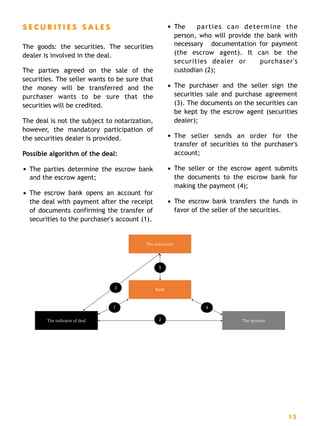

The document discusses recent legal amendments in Ukraine regarding corporate governance and agreements, notably introducing concepts such as irrevocable powers of attorney for corporate rights and unilateral termination of contracts. It highlights the implications of these changes for corporate relations and the establishment of escrow accounts as a new legal instrument for secure transactions. The analysis emphasizes the alignment of these legal updates with European standards and their potential impact on business practices in Ukraine.