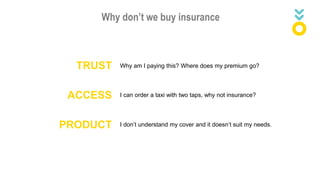

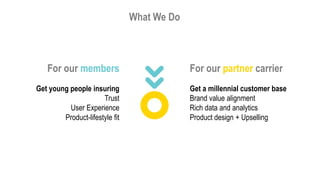

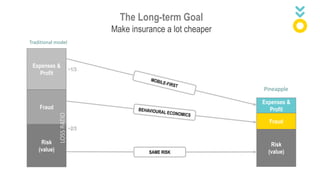

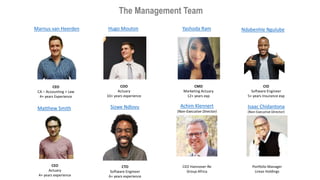

This document summarizes Pineapple, a South African insurtech startup that provides insurance products tailored for millennials. Pineapple aims to address issues of trust, access and suitable products that prevent young people from purchasing insurance. Their mobile-first platform allows customers to easily purchase month-to-month coverage for just the items they want. Pineapple has experienced rapid growth since launching 7 months ago, insuring over 12,000 members with a cost per acquisition 6 times lower than industry standards. They hope to expand their offerings and customer base while maintaining their focus on the millennial market.