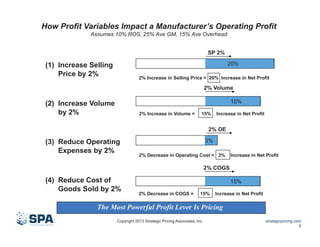

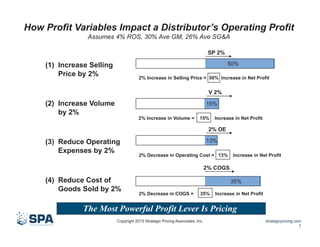

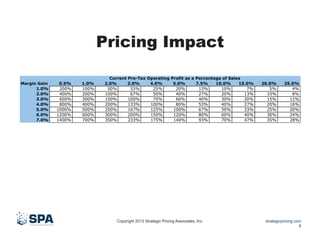

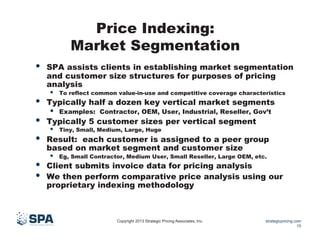

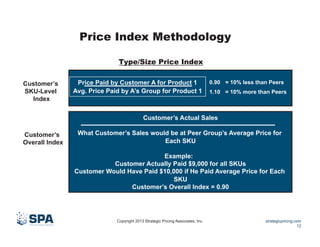

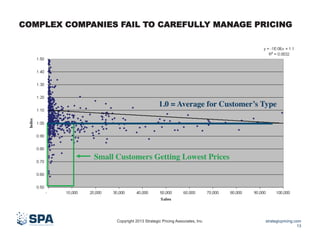

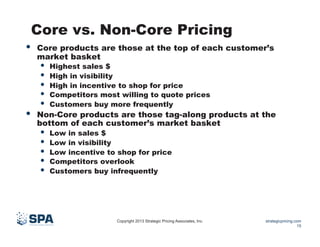

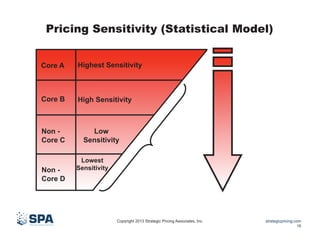

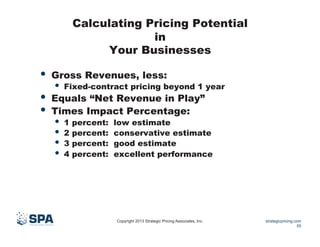

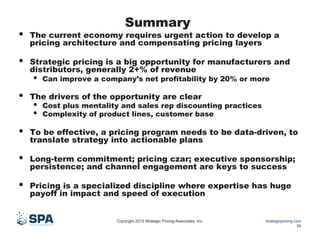

Strategic Pricing Associates, founded in 1993, specializes in optimizing pricing strategies for manufacturers and distributors to maximize profitability, citing successful collaboration with major companies such as Parker Hannifin and ExxonMobil. Effective strategic pricing management is vital as it significantly influences revenue and profits, with a focus on data-driven insights and structured pricing methodologies. The document emphasizes the need for a systematic approach to pricing architecture to overcome common challenges like cost-plus mentality and unstructured discounting.