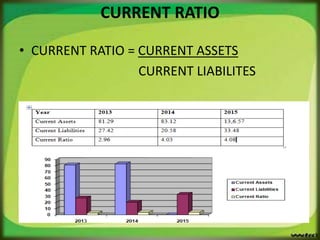

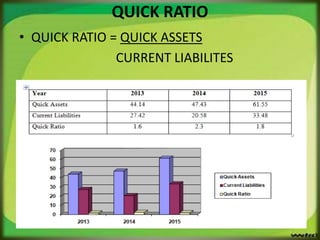

This document is a summer training project report submitted by Shivansh Goyal to the Head & Dean of FMS at ITC Ltd in Saharanpur analyzing the working capital management of ITC Ltd. It discusses the goals of working capital management, analyzes ITC's current assets and current liabilities, and assesses the company's working capital management policies through ratio analysis and other techniques. The report finds that ITC's inventory levels are increasing but inventory turnover is decreasing, indicating potential issues with stock velocity that could impact the company's performance if not addressed.