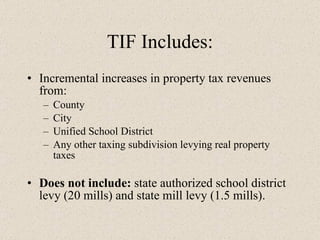

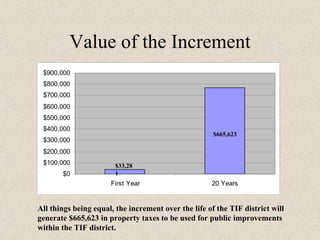

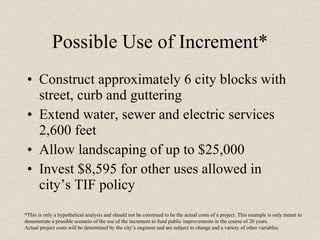

Tax increment financing (TIF) is a tool that allows future tax revenues from new development in a designated area to pay for public infrastructure improvements in that area. TIF districts are established to promote development in blighted, contaminated, conservation or enterprise zones. The tax increment is the difference between taxes collected from property values before and after improvements. This increment is used to finance things like streets, sewers and parking in support of the new development. Ottawa, Kansas has several eligible areas for potential TIF districts, including industrial parks and corridors that could be annexed into city limits. The process involves establishing the district boundaries, approving a redevelopment plan, and issuing bonds or other financing to fund approved infrastructure projects.