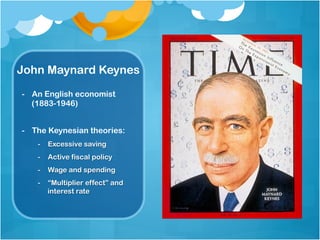

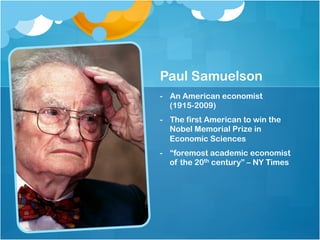

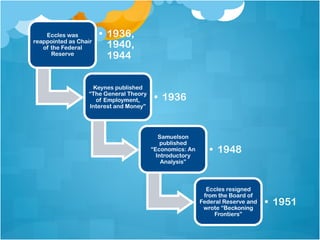

Marriner Eccles held views on the Great Depression that differed from Keynes and Samuelson. Eccles believed that excessive saving could be detrimental during a recession, unlike the conventional view. He also thought the government could spend money through creating it, not depending on private profits, and that increased government spending was the only escape from depression. Eccles' famous policies as Chairman of the Federal Reserve included the FHA Act, utilizing private funds but with government protection, centralizing control over money supply through the Banking Act of 1935. His views preceded and aligned with later Keynesian general theories and Samuelson's textbook.