Sushil Finance's Daily Commodity Update - Sushil Finance

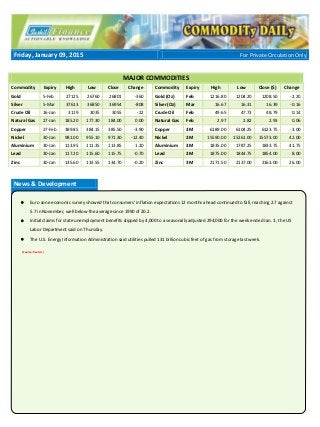

- 1. Friday, January 09, 2015 For Private Circulation Only MAJOR COMMODITIES Commodity Expiry High Low Close Change Commodity Expiry High Low Close ($) Change Gold 5-Feb 27125 26760 26801 -360 Gold (Oz) Feb 1216.80 1204.20 1208.50 -2.20 Silver 5-Mar 37613 36850 36954 -808 Silver (Oz) Mar 16.67 16.31 16.39 -0.16 Crude Oil 16-Jan 3119 3035 3055 -22 Crude Oil Feb 49.65 47.73 48.79 0.14 Natural Gas 27-Jan 185.20 177.30 184.00 0.00 Natural Gas Feb 2.97 2.82 2.93 0.06 Copper 27-Feb 389.85 384.15 385.50 -3.90 Copper 3M 6189.00 6104.25 6123.75 -3.00 Nickel 30-Jan 981.00 955.10 971.30 -12.40 Nickel 3M 15590.00 15261.00 15573.00 42.00 Aluminium 30-Jan 113.95 111.35 113.85 1.20 Aluminium 3M 1835.00 1787.25 1833.75 41.75 Lead 30-Jan 117.20 115.60 115.75 -0.70 Lead 3M 1875.00 1844.75 1854.00 8.00 Zinc 30-Jan 135.60 133.55 134.70 -0.20 Zinc 3M 2171.50 2137.00 2163.00 26.00 News & Development Euro zone economic survey showed that consumers' inflation expectations 12 months ahead continued to fall, reaching 2.7 against 5.7 in November, well below the average since 1990 of 20.2. Initial claims for state unemployment benefits slipped by 4,000 to a seasonally adjusted 294,000 for the week ended Jan. 3, the US Labor Department said on Thursday. The U.S. Energy Information Administration said utilities pulled 131 billion cubic feet of gas from storage last week. (Source: Reuters)

- 2. Page 2 Commodity Daily Gold Gold fell for the second straight day on Thursday, in a choppy session weighed down by a stronger dollar and rising stock markets after being buoyed by expectations the Federal Reserve will be patient in raising interest rates. Minutes from the Federal Reserve's latest policy meeting released on Wednesday reassured markets that the central bank was in no hurry to raise interest rates, lifting European shares. Among currencies, the dollar hit a 9-year high against the euro, as investors ramped up bets the European Central Bank was getting closer to loosening monetary policy to ward off deflation. Analysts are awaiting the release of U.S. non-farm payrolls data for December on Friday, a key barometer of the health of the U.S. economy. An upbeat report is likely to support the view that the Fed will raise rates sooner rather than later. Outlook We expect gold prices are likely to trade on negative note on the back of US interest rate outlook. Technical Outlook Gold Strategy S2 S1 Close R1 R2 Feb Sell @ R1 26600 26700 26801 26900 27000 *Investors can use S2/R2 as Stop Loss/Target depending upon the strategy advised Silver Silver was down 1 percent at $16.35 an ounce. The number of Americans filing new claims for unemployment benefits fell last week and job cuts declined sharply in December, suggesting the labor market is tightening. Thursday's reports support views of faster growth this year, driven by consumer spending, despite a faltering global economy. Outlook We expect Silver prices are likely to trade negative note on the back of US interest rate outlook. Technical Outlook Silver Strategy S2 S1 Close R1 R2 Mar Sell @ R1 36500 36800 36954 37400 37800 *Investors can use S2/R2 as Stop Loss/Target depending upon the strategy advised

- 3. Page 3 Commodity Daily Crude Oil Global oil prices were little changed for a second straight day on Thursday after better-than-expected U.S. jobs data helped the market hold ground after a 10 percent loss earlier in the week. But support for oil was likely to be short-lived as market bears continue hunting for a bottom to the second-biggest price rout in crude's history, traders said. Some traders think oil prices could be at a crossroads after losing over half their value from June highs, and that could explain benchmark Brent's stalling at above $50 since Wednesday. Others believe the market has just been handed a reprieve before being hammered lower. Data on Thursday showed jobless claims in the United States fell last week, while a separate report said U.S. employers announced a total of 483,171 job cuts in 2014. That was 5 percent fewer than in 2013 and the smallest number since 1997. Expectations the European Central Bank could resort to stimulus measures after a rash of weak economic data and record crude imports by China in December, possibly due to attractive pricing, also helped sentiment, traders said. But the world's largest oil traders have also started hiring supertankers to store crude at sea, marking a milestone in the build-up of the global glut of supplies, freight brokers and shipping sources said. Outlook We expect crude oil prices likely to trade on negative note on the back of increasing supply and decreasing demand is likely to keep crude oil prices under pressure. Technical Outlook Crude Oil Strategy S2 S1 Close R1 R2 Jan Sell @ R1 3000 3030 3055 3120 3160 *Investors can use S2/R2 as Stop Loss/Target depending upon the strategy advised Natural Gas U.S. natural gas futures gained 2 percent on Thursday after the government reported a bigger-than-expected storage draw and on colder-than-normal forecasts for the next two weeks. The U.S. Energy Information Administration said utilities pulled 131 billion cubic feet of gas from storage last week. As on Wednesday, the latest weather models for the lower 48 U.S. states on Thursday called for colder-than-normal temperatures over the next two weeks, with an expected 502 heating degree days. Outlook We expect Natural gas prices to trade on negative note on the back of lesser cold temperature forecast over the next few days. Technical Outlook Nat Gas Strategy S2 S1 Close R1 R2 Jan Sell @ R1 175 180 184 186 190 *Investors can use S2/R2 as Stop Loss/Target depending upon the strategy advised

- 4. Page 4 Commodity Daily LME Inventories Copper Lead Zinc Aluminium Nickel Current Stock 179225 221975 676375 4175750 415842 Change 550 0 -4475 -8650 30 % Change 0.31% 0.00% -0.66% -0.21% 0.01% Base Metals Aluminium rebounded from lows on Thursday as some investors bought back short positions to lock in profits, but more losses were expected for copper and zinc ahead of the new year holiday in top metals consumer China. Copper, burdened by worries about oversupply, failed to sustain a bounce from 4-1/2 year lows the previous day, ending in the red again. At its lows on Wednesday, aluminium had shed 15 percent since late November as investors worried about smelters restarting capacity they had shut down. Also weighing on copper was more evidence of higher supplies as LME inventories rose to 179,225 tonnes, bringing the increase since last August to 27 percent. Outlook We expect base metal prices to trade on negative note on the back of fears of slowdown in China. Technical Outlook Jan/Feb Strategy S2 S1 Close R1 R2 Copper Sell @ R1 381 384 385.5 388 391 Nickel Sell @ R1 955 965 971.3 976 989 Alum Sideways 112.5 113.5 113.8 114.2 115 Lead Sell @ R1 114 115 115.7 117 118 Zinc Sell @ R1 132.5 133.5 134.7 135.2 136.2 *Investors can use S2/R2 as Stop Loss/Target depending upon the strategy advised

- 5. Page 5 Commodity Daily DATE TIME (IST) COUNTRY ECONOMIC DATA CONSENSUS PREVIOUS IMPACT Fri, Jan 9 7:00am China CPI y/y 1.50% 1.40% High 7:00am China PPI y/y -3.10% -2.70% Medium 1:15pm EUR French Industrial Production m/m 0.40% -0.80% Medium 3:00pm UK Manufacturing Production m/m 0.40% -0.70% High 3:00pm UK Trade Balance -9.5B -9.6B Medium 7:00pm US Non-Farm Employment Change 241K 321K High 7:00pm US Unemployment Rate 5.70% 5.80% High 7:00pm US Average Hourly Earnings m/m 0.20% 0.40% Medium 8:30pm UK NIESR GDP Estimate 0.70% Medium For Further Assistance Contact: - 022-40934000 Ashish Shah Tejas Nikhar Mohit Agarwal AVP ashish.shah@sushilfinance.com Sr. Research Analyst tejas.nikhar@sushilfinance.com Research Analyst mohit.agarwal@sushilfinance.com WE / OUR CLIENTS / OUR RELATIVES MAY HAVE PERSONAL TRADING / INVESTMENT INTEREST IN THE STOCKS MENTIONED HERE IN. STATEMENT OF DISCLAIMER This report includes information from sources believed to be reliable but no independent verification has been made and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report cannot be construed as a request to engage in any transaction involving the purchase or sale of a futures contract. The risk of loss in trading futures contracts can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. Additional information with respect to any commodities referred to herein will be available on request. Sushil Global Commodities Pvt. Ltd. and its connected companies, and their respective Directors, Officers and employees, may, from time to time, have a long or short position in the commodities mentioned and may sell or buy such commodities. Sushil Global may act upon or make use of information contained herein prior to the publication thereof. This data sheet is for private circulation only. While utmost care has been taken in preparing the above, we claim no responsibility for its accuracy. We shall not be liable for any direct or indirect losses arising from the use thereof and the investors are requested to use the information contained herein at their own risk. Sushil Global Commodities Private Limited Member: NCDEX, FMC Regn.No. 00304 | MCX, FMC Regn.No. 12240 Genius, 4th Road, Khar (W), Mumbai – 400 052. Tel.: 022-6698 0636 Fax: 022-6698 0606 | E-mail: commodities@sushilfinance.com | www.sushilfinance.com