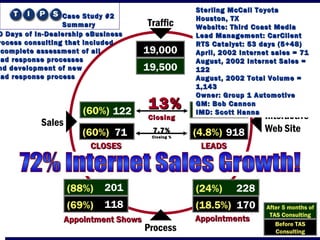

1. This case study examines the results of a dealership's internet sales department before and after undergoing consulting from Reynolds Consulting Services over 5 months.

2. In April 2002, the dealership was selling 71 units per month but had a low closing ratio of 5-7.7%.

3. After consulting, the dealership improved key metrics like leads, show rate, closing rate, internet sales, and total volume. Internet sales increased from 71 to 122 units per month over the 5 month period.