Puerto Rico: Value Added Tax - Impact on Wholesale and Retail Industries

- 1. DISCLAIMER: This update and its content do not constitute advice. Clients should not act solely on the basis of the material contained in this publication. It is intended for information purposes only and should not be regarded as specific advice. In addition, advice from proper consultant should be obtained prior to taking action on any issue dealt with this update. © 2015 Kevane Grant Thornton LLP All rights reserved. Kevane Grant Thornton LLP is a member firm of Grant Thornton International Ltd (GTIL). GTIL and the member firms are not a worldwide partnership. Services are delivered by the member firms. GTIL and its member firms are not agents of, and do not obligate, one another and are not liable for one another’s acts or omissions. Please visit www.kevane.com for further details. Value added tax – impact on the Wholesale and Retail Industries Act 72 which amends the Internal Revenue Code for a New Puerto Rico introduces a value added tax system in Puerto Rico that will replace the Sales and Use tax system (“SUT”) effective April 1, 2016, for state tax purposes. The SUT will continue to be in place for municipal tax purposes after March 31, 2016. Effective July 1, 2015, the current Sales and Use Tax increased to 10.5% (state tax) for a transition period that will end on March 31, 2016. The credit for SUT to be claimed in the monthly Sales and Use Tax Return will be 100% of the tax liability in the case of resellers of tangible personal property (an increase from the current 75%). On October 1, 2015, a new tax of 4% will apply to services provided to other merchants (B2B) and for designated professional services unless these are covered by a qualified contract. Please refer to our tax alert from June 25, 2015, where we discuss the special sales and use tax transition rules applicable to qualified contracts. On April 1, 2016, a new Value Added Tax will replace the state Sales and Use Tax of 10.5%. Designated services and services rendered to other businesses (B2B) will be subject to a 10.5% VAT rate unless these are covered by a qualified contract. From a municipal point of view the sales and use tax will continue to be 1%. Services to other merchants and designated professional services will be exempt from this municipal tax. This alert concentrates on the specific aspects related to value added taxes for the wholesale and retail industries. In addition, and for your reference, we have prepared a diagram to illustrate an example of how the value added tax is paid and credited by the retailer/ wholesaler business. Will merchants on retail industries need to reflect the VAT separate on its receipt? Merchants that have the responsibility to collect the VAT on a retail sale will need to give the buyer a receipt that shows separately the price of the good or service sold and the applicable tax. Returns and declaration Imports Declaration –upon the introduction of goods into PR and before release of merchandise Tax on Imports Monthly Return – on the 10th day following the closing of each month Small Merchant Annual Informative Declaration – within a period of 60 days from the date of the filing of the income tax return Monthly VAT Return – on the 20th day following the closing of each month. The VAT monthly return will show the merchant’s VAT liability for a month computed as follows: VAT (10.5%) on goods and services sold during a month Contact us For assistance in this matter, please contact us via maria.rivera@pr.gt.com Tax Partner or javier.oyola@pr.gt.com Tax Manager Kevane Grant Thornton LLP 33 Calle Bolivia Ste 400 San Juan, Puerto Rico 00917-2013 T + 1 787 754 1915 F + 1 787 751 1284 www.kevane.com Follow us on June 30, 2015

- 2. Page 2 DISCLAIMER: This update and its content do not constitute advice. Clients should not act solely on the basis of the material contained in this publication. It is intended for information purposes only and should not be regarded as specific advice. In addition, advice from proper consultant should be obtained prior to taking action on any issue dealt with this update. © 2015 Kevane Grant Thornton LLP All rights reserved. Kevane Grant Thornton LLP is a member firm of Grant Thornton International Ltd (GTIL). GTIL and the member firms are not a worldwide partnership. Services are delivered by the member firms. GTIL and its member firms are not agents of, and do not obligate, one another and are not liable for one another’s acts or omissions. Please visit www.kevane.com for further details. Plus/Minus: adjustments that increase/decrease the sales price of goods sold Minus: Credit for VAT paid on goods or services purchased (imported) Credit for value-added taxes paid Every merchant, except small merchants holding a Small Merchant’s Registration Certificate, will be allowed to claim a credit for the VAT paid during the corresponding month in the case that the merchant sells taxable goods or services subject to the 10.5% or 0% VAT. If there is a combination of exempt and taxable goods, the wholesaler/ retailer will need to make an allocation on the VAT incurred on costs. If the wholesaler/ retailer sells goods that are exempt from VAT it will not have to charge VAT. However, the wholesaler/retailer will not be able to recover any VAT paid on costs, either charged by its suppliers or paid on the importation of goods or services, which are directly or indirectly related to those exempt or excluded sales. In general terms, the amount of the credit will be computed based on the sum of the following items: VAT paid upon introduction of taxable items into Puerto Rico that are directly or indirectly related to the sale of taxable items and services, plus; VAT paid by a merchant on the purchase of taxable items and services that are directly or indirectly related to the sale of taxable items or services as reported in the fiscal statement, plus; VAT paid by the merchant for a service provided by a non-resident and included on the VAT monthly return. Credit for Consumption Tax Paid to Foreign Countries for Services Rendered by Related Entities Any merchant to which a related entity not engaged in trade or business in Puerto Rico has provided a service may claim a credit on its monthly VAT return for the amount paid for the concept of consumption taxes paid to foreign countries after any credit claimed for such tax on the foreign country, with respect to the service. VAT Overpayment A VAT overpayment will be the excess of any adjustment or credits over the applicable VAT on sales of goods and services made during the corresponding month, as disclosed on the monthly VAT return. If the VAT overpayment does not exceed $10,000, it must be applied against the VAT liability shown in the monthly VAT return and for the following months until fully exhausted. If the VAT overpayment exceeds $10,000, the merchant may request a refund if it is considered an eligible merchant or it has reflected overpayment on its monthly VAT Returns for the last three months. Reimbursement of VAT Non-resident individuals that acquire goods in Puerto Rico and have paid VAT may request a reimbursement if the individual leaves Puerto Rico within a period of 30 days from the date of the purchase of goods and the total paid for the goods exceeds $500.

- 3. Page 3 DISCLAIMER: This update and its content do not constitute advice. Clients should not act solely on the basis of the material contained in this publication. It is intended for information purposes only and should not be regarded as specific advice. In addition, advice from proper consultant should be obtained prior to taking action on any issue dealt with this update. © 2015 Kevane Grant Thornton LLP All rights reserved. Kevane Grant Thornton LLP is a member firm of Grant Thornton International Ltd (GTIL). GTIL and the member firms are not a worldwide partnership. Services are delivered by the member firms. GTIL and its member firms are not agents of, and do not obligate, one another and are not liable for one another’s acts or omissions. Please visit www.kevane.com for further details. Merchant’s Registration Certificate Any person who wants to do business in Puerto Rico must be registered at the Puerto Rico Treasury Department before commencing operations. The original certificate must be displayed at all times in a place visible by the general public in each place of business for which it was issued. Any person that conducts business in PR that does not maintain the registry certificate or when such certificate has expired will be subject to penalties. Merchants that are part of a controlled or affiliate group could elect to be treated as one merchant. Exempt Purchases Certificate It is available to eligible persons on the import or acquisition of goods or services exempt from VAT. It is valid for three years. The Secretary at its discretion may extend or limit the validity of such certificate. Eligible persons include the Government of the United States of America and its States, the District of Columbia and the Government of the Commonwealth of Puerto Rico, any hospital unit, merchants dedicated to the tourism industry and bona-fide farmers. Eligible Merchant’s Certificate It will be issued to those merchants with an annual volume of business in excess of $500,000 for the last three preceding years and which 80% of its sales are subject to a 0% VAT tax rate. Eligible Reseller Certificate In the case of holders of an eligible reseller of tangible personal property, they must have a current certificate to claim a credit on their monthly return for the period in which the sales tax was paid, up to a 100% (i.e. after June 30, 2015, and before April 1, 2016) of the tax liability shown on its return. Effectiveness of current certificates and new certificates for VAT Effectiveness of certificates issued under the 2011 Code was not part of the discussion of Act 72. We will continue to monitor PRTD communications on this issue. Transitory provisions Bonds approved under the SUT provisions will be effective until its expiration date. Credits not claimed as a refund and available as of March 31, 2016, as reflected on the Monthly SUT return filed not later than April 20, 2016, could be used as a credit on subsequent monthly VAT returns until these are exhausted. Administrative determinations and closing agreements issued under the 2011 Code with provisions are similar to VAT provisions enacted with Act 72 and that affect the taxpayer responsibility for a taxable event after April 1, 2016, will be applicable under the provisions of Subtitle DD (VAT) under Act 72.

- 4. Page 4 DISCLAIMER: This update and its content do not constitute advice. Clients should not act solely on the basis of the material contained in this publication. It is intended for information purposes only and should not be regarded as specific advice. In addition, advice from proper consultant should be obtained prior to taking action on any issue dealt with this update. © 2015 Kevane Grant Thornton LLP All rights reserved. Kevane Grant Thornton LLP is a member firm of Grant Thornton International Ltd (GTIL). GTIL and the member firms are not a worldwide partnership. Services are delivered by the member firms. GTIL and its member firms are not agents of, and do not obligate, one another and are not liable for one another’s acts or omissions. Please visit www.kevane.com for further details. Exclusion of Contracts and Pre- existing Bids The retail sales covered by executed contracts and pre-existing bids at auction before April 1, 2016, will be excluded from VAT to the extent these were excluded from SUT. The merchant may acquire the taxable items subject to such contract or auction during a period of 12 months or contract term, whichever is less. Services provided to other merchants (B2B) and designated services pursuant to preexisting contracts executed before July 1, 2015, will be exempt from the 4% and 10.5% from April 1, 2016, on to the extent that a certification of qualified contract has been obtained from the Secretary of Treasury. Such certification needs to be requested to the Secretary of Treasury not later than September 30, 2015. If the certification is not obtained the services rendered after September 30, 2015, will be subject to a 4% state tax and to the valued added tax effective April 1, 2016. Commission for Alternatives to Transform the Consumption Tax This is a mechanism to evaluate the Puerto Rico Tax System based on the fiscal and budgetary reality of the government. Its function will be to evaluate the different tax models and provide a report not later than 60 days after the enactment of Act 72 (i.e. May 29, 2015) with recommendations on the feasibility of implementing a model as a transformation of the actual tax on consumption taking in consideration the collections necessary for the Government and the compliance of its obligations. The following table summarizes the effective date of all changes in sales and use tax and value added tax introduced by Act 72-2015. Up to 6/30/15 General SUT – 6%* Designated services – exempt B2B – exempt Municipal Level *Resellers receive a credit and is applicable to taxable B2B 4/1/16 General VAT – 10.5% or 0% (credit) Designated services – 10.5% (credit) B2B – 10.5% (credit) Up to 6/30/15 General SUT – 1% Designated services – exempt B2B – exempt 7/01/15 – 9/30/15 General SUT – 10.5%* Designated services – exempt B2B – exempt 10/1/15 – 3/31/16 General SUT – 10.5%* Designated services – 4% B2B – 4% 7/01/15 – 9/30/15 General SUT – 1% Designated services – exempt B2B – exempt 10/1/15 – 3/31/16 4/1/16 General SUT – 1% General SUT – 1% Designated services – exempt Designated services – exempt B2B – exempt B2B – exempt State Level

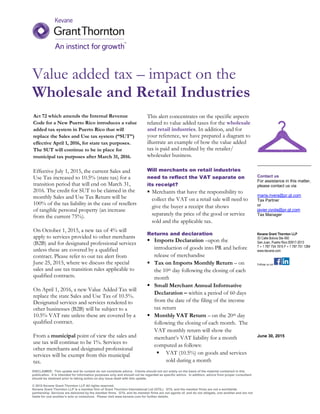

- 5. Impact of proposed value added tax Wholesale and Retail Industries - Retailer/Wholesaler sells products to consumers in the amount of $12,200,000 Collects VAT of $1,281,000 - Retailer/Wholesaler may take a credit for the VAT paid on imported products, local products and services bought in the amount of $1,060,500 Deposits $220,500 = ($1,281,000-1,060,500) at the PRTD after taking the credits for VAT paid. Total VAT paid: Imported products 367,500$ Clothes & other products 577,500 Services and other 115,500 Total VAT paid: 1,060,500$ *Only 10.5% VAT at the state level. Municipal remains at a 1% under SUT. Audit · Tax · Advisory Member firm of Grant Thornton International Ltd Retailer/Wholesaler Imports Purchases: - Clothes - $3,000,000 - Office Equipment - $500,000. Pays 10.5%* VAT on the clothes & office equipment= $367,500 - Retailer/wholesaler acquires locally clothes and other taxable items for $5,500,000 - Pays VAT of $577,500 to the seller. - Customer pays the tax on the purchase of the final product - If merchant may be able to credit. - Retailer/wholesaler buys services in the amount of $1,100,000 and pays 10.5% * VAT in the amount of $115,500.