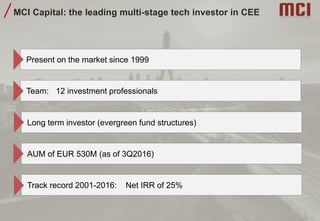

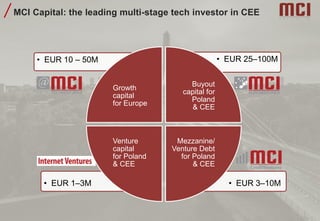

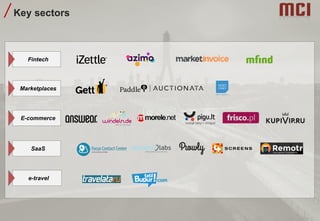

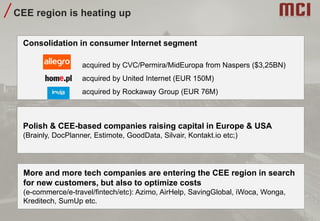

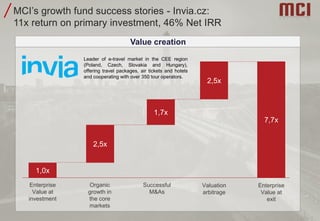

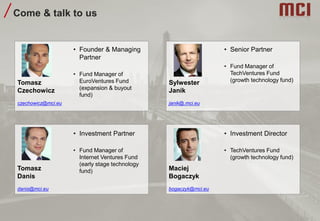

MCI Capital is a leading multi-stage tech investor in Central and Eastern Europe, with a history of strong returns and an AUM of EUR 530 million as of late 2016. Their investment strategy focuses on growth capital across key sectors like fintech and e-travel, supporting entrepreneurs with partnerships, geo-expansion, and talent recruitment. The Noah Conference emphasizes MCI's role in the tech investment landscape, showcasing successful transactions and connections within the industry.