Embed presentation

Download as PDF, PPTX

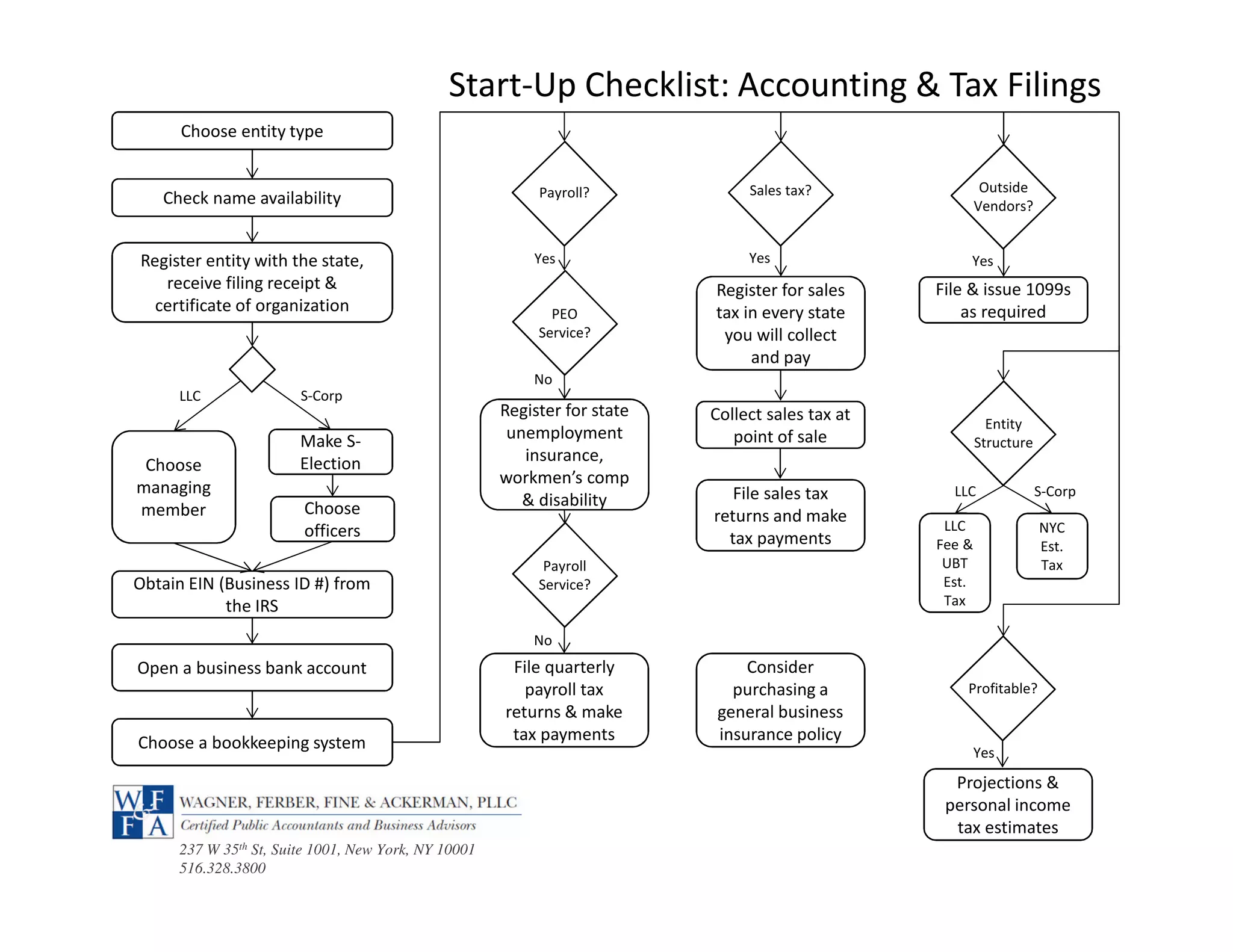

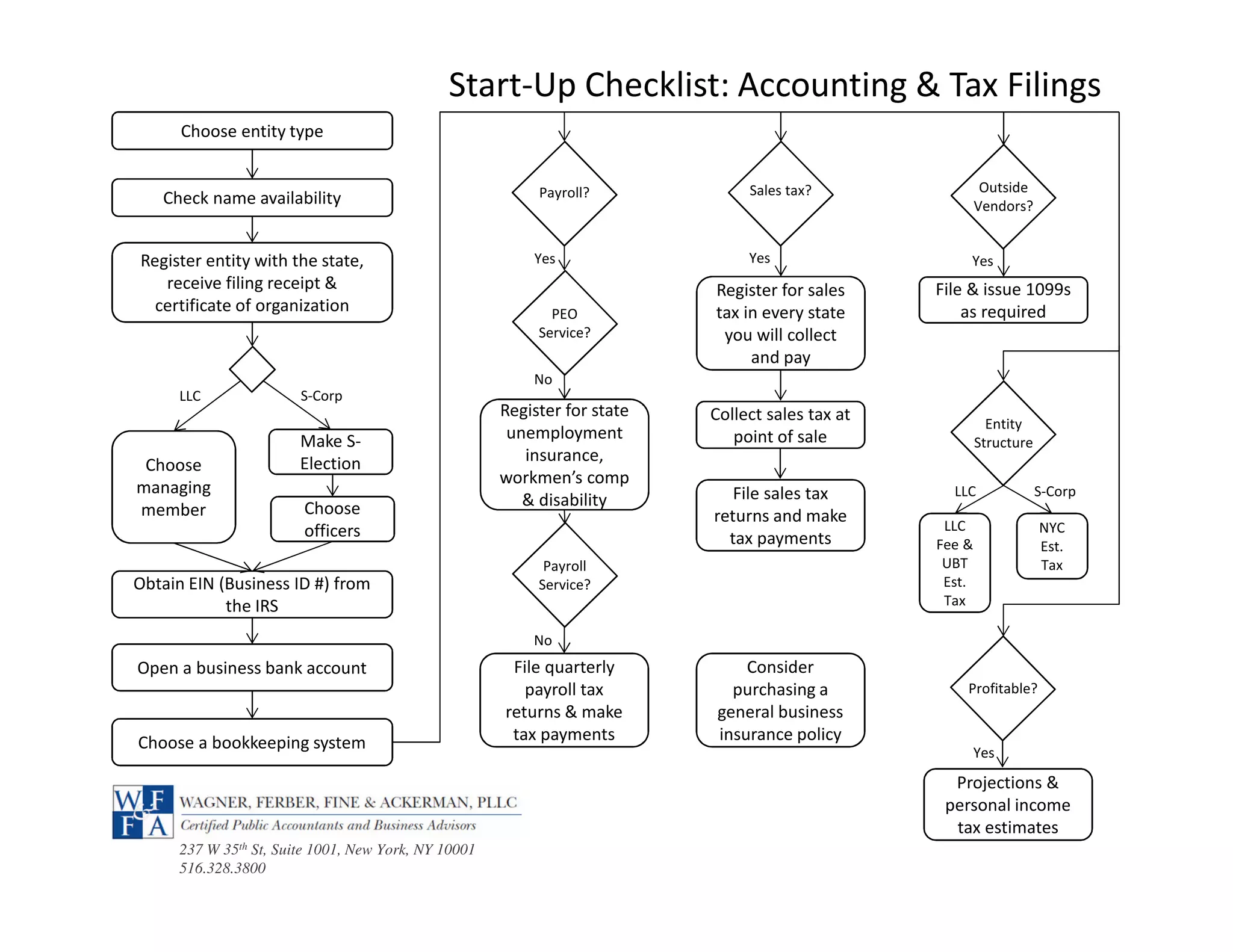

This document outlines the key steps needed to set up an LLC or S-Corp business entity including registering the entity with the state, obtaining an EIN number from the IRS, choosing officers and managing members, setting up business banking and bookkeeping, making tax elections, registering for necessary insurances, and ensuring compliance with payroll, sales, and income tax filing requirements.