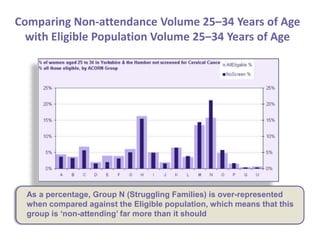

The data profiling of cervical screening non-attendance in Yorkshire and Humber clearly showed that group N (Struggling Families) was over-represented and consistently prevalent among all PCTs profiled. This target audience, characterized by young single mums, needs to be better understood to influence their behavior and increase screening rates.