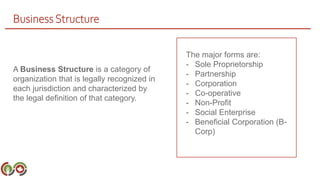

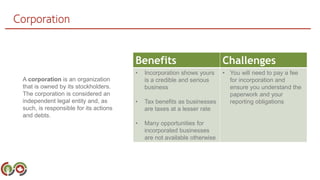

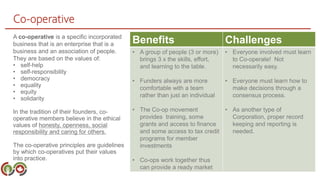

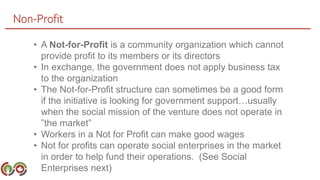

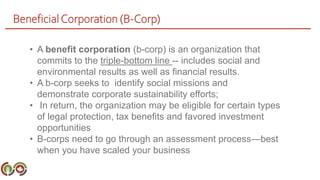

The document discusses different business structures including sole proprietorships, partnerships, corporations, cooperatives, non-profits, social enterprises, and B-Corps. Each structure has benefits and challenges. For example, a sole proprietorship gives full control but the owner bears all risks, while a corporation shows credibility but requires paperwork and reporting. The best structure depends on factors like an individual's values, skills, and goals for the business. Cooperatives require members to learn cooperation and consensus decision making. Non-profits are not intended to generate profit but can operate social enterprises. Social enterprises and B-Corps have social and environmental goals in addition to financial goals.