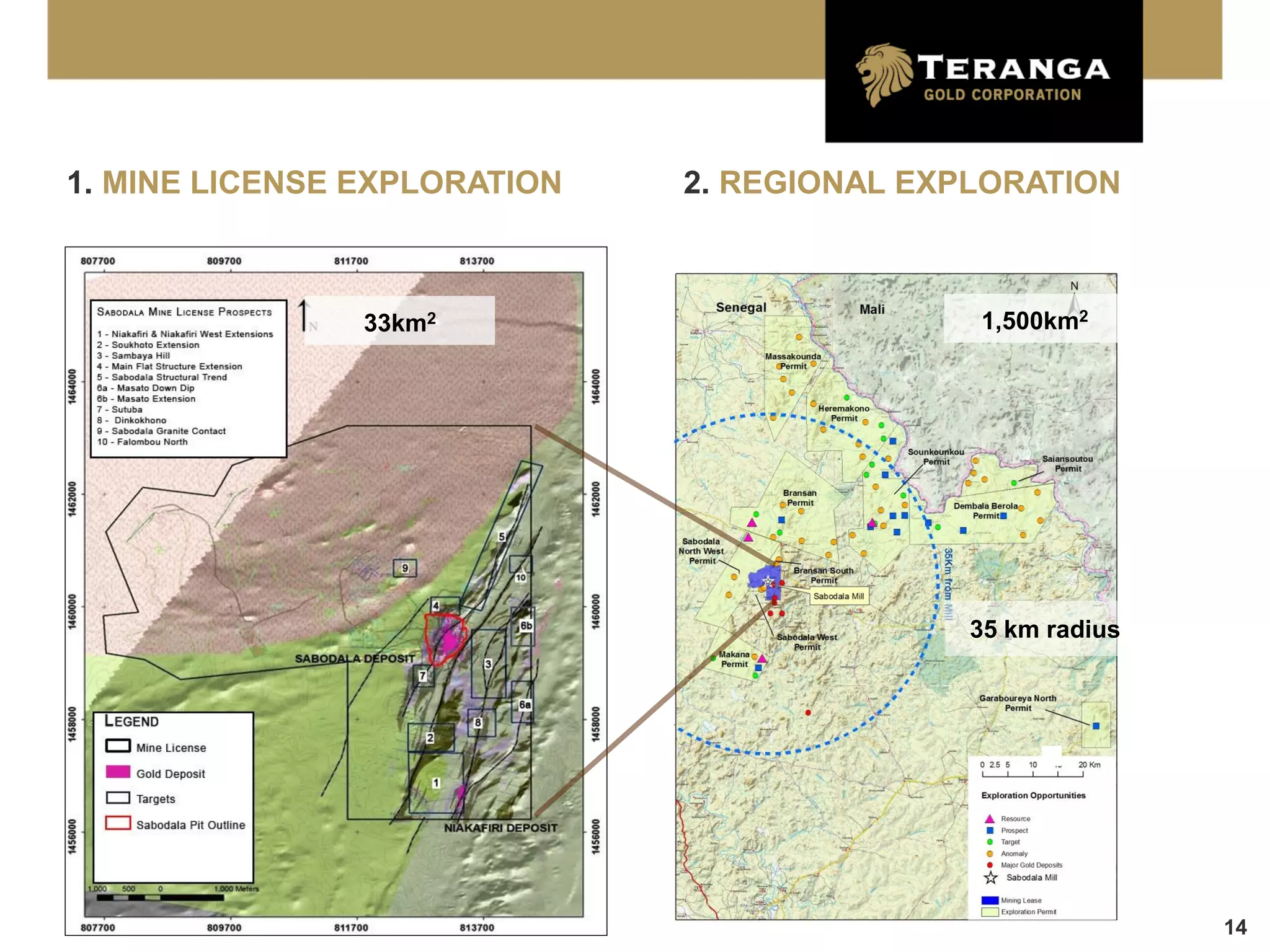

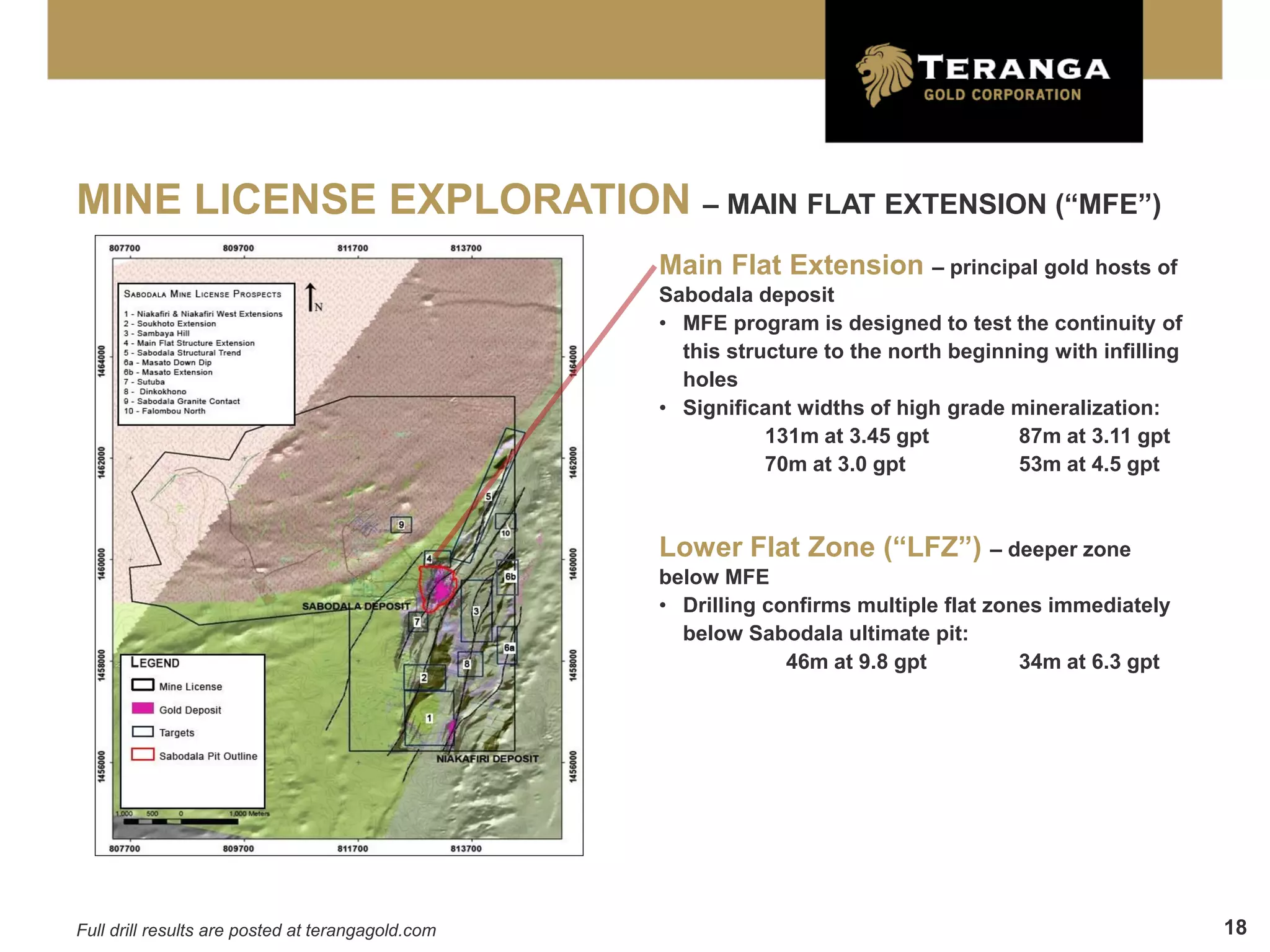

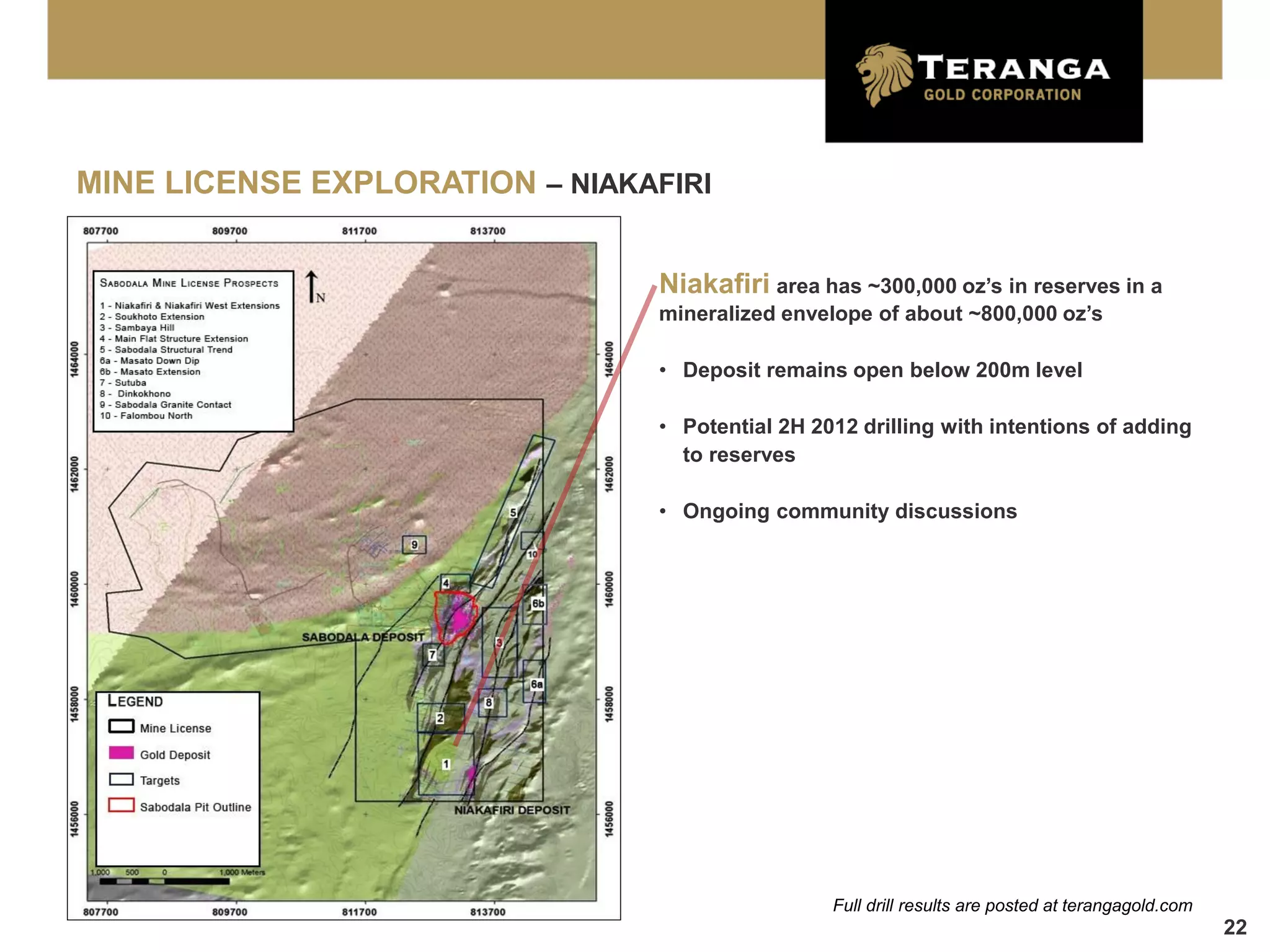

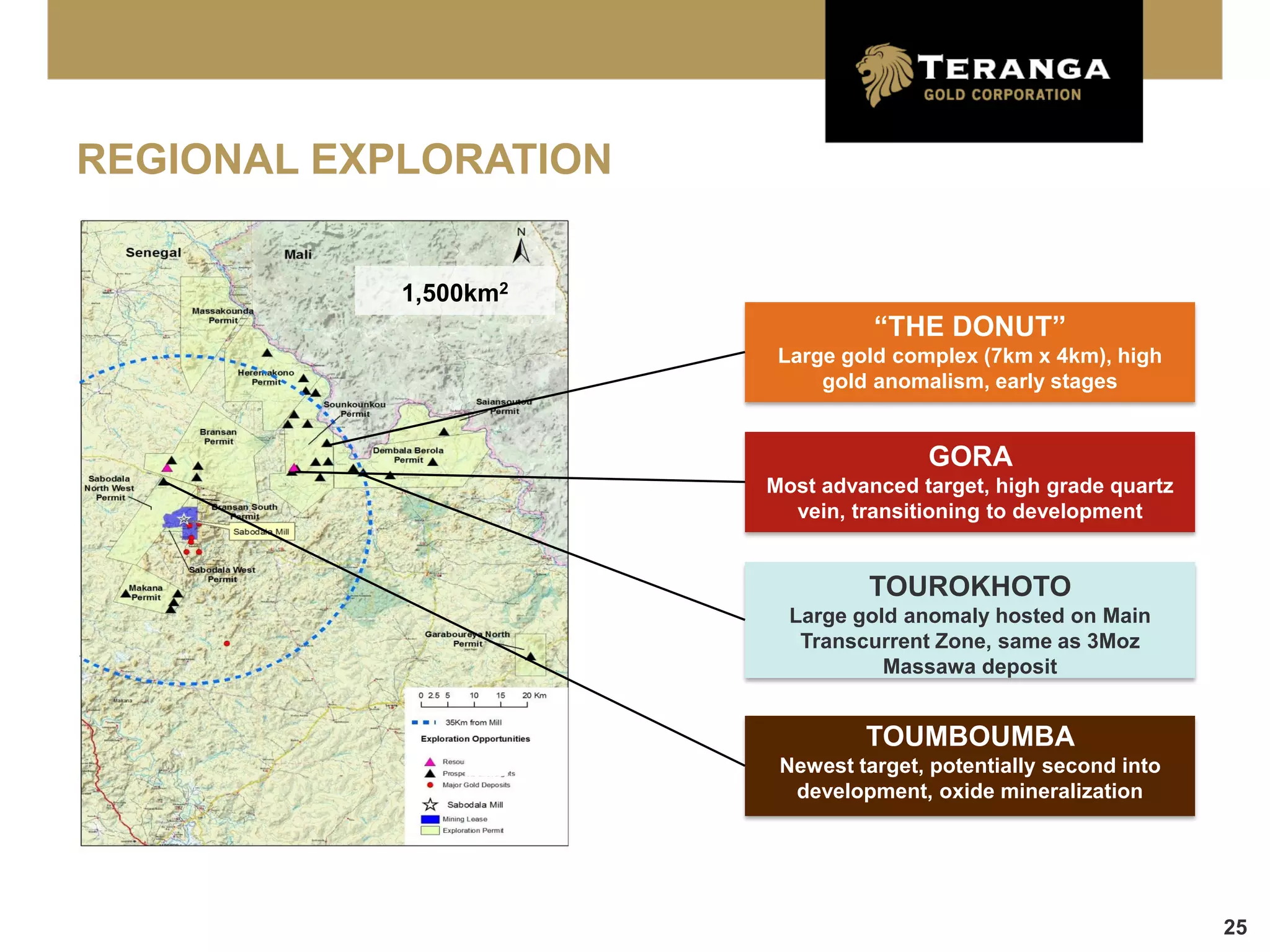

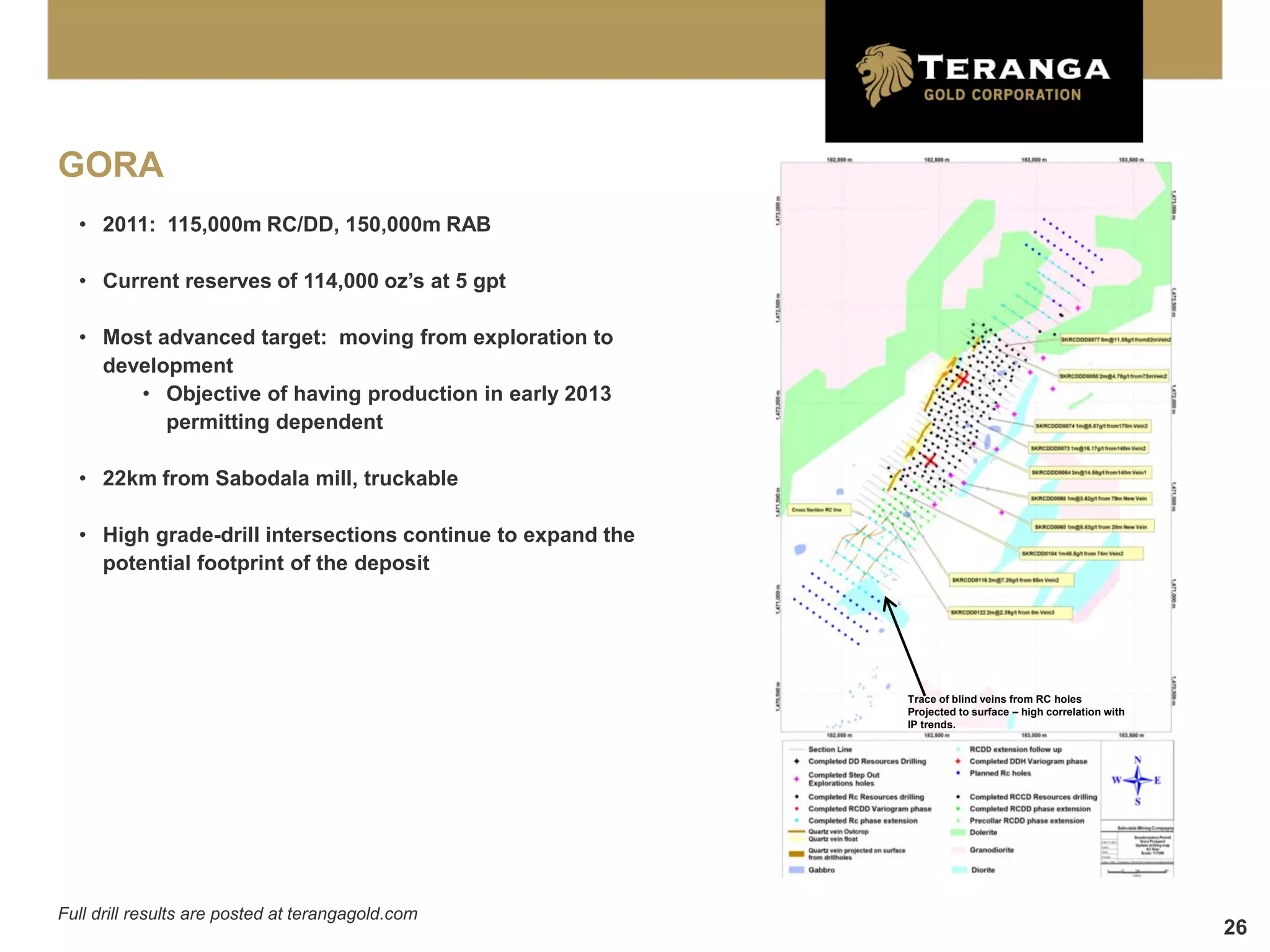

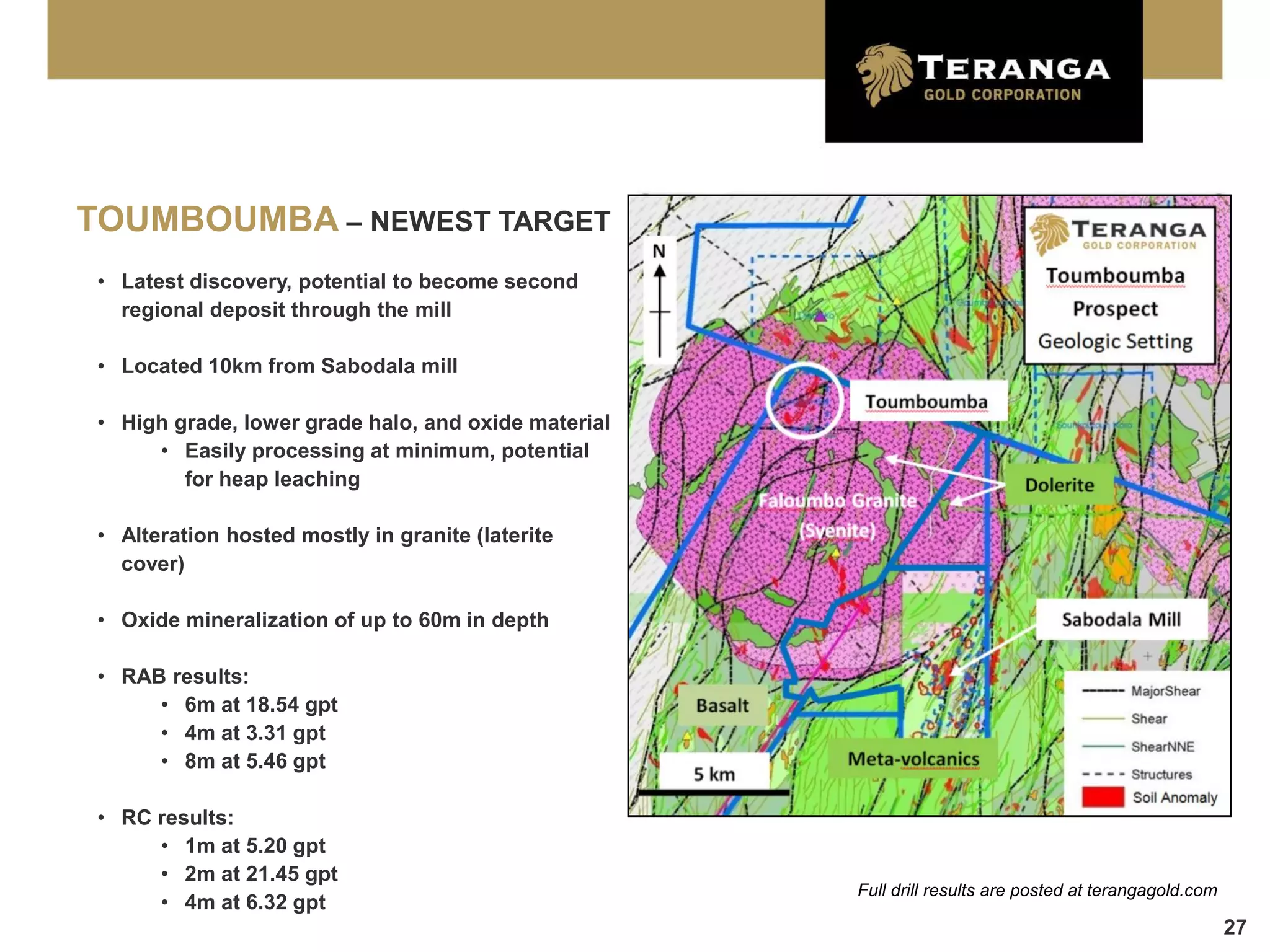

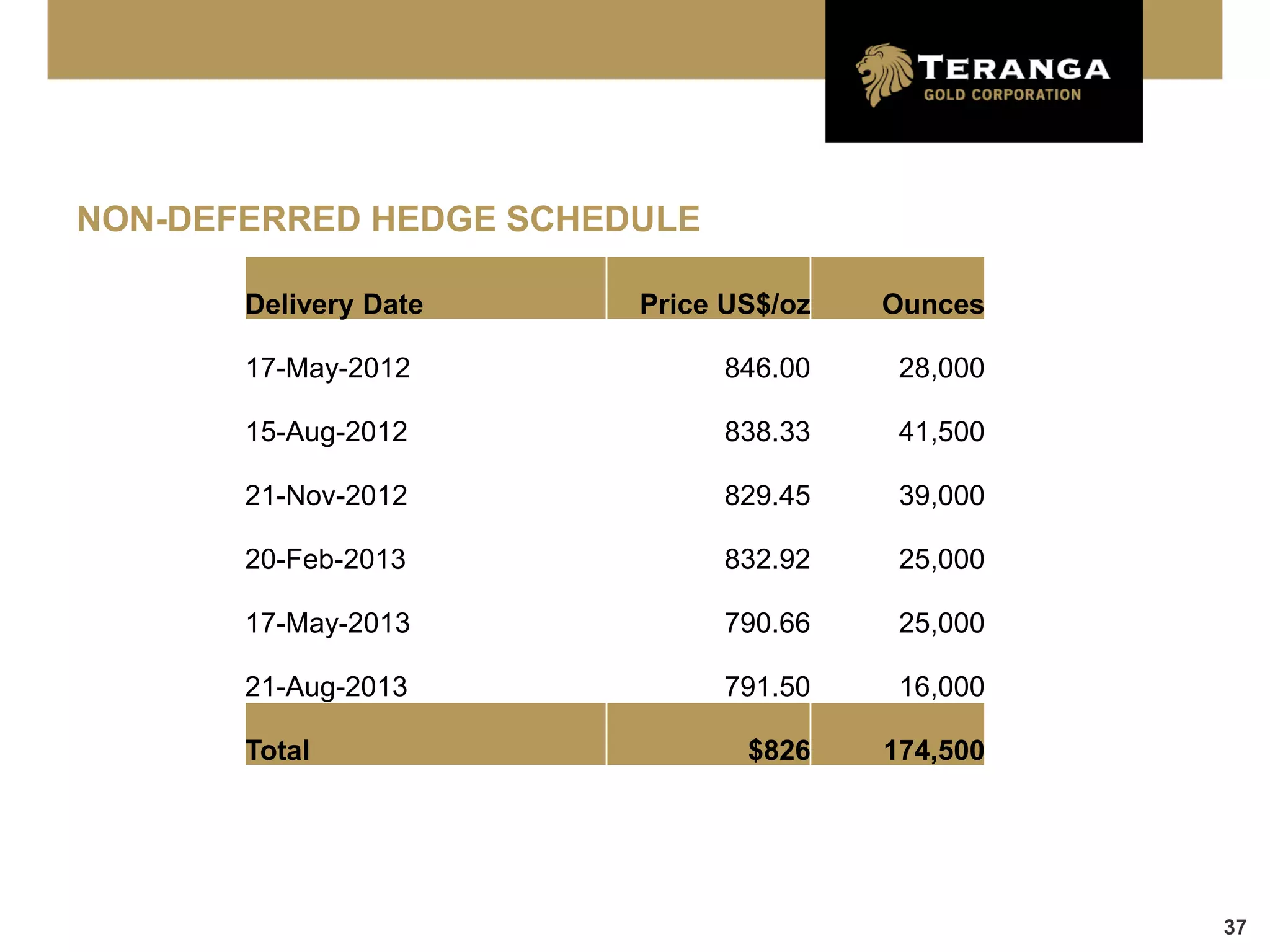

Teranga Gold Corporation operates the Sabodala gold mine in Senegal, West Africa, which is the only large-scale gold mine currently operating in the country. Teranga is focused on growing production and reserves through expanding the Sabodala mine and exploring its large land package. In 2012, Teranga plans to produce 210,000-225,000 ounces of gold and spend $40 million on exploration, with the goals of doubling mill capacity and becoming a mid-tier gold producer.