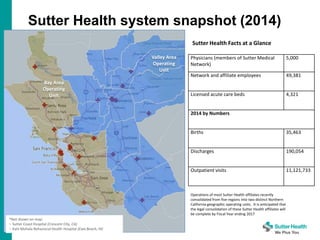

This document provides a summary of a presentation that will be given by executives from Sutter Health, a large non-profit health system, at an investor conference in June 2015. The presentation will provide an overview of Sutter Health, including its size, geographic reach, services provided, and recent financial performance. It also notes that the information being presented does not constitute a prediction of future financial performance and is subject to various risks and uncertainties.