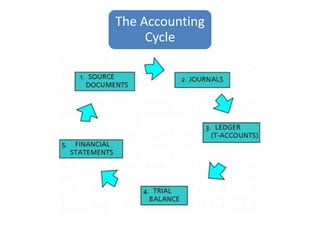

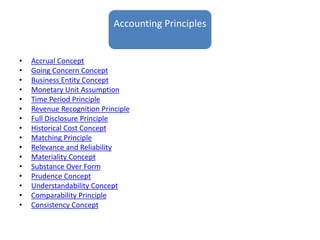

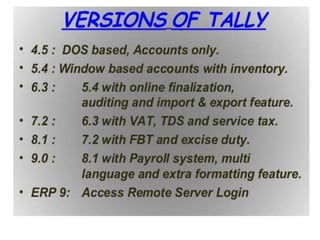

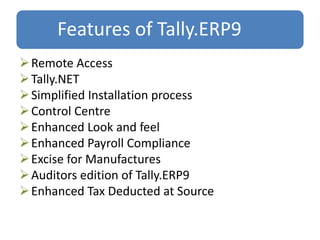

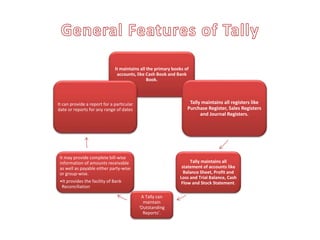

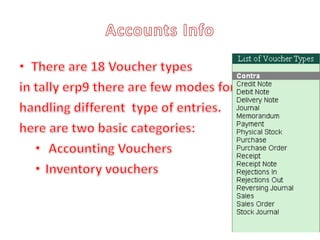

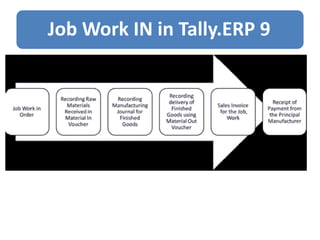

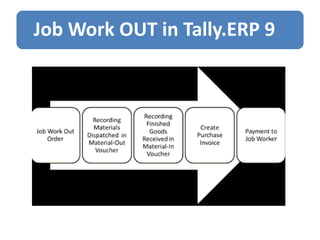

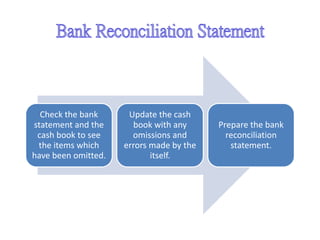

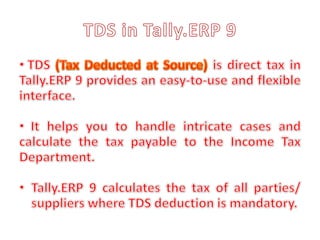

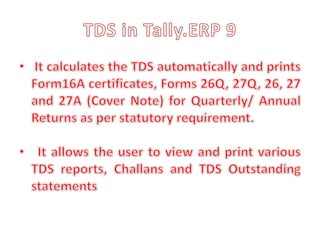

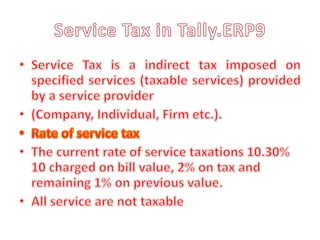

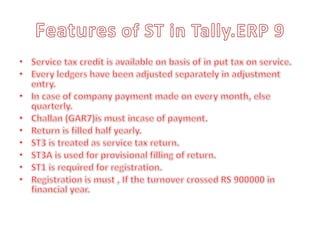

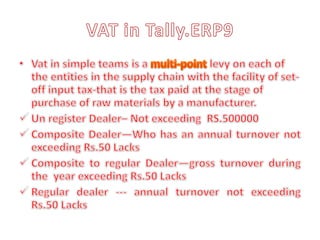

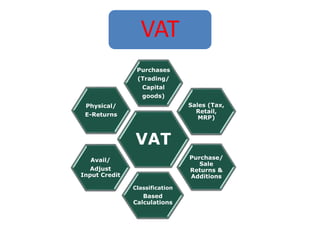

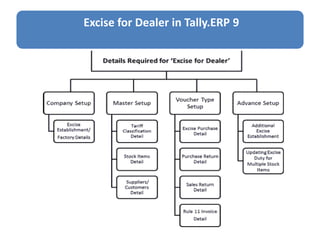

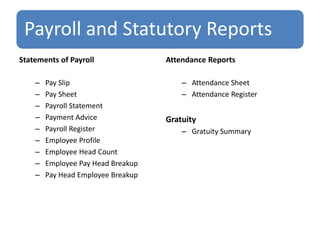

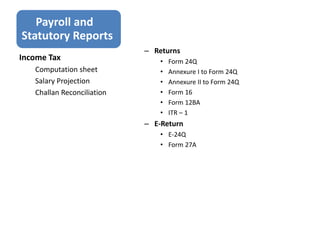

This document provides an overview of accounting and the accounting software Tally ERP 9. It defines accounting and outlines its key advantages. It describes the different types of accounts in accounting and the golden rules of accounting. It then explains the accounting cycle and key accounting principles. The rest of the document focuses on introducing and describing the features and functionality of Tally ERP 9, including how it can be used for payroll, VAT, excise, job work, bank reconciliation, budgets, cost centers, and more.