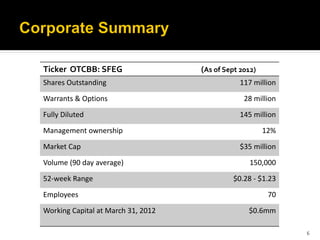

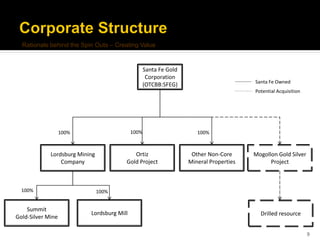

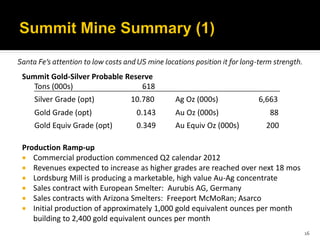

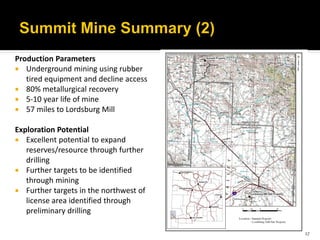

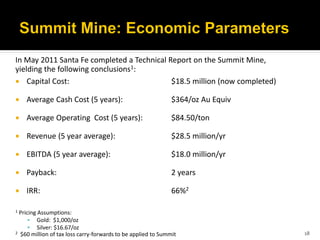

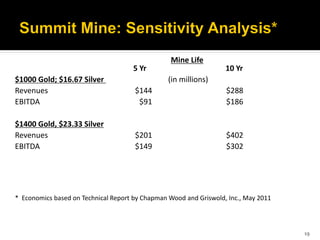

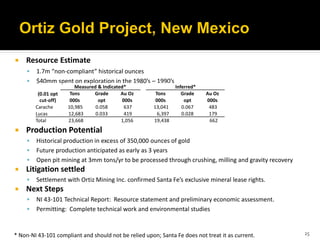

This presentation by a mining company provides an overview of its operations and growth prospects. It discusses its producing Summit Gold-Silver Mine, potential acquisition of the Mogollon Gold-Silver Project which could double its resources, and Ortiz Gold Project which has over 1.7 million ounces of historical gold resources. The presentation highlights the company's transition to producer status, increasing cash flow outlook from its assets, low cost of production, and pursuit of strategic acquisitions and a senior stock exchange listing to further create shareholder value.