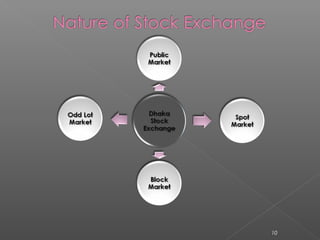

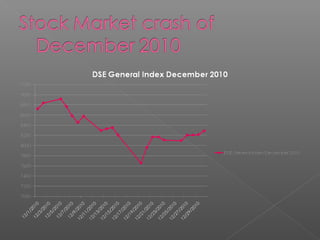

The document discusses the stock markets of Bangladesh, including the Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE). It notes that the DSE is the main stock exchange located in Dhaka, while the CSE is located in Chittagong. Both exchanges have undergone automation and now utilize electronic trading systems. The Securities and Exchange Commission regulates both exchanges and defines the rules under which they operate. The document also discusses some challenges facing the exchanges, such as price manipulation and delays in settlements.