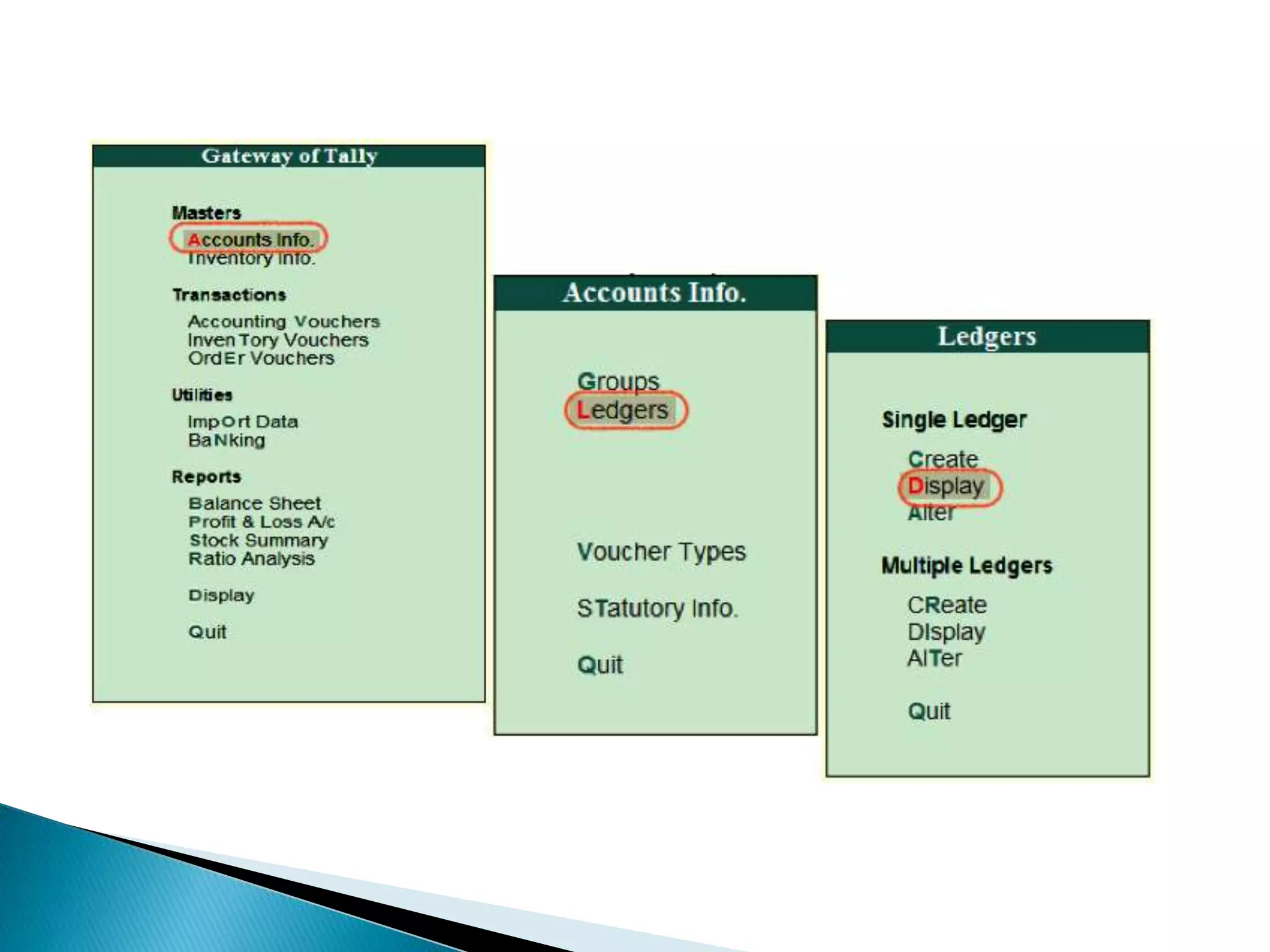

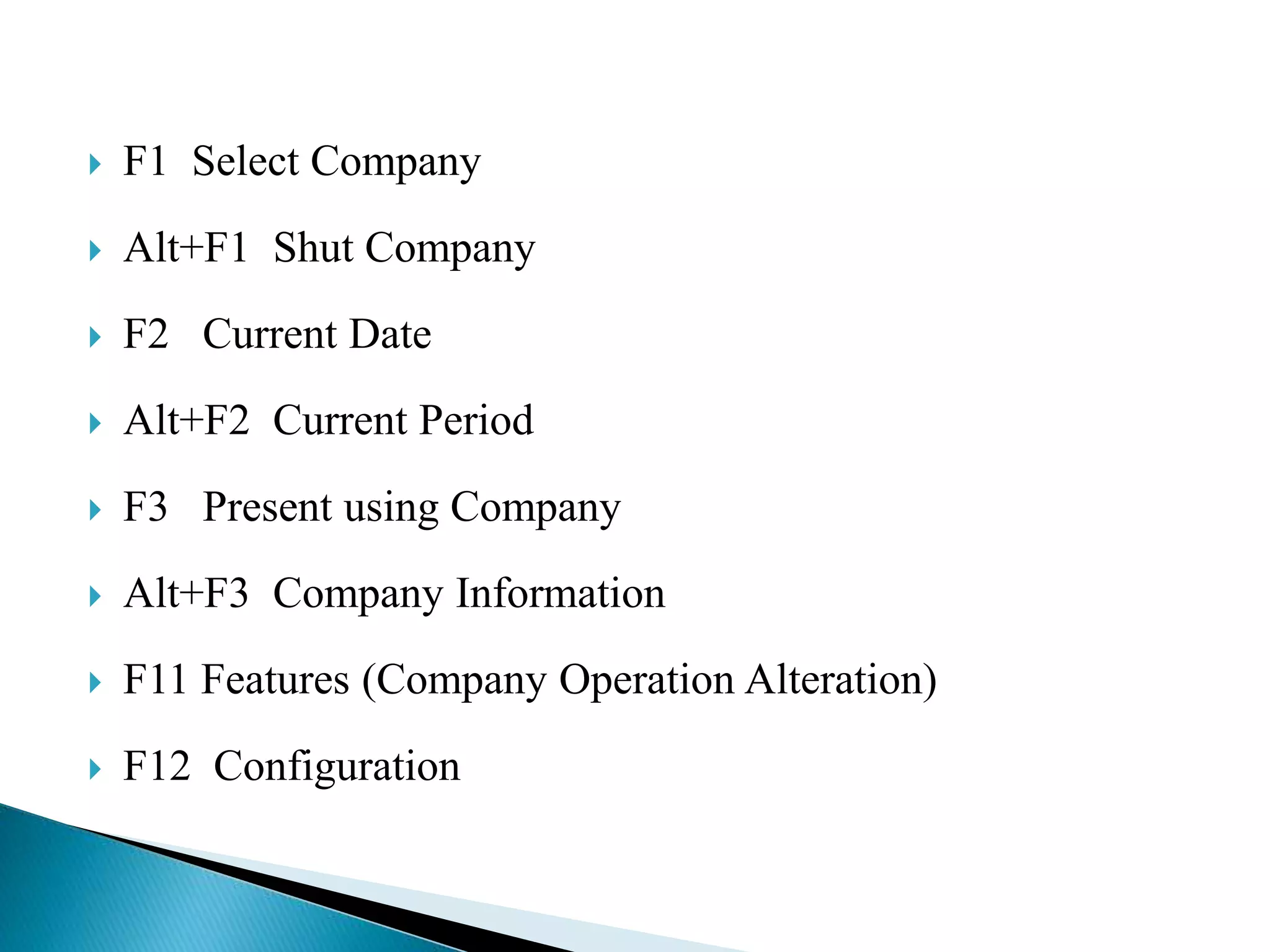

Tally is financial accounting software that helps record daily business transactions. It was developed in 1986 as The Accountant software and later renamed Tally. The latest versions are Tally Prime and Tally ERP 9, which include inventory management, payroll, and GST features to help various types of businesses with their accounting needs. Tally provides different voucher types to record purchases, sales, payments, receipts and other transactions. It also allows generating reports for financial statements, ratio analysis, and other purposes.