The document provides guidance on resolving GST report errors in Tally.ERP 9, highlighting common issues such as mismatched tax rates, invalid GSTIN, and supply place details. It includes step-by-step solutions for each error type and emphasizes the importance of backing up Tally data before making changes.

![EazyAUTO4 : Excel to Tally.ERP 9 Data Converter

www.exceltotally.in

Impression Systems

Excel to Tally ERP 9 data Import | www.exceltotally.in

Possible Error(s) List:

Tax rate/tax type note specified (A).

Tax rate/tax type note specified (B).

GSTIN/UNI is not specified/Invalid

Mismatch due to tax amount modified in voucher.

Tax amount does not match the value calculated as per the set tax rate. (Verify

Central Tax and State Tax amount)

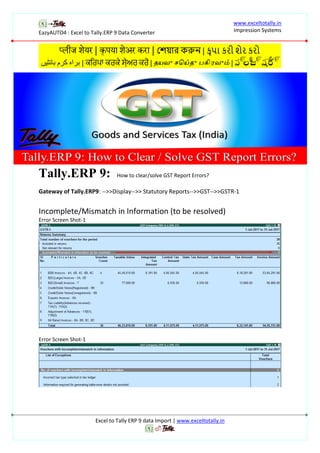

Place of supply not specified/invalid.

***IMPORTATNT***

Before doing any changes in your Tally Company/Data take your existing Tally data backup

You can take help of your:

o IT Team/Manager

o Finance Team/Manager

o Account Team/Manager

o Chartered Accountant [ CA ]

o Tax Consultant / Accountant

How to Solve? Tax rate/tax type note specified (A).

Error Screen Shot1

Error Screen Shot2

Reason:

Tax rate not specified in stock item (or)

Tax Ledgers CGST & SGST Not configured correctly.

Solution: [Alter Sales, CGST & SGST, Cess etc / Stock Items]

1. Ledger Alteration [ From Gateway of Tally: ]

o Accounts Info-->>Ledgers-->>Alter-->> Select Tax Ledger(s)

o Ex. CGST-->> Under-->>Duties & Taxes-->> Type of duty/Tax--

>GST-->>Tax Type-->> Central Tax. [ Do same changes for SGST="State

Tax" ] & Accept ="Yes"](https://image.slidesharecdn.com/tally-171212121325/85/Tally-ERP-9-GST-Errors-and-Solutions-2-320.jpg)

![EazyAUTO4 : Excel to Tally.ERP 9 Data Converter

www.exceltotally.in

Impression Systems

Excel to Tally ERP 9 data Import | www.exceltotally.in

o

2. Stock Item Alteration [ From Gateway of Tally: ]

o Inventory Info-->>Stock Items-->>Alter-Select Item and enter.

o GST Applicable-->> Applicable

o Set/alter GST Details-->>"Yes"

o Calculation type-->> "On Value"

o Taxability -->> "Taxable"

o Ingratiated Tax-->> "Enter %"

o Type of Supply-->>Goods

o Yes

Press Ctrl+A to save configuration / Accept= “Yes”](https://image.slidesharecdn.com/tally-171212121325/85/Tally-ERP-9-GST-Errors-and-Solutions-3-320.jpg)

![EazyAUTO4 : Excel to Tally.ERP 9 Data Converter

www.exceltotally.in

Impression Systems

Excel to Tally ERP 9 data Import | www.exceltotally.in

How to Solve? Tax rate/tax type note specified (B).

Screen Shot-1

Screen Shot-2

Reason: [State name mismatched as per Tally.]

[Open entry and check in buyer details, state and place of supply mismatched as

per Tally]

Screen Shot-1

Solution:

Correct the state name and place of supply as per Tally State List. Like

"Maharashtra"](https://image.slidesharecdn.com/tally-171212121325/85/Tally-ERP-9-GST-Errors-and-Solutions-4-320.jpg)

![EazyAUTO4 : Excel to Tally.ERP 9 Data Converter

www.exceltotally.in

Impression Systems

Excel to Tally ERP 9 data Import | www.exceltotally.in

Information required for generating table-wise details not proved.

GSTIN/UNI is not specified/Invalid

Screen Shot1

Screen Shot2

Reason:

GSTIN/UIN is not invalid/ Or/ mistake while entering GST Number.

State name Mismatched as per Tally.

Solution:

Enter Correct/Actual GST Number.

[You can validate number on "https://services.gst.gov.in/services/searchtp"]

Check for State Name/ Check for State Name Spelling.](https://image.slidesharecdn.com/tally-171212121325/85/Tally-ERP-9-GST-Errors-and-Solutions-5-320.jpg)

![EazyAUTO4 : Excel to Tally.ERP 9 Data Converter

www.exceltotally.in

Impression Systems

Excel to Tally ERP 9 data Import | www.exceltotally.in

Tax amount does not match the value calculated as per the set tax

rate. (Verify Central Tax and State Tax amount)

Screen Shot-1

Reason:

For Interstate Sales Selected CGST&SGST Tax Ledgers

Tax rates not provided in Stock Item(s)

o If you are using Single Sales Ledger and Tax Ledger CGST&SGST.

Tax rate % not provided in CGST&SGST.

o If you are using Tax rate wise sales & Tax Ledgers; like

GSTSales@5% and CGST@2.5% SGST@2.5%

Solution: See solution [How to solve? Tax rate/tax type note specified (B).]

Configure tax rates for Stock Item(s)

Configure tax rates for Tax Ledger(s)

Select Correct Tax Ledger If Interstate Sale ( See Screen Shot)

Screen Shot:](https://image.slidesharecdn.com/tally-171212121325/85/Tally-ERP-9-GST-Errors-and-Solutions-7-320.jpg)

![EazyAUTO4 : Excel to Tally.ERP 9 Data Converter

www.exceltotally.in

Impression Systems

Excel to Tally ERP 9 data Import | www.exceltotally.in

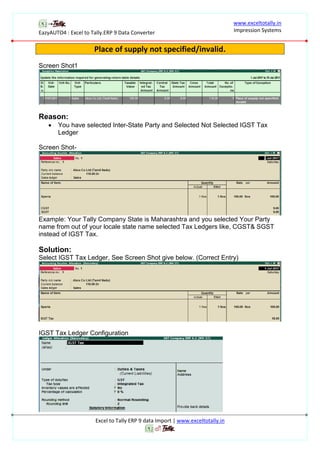

How to See?

Stock Items which are not configured GST Tax Rates & HSN/SAC Codes.

Ledgers which are not having GSTIN/UIN

Gateway of Tally.ERP9: -->>Display-->> Statutory Reports-->>GST.

Stock Items which are not configured GST Tax Rates & HSN/SAC Codes.

GST Rate Setup

Ledgers which are not having GSTIN/UIN

Update Party GSTIN

For more details contact:

Finance Team/Manager

Account Team/Manager

Chartered Accountant [ CA ]

Tax Consultant / Accountant

Tally Vendor

Tally Server Provider

Useful Links

https://tallysolutions.com/gst/

https://help.tallysolutions.com/

http://blogs.tallysolutions.com/

https://tallysolutions.com/

https://www.youtube.com/user/simplytally

https://www.youtube.com/channel/TallyforGST

Search by GSTIN/UIN](https://image.slidesharecdn.com/tally-171212121325/85/Tally-ERP-9-GST-Errors-and-Solutions-9-320.jpg)