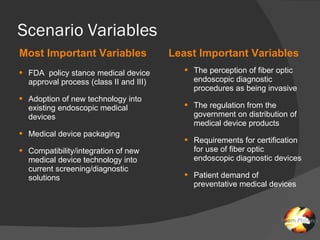

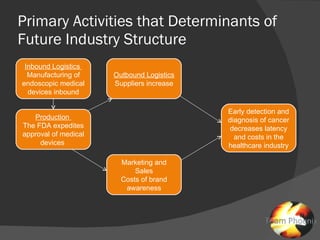

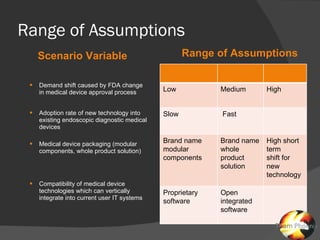

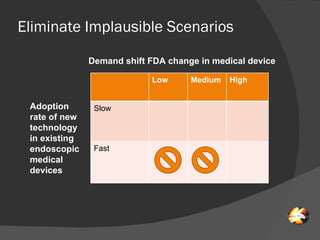

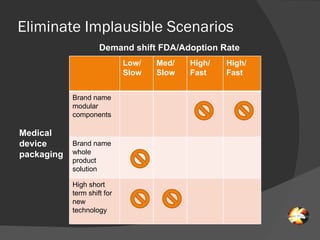

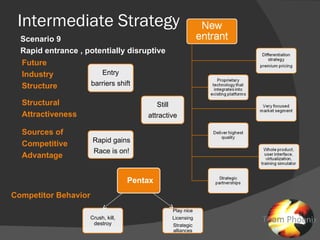

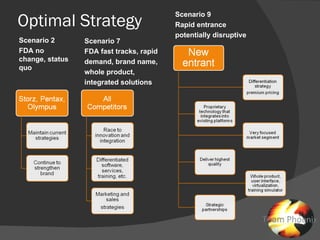

The document discusses uncertainties in the structure of the U.S. medical device industry. It notes that the FDA's stance on approving new medical devices could lower barriers to entry or increase threats to new entrants. New innovations may fragment the industry as they increase choice and potentially lower prices. New endoscopic devices that do not integrate into existing platforms may reduce industry profits by increasing learning curves.