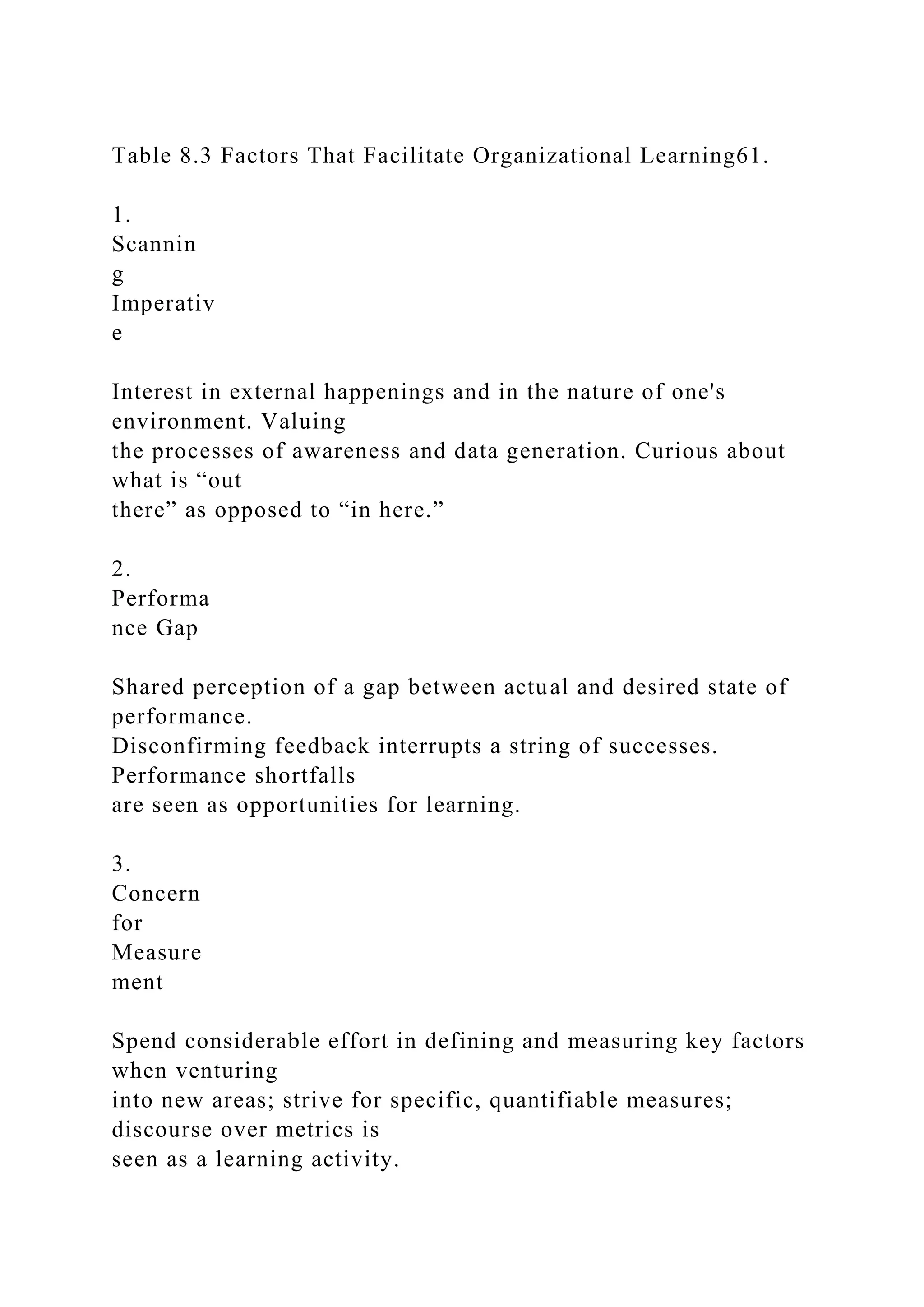

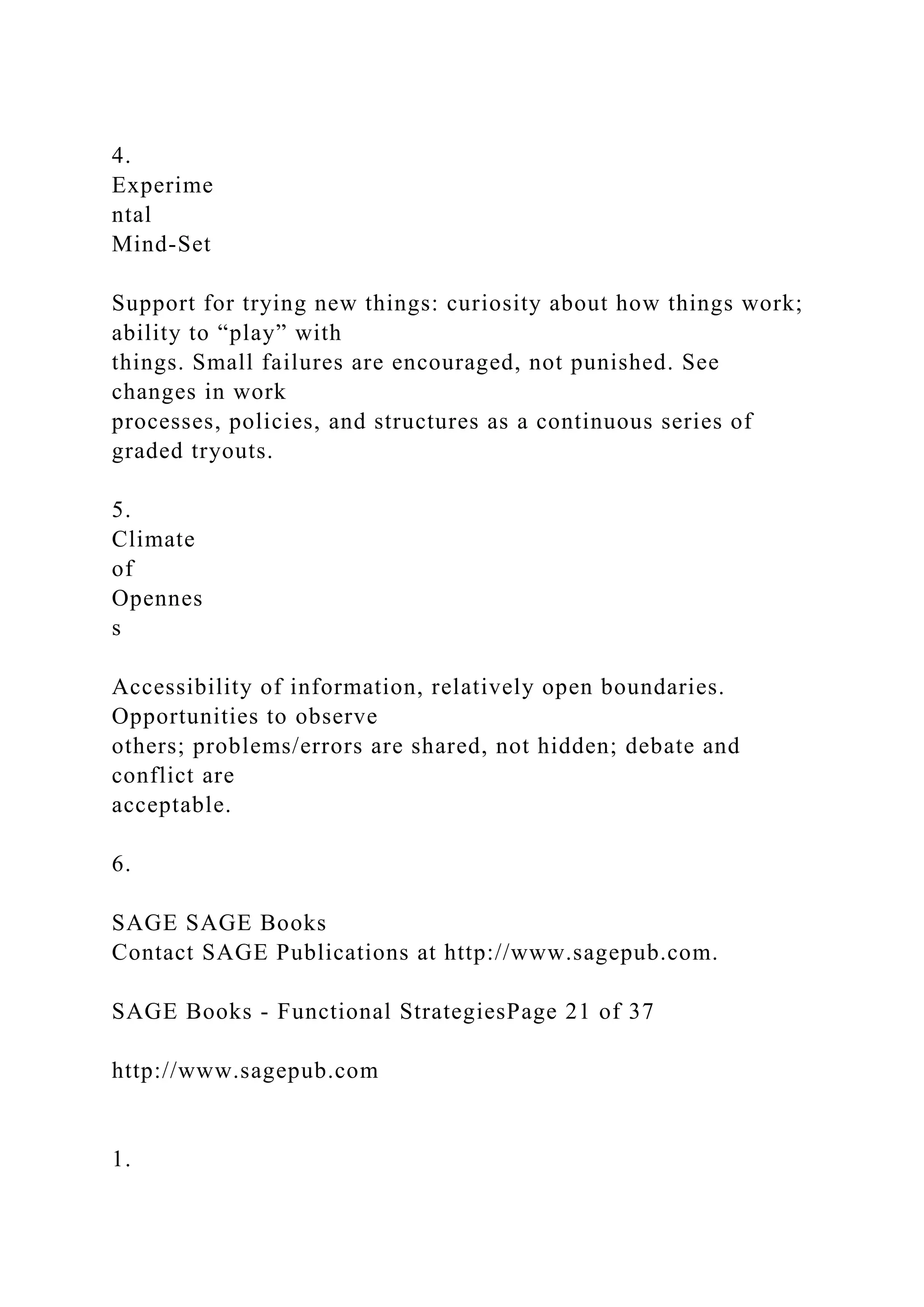

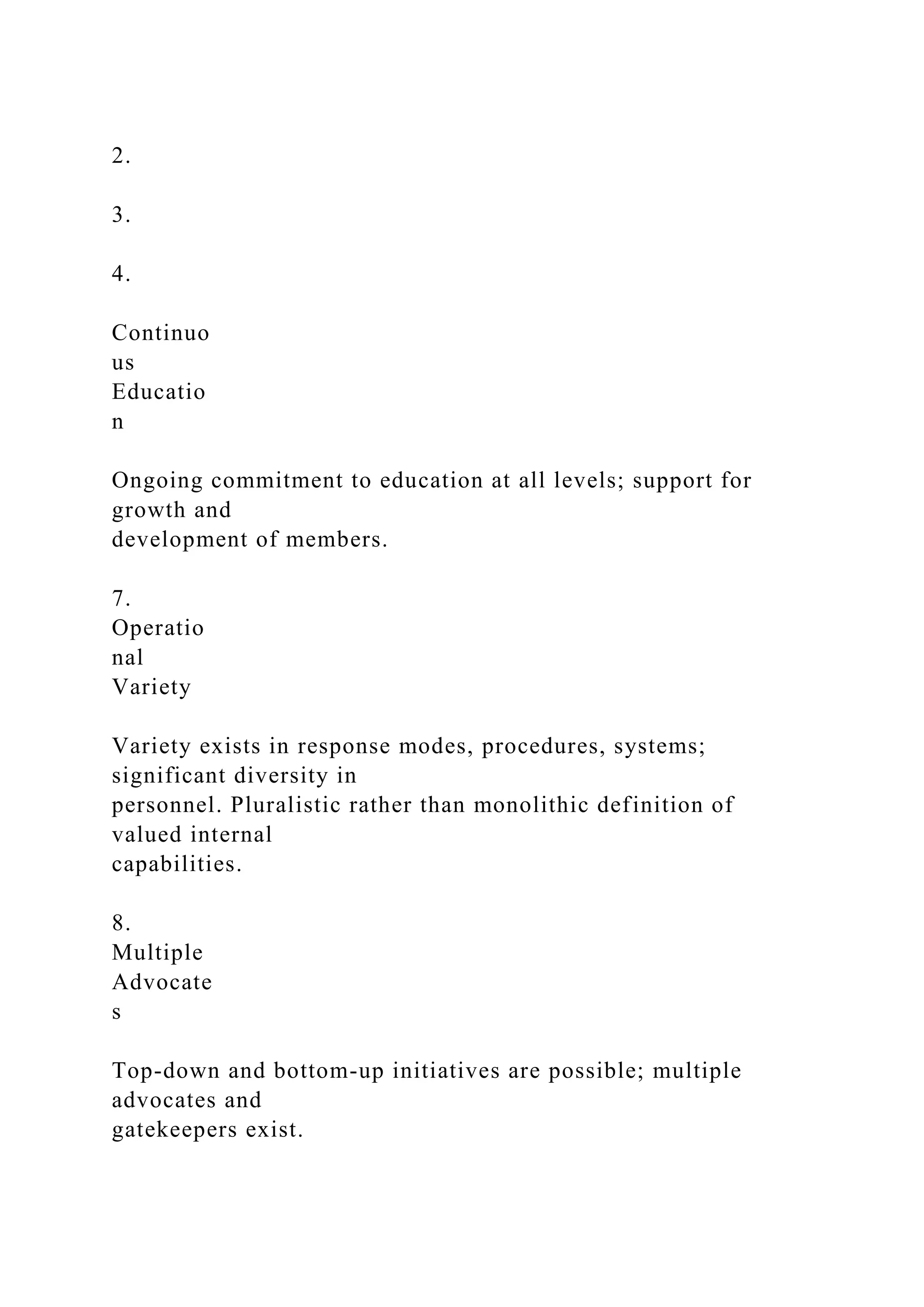

The document discusses the importance of functional strategies in achieving corporate and business-level strategies within various operational areas such as marketing, finance, and human resources. It emphasizes that effective integration among these functional areas is crucial for maintaining overall business performance and highlights the relationship between marketing and business strategies through tactical implementation. Additionally, the chapter outlines key considerations for each functional strategy, including pricing, promotional techniques, and product/service decisions, illustrating how they should function cohesively to support the organization's strategic objectives.