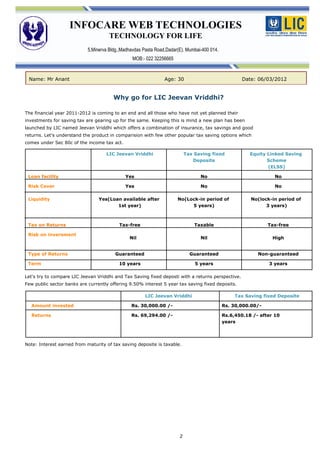

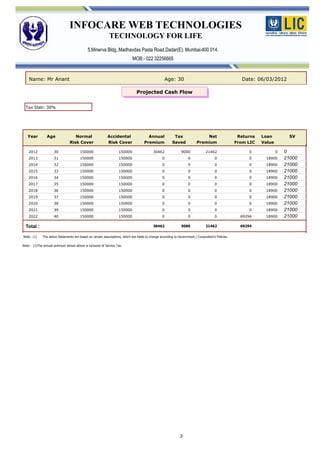

This document presents a summary of a single premium non-linked insurance plan for Mr. Anant aged 30. It outlines key details of the plan including a sum assured of Rs. 150,000, term of 10 years, and single premium of Rs. 30,000. On maturity, the guaranteed maturity sum of Rs. 69,294 along with any loyalty additions will be payable. The plan provides life cover of 5 times the single premium and allows for loan and surrender benefits after 2 years.