The document summarizes EDC's (Export Development Canada) support for Canadian exports and international investments in 2004. Some key points:

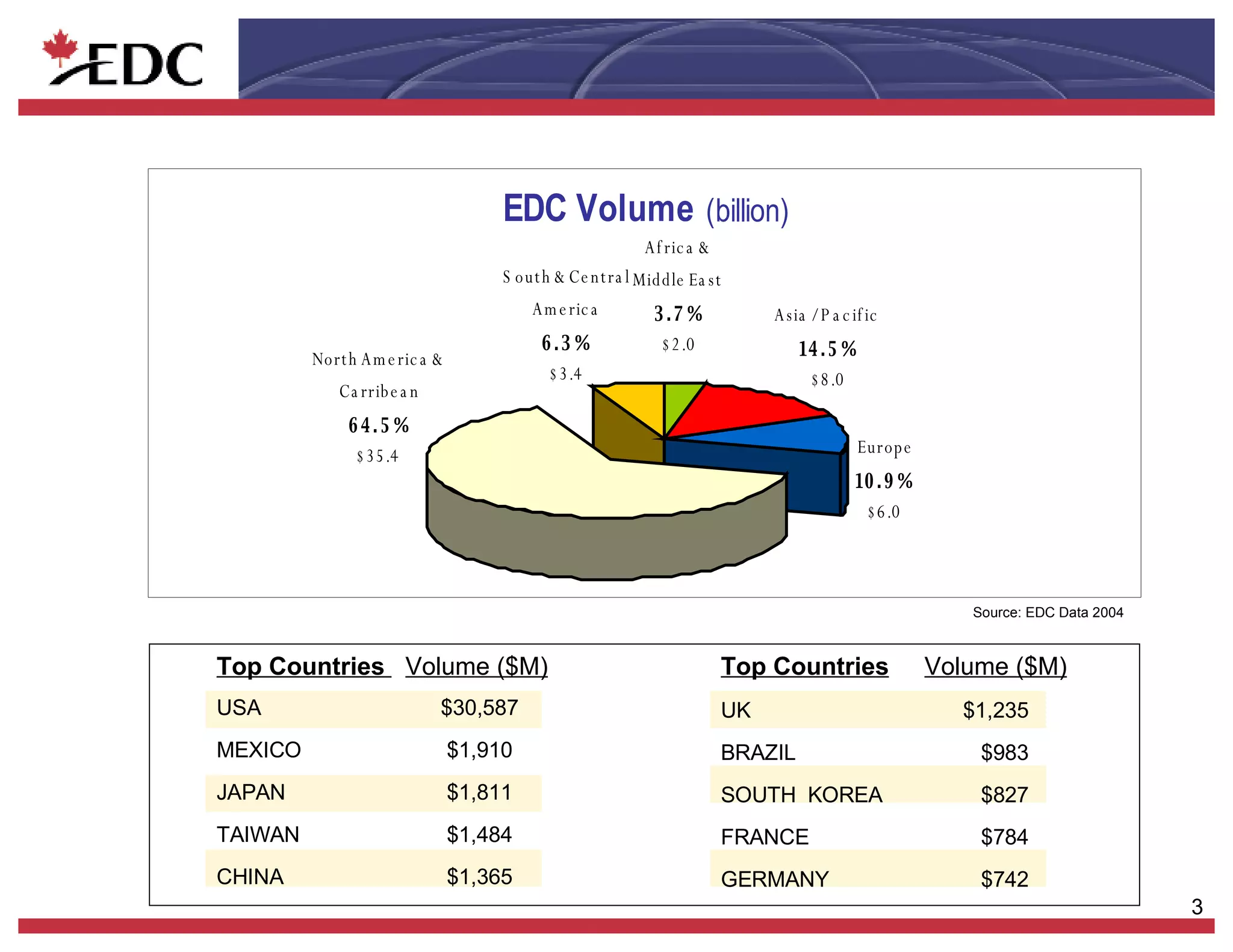

- EDC supported $54.9 billion in exports and $11.6 billion in developing markets like Brazil, China, and India.

- EDC's total assets were $20.7 billion in 2004.

- EDC provides various financing, insurance, and bonding programs to help small and medium enterprises export goods and services. This includes accounts receivable insurance, contract insurance, and financing programs.

- EDC also offers political risk insurance, project financing, and information/intelligence services to Canadian exporters and investors.