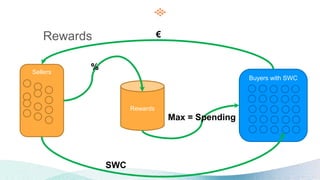

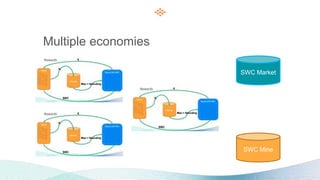

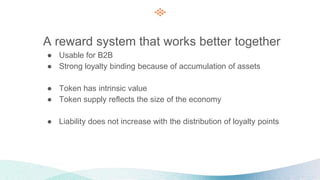

The Sweetcoins token engineering presentation addresses common issues in loyalty programs, such as lack of relevance and customer service challenges, offering benefits to sellers, buyers, and investors through a token incentive model. The system allows buyers to earn Sweetcoins (SWC) as rewards from sellers, while sellers can benefit from undistributed rewards and participation in growth. SWC has intrinsic value, is integrable into B2B applications, and discourages non-buyers from activating tokens by requiring a 30-day activity period for rewards eligibility.

![Benefits

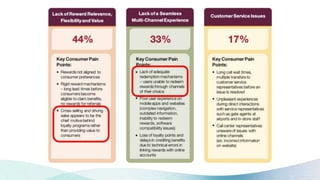

Solving the most common pain points related to loyalty programs:

● Lack of Reward Relevance

● Flexibility

● Value

● Lack of a Seamless Multi-Channel Experience

● Customer Service Issues

[Source: Capgemini Consulting Analysis, Social Media Scan conducted in December 2014

https://www.capgemini.com/consulting/wp-content/uploads/sites/30/2017/07/reinventing_loyalty_programs.pdf]](https://image.slidesharecdn.com/4micharoon-181105110240/85/Sweetbridge-Token-Design-Discount-Token-2-320.jpg)