This document discusses pathways by which improved market information can affect market performance and implications for evaluating the impacts of market information systems (MIS). It summarizes that:

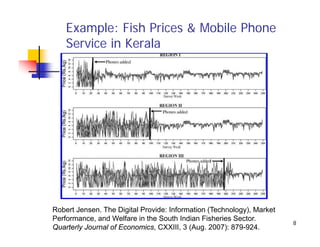

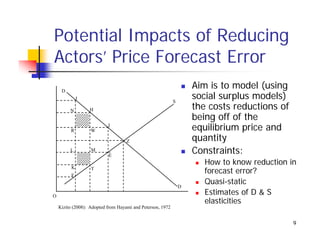

1) MIS can directly impact private actors' decisions around spatial arbitrage, production, and pricing, but indirectly impact markets through complementarity with other infrastructure and improved policies.

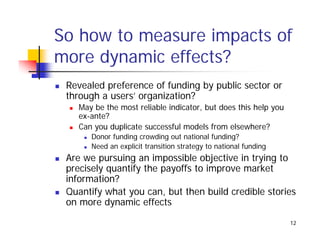

2) Evaluating direct impacts is more straightforward but attributing indirect impacts to MIS is difficult due to other contemporaneous factors.

3) While conceptual links exist between better information and market outcomes, private investment alone may not sufficiently provide information due to issues like indivisibility, non-excludability, and uncertainty.